Markets

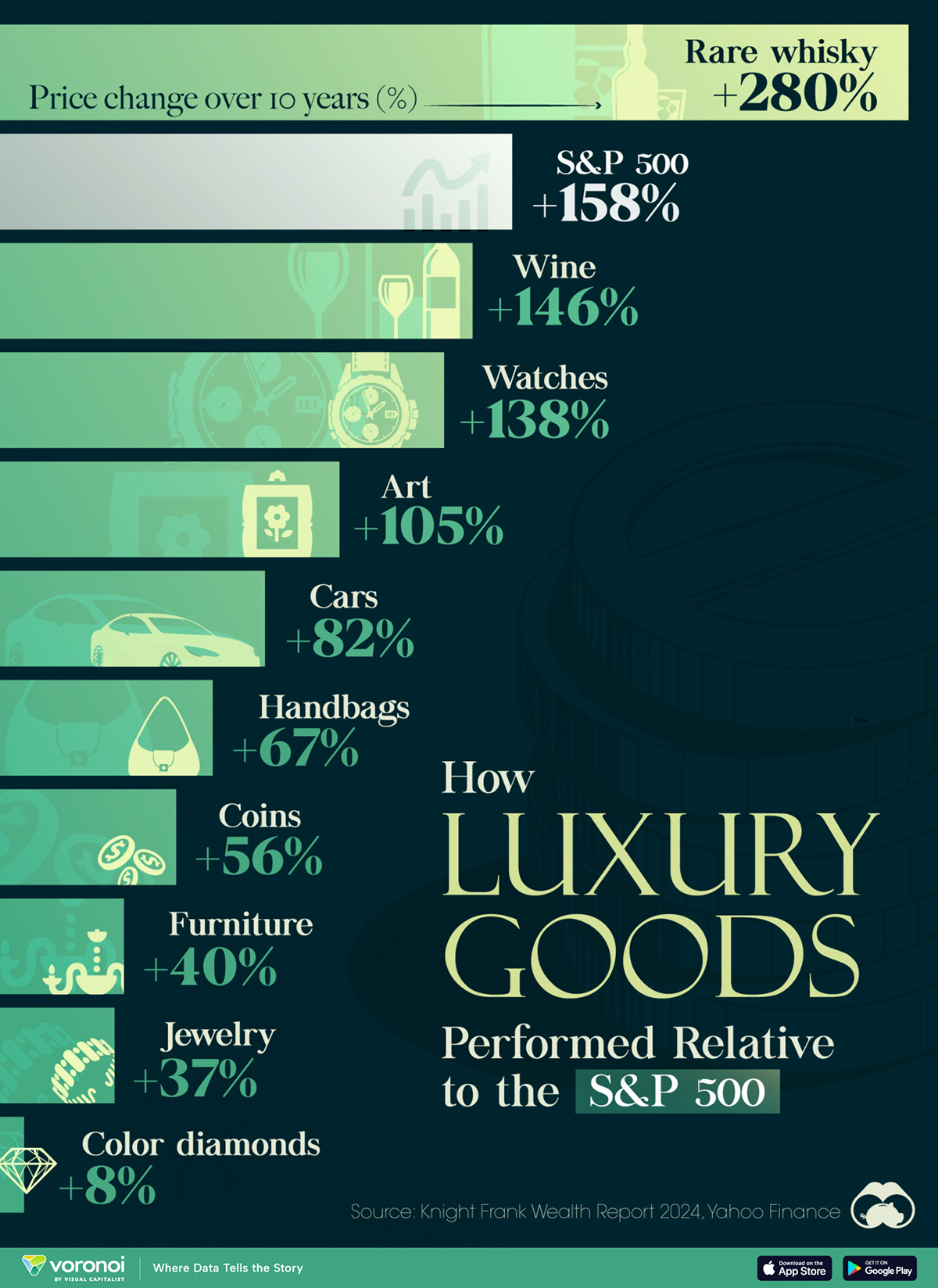

Charted: Luxury Goods Investments vs. S&P 500 in the Last 10 Years

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

Charted: Luxury Goods by Appreciation in Value Over 10 Years

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Some of the world’s ultra-wealthy spend their money on luxury goods such as fine wines, expensive watches, or one-of-a-kind art pieces as a passion, but others consider them investments—and their returns do often end up paying off.

We dive into the 10-year performance of various luxury good classes as of Q4 2023, according to the Knight Frank Luxury Investment Index released as part of the 2024 Wealth Report. The 10-year return of the S&P 500 was included for additional context.

Rare Whisky Bottles Have Outperformed the S&P 500 Since 2013

Knight Frank’s index uses the weighted average of each individual asset, tracking sales of reference brands and pieces for each asset.

| Asset | Price Change (Q4 2013–23) |

|---|---|

| 🥃 Rare Whiskey | +280% |

| 🍷 Wine | +146% |

| ⌚ Watches | +138% |

| 🖼️ Art | +105% |

| 🏎️ Cars | +82% |

| 👜 Handbags | +67% |

| 🪙 Coins | +56% |

| 🛋️ Furniture | +40% |

| 💍 Jewelery | +37% |

| 💎 Colored Diamonds | +8% |

| S&P 500 | +158% |

Over the past 10 years, rare whisky (or whiskey, depending on where it was made) has been the best performing luxury asset, appreciating by 280% and even besting the S&P 500.

Numerous sale records have been broken at auctions since COVID-19, with collectors sometimes shelling out millions for a single bottle. In November 2023 for example, a bottle of The Macallan Valerio Adami 60 Year Old (of which only 40 bottles were produced) sold for $2.7 million at a Sotheby’s auction. Before bidding commenced, Sotheby’s had given the bottle a high estimate of $1.5M.

Fine wine and luxury watches were the next two best performing luxury goods by 10-year returns, at +146% and +138% respectively.

At the bottom were jewelry (+37%), such as rings and necklaces, and colored diamonds (+8%), including rare pink and blue diamonds.

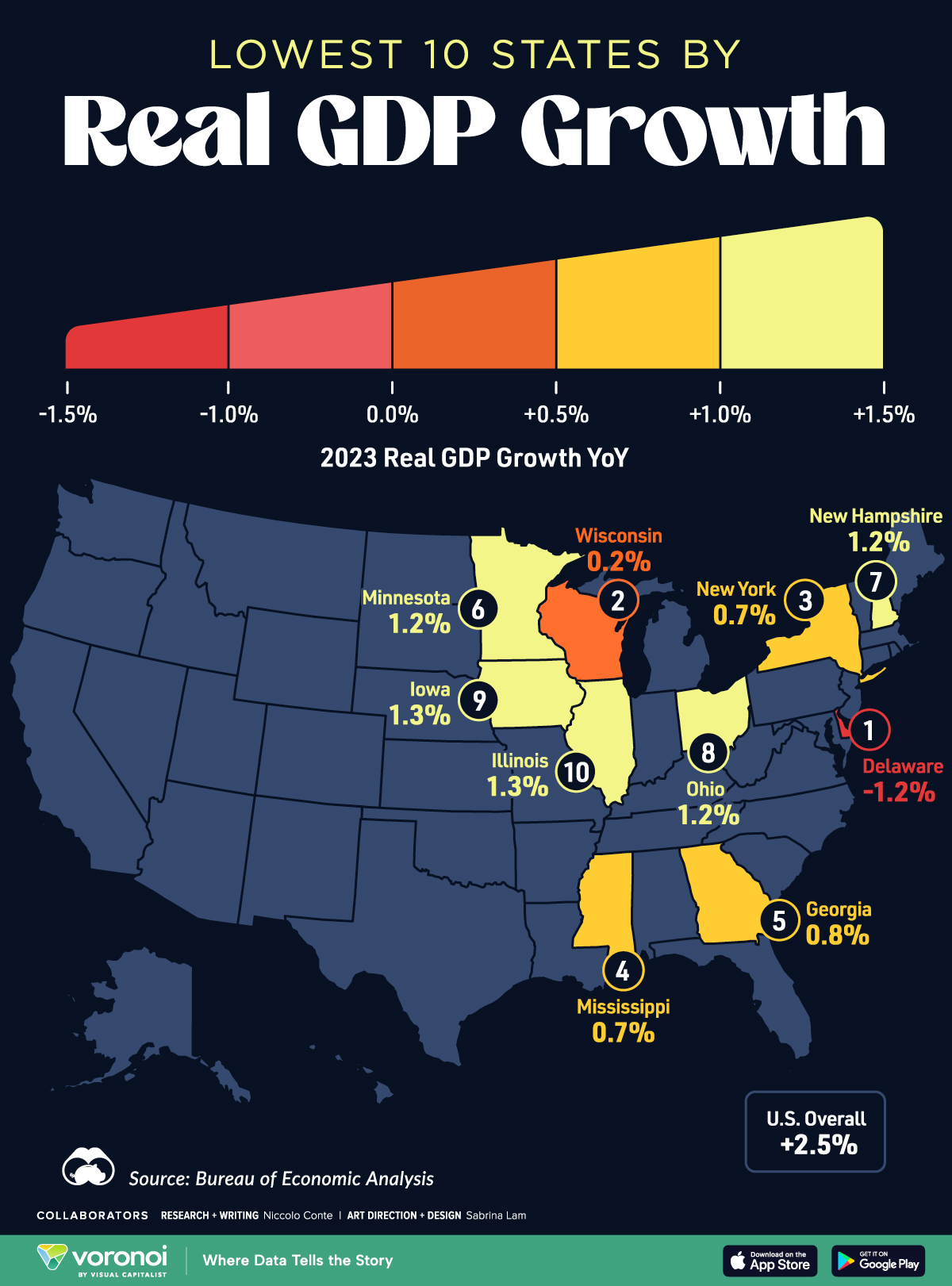

Maps

Mapped: The 10 U.S. States With the Lowest Real GDP Growth

In this graphic, we show where real GDP lagged the most across America in 2023 as high interest rates weighed on state economies.

The Top 10 U.S. States, by Lowest Real GDP Growth

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

While the U.S. economy defied expectations in 2023, posting 2.5% in real GDP growth, several states lagged behind.

Last year, oil-producing states led the pack in terms of real GDP growth across America, while the lowest growth was seen in states that were more sensitive to the impact of high interest rates, particularly due to slowdowns in the manufacturing and finance sectors.

This graphic shows the 10 states with the least robust real GDP growth in 2023, based on data from the Bureau of Economic Analysis.

Weakest State Economies in 2023

Below, we show the states with the slowest economic activity in inflation-adjusted terms, using chained 2017 dollars:

| Rank | State | Real GDP Growth 2023 YoY | Real GDP 2023 |

|---|---|---|---|

| 1 | Delaware | -1.2% | $74B |

| 2 | Wisconsin | +0.2% | $337B |

| 3 | New York | +0.7% | $1.8T |

| 4 | Missississippi | +0.7% | $115B |

| 5 | Georgia | +0.8% | $661B |

| 6 | Minnesota | +1.2% | $384B |

| 7 | New Hampshire | +1.2% | $91B |

| 8 | Ohio | +1.2% | $698B |

| 9 | Iowa | +1.3% | $200B |

| 10 | Illinois | +1.3% | $876B |

| U.S. | +2.5% | $22.4T |

Delaware witnessed the slowest growth in the country, with real GDP growth of -1.2% over the year as a sluggish finance and insurance sector dampened the state’s economy.

Like Delaware, the Midwestern state of Wisconsin also experienced declines across the finance and insurance sector, in addition to steep drops in the agriculture and manufacturing industries.

America’s third-biggest economy, New York, grew just 0.7% in 2023, falling far below the U.S. average. High interest rates took a toll on key sectors, with notable slowdowns in the construction and manufacturing sectors. In addition, falling home prices and a weaker job market contributed to slower economic growth.

Meanwhile, Georgia experienced the fifth-lowest real GDP growth rate. In March 2024, Rivian paused plans to build a $5 billion EV factory in Georgia, which was set to be one of the biggest economic development initiatives in the state in history.

These delays are likely to exacerbate setbacks for the state, however, both Kia and Hyundai have made significant investments in the EV industry, which could help boost Georgia’s manufacturing sector looking ahead.

-

Personal Finance1 week ago

Personal Finance1 week agoVisualizing the Tax Burden of Every U.S. State

-

Misc6 days ago

Misc6 days agoVisualized: Aircraft Carriers by Country

-

Culture6 days ago

Culture6 days agoHow Popular Snack Brand Logos Have Changed

-

Mining1 week ago

Mining1 week agoVisualizing Copper Production by Country in 2023

-

Misc1 week ago

Misc1 week agoCharted: How Americans Feel About Federal Government Agencies

-

Healthcare1 week ago

Healthcare1 week agoWhich Countries Have the Highest Infant Mortality Rates?

-

Demographics1 week ago

Demographics1 week agoMapped: U.S. Immigrants by Region

-

Maps1 week ago

Maps1 week agoMapped: Southeast Asia’s GDP Per Capita, by Country