Technology

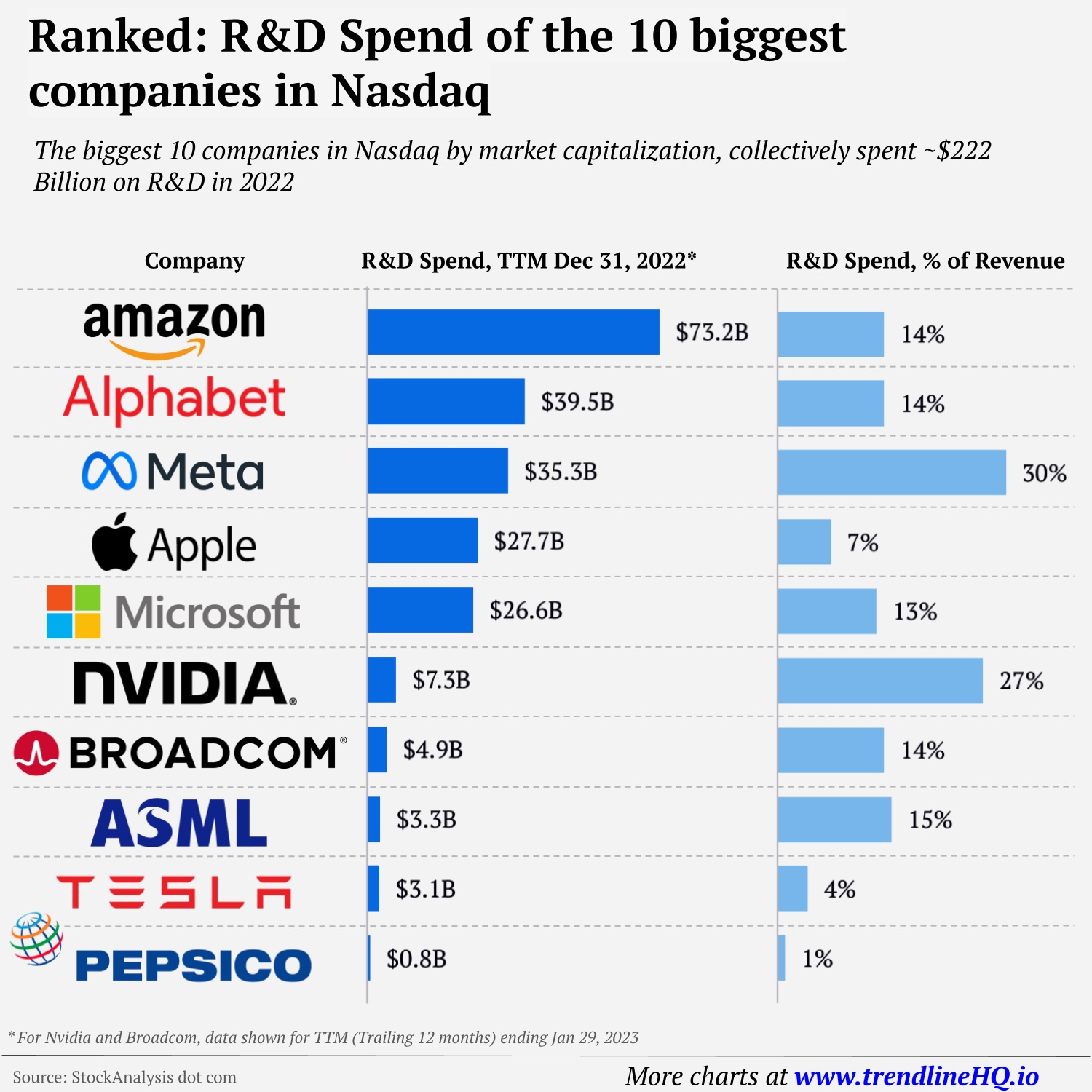

Visualizing the R&D Investment of the 10 Biggest Nasdaq Companies

R&D Investment of the 10 Biggest Nasdaq Companies

Over the last decade, Apple’s research and development (R&D) spending has jumped from about $3 billion to over $26 billion.

The world’s largest company, like other tech giants, is investing heavily in R&D on the heels of AI disruption and the rapid speed of innovation. As these technologies become more pervasive in our daily lives, so too has investment in R&D across major companies.

This graphic from Trendline shows the scale at which the 10 biggest companies listed on the Nasdaq are spending on R&D.

R&D Investment by the 10 Biggest Nasdaq Firms

In 2022, the 10 largest Nasdaq companies by market cap spent roughly $222 billion on R&D—a figure that has risen considerably in recent years.

| Rank | Name | R&D % of Revenue | R&D Spend in 2022* (Billions) |

|---|---|---|---|

| 1 | Amazon | 14% | $73.2 |

| 2 | Alphabet | 14% | $39.5 |

| 3 | Meta | 30% | $35.3 |

| 4 | Apple | 7% | $27.7 |

| 5 | Microsoft | 13% | $26.6 |

| 6 | Nvidia | 27% | $7.3 |

| 7 | Broadcom | 14% | $4.9 |

| 8 | ASML | 15% | $3.3 |

| 9 | Tesla | 4% | $3.1 |

| 10 | PepsiCo | 1% | $0.8 |

*Trailing 12 months, ending December 31, 2022. Nvidia and Broadcom data is as of January 29, 2023.

Amazon invested over $73 billion in R&D last year, more than double the levels seen at Meta or Apple. R&D spending increased 30% over the year for the retail heavyweight, as it invested in technology infrastructure that underlies everything from software to autonomous vehicles.

Facebook parent Meta spent almost a third of its annual revenues on R&D in 2022, the highest proportion across the 10 largest Nasdaq companies. The majority of these investments were through its research arm, Reality Labs, which is focused on building a metaverse. However, the company has since pivoted away from its work on the metaverse due to a lackluster response—instead focusing on generative AI.

Chipmaker Nvidia, which has seen its market capitalization skyrocket in 2023, spent over $7 billion on R&D across generative AI, deep learning, robotics, and a number of other research areas. Between 2021 and 2022, investments in R&D grew by 34%.

Fastest Rising R&D Spenders, Globally

Beyond big tech names in the Nasdaq, many companies are accelerating their investment in R&D as the complexity of technology increases.

The table below shows the top 10 companies globally with the highest increase in R&D spend, based on analysis by fDi Intelligence.

| Rank | Name | Country | R&D Spending % Change 2021-2022 |

|---|---|---|---|

| 1 | BYD | 🇨🇳 China | +133% |

| 2 | AMD | 🇺🇸 U.S. | +76% |

| 3 | Moderna | 🇺🇸 U.S. | +65% |

| 4 | Meta | 🇺🇸 U.S. | +43% |

| 5 | Nvidia | 🇺🇸 U.S. | +39% |

| 6 | Uber | 🇺🇸 U.S. | +36% |

| 7 | Novo Nordisk | 🇩🇰 Denmark | +35% |

| 8 | Vertex Pharmaceuticals | 🇺🇸 U.S. | +31% |

| 9 | TSMC | 🇨🇳 Taiwan | +31% |

| 10 | Amazon | 🇺🇸 U.S. | +31% |

China’s largest electric vehicle maker, BYD, increased R&D investment by 133%, the most across companies analyzed. Among its primary research areas is the “Blade Battery”, which is a prismatic battery designed to hold as much as 50% more energy than comparable models.

Two chipmakers, AMD and TSMC also made the list, while three healthcare companies Moderna, Novo Nordisk, and Vertex Pharmaceuticals made significant R&D investments.

The Future of Innovation Spending

Even as many big tech names saw their stock prices fall in 2022, many dramatically increased their R&D investment.

This came as tech firms laid off thousands of employees. Together, Amazon, Microsoft, and Google’s parent company Alphabet laid of 40,000 employees as of early 2023.

Despite challenging environments, the focus on R&D is evident. Large companies can apply innovation across numerous areas of their business, improve efficiencies, with the goal of making the most out of research dollars spent.

At the same time, the complexity of technology is accelerating, requiring companies to spend more to keep with the pace of innovation. This involves investment in engineers, research facilities, along with the cost of running more advanced technological infrastructure.

Between 2000 and 2020, global R&D spending increased more than threefold to $2.4 trillion, a trend that shows minimal signs of slowing.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Technology

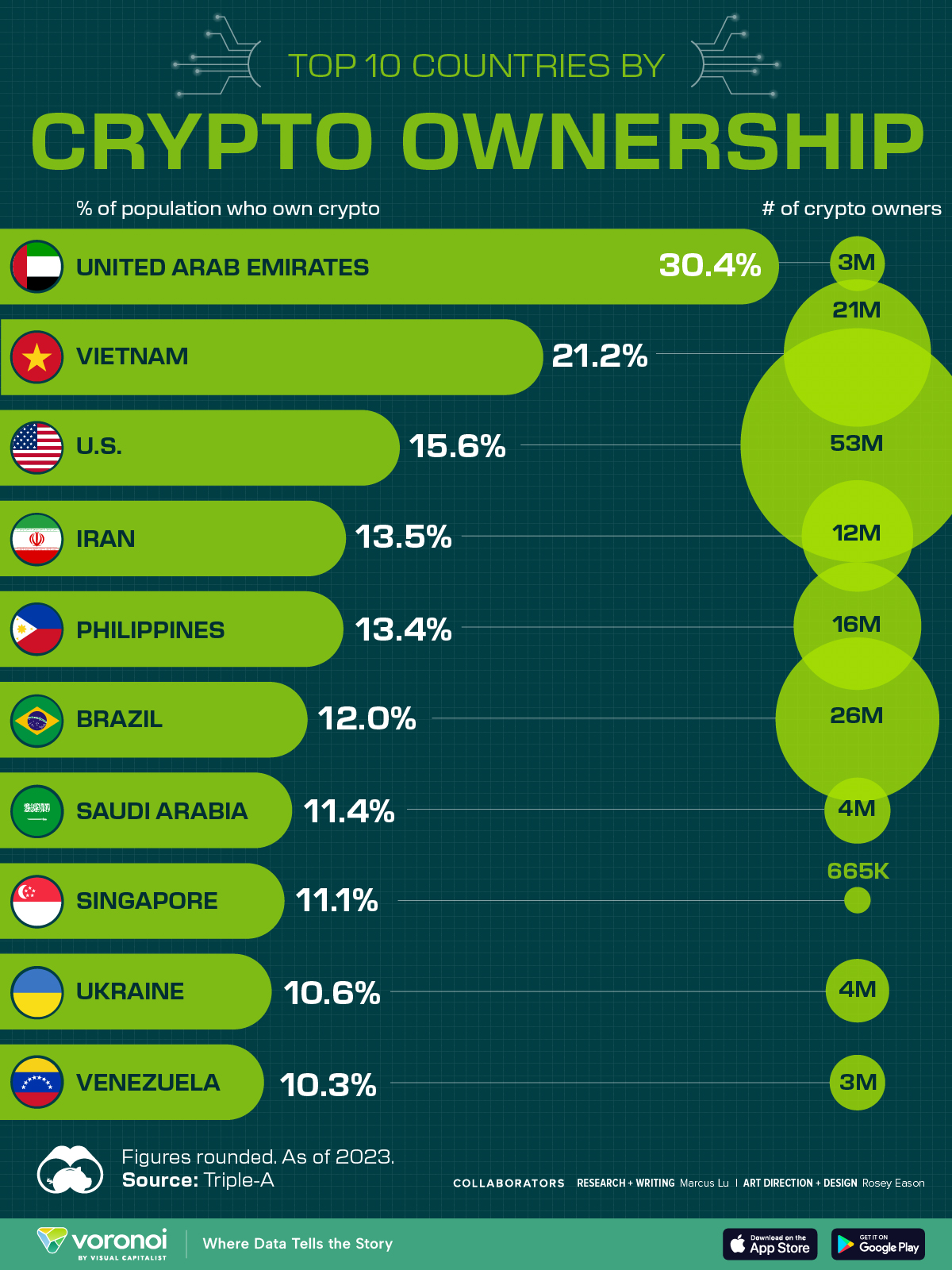

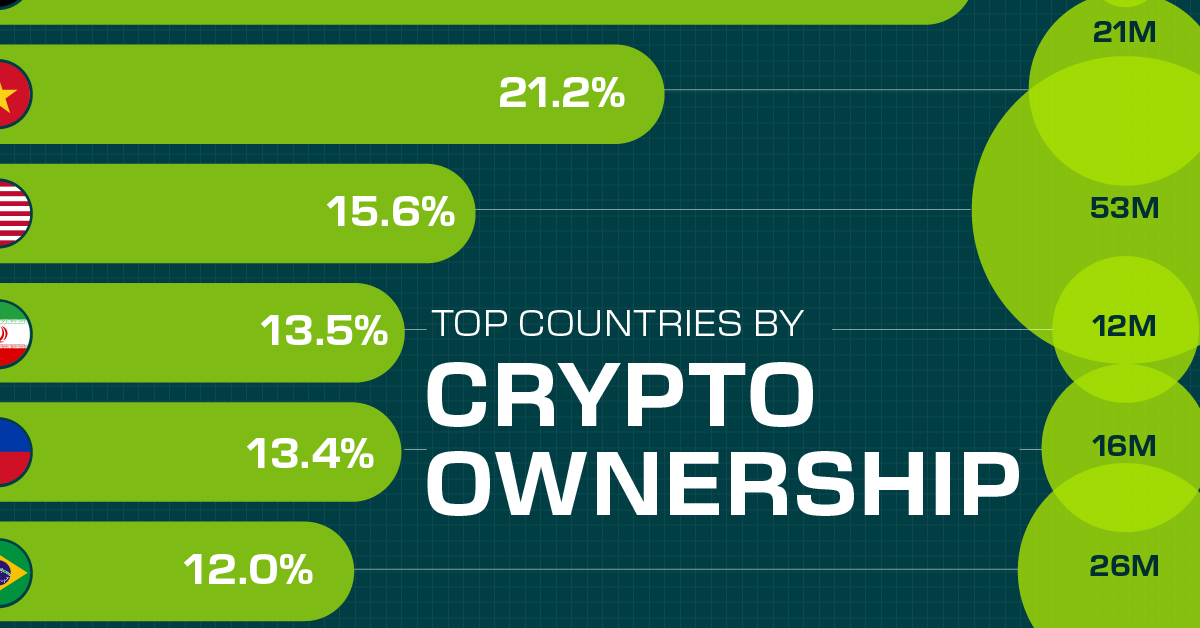

Countries With the Highest Rates of Crypto Ownership

While the U.S. is a major market for cryptocurrencies, two countries surpass it in terms of their rates of crypto ownership.

Countries With the Highest Rates of Crypto Ownership

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This graphic ranks the top 10 countries by their rate of cryptocurrency ownership, which is the percentage of the population that owns crypto. These figures come from crypto payment gateway, Triple-A, and are as of 2023.

Data and Highlights

The table below lists the rates of crypto ownership in the top 10 countries, as well as the number of people this amounts to.

| Country | % of Population Who Own Crypto | # of Crypto Owners |

|---|---|---|

| 🇦🇪 United Arab Emirates | 30.4 | 3M |

| 🇻🇳 Vietnam | 21.2 | 21M |

| 🇺🇸 U.S. | 15.6 | 53M |

| 🇮🇷 Iran | 13.5 | 12M |

| 🇵🇭 Philippines | 13.4 | 16M |

| 🇧🇷 Brazil | 12 | 26M |

| 🇸🇦 Saudi Arabia | 11.4 | 4M |

| 🇸🇬 Singapore | 11.1 | 665K |

| 🇺🇦 Ukraine | 10.6 | 4M |

| 🇻🇪 Venezuela | 10.3 | 3M |

Note that if we were to rank countries based on their actual number of crypto owners, India would rank first at 93 million people, China would rank second at 59 million people, and the U.S. would rank third at 52 million people.

The UAE Takes the Top Spot

The United Arab Emirates (UAE) boasts the highest rates of crypto ownership globally. The country’s government is considered to be very crypto friendly, as described in Henley & Partners’ Crypto Wealth Report 2023:

In the UAE, the Financial Services Regulatory Authority (FSRA-ADGM) was the first to provide rules and regulations regarding cryptocurrency purchasing and selling. The Emirates are generally very open to new technologies and have proposed zero taxes for crypto owners and businesses.

Vietnam leads Southeast Asia

According to the Crypto Council for Innovation, cryptocurrency holdings in Vietnam are also untaxed, making them an attractive asset.

Another reason for Vietnam’s high rates of ownership could be its large unbanked population (people without access to financial services). Cryptocurrencies may provide an alternative means of accessing these services without relying on traditional banks.

Learn More About Crypto From Visual Capitalist

If you enjoyed this post, be sure to check out The World’s Largest Corporate Holders of Bitcoin, which ranks the top 12 publicly traded companies by their Bitcoin holdings.

-

Personal Finance1 week ago

Personal Finance1 week agoVisualizing the Tax Burden of Every U.S. State

-

Misc6 days ago

Misc6 days agoVisualized: Aircraft Carriers by Country

-

Culture7 days ago

Culture7 days agoHow Popular Snack Brand Logos Have Changed

-

Mining1 week ago

Mining1 week agoVisualizing Copper Production by Country in 2023

-

Misc1 week ago

Misc1 week agoCharted: How Americans Feel About Federal Government Agencies

-

Healthcare1 week ago

Healthcare1 week agoWhich Countries Have the Highest Infant Mortality Rates?

-

Demographics1 week ago

Demographics1 week agoMapped: U.S. Immigrants by Region

-

Maps1 week ago

Maps1 week agoMapped: Southeast Asia’s GDP Per Capita, by Country