Markets

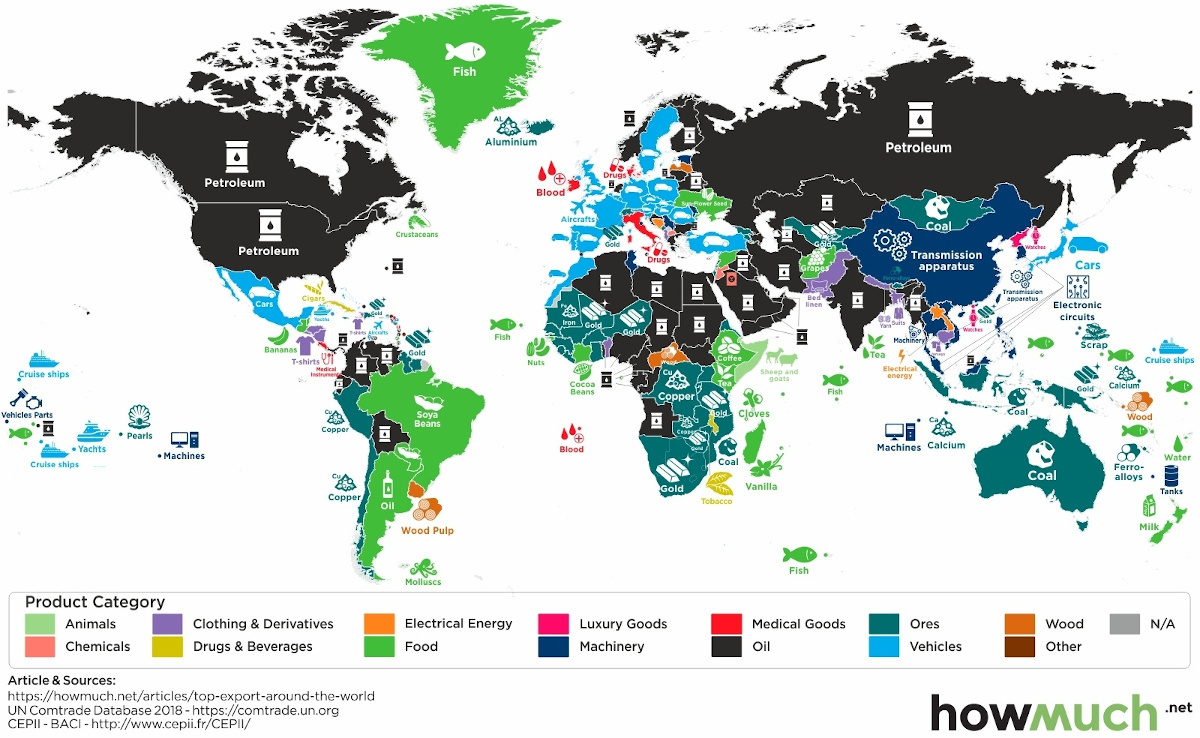

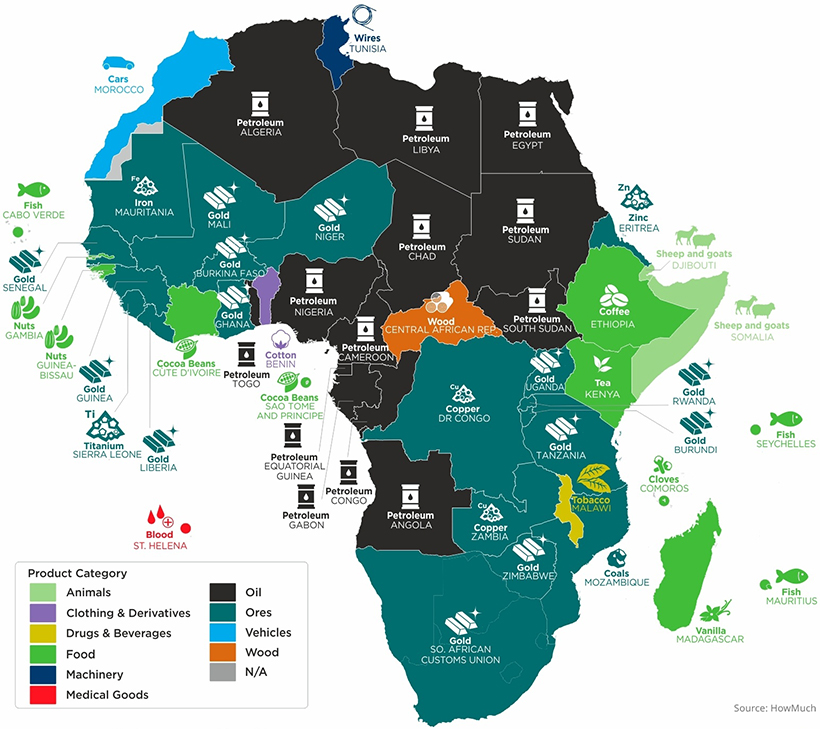

Mapped: The Top Export in Every Country

Click to view a larger version of this infographic

Mapped: The Top Export in Every Country

View the high resolution of this infographic by clicking here.

Today, exports make up roughly 25% of total global production.

One of the common influences on these exports, unsurprisingly, is oil. In fact, petroleum is the top export across over 50 nations, and along with many other resource-driven materials makes up a sizable share of the global export market. Since 2000, the total value of all exported global trade of goods and services has tripled to $19.5 trillion.

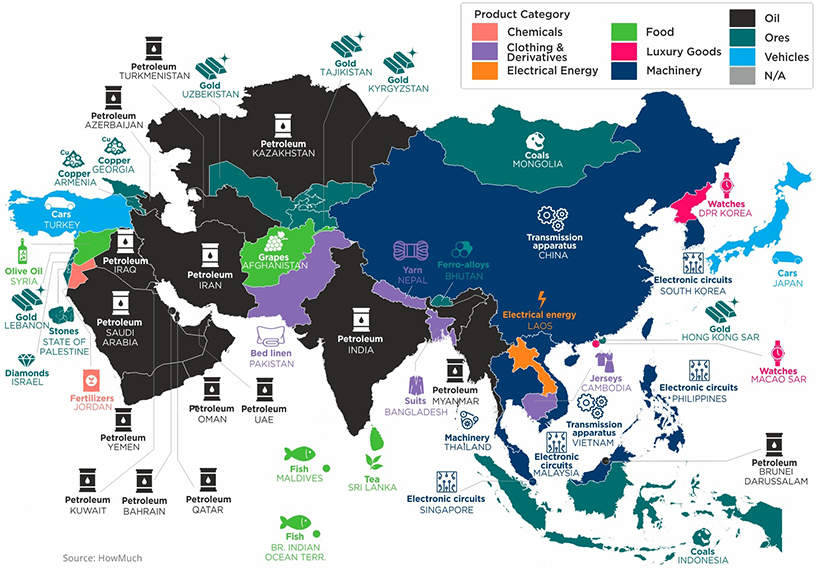

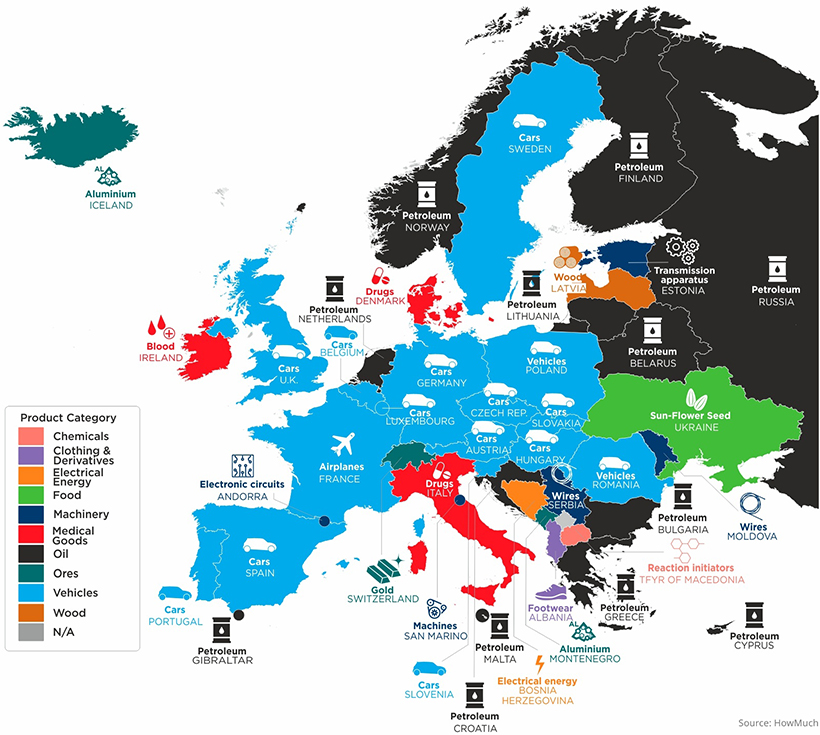

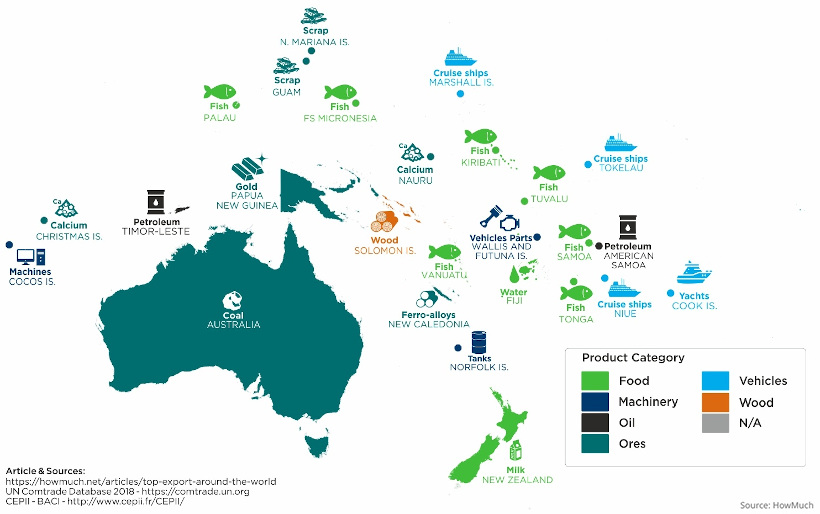

This infographic from HowMuch.net shows the top export in every country by value, according to the most recent global data from 2018.

Top Exports, by Region

Let’s dive into some particular regions, to see how top exports can vary:

Editor’s note: for even larger versions of each regional infographic below, visit HowMuch.net. All export data is from 2018 and comes from CEPII, a leading French center of economic analysis.

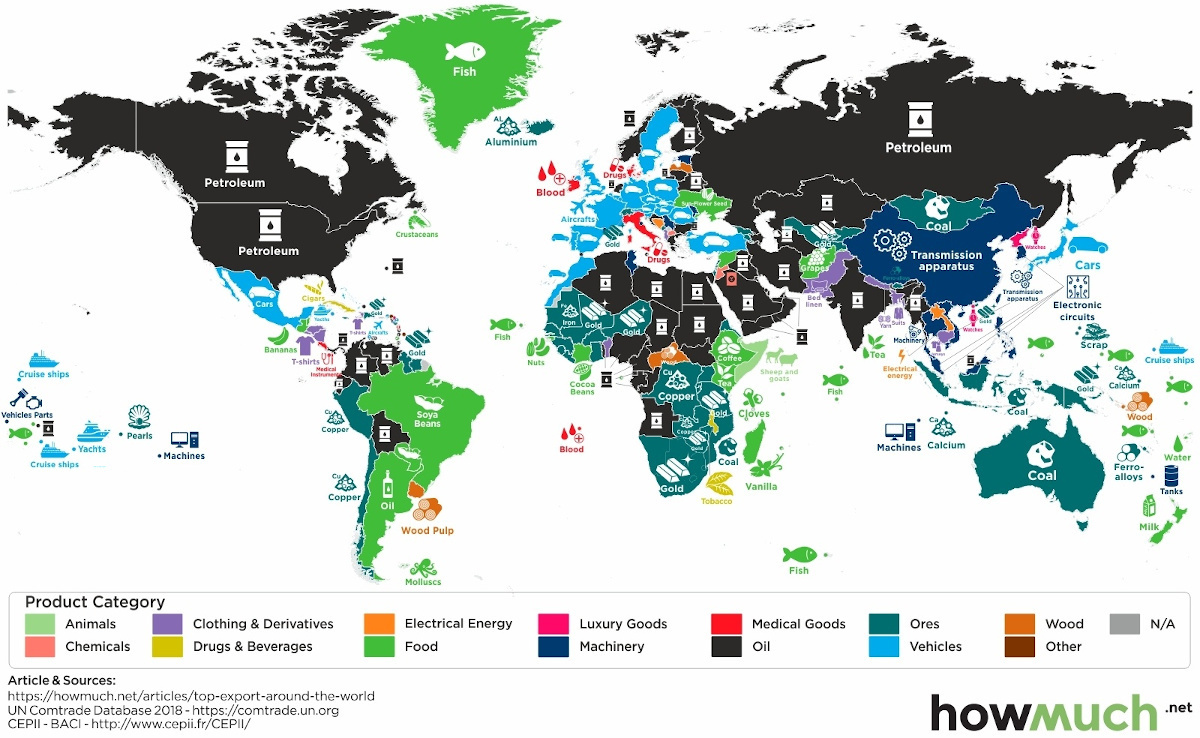

North America

In the U.S. petroleum outpaces all other exports, with crude oil accounting for 35% of total petroleum exports. Canada too, lists petroleum at the top.

| Country | Top Export |

|---|---|

| Canada | Petroleum |

| Greenland | Fish |

| Mexico | Cars |

| Saint Pierre and Quelon | Crustaceans |

| U.S. | Petroleum |

With a market valued at $50.7 billion, Mexico’s top export is cars—making it the fourth largest exporter worldwide.

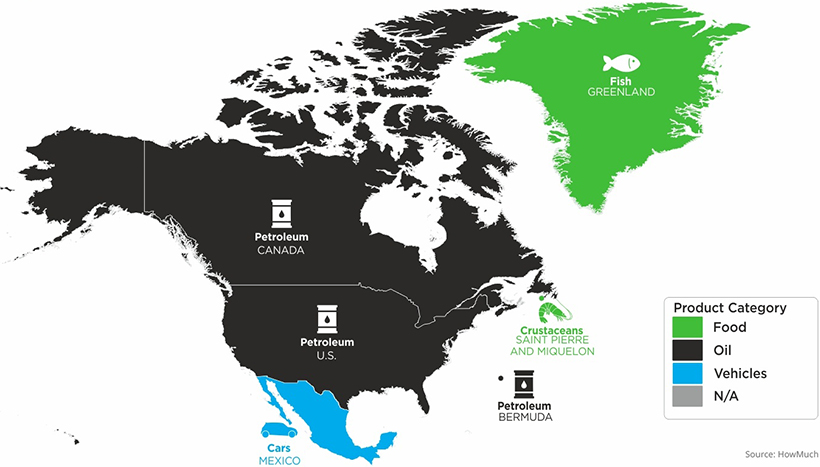

Africa

From Egypt to Senegal, Africa has a diverse spectrum of exports. Primarily, these are resource-driven, with the top five exports being petroleum, gold, diamonds, natural gas, and coal.

| Country | Top Export |

|---|---|

| Algeria | Petroleum |

| Angola | Petroleum |

| Benin | Cotton |

| Burkina Faso | Gold |

| Burundi | Gold |

| Cabo Verde | Fish |

| Cameroon | Petroleum |

| Central African Republic | Wood |

| Chad | Petroleum |

| Comoros | Cloves |

| Congo | Petroleum |

| Cote D'Ivoire | Cocoa Beans |

| Dijibouti | Sheep and goats |

| DR Congo | Copper |

| Egypt | Petroleum |

| Eritrea | Zinc |

| Ethiopia | Coffee |

| Gambia | Nuts |

| Ghana | Gold |

| Guinea | Gold |

| Guinea-Bissau | Nuts |

| Kenya | Tea |

| Liberia | Gold |

| Libya | Petroleum |

| Madagascar | Vanilla |

| Malawi | Tobacco |

| Mali | Gold |

| Mauritania | Iron |

| Mauritus | Fish |

| Morocco | Cars |

| Mozambique | Cloves |

| Niger | Gold |

| Nigeria | Petroleum |

| Rwanda | Gold |

| Senegal | Gold |

| Seychelles | Fish |

| Sierra Leone | Titanium |

| Somalia | Sheep and goats |

| South African Customs Union | Gold |

| South Sudan | Petroleum |

| St. Helena | Blood |

| Sudan | Petroleum |

| Tanzana | Gold |

| Togo | Petroleum |

| Tunisia | Wires |

| Uganda | Gold |

| Zambia | Copper |

| Zimbabwe | Gold |

Meanwhile, Ethiopia’s top export is coffee, shipping nearly $1 billion alone in 2018. Similarly, off the east coast, Madagascar is the world’s largest producer of vanilla.

Asia

While petroleum is also a dominant export across many countries in Asia, the region’s export landscape is a lot more tech-focused.

In South Korea, electronic circuits are the largest export. Samsung, headquartered in Seoul, is a major supplier to Apple for multiple electronic components. With one of the highest export ratios in Asia, 40% of South Korea’s economic output is derived from its export market.

Here are the top exports across other Asian countries.

| Country | Top Export |

|---|---|

| Afghanistan | Grapes |

| Armenia | Copper |

| Azerbaijan | Petroleum |

| Bahrain | Petroleum |

| Bangladesh | Suits |

| Bhutan | Ferro-alloys |

| Br. Indian Ocean Terr. | Fish |

| Brunei Darussalam | Petroleum |

| Cambodia | Jerseys |

| China | Transmission apparatus |

| DPR Korea | Watches |

| Georgia | Copper |

| Hong Kong SAR | Gold |

| Indonesia | Coals |

| Iran | Petroleum |

| Iraq | Petroleum |

| Israel | Diamonds |

| Japan | Cars |

| Jordan | Fertilizers |

| Kazakhstan | Petroleum |

| Kuwait | Petroleum |

| Kyrgyzstan | Gold |

| Laos | Electrical energy |

| Lebanon | Gold |

| Macao SAR | Watches |

| Malaysia | Electronic circuits |

| Maldives | Fish |

| Mongolia | Coals |

| Myanmar | Petroleum |

| Nepal | Yarn |

| Oman | Petroleum |

| Pakistan | Bed linen |

| Philippines | Electronic circuits |

| Qatar | Petroleum |

| Saudi Arabia | Petroleum |

| Singapore | Electronic circuits |

| South Korea | Electronic circuits |

| Sri Lanka | Tea |

| State of Palestine | Stones |

| Syria | Olive oil |

| Tajikistan | Gold |

| Thailand | Machinery |

| Turkmenistan | Petroleum |

| Turkey | Cars |

| UAE | Petroleum |

| Uzbekistan | Gold |

| Vietnam | Transmission apparatus |

| Yemen | Petroleum |

In Afghanistan, grapes are the top export, valued at $237 million. Almost one-fifth of Afghanistan’s exports come from the grape industry.

Europe

Across the European continent, the automotive industry stands out as a primary driver of exports, with 14 countries having cars or vehicles as their most exported good.

In fact, in 2019, the European Union exported a total of 5.6 million motor vehicles. Of these, 28% were shipped to the U.S. and 16.5% to China.

| Country | Top Export |

|---|---|

| Albania | Footwear |

| Andorra | Electronic circults |

| Austria | Cars |

| Belarus | Petroleum |

| Belgium | Cars |

| Bosnia Herzegovina | Electrical energy |

| Bulgaria | Petroleum |

| Croatia | Petroleum |

| Cyprus | Petroleum |

| Czech Republic | Cars |

| Denmark | Drugs |

| Estonia | Transmission apparatus |

| Finland | Petroleum |

| France | Airplanes |

| Germany | Cars |

| Gibraltar | Petroleum |

| Greece | Petroleum |

| Hungary | Cars |

| Iceland | Aluminium |

| Ireland | Blood |

| Italy | Drugs |

| Latvia | Wood |

| Lithuania | Petroleum |

| Luxembourg | Cars |

| Malta | Petroleum |

| Moldova | Wires |

| Montenegro | Aluminium |

| Netherlands | Petroleum |

| Norway | Petroleum |

| Poland | Vehicles |

| Portugal | Cars |

| Romania | Vehicles |

| Russia | Petroleum |

| San Marino | Machines |

| Serbia | Wires |

| Slovakia | Cars |

| Slovenia | Cars |

| Spain | Cars |

| Sweden | Cars |

| Switzerland | Gold |

| TFYR of Macedonia | Reaction initiators |

| U.K. | Cars |

| Ukraine | Sun-Flower Seed |

The Balkan nation of Albania has footwear as its top export. Overall, nearly 80% of the nation’s GDP relies on goods and services exports.

France, on the other hand, has airplanes as its highest export while Italy and Denmark’s highest are drugs. Italy is the top producer of pharmaceuticals in Europe, an industry which employs 66,500 across the country. Globally, it makes up 2.8% of pharmaceutical sales.

Due to its cheap electricity prices, companies have flocked to Iceland to produce aluminum. Iceland’s dams, which generate power from glacial water, produce electricity as much as 30% cheaper than in America.

Latin America & the Caribbean Islands

Like other regions, petroleum stands out as a key export in countries across Latin America.

Take Venezuela. With the largest oil reserves in the world, its oil exports were valued at $90 billion annually ten years ago. Since the pandemic, however, earnings are projected to reach just a fraction of this total—only $2.3 billion this year.

Along with this, the U.S. has imposed sanctions on president Nicolás Maduro and Venezuela’s state oil company, PDVSA, causing oil exports to slump to their lowest point in nearly 80 years.

| Country | Top Export |

|---|---|

| Anguilla | Ethyl alcohol |

| Antigua and Barbuda | Cruise ships |

| Argentina | Oil |

| Aruba | Airplanes |

| Bahamas | Cruise ships |

| Barbados | Ethyl alcohol |

| Belize | Cane sugar |

| Bolivia | Petroleum |

| Bonaire | Petroleum |

| Brazil | Soya beans |

| British Virgin Islands | Yachts |

| Cayman Islands | Yachts |

| Chile | Copper |

| Colombia | Petroleum |

| Costa Rica | Medical instruments |

| Cuba | Cigars |

| Curacao | Petroleum |

| Dominica | Medical instruments |

| Dominican Republic | Gold |

| Ecuador | Petroleum |

| El Salvador | T-shirts |

| Falkland Is. (Malvinas) | Molluscs |

| Grenada | Nutmeg |

| Guatemala | Bananas |

| Guyana | Gold |

| Haiti | T-shirts |

| Honduras | T-shirts |

| Jamaica | Aluminium |

| Montserrat | Sand |

| Neth. Antilles | Cars |

| Nicaragua | T-shirts |

| Panama | Petroleum |

| Paraguay | Soya beans |

| Peru | Copper |

| Saint Barthelemy | Cosmetics |

| Saint Kitts and Nevis | Transmission apparatus |

| Saint Lucia | Petroleum |

| Saint Maarten | Jewellery |

Saint Vincent and the Grenadines | Petroleum |

| Suriname | Gold |

| Trinidad and Tobago | Petroleum |

| Turks and Caicos Is. | Petroleum |

| Uruguay | Wood pulp |

| Venezuela | Petroleum |

For Caribbean nations, unsurprisingly, many top exports in this region are linked to tourism.

Cruise ships stood out as a primary export in the Bahamas, while yachts were most significant in the Cayman Islands. However, due to the pandemic, many of these national economies are at heightened risk, with some economies across the region projected to contract 10% in 2020.

Oceania

Finally, in Oceania, Australia had coal as it’s top export in 2018 (though it has since switched to iron ore in 2019), while New Zealand sends milk abroad.

For many of the smaller islands throughout the Pacific, it can be seen that fish, cruise ships, water, and yachts are key exports.

The Future of Trade

Now, COVID-19 and a host of other factors are changing the way the world trades. Unexpected shocks, trade wars, the carbon footprint, and labor standards are influencing firms to build more resilient supply chains.

According to The Economist, it’s estimated that over the next five years that 16-26% of exported goods production could shift locations.

Markets

The European Stock Market: Attractive Valuations Offer Opportunities

On average, the European stock market has valuations that are nearly 50% lower than U.S. valuations. But how can you access the market?

European Stock Market: Attractive Valuations Offer Opportunities

Europe is known for some established brands, from L’Oréal to Louis Vuitton. However, the European stock market offers additional opportunities that may be lesser known.

The above infographic, sponsored by STOXX, outlines why investors may want to consider European stocks.

Attractive Valuations

Compared to most North American and Asian markets, European stocks offer lower or comparable valuations.

| Index | Price-to-Earnings Ratio | Price-to-Book Ratio |

|---|---|---|

| EURO STOXX 50 | 14.9 | 2.2 |

| STOXX Europe 600 | 14.4 | 2 |

| U.S. | 25.9 | 4.7 |

| Canada | 16.1 | 1.8 |

| Japan | 15.4 | 1.6 |

| Asia Pacific ex. China | 17.1 | 1.8 |

Data as of February 29, 2024. See graphic for full index names. Ratios based on trailing 12 month financials. The price to earnings ratio excludes companies with negative earnings.

On average, European valuations are nearly 50% lower than U.S. valuations, potentially offering an affordable entry point for investors.

Research also shows that lower price ratios have historically led to higher long-term returns.

Market Movements Not Closely Connected

Over the last decade, the European stock market had low-to-moderate correlation with North American and Asian equities.

The below chart shows correlations from February 2014 to February 2024. A value closer to zero indicates low correlation, while a value of one would indicate that two regions are moving in perfect unison.

| EURO STOXX 50 | STOXX EUROPE 600 | U.S. | Canada | Japan | Asia Pacific ex. China |

|

|---|---|---|---|---|---|---|

| EURO STOXX 50 | 1.00 | 0.97 | 0.55 | 0.67 | 0.24 | 0.43 |

| STOXX EUROPE 600 | 1.00 | 0.56 | 0.71 | 0.28 | 0.48 | |

| U.S. | 1.00 | 0.73 | 0.12 | 0.25 | ||

| Canada | 1.00 | 0.22 | 0.40 | |||

| Japan | 1.00 | 0.88 | ||||

| Asia Pacific ex. China | 1.00 |

Data is based on daily USD returns.

European equities had relatively independent market movements from North American and Asian markets. One contributing factor could be the differing sector weights in each market. For instance, technology makes up a quarter of the U.S. market, but health care and industrials dominate the broader European market.

Ultimately, European equities can enhance portfolio diversification and have the potential to mitigate risk for investors.

Tracking the Market

For investors interested in European equities, STOXX offers a variety of flagship indices:

| Index | Description | Market Cap |

|---|---|---|

| STOXX Europe 600 | Pan-regional, broad market | €10.5T |

| STOXX Developed Europe | Pan-regional, broad-market | €9.9T |

| STOXX Europe 600 ESG-X | Pan-regional, broad market, sustainability focus | €9.7T |

| STOXX Europe 50 | Pan-regional, blue-chip | €5.1T |

| EURO STOXX 50 | Eurozone, blue-chip | €3.5T |

Data is as of February 29, 2024. Market cap is free float, which represents the shares that are readily available for public trading on stock exchanges.

The EURO STOXX 50 tracks the Eurozone’s biggest and most traded companies. It also underlies one of the world’s largest ranges of ETFs and mutual funds. As of November 2023, there were €27.3 billion in ETFs and €23.5B in mutual fund assets under management tracking the index.

“For the past 25 years, the EURO STOXX 50 has served as an accurate, reliable and tradable representation of the Eurozone equity market.”

— Axel Lomholt, General Manager at STOXX

Partnering with STOXX to Track the European Stock Market

Are you interested in European equities? STOXX can be a valuable partner:

- Comprehensive, liquid and investable ecosystem

- European heritage, global reach

- Highly sophisticated customization capabilities

- Open architecture approach to using data

- Close partnerships with clients

- Part of ISS STOXX and Deutsche Börse Group

With a full suite of indices, STOXX can help you benchmark against the European stock market.

Learn how STOXX’s European indices offer liquid and effective market access.

-

Economy2 days ago

Economy2 days agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

This graphic shows the states with the highest real GDP growth rate in 2023, largely propelled by the oil and gas boom.

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

In this graphic, we show the highest earning flight routes globally as air travel continued to rebound in 2023.

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

The U.S. residential real estate market is worth a staggering $47.5 trillion. Here are the most valuable housing markets in the country.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024