Technology

The Jeff Bezos Empire in One Giant Chart

The Jeff Bezos Empire in One Giant Chart

With a fortune largely tied to his 79 million Amazon shares, the net worth of Jeff Bezos has continued to rise.

Most recently, the Amazon founder was even able to surpass Bill Gates on the global wealth leaderboard with $137 billion to his name – however, this ascent to the very top may be extremely short-lived.

On January 9th, 2019, Jeff Bezos announced on Twitter that he was divorcing MacKenzie Bezos, his wife of 25 years. While the precise ramifications of the news are not yet clear, it’s anticipated that MacKenzie Bezos could end up with a considerable portion of shares in Amazon as a result.

There is much to be decided as the world’s wealthiest couple splits their assets – but for now, here is a list of what Jeff Bezos owns today.

The Jeff Bezos Empire in 2019

The obvious centerpiece to the Jeff Bezos Empire is the 16% ownership stake in Amazon.com.

However, beyond that, there is a wide variety of other investments and acquisitions that Jeff Bezos has made through Amazon or his other investment vehicles. These range from household names to more secretive endeavors, and are worth looking at to truly understand his assets and fortune.

Amazon.com

Amazon makes acquisitions and investments that relate to the company’s core business and future ambitions. This includes acquisitions of Whole Foods ($13.7 billion in 2017), Zappos.com ($1.2 billion in 2009), PillPack ($1 billion in 2018), Twitch.tv ($970 million in 2014), and Kiva Systems ($780 million in 2012).

This also includes investments in everything form failed dot-com company Kozmo.com (2000) to Twilio, which successfully IPO’d in 2016.

Bezos Expeditions

Bezos Expeditions manages Jeff Bezos’ venture capital investments. Over the years, this venture arm has put money into Twitter, Domo, Juno Therapeutics, Workday, General Fusion, Rethink Robotics, Business Insider, MakerBot, and Stack Overflow.

More recent investments include GRAIL, a startup that recently raised over $900 million to cure cancer before it happens, as well as EverFi, an edtech startup.

Jeff Bezos

Jeff Bezos also invests money on a personal level. He was an angel investor in Google in 1998, and has also put money in Uber and Airbnb. (Note: these last two companies are listed on the Bezos Expeditions website, but on Crunchbase they are listed as personal investments.)

Nash Holdings LLC

Nash Holdings is the private company owned by Bezos that bought The Washington Post for $250 million.

Bezos Family Foundation

The BFF is run by Jeff Bezos’ parents, and is funded through Amazon stock. It focuses on early education, and has also made an investment in LightSail Education’s $11 million Series B round.

Blue Origin

Finally, it’s also worth noting that Jeff Bezos is the founder of Blue Origin, an aerospace company that is competing with SpaceX in mankind’s final frontier.

Note: This article and infographic were originally published in June 20, 2017. Both have been updated as of January 11, 2019 to include more up-to-date acquisitions and investments.

Technology

Charting the Next Generation of Internet

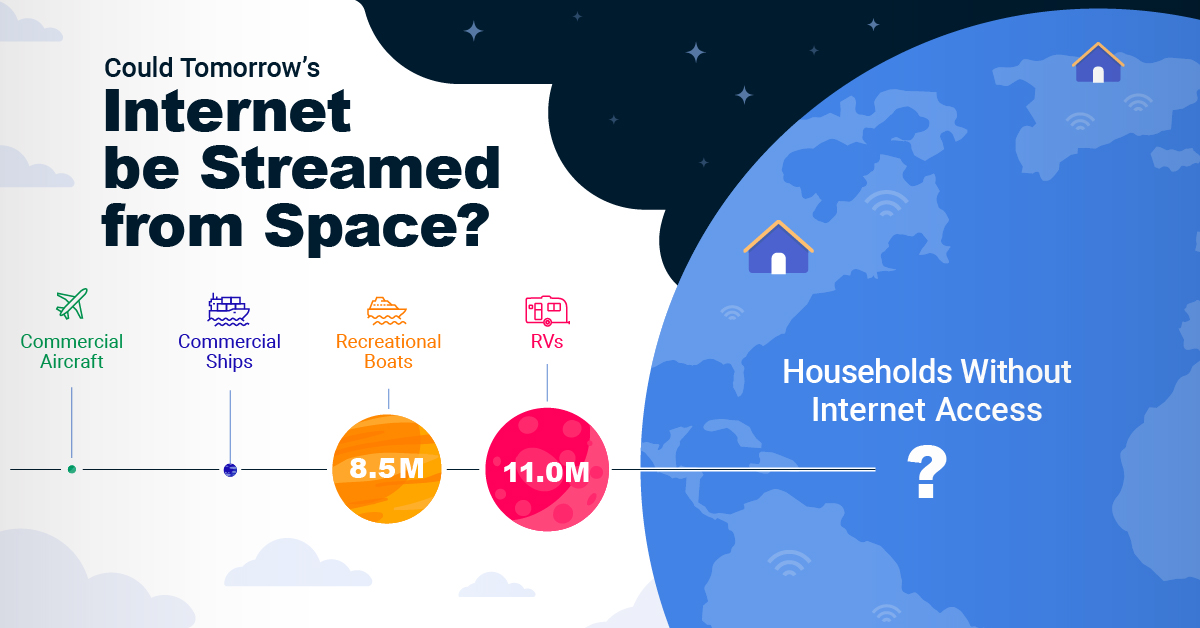

In this graphic, Visual Capitalist has partnered with MSCI to explore the potential of satellite internet as the next generation of internet innovation.

Could Tomorrow’s Internet be Streamed from Space?

In 2023, 2.6 billion people could not access the internet. Today, companies worldwide are looking to innovative technology to ensure more people are online at the speed of today’s technology.

Could satellite internet provide the solution?

In collaboration with MSCI, we embarked on a journey to explore whether tomorrow’s internet could be streamed from space.

Satellite Internet’s Potential Customer Base

Millions of people live in rural communities or mobile homes, and many spend much of their lives at sea or have no fixed abode. So, they cannot access the internet simply because the technology is unavailable.

Satellite internet gives these communities access to the internet without requiring a fixed location. Consequently, the volume of people who could get online using satellite internet is significant:

| Area | Potential Subscribers |

|---|---|

| Households Without Internet Access | 600,000,000 |

| RVs | 11,000,000 |

| Recreational Boats | 8,500,000 |

| Ships | 100,000 |

| Commercial Aircraft | 25,000 |

Advances in Satellite Technology

Satellite internet is not a new concept. However, it has only recently been that roadblocks around cost and long turnaround times have been overcome.

NASA’s space shuttle, until it was retired in 2011, was the only reusable means of transporting crew and cargo into orbit. It cost over $1.5 billion and took an average of 252 days to launch and refurbish.

In stark contrast, SpaceX’s Falcon 9 can now launch objects into orbit and maintain them at a fraction of the time and cost, less than 1% of the space shuttle’s cost.

| Average Rocket Turnaround Time | Average Launch/Refurbishment Cost | |

|---|---|---|

| Falcon 9* | 21 days | < $1,000,000 |

| Space Shuttle | 252 days | $1,500,000,000 (approximately) |

Satellites are now deployed 300 miles in low Earth orbit (LEO) rather than 22,000 miles above Earth in Geostationary Orbit (GEO), previously the typical satellite deployment altitude.

What this means for the consumer is that satellite internet streamed from LEO has a latency of 40 ms, which is an optimal internet connection. Especially when compared to the 700 ms stream latency experienced with satellite internet streamed from GEO.

What Would it Take to Build a Satellite Internet?

SpaceX, the private company that operates Starlink, currently has 4,500 satellites. However, the company believes it will require 10 times this number to provide comprehensive satellite internet coverage.

Charting the number of active satellites reveals that, despite the increasing number of active satellites, many more must be launched to create a comprehensive satellite internet.

| Year | Number of Active Satellites |

|---|---|

| 2022 | 6,905 |

| 2021 | 4,800 |

| 2020 | 3,256 |

| 2019 | 2,272 |

| 2018 | 2,027 |

| 2017 | 1,778 |

| 2016 | 1,462 |

| 2015 | 1,364 |

| 2014 | 1,262 |

| 2013 | 1,187 |

Next-Generation Internet Innovation

Innovation is at the heart of the internet’s next generation, and the MSCI Next Generation Innovation Index exposes investors to companies that can take advantage of potentially disruptive technologies like satellite internet.

You can gain exposure to companies advancing access to the internet with four indexes:

- MSCI ACWI IMI Next Generation Internet Innovation Index

- MSCI World IMI Next Generation Internet Innovation 30 Index

- MSCI China All Shares IMI Next Generation Internet Innovation Index

- MSCI China A Onshore IMI Next Generation Internet Innovation Index

MSCI thematic indexes are objective, rules-based, and regularly updated to focus on specific emerging trends that could evolve.

Click here to explore the MSCI thematic indexes

-

Technology2 weeks ago

Technology2 weeks agoCountries With the Highest Rates of Crypto Ownership

While the U.S. is a major market for cryptocurrencies, two countries surpass it in terms of their rates of crypto ownership.

-

Technology2 weeks ago

Technology2 weeks agoMapped: The Number of AI Startups By Country

Over the past decade, thousands of AI startups have been funded worldwide. See which countries are leading the charge in this map graphic.

-

Technology3 weeks ago

Technology3 weeks agoAll of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

-

Technology4 weeks ago

Technology4 weeks agoVisualizing AI Patents by Country

See which countries have been granted the most AI patents each year, from 2012 to 2022.

-

Technology4 weeks ago

Technology4 weeks agoHow Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

-

AI1 month ago

AI1 month agoRanked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

-

United States7 days ago

United States7 days agoMapped: Countries Where Recreational Cannabis is Legal

-

Healthcare2 weeks ago

Healthcare2 weeks agoLife Expectancy by Region (1950-2050F)

-

Markets2 weeks ago

Markets2 weeks agoThe Growth of a $1,000 Equity Investment, by Stock Market

-

Markets2 weeks ago

Markets2 weeks agoMapped: Europe’s GDP Per Capita, by Country

-

Money2 weeks ago

Money2 weeks agoCharted: What Frustrates Americans About the Tax System

-

Technology2 weeks ago

Technology2 weeks agoCountries With the Highest Rates of Crypto Ownership

-

Mining2 weeks ago

Mining2 weeks agoWhere the World’s Aluminum is Smelted, by Country

-

Personal Finance2 weeks ago

Personal Finance2 weeks agoVisualizing the Tax Burden of Every U.S. State