Markets

The Top Performing Investment Themes of 2023

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

The Top Performing Investment Themes of 2023

This was originally posted on Advisor Channel. Sign up to the free mailing list to get beautiful visualizations on financial markets that help advisors and their clients.

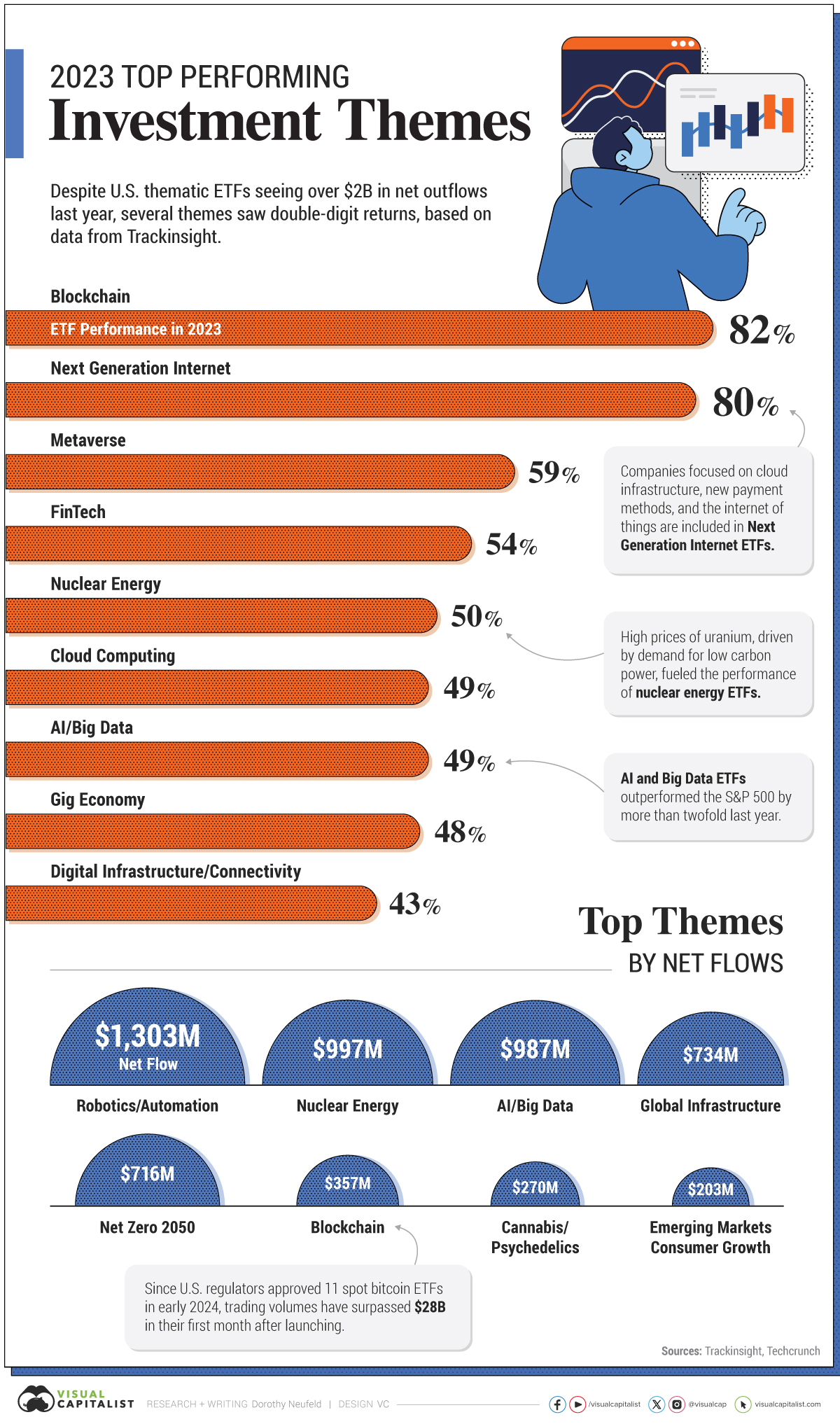

While the S&P 500 rebounded over 24% in 2023, many investment themes soared even higher.

In many ways, the year was defined by breakthrough announcements in AI and the resurgence of Bitcoin. At the same time, investors looked to nuclear energy ETFs thanks to nuclear’s growing role as a low carbon energy source and the war in Ukraine.

This graphic shows the best performing investment themes last year, based on data from Trackinsight.

Blockchain ETFs Lead the Pack

With 82% returns, blockchain ETFs outperformed all other themes in the U.S. due to the sharp rise in the bitcoin price over the year.

These ETFs hold mainly bitcoin mining firms, since ETFs investing directly in bitcoin were not yet approved by regulators in 2023. However, as of January 2024, U.S. regulators have approved 11 spot bitcoin ETFs for trading, which drew in $10 billion in assets in their first 20 days alone.

Below, we show the top performing themes across U.S. ETFs in 2023:

| Theme | 2023 Performance |

|---|---|

| Blockchain | 82% |

| Next Generation Internet | 80% |

| Metaverse | 59% |

| FinTech | 54% |

| Nuclear Energy | 50% |

| Cloud Computing | 49% |

| AI/Big Data | 49% |

| Gig Economy | 48% |

| Digital Infrastructure & Connectivity | 43% |

As we can see, next generation internet ETFs—which include companies focused on the internet of things and new payment methods—also boomed.

Meanwhile, nuclear energy ETFs had a banner year as uranium prices hit 15-year highs. Investor optimism for nuclear power is part of a wider trend of reactivating nuclear power plants globally in the push towards decarbonizing the energy supply. In fact, 63 new reactors across countries including Japan, Türkiye, and China are planned for construction amid higher global demand.

With 49% returns, AI and big data ETFs were another top performing investment theme. Driving these returns were companies like chipmaker Nvidia, whose share price jumped by 239% in 2023 thanks to its technology being fundamental to powering AI models.

Top Investment Themes, by Net Flows

Here are the the investment themes that saw the highest net flows over the year:

| Theme | 2023 Net Flows |

|---|---|

| Robotics & Automation | $1,303M |

| Nuclear Energy | $997M |

| AI/Big Data | $987M |

| Global Infrastructure | $734M |

| Net Zero 2050 | $716M |

| Blockchain | $357M |

| Cannabis & Psychedelics | $270M |

| Emerging Markets Consumer Growth | $203M |

Overall, ETFs focused on robotics and automation saw the greatest net flows amid wider deployment of these technologies across factories, healthcare, and transportation actvities.

The success of AI large language models over the year is another key factor in powering robotics capabilities. For instance, Microsoft is planning to build a robot powered by ChatGPT that provides it with higher context awareness of certain tasks.

Like robotics and automation, AI and big data, along with blockchain ETFs attracted high inflows.

Interestingly, ETFs surrounding emerging markets consumer growth saw strong inflows thanks to an expanding middle class across countries like India and China spurring potential growth opportunities. In 2024, 113 million people are projected to join the global middle class, seen mainly across countries in Asia.

Will Current Trends Continue in 2024?

So far, many of these investment themes have continued to see positive momentum including blockchain and next generation internet ETFs.

In many cases, these investment themes cover broad, underlying trends that have the potential to reshape sectors and industries. Going further, select investment themes have often defined each decade thanks to factors like technological disruption, geopolitics, and the economic environment.

While several factors could impact their performance—such as a global downturn or a second wave of inflation—it remains to be seen if investor demand will carry through the year and beyond.

Maps

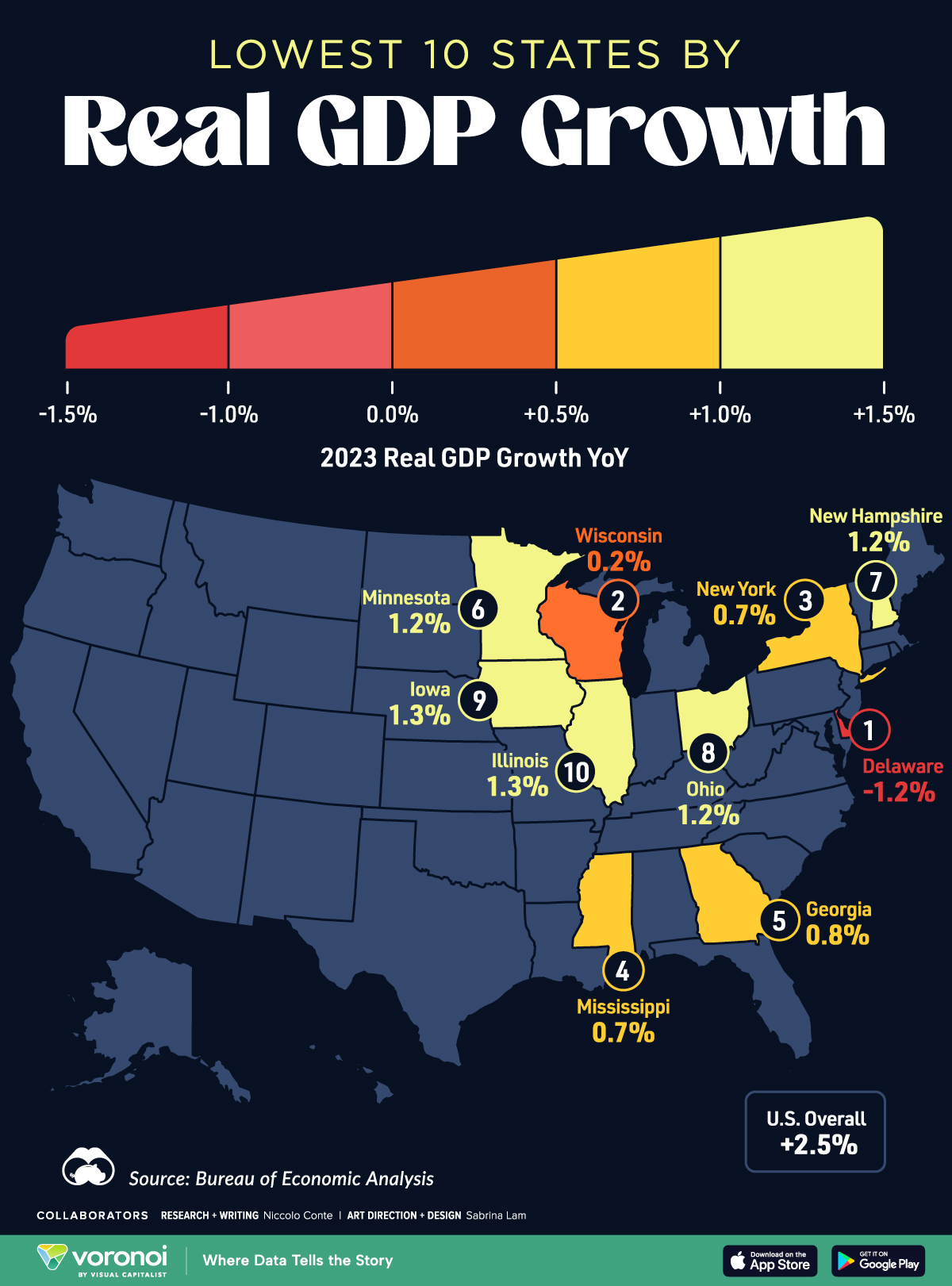

Mapped: The 10 U.S. States With the Lowest Real GDP Growth

In this graphic, we show where real GDP lagged the most across America in 2023 as high interest rates weighed on state economies.

The Top 10 U.S. States, by Lowest Real GDP Growth

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

While the U.S. economy defied expectations in 2023, posting 2.5% in real GDP growth, several states lagged behind.

Last year, oil-producing states led the pack in terms of real GDP growth across America, while the lowest growth was seen in states that were more sensitive to the impact of high interest rates, particularly due to slowdowns in the manufacturing and finance sectors.

This graphic shows the 10 states with the least robust real GDP growth in 2023, based on data from the Bureau of Economic Analysis.

Weakest State Economies in 2023

Below, we show the states with the slowest economic activity in inflation-adjusted terms, using chained 2017 dollars:

| Rank | State | Real GDP Growth 2023 YoY | Real GDP 2023 |

|---|---|---|---|

| 1 | Delaware | -1.2% | $74B |

| 2 | Wisconsin | +0.2% | $337B |

| 3 | New York | +0.7% | $1.8T |

| 4 | Missississippi | +0.7% | $115B |

| 5 | Georgia | +0.8% | $661B |

| 6 | Minnesota | +1.2% | $384B |

| 7 | New Hampshire | +1.2% | $91B |

| 8 | Ohio | +1.2% | $698B |

| 9 | Iowa | +1.3% | $200B |

| 10 | Illinois | +1.3% | $876B |

| U.S. | +2.5% | $22.4T |

Delaware witnessed the slowest growth in the country, with real GDP growth of -1.2% over the year as a sluggish finance and insurance sector dampened the state’s economy.

Like Delaware, the Midwestern state of Wisconsin also experienced declines across the finance and insurance sector, in addition to steep drops in the agriculture and manufacturing industries.

America’s third-biggest economy, New York, grew just 0.7% in 2023, falling far below the U.S. average. High interest rates took a toll on key sectors, with notable slowdowns in the construction and manufacturing sectors. In addition, falling home prices and a weaker job market contributed to slower economic growth.

Meanwhile, Georgia experienced the fifth-lowest real GDP growth rate. In March 2024, Rivian paused plans to build a $5 billion EV factory in Georgia, which was set to be one of the biggest economic development initiatives in the state in history.

These delays are likely to exacerbate setbacks for the state, however, both Kia and Hyundai have made significant investments in the EV industry, which could help boost Georgia’s manufacturing sector looking ahead.

-

Personal Finance1 week ago

Personal Finance1 week agoVisualizing the Tax Burden of Every U.S. State

-

Misc6 days ago

Misc6 days agoVisualized: Aircraft Carriers by Country

-

Culture7 days ago

Culture7 days agoHow Popular Snack Brand Logos Have Changed

-

Mining1 week ago

Mining1 week agoVisualizing Copper Production by Country in 2023

-

Misc1 week ago

Misc1 week agoCharted: How Americans Feel About Federal Government Agencies

-

Healthcare1 week ago

Healthcare1 week agoWhich Countries Have the Highest Infant Mortality Rates?

-

Demographics1 week ago

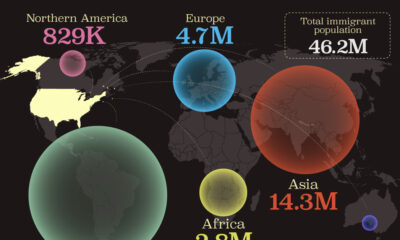

Demographics1 week agoMapped: U.S. Immigrants by Region

-

Maps1 week ago

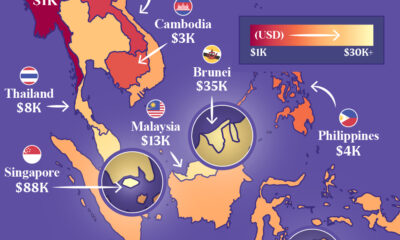

Maps1 week agoMapped: Southeast Asia’s GDP Per Capita, by Country