Markets

Animation: Berkshire Hathaway’s Holdings Since 1994

Visualizing Berkshire Hathaway’s Holdings Since 1994

If you’re a long-time follower of Visual Capitalist, then you probably know that we’re big fans of Warren Buffett.

We’ve written numerous articles about the world-famous investor, covering everything from his early years to his most famous quotes. As one of the wealthiest and most influential investors in the world, he’s an important market player to keep track of.

As our latest addition to the Warren Buffett archives, this animated video by Sjoerd Tilmans highlights three decades of Warren Buffett’s investments. It shows what his holding company, Berkshire Hathaway, has been invested in since 1994, using data from the company’s financial reports.

A Rocky Start: The Early Years of Berkshire Hathaway

Before becoming the multinational conglomerate that it is today, Berkshire Hathaway was once a massive (yet struggling) textile company in Rhode Island.

Buffett first invested in the company in the late 1950s, when the company’s shares were declining. By 1964, things still hadn’t picked up for the company, and Buffett was ready to cut his losses and move on.

But when industrialist Seabury Stanton, the CEO of Berkshire Hathaway at the time, offered to buy Buffett out for less than the price he’d originally promised, things got interesting. Buffett was so furious by the offer that instead of selling his shares, he bought more, eventually taking control of the company and letting Stanton go.

The textile company never recovered, and Berkshire Hathaway eventually became Buffett’s holding company for other investments. He estimates that his investment in Berkshire Hathaway ultimately cost him $200 billion.

A Brighter Future: Berkshire Hathaway Now

Despite its tumultuous past, Berkshire Hathaway is now associated with tremendous financial success. In 2021, the conglomerate generated over $276 billion in total revenue.

And Buffett has about a 38% stake in the company, which means he’s one of the wealthiest people on the planet. As of today’s publication date, his net worth sits at $93.3 billion.

In the long run, Berkshire Hathaway has outperformed the market by a landslide. Here’s a look at the holding company’s compounded annual gain, and overall gain, compared to the S&P 500:

| Berkshire Hathaway | S&P 500 | |

|---|---|---|

| Compounded Annual Gain (1965-2021) | 20.1% | 10.5% |

| Overall Gain (1964-2021) | 3,641,613% | 30,209% |

Note: These figures are from Berkshire Hathaway’s (BH) Annual Report. BH’s market value is after-tax, and S&P 500 is pre-tax, including dividends.

According to the conglomerate’s website, it owns 62 different companies outright, including big names like GEICO, Dairy Queen, Kraft Heinz, and Duracell, and also has large investments in companies like Apple, Wells Fargo, and Coca-Cola.

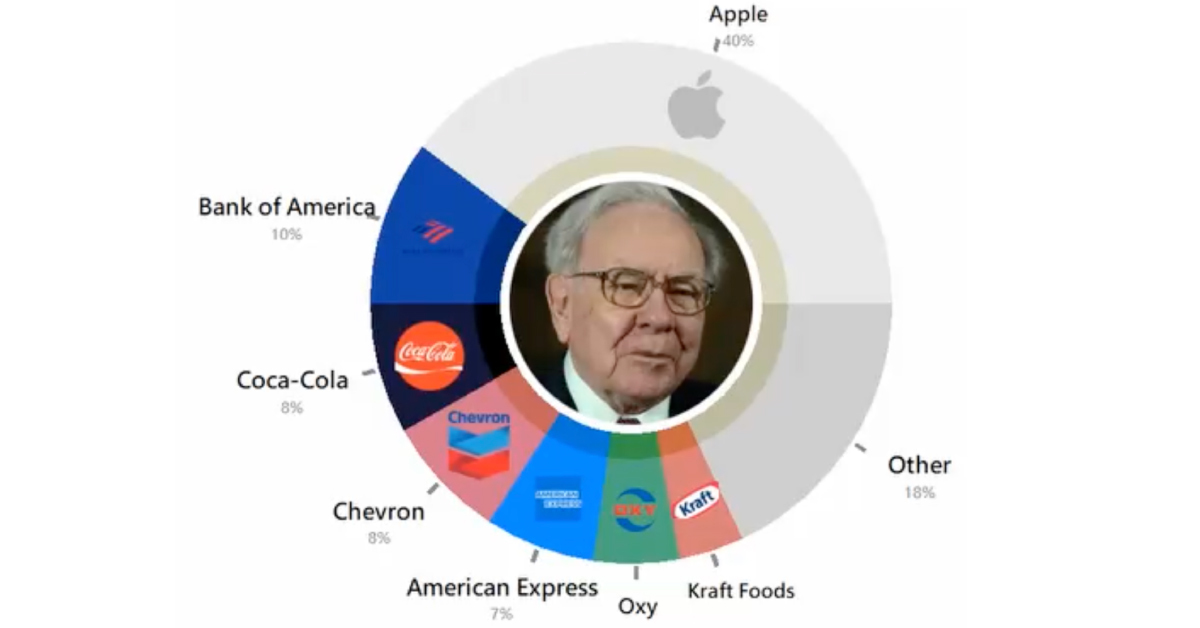

However, as the graphic above indicates, the exact composition of its portfolio has certainly evolved over the years. As of June 2022, here’s a breakdown of Berkshire Hathaway Holdings:

| Company | Value (Millions) | % of Portfolio |

|---|---|---|

| Apple | $122,337 | 40% |

| American Express | $21,016 | 7% |

| Bank of America | $31,444 | 10% |

| Coca-Cola | $25,164 | 8% |

| Chevron | $23,373 | 8% |

| Kraft Foods | $12,419 | 4% |

| Other | $71,559 | 23% |

It’s a well-balanced portfolio of big tech, banks, and consumer goods. Despite being 92 years old, Buffett remains the chairman and CEO of the conglomerate.

As for future succession plans, Greg Abel has been selected as the successor to Buffett as CEO, while the the Guardian has reported that Buffett’s oldest son Howard is expected to take over as non-executive chair when his father is no longer in charge.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Maps

Mapped: The 10 U.S. States With the Lowest Real GDP Growth

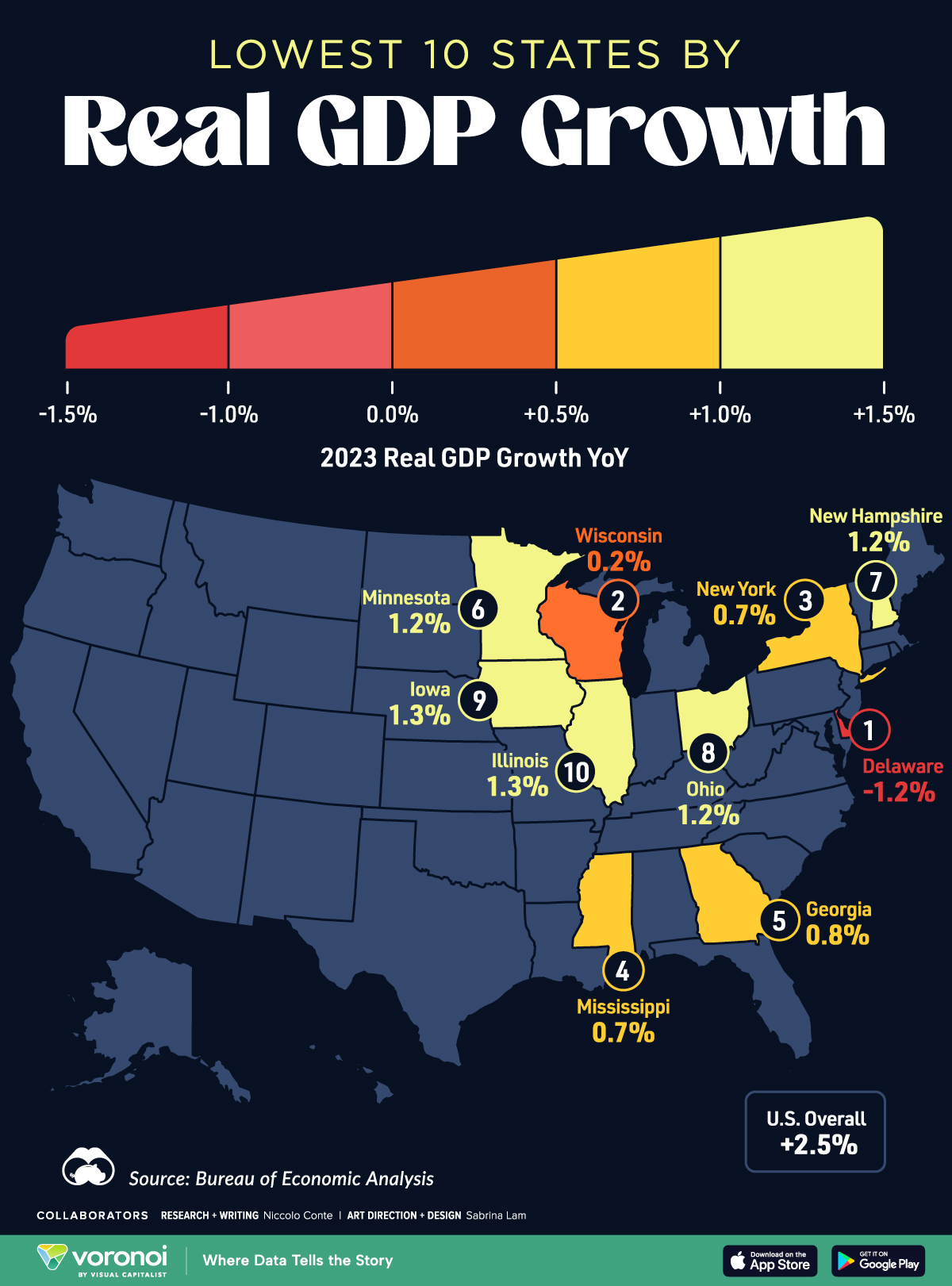

In this graphic, we show where real GDP lagged the most across America in 2023 as high interest rates weighed on state economies.

The Top 10 U.S. States, by Lowest Real GDP Growth

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

While the U.S. economy defied expectations in 2023, posting 2.5% in real GDP growth, several states lagged behind.

Last year, oil-producing states led the pack in terms of real GDP growth across America, while the lowest growth was seen in states that were more sensitive to the impact of high interest rates, particularly due to slowdowns in the manufacturing and finance sectors.

This graphic shows the 10 states with the least robust real GDP growth in 2023, based on data from the Bureau of Economic Analysis.

Weakest State Economies in 2023

Below, we show the states with the slowest economic activity in inflation-adjusted terms, using chained 2017 dollars:

| Rank | State | Real GDP Growth 2023 YoY | Real GDP 2023 |

|---|---|---|---|

| 1 | Delaware | -1.2% | $74B |

| 2 | Wisconsin | +0.2% | $337B |

| 3 | New York | +0.7% | $1.8T |

| 4 | Missississippi | +0.7% | $115B |

| 5 | Georgia | +0.8% | $661B |

| 6 | Minnesota | +1.2% | $384B |

| 7 | New Hampshire | +1.2% | $91B |

| 8 | Ohio | +1.2% | $698B |

| 9 | Iowa | +1.3% | $200B |

| 10 | Illinois | +1.3% | $876B |

| U.S. | +2.5% | $22.4T |

Delaware witnessed the slowest growth in the country, with real GDP growth of -1.2% over the year as a sluggish finance and insurance sector dampened the state’s economy.

Like Delaware, the Midwestern state of Wisconsin also experienced declines across the finance and insurance sector, in addition to steep drops in the agriculture and manufacturing industries.

America’s third-biggest economy, New York, grew just 0.7% in 2023, falling far below the U.S. average. High interest rates took a toll on key sectors, with notable slowdowns in the construction and manufacturing sectors. In addition, falling home prices and a weaker job market contributed to slower economic growth.

Meanwhile, Georgia experienced the fifth-lowest real GDP growth rate. In March 2024, Rivian paused plans to build a $5 billion EV factory in Georgia, which was set to be one of the biggest economic development initiatives in the state in history.

These delays are likely to exacerbate setbacks for the state, however, both Kia and Hyundai have made significant investments in the EV industry, which could help boost Georgia’s manufacturing sector looking ahead.

-

Technology1 week ago

Technology1 week agoCountries With the Highest Rates of Crypto Ownership

-

Mining6 days ago

Mining6 days agoVisualizing Copper Production by Country in 2023

-

Politics7 days ago

Politics7 days agoCharted: How Americans Feel About Federal Government Agencies

-

Healthcare1 week ago

Healthcare1 week agoWhich Countries Have the Highest Infant Mortality Rates?

-

Demographics1 week ago

Demographics1 week agoMapped: U.S. Immigrants by Region

-

Economy1 week ago

Economy1 week agoMapped: Southeast Asia’s GDP Per Capita, by Country

-

Automotive1 week ago

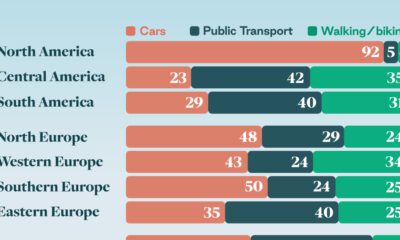

Automotive1 week agoHow People Get Around in America, Europe, and Asia

-

Personal Finance1 week ago

Personal Finance1 week agoVisualizing the Tax Burden of Every U.S. State