Money

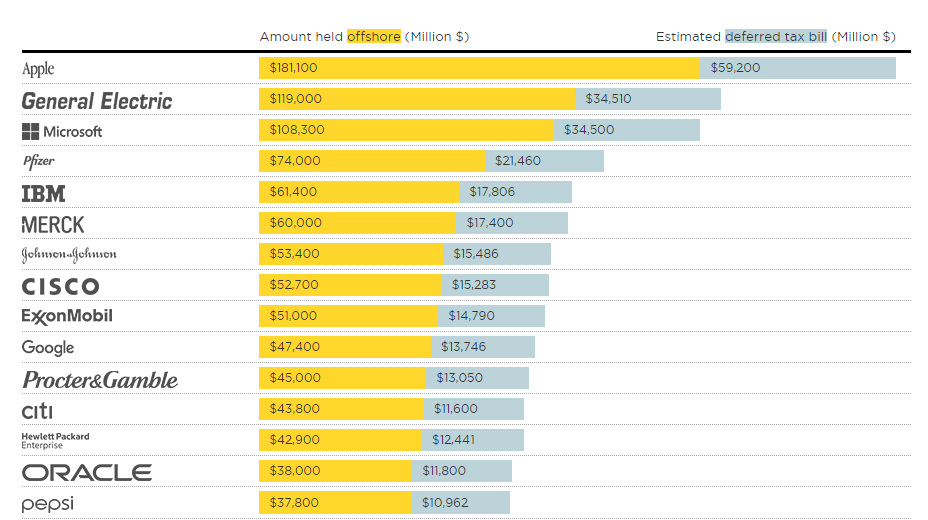

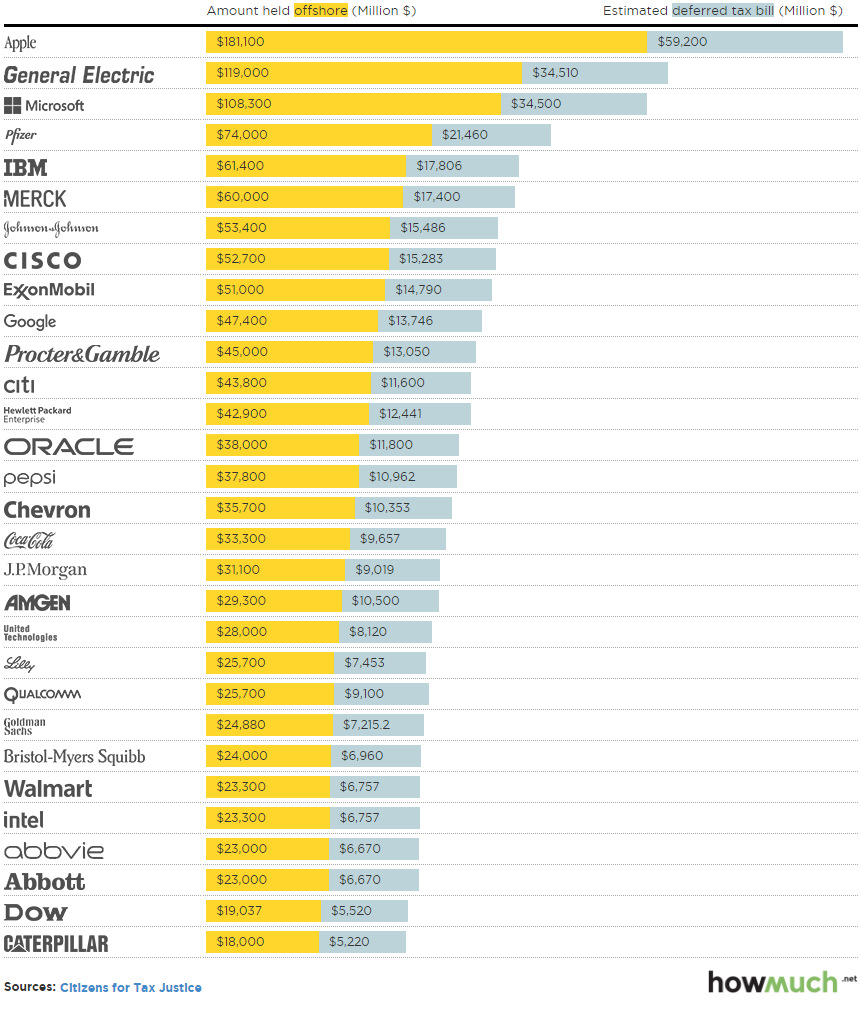

The Fortune 500 Companies with the Most Cash in Offshore Tax Havens

When the taxman comes knocking at the door, there’s not a lot that the Regular Joe can do besides pay up.

Fortune 500 companies, on the other hand, have the resources and wherewithal to give themselves options that regular folks do not. With billions of revenues, it’s worth it for these companies to do whatever they can to avoid the IRS – and much of the time, that means stashing cash in offshore tax havens.

Fortune 500 Firms with Cash in Offshore Tax Havens

Today’s infographic is from HowMuch.net, a cost information site. It looks at the 30 companies in the Fortune 500 index with the most holdings in offshore tax havens.

Image courtesy of: HowMuch.net

Apple, which is the world’s largest public company, has a boatload of cash and assets stored offshore – about $181.1 billion in fact. That’s about enough money to buy Coca-Cola, Goldman Sachs, or Walt Disney.

The deferred tax bill on bringing that back onshore? It’s estimated to be $59.2 billion.

Markets

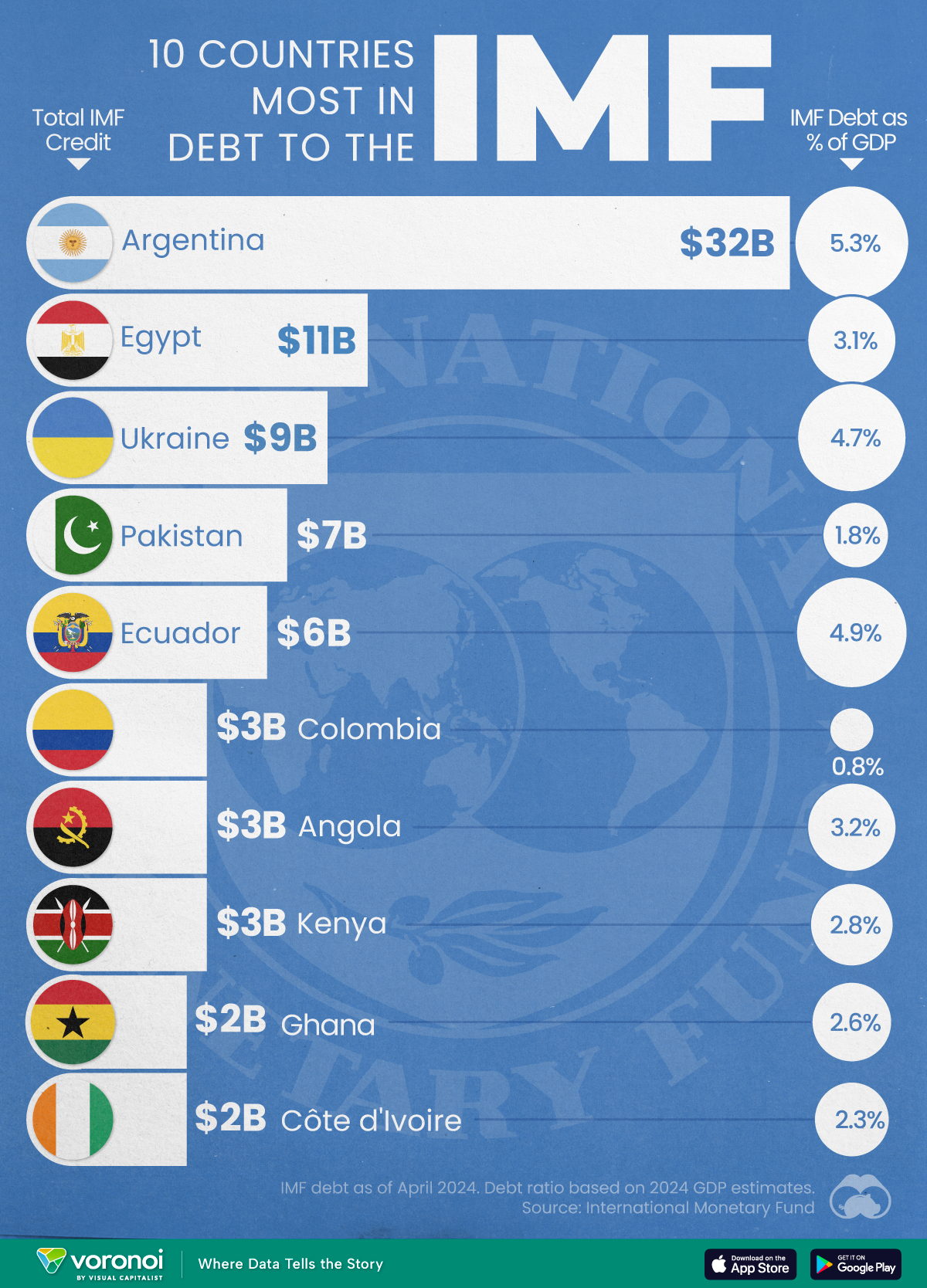

Top 10 Countries Most in Debt to the IMF

Argentina tops the ranking, with a debt equivalent to 5.3% of the country’s GDP.

Top 10 Countries Most in Debt to the IMF

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Established in 1944, the International Monetary Fund (IMF) supports countries’ economic growth by providing financial aid and guidance on policies to enhance stability, productivity, and job opportunities.

Countries seek loans from the IMF to address economic crises, stabilize their currencies, implement structural reforms, and alleviate balance of payments difficulties.

In this graphic, we visualize the 10 countries most indebted to the fund.

Methodology

We compiled this ranking using the International Monetary Fund’s data on Total IMF Credit Outstanding. We selected the latest debt data for each country, accurate as of April 29, 2024.

Argentina Tops the Rank

Argentina’s debt to the IMF is equivalent to 5.3% of the country’s GDP. In total, the country owns more than $32 billion.

| Country | IMF Credit Outstanding ($B) | GDP ($B, 2024) | IMF Debt as % of GDP |

|---|---|---|---|

| 🇦🇷 Argentina | 32 | 604.3 | 5.3 |

| 🇪🇬 Egypt | 11 | 347.6 | 3.1 |

| 🇺🇦 Ukraine | 9 | 188.9 | 4.7 |

| 🇵🇰 Pakistan | 7 | 374.7 | 1.8 |

| 🇪🇨 Ecuador | 6 | 121.6 | 4.9 |

| 🇨🇴 Colombia | 3 | 386.1 | 0.8 |

| 🇦🇴 Angola | 3 | 92.1 | 3.2 |

| 🇰🇪 Kenya | 3 | 104.0 | 2.8 |

| 🇬🇭 Ghana | 2 | 75.2 | 2.6 |

| 🇨🇮 Ivory Coast | 2 | 86.9 | 2.3 |

A G20 member and major grain exporter, the country’s history of debt trouble dates back to the late 1890s when it defaulted after contracting debts to modernize the capital, Buenos Aires. It has already been bailed out over 20 times in the last six decades by the IMF.

Five of the 10 most indebted countries are in Africa, while three are in South America.

The only European country on our list, Ukraine has relied on international support amidst the conflict with Russia. It is estimated that Russia’s full-scale invasion of the country caused the loss of a third of the country’s economy. The country owes $9 billion to the IMF.

In total, almost 100 countries owe money to the IMF, and the grand total of all of these debts is $111 billion. The above countries (top 10) account for about 69% of these debts.

-

Healthcare2 weeks ago

Healthcare2 weeks agoWhich Countries Have the Highest Infant Mortality Rates?

-

Misc1 week ago

Misc1 week agoVisualizing Global Losses from Financial Scams

-

population1 week ago

population1 week agoMapped: U.S. States By Number of Cities Over 250,000 Residents

-

Culture1 week ago

Culture1 week agoCharted: How the Logos of Select Fashion Brands Have Evolved

-

United States1 week ago

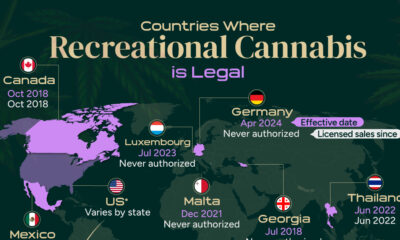

United States1 week agoMapped: Countries Where Recreational Cannabis is Legal

-

Misc1 week ago

Misc1 week agoVisualized: Aircraft Carriers by Country

-

Culture1 week ago

Culture1 week agoHow Popular Snack Brand Logos Have Changed

-

Mining2 weeks ago

Mining2 weeks agoVisualizing Copper Production by Country in 2023