Debt

Ranked: Government Debt by Country, in Advanced Economies

Government Debt by Country, in Advanced Economies

The amount of debt a government holds is a crucial indicator for the sustainability of its finances.

If the debt is excessively high—especially as a percentage of gross domestic product (GDP)—it may signal challenges in meeting financial obligations, potentially leading to economic instability.

This graphic ranks government debt by country for advanced economies, using their gross debt-to-GDP ratio. The ranking is based on IMF Outlook from October 2023.

Debt-to-GDP Ratio for Advanced Economies in 2023

From 20 economies analyzed, 11 have a debt-to-GDP ratio of over 100%.

At the top is Japan, whose national debt has remained above 100% of its GDP for two decades, reaching 255% in 2023.

| Economy by Gross Debt | % of GDP (2023) |

|---|---|

| 🇯🇵 Japan | 255% |

| 🇬🇷 Greece | 168% |

| 🇸🇬 Singapore | 168% |

| 🇮🇹 Italy | 144% |

| 🇺🇸 United States* | 123% |

| 🇫🇷 France | 110% |

| 🇵🇹 Portugal | 108% |

| 🇪🇸 Spain | 107% |

| 🇨🇦 Canada* | 106% |

| 🇧🇪 Belgium | 106% |

| 🇬🇧 United Kingdom | 104% |

| 🇨🇾 Cyprus | 79% |

| 🇦🇹 Austria | 75% |

| 🇫🇮 Finland | 74% |

| 🇸🇮 Slovenia | 69% |

| 🇩🇪 Germany | 66% |

| 🇭🇷 Croatia | 64% |

| 🇮🇸 Iceland | 61% |

| 🇮🇱 Israel | 58% |

| 🇸🇰 Slovak Republic | 57% |

| 🌎 G7 Average | 128% |

*For the U.S. and Canada, gross debt levels were adjusted to exclude unfunded pension liabilities of government employees’ defined-benefit pension plans.

Japan has indeed been borrowing heavily, though mainly in the form of intergovernmental holdings with interest rates around 0%. However, with the country experiencing a rapidly aging population, an increasing burden of social security expenses could lead to an even larger fiscal deficit in the future.

The U.S. national debt hit $32 trillion in 2023, making up 123% of the country’s GDP. To put it in perspective, two decades ago, the U.S. debt-to-GDP ratio was less than half of what it is today. Nonetheless, it remains below the G7 average of 128%.

Germany’s ratio of 66% is the lowest in the G7, though it climbed following the COVID-19 pandemic. All EU member states attempt to keep their ratios below 60% for stability. Otherwise, when debt grows beyond what countries can pay, emergency bailouts and defaults lead to economies crashing, as seen in the European debt crisis from 2009 to 2014.

However, a high gross debt-to-GDP ratio (over 100%) is not always a cause for concern. Net ratios that take intergovernmental holdings into account can indicate exposure to debt better in the short-term, as does comparing liabilities and assets. The question is, where are debt ratios heading in the future?

Markets

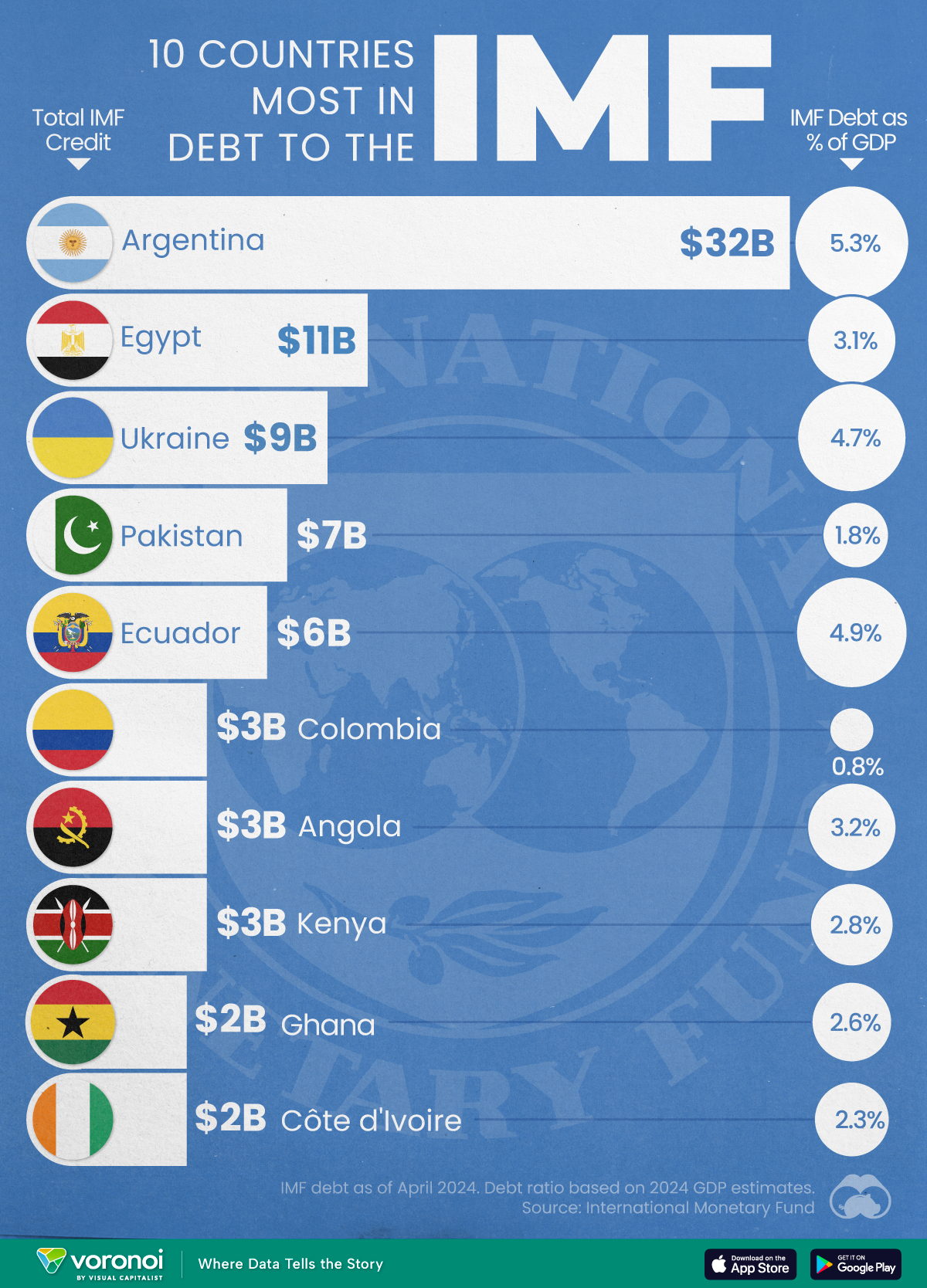

Top 10 Countries Most in Debt to the IMF

Argentina tops the ranking, with a debt equivalent to 5.3% of the country’s GDP.

Top 10 Countries Most in Debt to the IMF

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Established in 1944, the International Monetary Fund (IMF) supports countries’ economic growth by providing financial aid and guidance on policies to enhance stability, productivity, and job opportunities.

Countries seek loans from the IMF to address economic crises, stabilize their currencies, implement structural reforms, and alleviate balance of payments difficulties.

In this graphic, we visualize the 10 countries most indebted to the fund.

Methodology

We compiled this ranking using the International Monetary Fund’s data on Total IMF Credit Outstanding. We selected the latest debt data for each country, accurate as of April 29, 2024.

Argentina Tops the Rank

Argentina’s debt to the IMF is equivalent to 5.3% of the country’s GDP. In total, the country owns more than $32 billion.

| Country | IMF Credit Outstanding ($B) | GDP ($B, 2024) | IMF Debt as % of GDP |

|---|---|---|---|

| 🇦🇷 Argentina | 32 | 604.3 | 5.3 |

| 🇪🇬 Egypt | 11 | 347.6 | 3.1 |

| 🇺🇦 Ukraine | 9 | 188.9 | 4.7 |

| 🇵🇰 Pakistan | 7 | 374.7 | 1.8 |

| 🇪🇨 Ecuador | 6 | 121.6 | 4.9 |

| 🇨🇴 Colombia | 3 | 386.1 | 0.8 |

| 🇦🇴 Angola | 3 | 92.1 | 3.2 |

| 🇰🇪 Kenya | 3 | 104.0 | 2.8 |

| 🇬🇭 Ghana | 2 | 75.2 | 2.6 |

| 🇨🇮 Ivory Coast | 2 | 86.9 | 2.3 |

A G20 member and major grain exporter, the country’s history of debt trouble dates back to the late 1890s when it defaulted after contracting debts to modernize the capital, Buenos Aires. It has already been bailed out over 20 times in the last six decades by the IMF.

Five of the 10 most indebted countries are in Africa, while three are in South America.

The only European country on our list, Ukraine has relied on international support amidst the conflict with Russia. It is estimated that Russia’s full-scale invasion of the country caused the loss of a third of the country’s economy. The country owes $9 billion to the IMF.

In total, almost 100 countries owe money to the IMF, and the grand total of all of these debts is $111 billion. The above countries (top 10) account for about 69% of these debts.

-

Personal Finance1 week ago

Personal Finance1 week agoVisualizing the Tax Burden of Every U.S. State

-

Misc6 days ago

Misc6 days agoVisualized: Aircraft Carriers by Country

-

Culture6 days ago

Culture6 days agoHow Popular Snack Brand Logos Have Changed

-

Mining1 week ago

Mining1 week agoVisualizing Copper Production by Country in 2023

-

Misc1 week ago

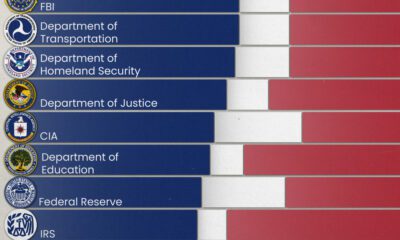

Misc1 week agoCharted: How Americans Feel About Federal Government Agencies

-

Healthcare1 week ago

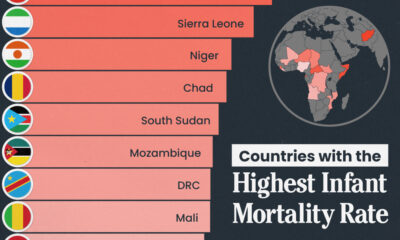

Healthcare1 week agoWhich Countries Have the Highest Infant Mortality Rates?

-

Demographics1 week ago

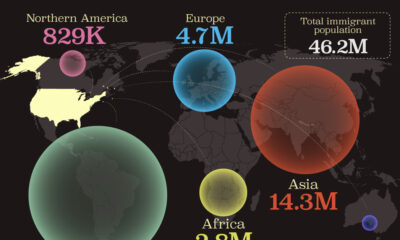

Demographics1 week agoMapped: U.S. Immigrants by Region

-

Maps1 week ago

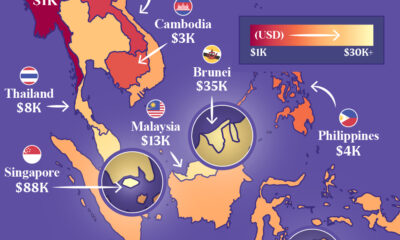

Maps1 week agoMapped: Southeast Asia’s GDP Per Capita, by Country