Technology

Ranked: America’s Largest Semiconductor Companies

![]()

Ranking America’s Largest Semiconductor Companies

As our world moves further into an era of widespread digitization, few industries can be considered as important as semiconductors.

These components are found in almost everything we use on a daily basis, and the ability to produce them domestically has become a topic of national security. For example, in 2022 the Biden administration announced the CHIPS and Science Act, which aims to strengthen America’s position in everything from clean energy to artificial intelligence.

With this in mind, we’ve ranked the top 15 U.S. semiconductor companies by their market capitalizations.

Data and Highlights

The data we used to create this infographic is listed in the table below. Year-to-date (YTD) returns were included for additional context. Both metrics are as of May 30, 2023.

| Rank | Company | Ticker | Market Cap (USD billions) | YTD Return |

|---|---|---|---|---|

| 1 | Nvidia | NVDA | $992 | 180.2% |

| 2 | Broadcom | AVGO | $335 | 45.1% |

| 3 | AMD | AMD | $202 | 95.7% |

| 4 | Texas Instruments | TXN | $160 | 8.2% |

| 5 | Qualcomm | QCOM | $129 | 8.2% |

| 6 | Intel | INTC | $125 | 12.2% |

| 7 | Applied Materials | AMAT | $115 | 41.2% |

| 8 | Analog Devices | ADI | $89 | 9.2% |

| 9 | Lam Research | LRCX | $85 | 52.1% |

| 10 | Micron Technology | MU | $78 | 42.3% |

| 11 | Snyopsys | SNPS | $71 | 45.4% |

| 12 | KLA | KLAC | $63 | 21.8% |

| 13 | Marvell Technology Group | MRVL | $54 | 76.2% |

| 14 | Microchip Technology | MCHP | $42 | 11.2% |

| 15 | ON Semiconductor | ON | $36 | 36.3% |

At the top is Nvidia, which became America’s newest $1 trillion company on Tuesday, May 30th. Shares pulled back slightly over the day and Nvidia closed at $992 billion. Over the past decade, Nvidia has transformed from a gaming-focused graphics card producer to a global leader in AI and data center chips.

In third and sixth place are two of America’s most well known chipmakers, AMD and Intel. These longtime rivals are moving in opposite trajectories, with AMD shares climbing 770% over the past five years, and Intel shares falling 47%. One reason for this is the data center segment, in which AMD appears to be stealing market share from Intel.

Further down the list we see Applied Materials in seventh, and Lam Research in ninth. Both firms specialize in semiconductor manufacturing equipment and thus play an important role in the industry’s supply chain.

Trade War Impacts

As tensions between the U.S. and China escalate, chipmakers are becoming increasingly entangled in geopolitical conflict.

In October 2022, the Biden administration introduced new export controls aimed at blocking China’s access to semiconductors produced with U.S. equipment. This impacted several companies in our top 15 list, including Lam Research and Applied Materials.

Shortly after the export controls were announced, Lam Research said it expected to lose upwards of $2.5 billion in annual revenues.

We lost some very profitable customers in the China region, and that’s going to persist, obviously.

– Doug Bettinger, CFO, Lam Research

In response, China announced in May 2023 that it would no longer allow America’s largest memory chipmaker, Micron, to sell its products to “critical national infrastructure operators”.

This is not the first time Micron has been involved in a controversy with China. In 2018, the firm alleged that Fujian Jinhua Integrated Circuit, a Chinese state-owned company, had solicited a Micron employee to steal specifications for memory chips. The U.S. Department of Commerce imposed export restrictions on Fujian Jinhua as a result.

Chipmakers on both sides of the Pacific will be closely watching as competition between these two countries heats up.

Technology

Charting the Next Generation of Internet

In this graphic, Visual Capitalist has partnered with MSCI to explore the potential of satellite internet as the next generation of internet innovation.

Could Tomorrow’s Internet be Streamed from Space?

In 2023, 2.6 billion people could not access the internet. Today, companies worldwide are looking to innovative technology to ensure more people are online at the speed of today’s technology.

Could satellite internet provide the solution?

In collaboration with MSCI, we embarked on a journey to explore whether tomorrow’s internet could be streamed from space.

Satellite Internet’s Potential Customer Base

Millions of people live in rural communities or mobile homes, and many spend much of their lives at sea or have no fixed abode. So, they cannot access the internet simply because the technology is unavailable.

Satellite internet gives these communities access to the internet without requiring a fixed location. Consequently, the volume of people who could get online using satellite internet is significant:

| Area | Potential Subscribers |

|---|---|

| Households Without Internet Access | 600,000,000 |

| RVs | 11,000,000 |

| Recreational Boats | 8,500,000 |

| Ships | 100,000 |

| Commercial Aircraft | 25,000 |

Advances in Satellite Technology

Satellite internet is not a new concept. However, it has only recently been that roadblocks around cost and long turnaround times have been overcome.

NASA’s space shuttle, until it was retired in 2011, was the only reusable means of transporting crew and cargo into orbit. It cost over $1.5 billion and took an average of 252 days to launch and refurbish.

In stark contrast, SpaceX’s Falcon 9 can now launch objects into orbit and maintain them at a fraction of the time and cost, less than 1% of the space shuttle’s cost.

| Average Rocket Turnaround Time | Average Launch/Refurbishment Cost | |

|---|---|---|

| Falcon 9* | 21 days | < $1,000,000 |

| Space Shuttle | 252 days | $1,500,000,000 (approximately) |

Satellites are now deployed 300 miles in low Earth orbit (LEO) rather than 22,000 miles above Earth in Geostationary Orbit (GEO), previously the typical satellite deployment altitude.

What this means for the consumer is that satellite internet streamed from LEO has a latency of 40 ms, which is an optimal internet connection. Especially when compared to the 700 ms stream latency experienced with satellite internet streamed from GEO.

What Would it Take to Build a Satellite Internet?

SpaceX, the private company that operates Starlink, currently has 4,500 satellites. However, the company believes it will require 10 times this number to provide comprehensive satellite internet coverage.

Charting the number of active satellites reveals that, despite the increasing number of active satellites, many more must be launched to create a comprehensive satellite internet.

| Year | Number of Active Satellites |

|---|---|

| 2022 | 6,905 |

| 2021 | 4,800 |

| 2020 | 3,256 |

| 2019 | 2,272 |

| 2018 | 2,027 |

| 2017 | 1,778 |

| 2016 | 1,462 |

| 2015 | 1,364 |

| 2014 | 1,262 |

| 2013 | 1,187 |

Next-Generation Internet Innovation

Innovation is at the heart of the internet’s next generation, and the MSCI Next Generation Innovation Index exposes investors to companies that can take advantage of potentially disruptive technologies like satellite internet.

You can gain exposure to companies advancing access to the internet with four indexes:

- MSCI ACWI IMI Next Generation Internet Innovation Index

- MSCI World IMI Next Generation Internet Innovation 30 Index

- MSCI China All Shares IMI Next Generation Internet Innovation Index

- MSCI China A Onshore IMI Next Generation Internet Innovation Index

MSCI thematic indexes are objective, rules-based, and regularly updated to focus on specific emerging trends that could evolve.

Click here to explore the MSCI thematic indexes

-

Technology1 week ago

Technology1 week agoCountries With the Highest Rates of Crypto Ownership

While the U.S. is a major market for cryptocurrencies, two countries surpass it in terms of their rates of crypto ownership.

-

Technology2 weeks ago

Technology2 weeks agoMapped: The Number of AI Startups By Country

Over the past decade, thousands of AI startups have been funded worldwide. See which countries are leading the charge in this map graphic.

-

Technology3 weeks ago

Technology3 weeks agoAll of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

-

Technology3 weeks ago

Technology3 weeks agoVisualizing AI Patents by Country

See which countries have been granted the most AI patents each year, from 2012 to 2022.

-

Technology4 weeks ago

Technology4 weeks agoHow Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

-

AI1 month ago

AI1 month agoRanked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

-

Personal Finance1 week ago

Personal Finance1 week agoVisualizing the Tax Burden of Every U.S. State

-

Misc6 days ago

Misc6 days agoVisualized: Aircraft Carriers by Country

-

Culture6 days ago

Culture6 days agoHow Popular Snack Brand Logos Have Changed

-

Mining1 week ago

Mining1 week agoVisualizing Copper Production by Country in 2023

-

Misc1 week ago

Misc1 week agoCharted: How Americans Feel About Federal Government Agencies

-

Healthcare1 week ago

Healthcare1 week agoWhich Countries Have the Highest Infant Mortality Rates?

-

Demographics1 week ago

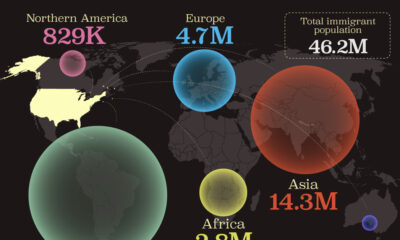

Demographics1 week agoMapped: U.S. Immigrants by Region

-

Maps1 week ago

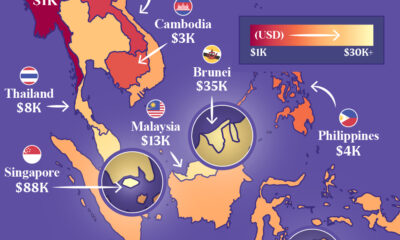

Maps1 week agoMapped: Southeast Asia’s GDP Per Capita, by Country