Markets

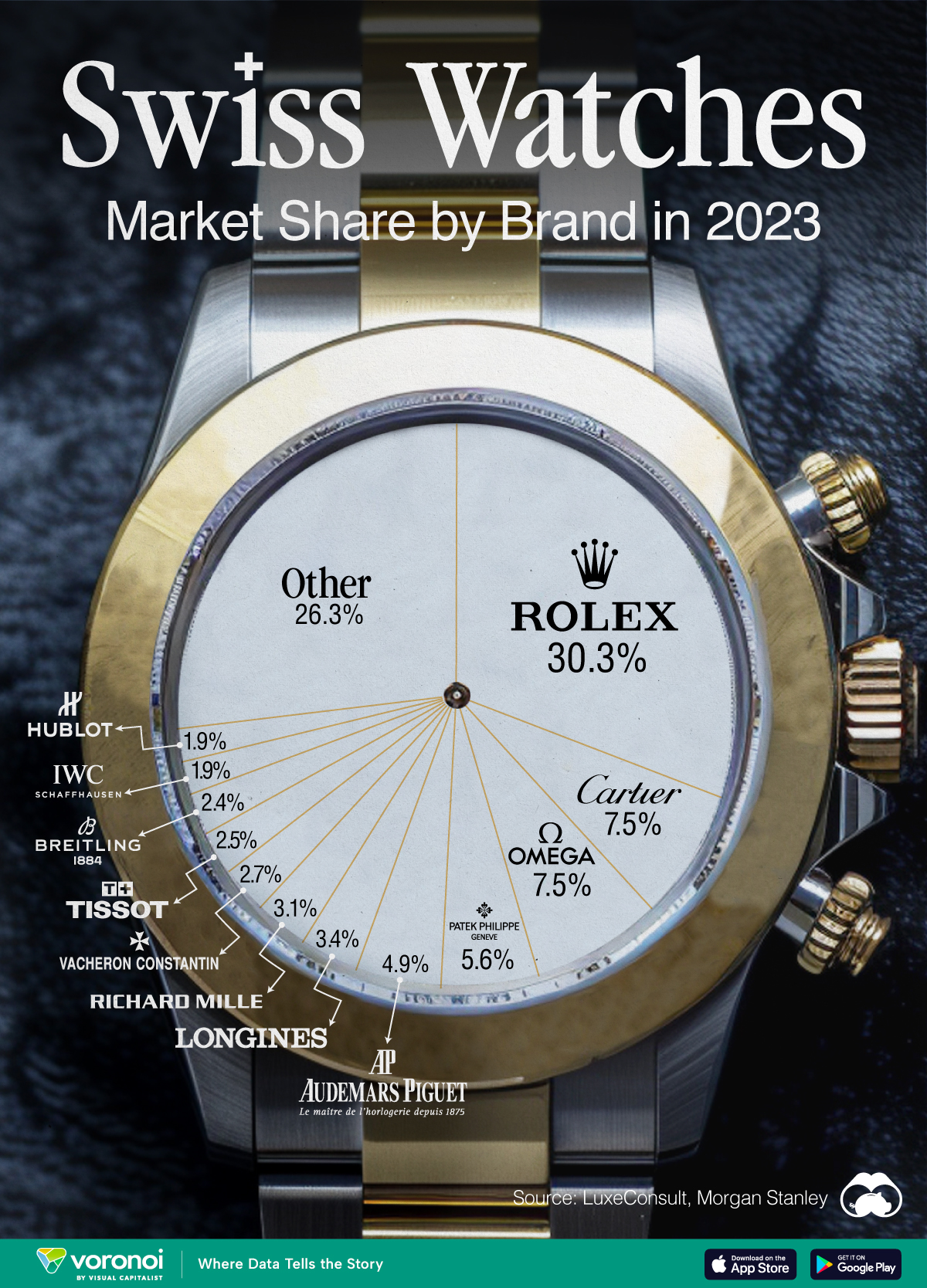

Swiss Watches: Market Share by Brand in 2023

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

Swiss Watches: Market Share by Brand in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Swiss watches are renowned for their precision, craftsmanship, and quality. In this visualization, we rank the top Swiss watch brands based on their estimated 2023 market share, which comes from data provided by LuxeConsult and Morgan Stanley.

Rolex Dominates the Swiss Watch Market

Sales of Rolex watches are believed to have surpassed 10 billion Swiss francs ($11.2 billion) for the first time in 2023, significantly outpacing rivals like Cartier CHF 3.1 billion ($3.5 billion) and Omega CHF 2.6 billion ($2.9 billion).

Additionally, Rolex has strengthened its dominant position in the market, capturing a remarkable 30.3% retail market share.

| Brand | Market Share (%) |

|---|---|

| Rolex | 30.3 |

| Cartier | 7.5 |

| Omega | 7.5 |

| Patek Philippe | 5.6 |

| Audemars Piguet | 4.9 |

| Longines | 3.4 |

| Richard Mille | 3.1 |

| Vacheron Constantin | 2.7 |

| Tissot | 2.5 |

| Breitling | 2.4 |

| IWC | 1.9 |

| Hublot | 1.9 |

| Jaeger-LeCoultre | 1.7 |

| TAG Heur | 1.7 |

| Other | 22.9 |

In 2023, the Swiss watch industry achieved record sales totaling CHF 26.7 billion ($30 billion). The “Big Four” watch brands—Rolex, Patek Philippe, Audemars Piguet, and Richard Mille—achieved a combined 43.9% market share last year, compared to a pre-Covid 2019 market share of 36.9%.

Also noteworthy is that Vacheron Constantin joined the billionaires’ club as the 8th brand to surpass CHF 1 billion in sales, reaching CHF 1.097 billion ($1.23 billion).

In conclusion, premium watches priced over CHF 25,000 ($28,000) drove 69% of the market’s growth in 2023, and constituted 44% of the total value of Swiss watch exports. Despite this significant value contribution, this segment represents only 2.5% of the total volume in terms of units sold.

See Related Infographics

If you enjoyed this content, check out The World’s Biggest Fashion Companies by Market Cap, or Ranked: Gen Z’s Favorite Brands in 2023.

Maps

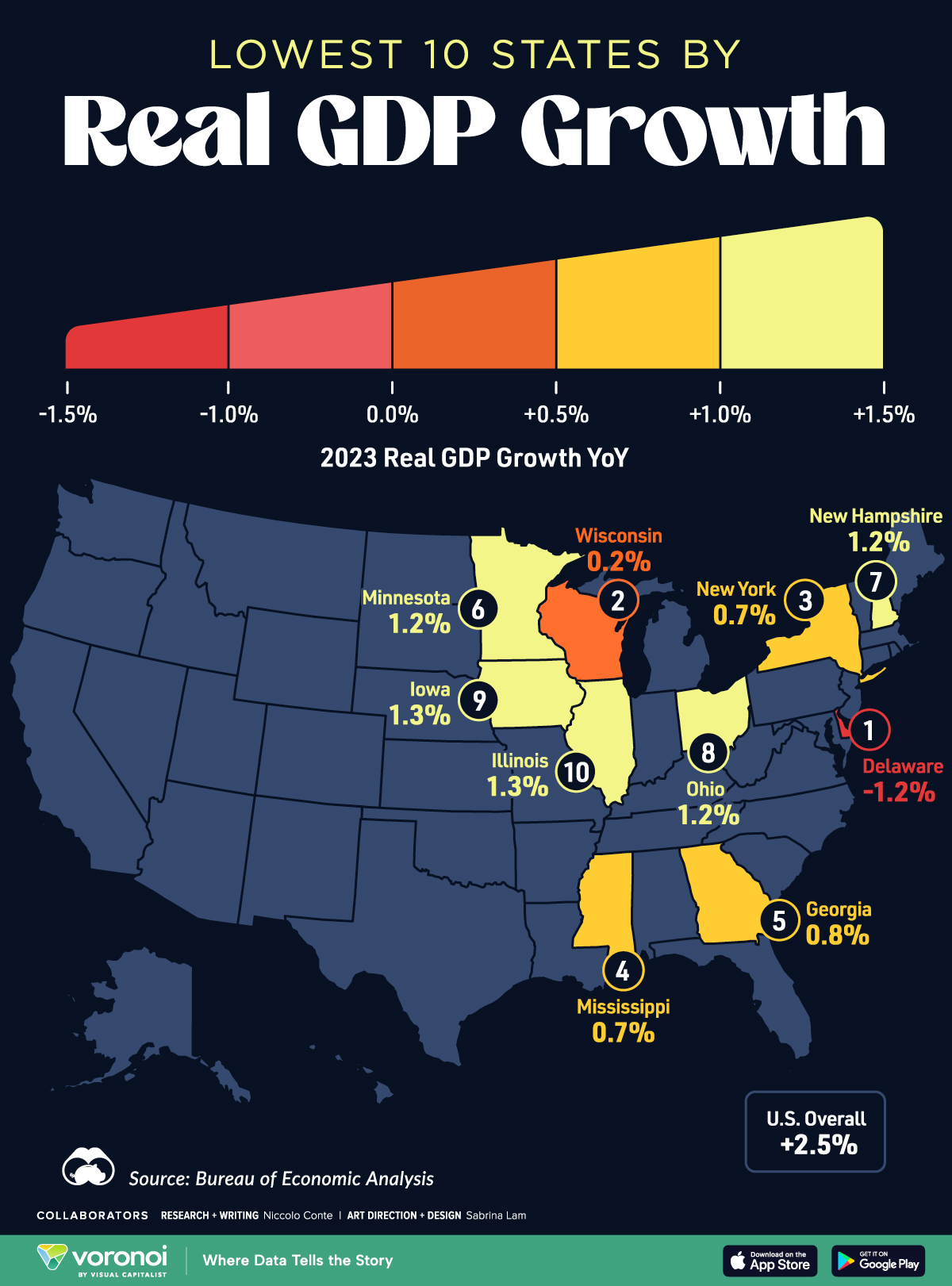

Mapped: The 10 U.S. States With the Lowest Real GDP Growth

In this graphic, we show where real GDP lagged the most across America in 2023 as high interest rates weighed on state economies.

The Top 10 U.S. States, by Lowest Real GDP Growth

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

While the U.S. economy defied expectations in 2023, posting 2.5% in real GDP growth, several states lagged behind.

Last year, oil-producing states led the pack in terms of real GDP growth across America, while the lowest growth was seen in states that were more sensitive to the impact of high interest rates, particularly due to slowdowns in the manufacturing and finance sectors.

This graphic shows the 10 states with the least robust real GDP growth in 2023, based on data from the Bureau of Economic Analysis.

Weakest State Economies in 2023

Below, we show the states with the slowest economic activity in inflation-adjusted terms, using chained 2017 dollars:

| Rank | State | Real GDP Growth 2023 YoY | Real GDP 2023 |

|---|---|---|---|

| 1 | Delaware | -1.2% | $74B |

| 2 | Wisconsin | +0.2% | $337B |

| 3 | New York | +0.7% | $1.8T |

| 4 | Missississippi | +0.7% | $115B |

| 5 | Georgia | +0.8% | $661B |

| 6 | Minnesota | +1.2% | $384B |

| 7 | New Hampshire | +1.2% | $91B |

| 8 | Ohio | +1.2% | $698B |

| 9 | Iowa | +1.3% | $200B |

| 10 | Illinois | +1.3% | $876B |

| U.S. | +2.5% | $22.4T |

Delaware witnessed the slowest growth in the country, with real GDP growth of -1.2% over the year as a sluggish finance and insurance sector dampened the state’s economy.

Like Delaware, the Midwestern state of Wisconsin also experienced declines across the finance and insurance sector, in addition to steep drops in the agriculture and manufacturing industries.

America’s third-biggest economy, New York, grew just 0.7% in 2023, falling far below the U.S. average. High interest rates took a toll on key sectors, with notable slowdowns in the construction and manufacturing sectors. In addition, falling home prices and a weaker job market contributed to slower economic growth.

Meanwhile, Georgia experienced the fifth-lowest real GDP growth rate. In March 2024, Rivian paused plans to build a $5 billion EV factory in Georgia, which was set to be one of the biggest economic development initiatives in the state in history.

These delays are likely to exacerbate setbacks for the state, however, both Kia and Hyundai have made significant investments in the EV industry, which could help boost Georgia’s manufacturing sector looking ahead.

-

Personal Finance1 week ago

Personal Finance1 week agoVisualizing the Tax Burden of Every U.S. State

-

Misc6 days ago

Misc6 days agoVisualized: Aircraft Carriers by Country

-

Culture6 days ago

Culture6 days agoHow Popular Snack Brand Logos Have Changed

-

Mining1 week ago

Mining1 week agoVisualizing Copper Production by Country in 2023

-

Misc1 week ago

Misc1 week agoCharted: How Americans Feel About Federal Government Agencies

-

Healthcare1 week ago

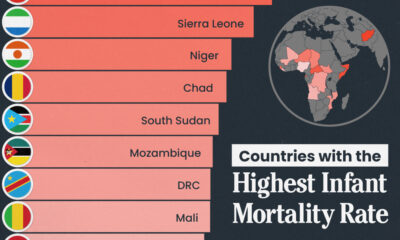

Healthcare1 week agoWhich Countries Have the Highest Infant Mortality Rates?

-

Demographics1 week ago

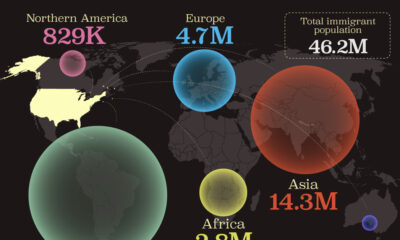

Demographics1 week agoMapped: U.S. Immigrants by Region

-

Maps1 week ago

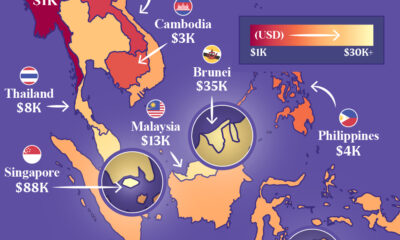

Maps1 week agoMapped: Southeast Asia’s GDP Per Capita, by Country