Markets

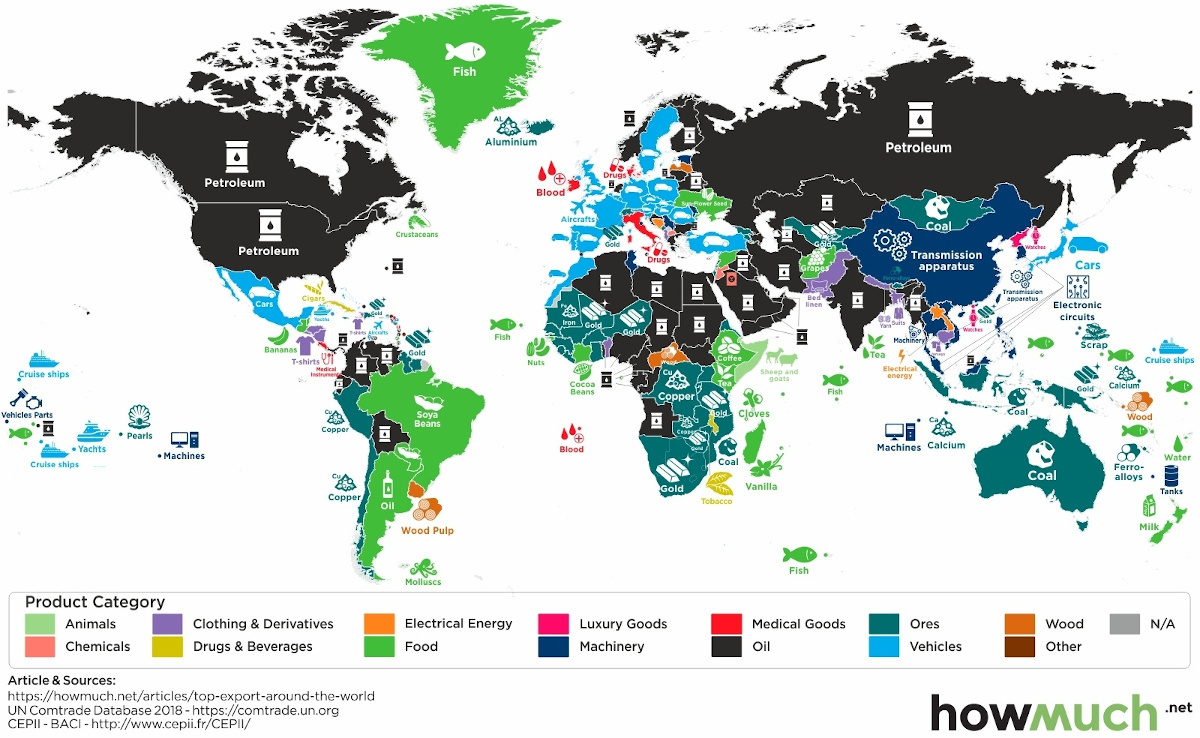

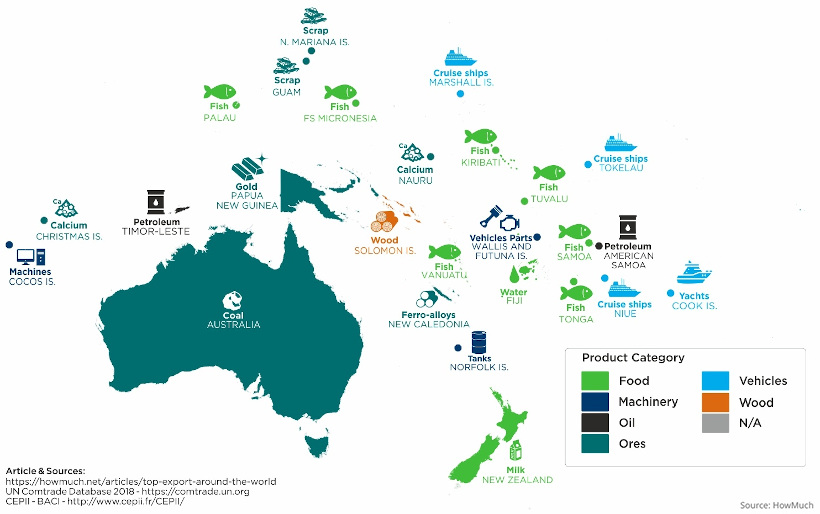

Mapped: The Top Export in Every Country

Click to view a larger version of this infographic

Mapped: The Top Export in Every Country

View the high resolution of this infographic by clicking here.

Today, exports make up roughly 25% of total global production.

One of the common influences on these exports, unsurprisingly, is oil. In fact, petroleum is the top export across over 50 nations, and along with many other resource-driven materials makes up a sizable share of the global export market. Since 2000, the total value of all exported global trade of goods and services has tripled to $19.5 trillion.

This infographic from HowMuch.net shows the top export in every country by value, according to the most recent global data from 2018.

Top Exports, by Region

Let’s dive into some particular regions, to see how top exports can vary:

Editor’s note: for even larger versions of each regional infographic below, visit HowMuch.net. All export data is from 2018 and comes from CEPII, a leading French center of economic analysis.

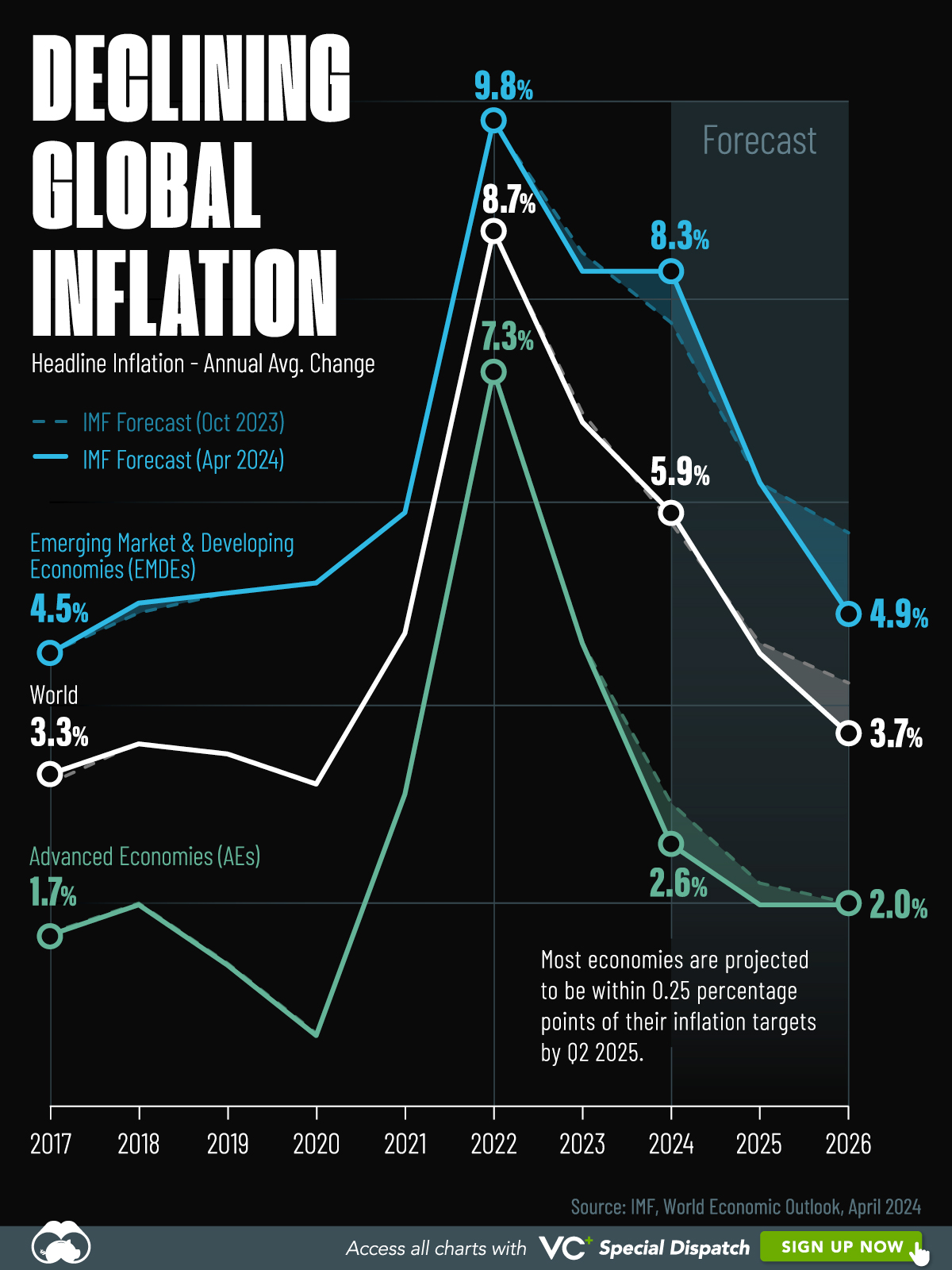

North America

In the U.S. petroleum outpaces all other exports, with crude oil accounting for 35% of total petroleum exports. Canada too, lists petroleum at the top.

| Country | Top Export |

|---|---|

| Canada | Petroleum |

| Greenland | Fish |

| Mexico | Cars |

| Saint Pierre and Quelon | Crustaceans |

| U.S. | Petroleum |

With a market valued at $50.7 billion, Mexico’s top export is cars—making it the fourth largest exporter worldwide.

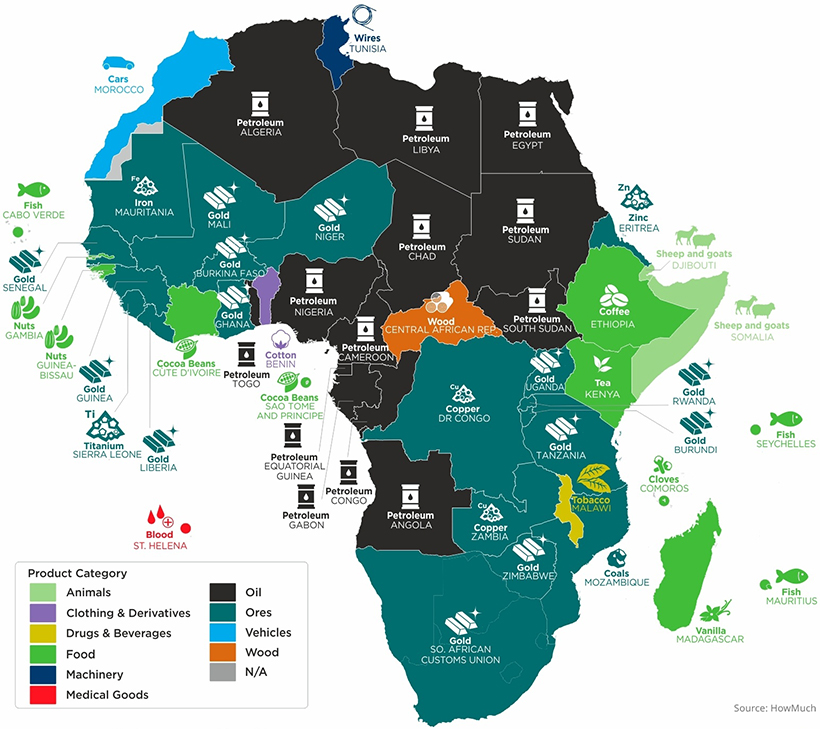

Africa

From Egypt to Senegal, Africa has a diverse spectrum of exports. Primarily, these are resource-driven, with the top five exports being petroleum, gold, diamonds, natural gas, and coal.

| Country | Top Export |

|---|---|

| Algeria | Petroleum |

| Angola | Petroleum |

| Benin | Cotton |

| Burkina Faso | Gold |

| Burundi | Gold |

| Cabo Verde | Fish |

| Cameroon | Petroleum |

| Central African Republic | Wood |

| Chad | Petroleum |

| Comoros | Cloves |

| Congo | Petroleum |

| Cote D'Ivoire | Cocoa Beans |

| Dijibouti | Sheep and goats |

| DR Congo | Copper |

| Egypt | Petroleum |

| Eritrea | Zinc |

| Ethiopia | Coffee |

| Gambia | Nuts |

| Ghana | Gold |

| Guinea | Gold |

| Guinea-Bissau | Nuts |

| Kenya | Tea |

| Liberia | Gold |

| Libya | Petroleum |

| Madagascar | Vanilla |

| Malawi | Tobacco |

| Mali | Gold |

| Mauritania | Iron |

| Mauritus | Fish |

| Morocco | Cars |

| Mozambique | Cloves |

| Niger | Gold |

| Nigeria | Petroleum |

| Rwanda | Gold |

| Senegal | Gold |

| Seychelles | Fish |

| Sierra Leone | Titanium |

| Somalia | Sheep and goats |

| South African Customs Union | Gold |

| South Sudan | Petroleum |

| St. Helena | Blood |

| Sudan | Petroleum |

| Tanzana | Gold |

| Togo | Petroleum |

| Tunisia | Wires |

| Uganda | Gold |

| Zambia | Copper |

| Zimbabwe | Gold |

Meanwhile, Ethiopia’s top export is coffee, shipping nearly $1 billion alone in 2018. Similarly, off the east coast, Madagascar is the world’s largest producer of vanilla.

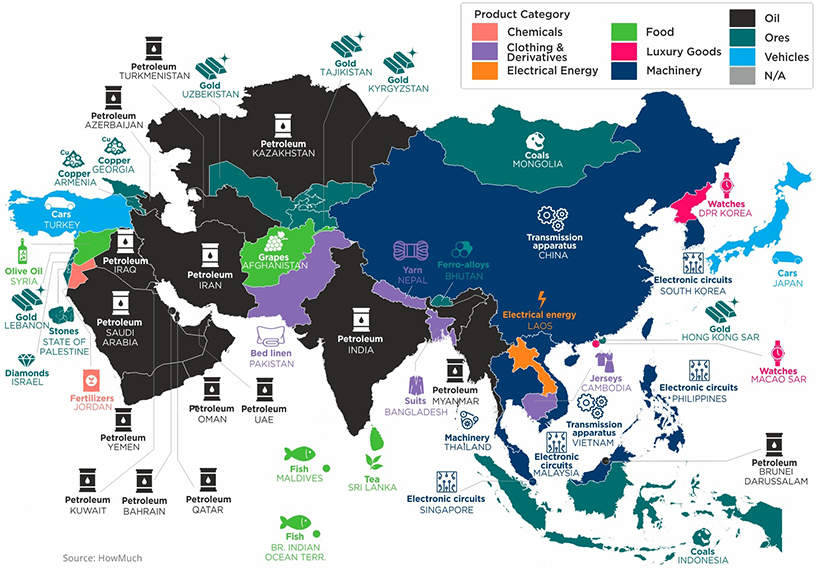

Asia

While petroleum is also a dominant export across many countries in Asia, the region’s export landscape is a lot more tech-focused.

In South Korea, electronic circuits are the largest export. Samsung, headquartered in Seoul, is a major supplier to Apple for multiple electronic components. With one of the highest export ratios in Asia, 40% of South Korea’s economic output is derived from its export market.

Here are the top exports across other Asian countries.

| Country | Top Export |

|---|---|

| Afghanistan | Grapes |

| Armenia | Copper |

| Azerbaijan | Petroleum |

| Bahrain | Petroleum |

| Bangladesh | Suits |

| Bhutan | Ferro-alloys |

| Br. Indian Ocean Terr. | Fish |

| Brunei Darussalam | Petroleum |

| Cambodia | Jerseys |

| China | Transmission apparatus |

| DPR Korea | Watches |

| Georgia | Copper |

| Hong Kong SAR | Gold |

| Indonesia | Coals |

| Iran | Petroleum |

| Iraq | Petroleum |

| Israel | Diamonds |

| Japan | Cars |

| Jordan | Fertilizers |

| Kazakhstan | Petroleum |

| Kuwait | Petroleum |

| Kyrgyzstan | Gold |

| Laos | Electrical energy |

| Lebanon | Gold |

| Macao SAR | Watches |

| Malaysia | Electronic circuits |

| Maldives | Fish |

| Mongolia | Coals |

| Myanmar | Petroleum |

| Nepal | Yarn |

| Oman | Petroleum |

| Pakistan | Bed linen |

| Philippines | Electronic circuits |

| Qatar | Petroleum |

| Saudi Arabia | Petroleum |

| Singapore | Electronic circuits |

| South Korea | Electronic circuits |

| Sri Lanka | Tea |

| State of Palestine | Stones |

| Syria | Olive oil |

| Tajikistan | Gold |

| Thailand | Machinery |

| Turkmenistan | Petroleum |

| Turkey | Cars |

| UAE | Petroleum |

| Uzbekistan | Gold |

| Vietnam | Transmission apparatus |

| Yemen | Petroleum |

In Afghanistan, grapes are the top export, valued at $237 million. Almost one-fifth of Afghanistan’s exports come from the grape industry.

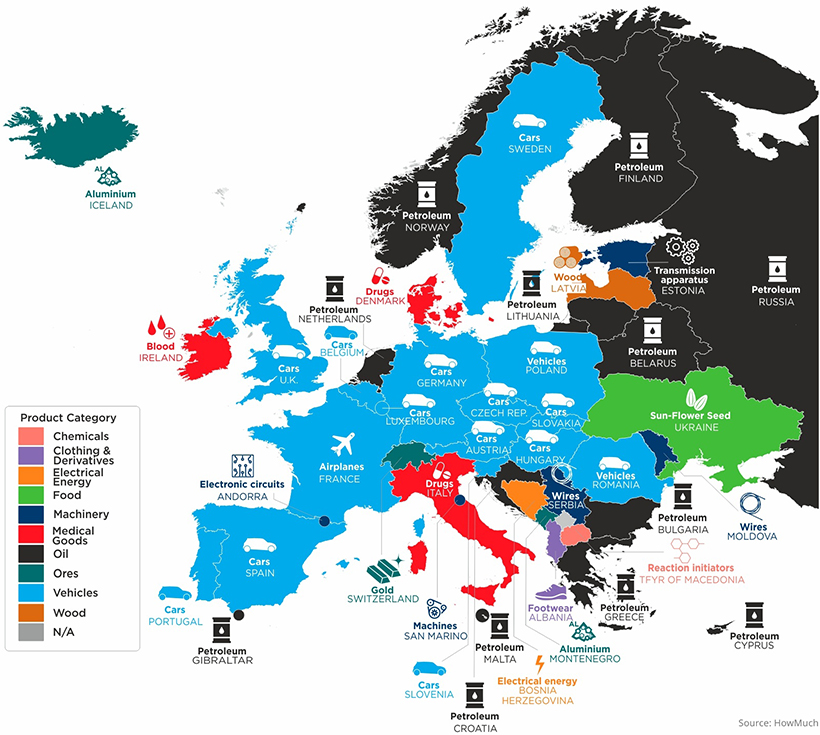

Europe

Across the European continent, the automotive industry stands out as a primary driver of exports, with 14 countries having cars or vehicles as their most exported good.

In fact, in 2019, the European Union exported a total of 5.6 million motor vehicles. Of these, 28% were shipped to the U.S. and 16.5% to China.

| Country | Top Export |

|---|---|

| Albania | Footwear |

| Andorra | Electronic circults |

| Austria | Cars |

| Belarus | Petroleum |

| Belgium | Cars |

| Bosnia Herzegovina | Electrical energy |

| Bulgaria | Petroleum |

| Croatia | Petroleum |

| Cyprus | Petroleum |

| Czech Republic | Cars |

| Denmark | Drugs |

| Estonia | Transmission apparatus |

| Finland | Petroleum |

| France | Airplanes |

| Germany | Cars |

| Gibraltar | Petroleum |

| Greece | Petroleum |

| Hungary | Cars |

| Iceland | Aluminium |

| Ireland | Blood |

| Italy | Drugs |

| Latvia | Wood |

| Lithuania | Petroleum |

| Luxembourg | Cars |

| Malta | Petroleum |

| Moldova | Wires |

| Montenegro | Aluminium |

| Netherlands | Petroleum |

| Norway | Petroleum |

| Poland | Vehicles |

| Portugal | Cars |

| Romania | Vehicles |

| Russia | Petroleum |

| San Marino | Machines |

| Serbia | Wires |

| Slovakia | Cars |

| Slovenia | Cars |

| Spain | Cars |

| Sweden | Cars |

| Switzerland | Gold |

| TFYR of Macedonia | Reaction initiators |

| U.K. | Cars |

| Ukraine | Sun-Flower Seed |

The Balkan nation of Albania has footwear as its top export. Overall, nearly 80% of the nation’s GDP relies on goods and services exports.

France, on the other hand, has airplanes as its highest export while Italy and Denmark’s highest are drugs. Italy is the top producer of pharmaceuticals in Europe, an industry which employs 66,500 across the country. Globally, it makes up 2.8% of pharmaceutical sales.

Due to its cheap electricity prices, companies have flocked to Iceland to produce aluminum. Iceland’s dams, which generate power from glacial water, produce electricity as much as 30% cheaper than in America.

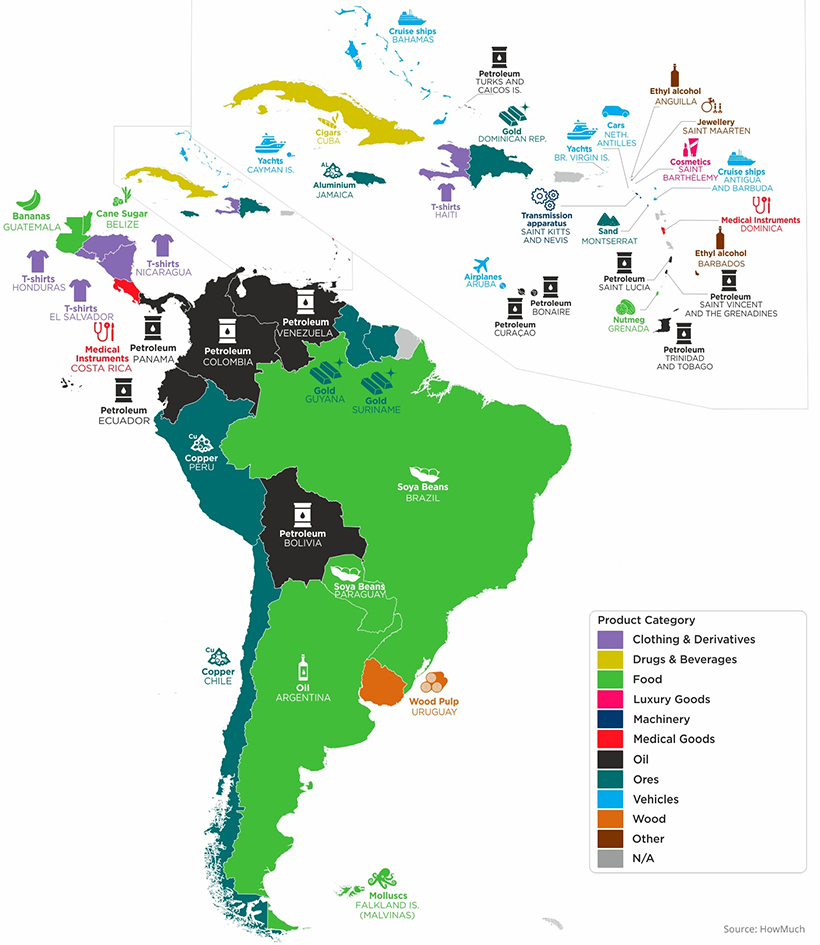

Latin America & the Caribbean Islands

Like other regions, petroleum stands out as a key export in countries across Latin America.

Take Venezuela. With the largest oil reserves in the world, its oil exports were valued at $90 billion annually ten years ago. Since the pandemic, however, earnings are projected to reach just a fraction of this total—only $2.3 billion this year.

Along with this, the U.S. has imposed sanctions on president Nicolás Maduro and Venezuela’s state oil company, PDVSA, causing oil exports to slump to their lowest point in nearly 80 years.

| Country | Top Export |

|---|---|

| Anguilla | Ethyl alcohol |

| Antigua and Barbuda | Cruise ships |

| Argentina | Oil |

| Aruba | Airplanes |

| Bahamas | Cruise ships |

| Barbados | Ethyl alcohol |

| Belize | Cane sugar |

| Bolivia | Petroleum |

| Bonaire | Petroleum |

| Brazil | Soya beans |

| British Virgin Islands | Yachts |

| Cayman Islands | Yachts |

| Chile | Copper |

| Colombia | Petroleum |

| Costa Rica | Medical instruments |

| Cuba | Cigars |

| Curacao | Petroleum |

| Dominica | Medical instruments |

| Dominican Republic | Gold |

| Ecuador | Petroleum |

| El Salvador | T-shirts |

| Falkland Is. (Malvinas) | Molluscs |

| Grenada | Nutmeg |

| Guatemala | Bananas |

| Guyana | Gold |

| Haiti | T-shirts |

| Honduras | T-shirts |

| Jamaica | Aluminium |

| Montserrat | Sand |

| Neth. Antilles | Cars |

| Nicaragua | T-shirts |

| Panama | Petroleum |

| Paraguay | Soya beans |

| Peru | Copper |

| Saint Barthelemy | Cosmetics |

| Saint Kitts and Nevis | Transmission apparatus |

| Saint Lucia | Petroleum |

| Saint Maarten | Jewellery |

Saint Vincent and the Grenadines | Petroleum |

| Suriname | Gold |

| Trinidad and Tobago | Petroleum |

| Turks and Caicos Is. | Petroleum |

| Uruguay | Wood pulp |

| Venezuela | Petroleum |

For Caribbean nations, unsurprisingly, many top exports in this region are linked to tourism.

Cruise ships stood out as a primary export in the Bahamas, while yachts were most significant in the Cayman Islands. However, due to the pandemic, many of these national economies are at heightened risk, with some economies across the region projected to contract 10% in 2020.

Oceania

Finally, in Oceania, Australia had coal as it’s top export in 2018 (though it has since switched to iron ore in 2019), while New Zealand sends milk abroad.

For many of the smaller islands throughout the Pacific, it can be seen that fish, cruise ships, water, and yachts are key exports.

The Future of Trade

Now, COVID-19 and a host of other factors are changing the way the world trades. Unexpected shocks, trade wars, the carbon footprint, and labor standards are influencing firms to build more resilient supply chains.

According to The Economist, it’s estimated that over the next five years that 16-26% of exported goods production could shift locations.

Markets

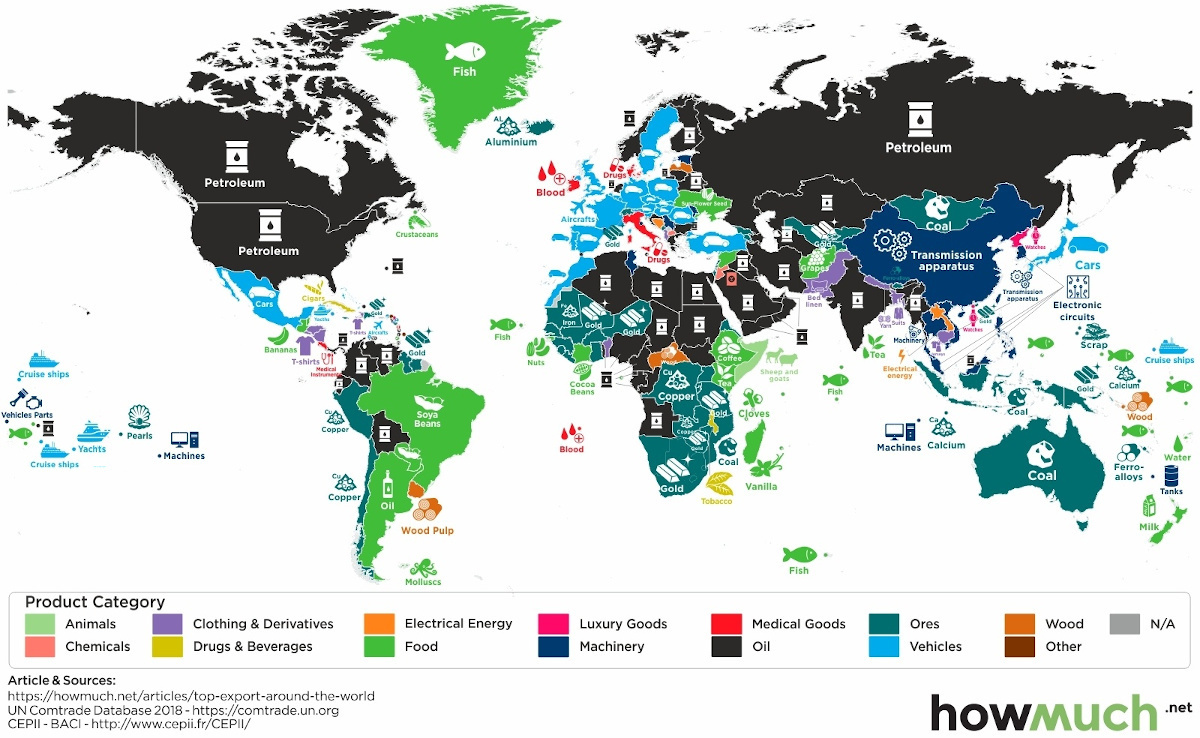

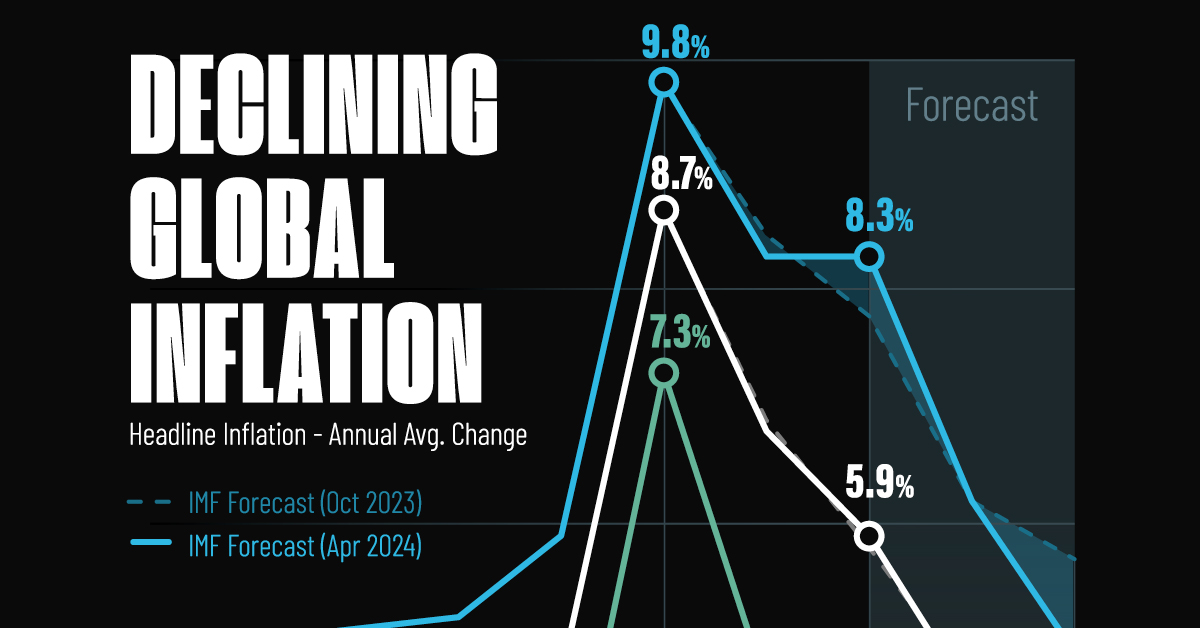

Visualizing Global Inflation Forecasts (2024-2026)

Here are IMF forecasts for global inflation rates up to 2026, highlighting a slow descent of price pressures amid resilient global growth.

Visualizing Global Inflation Forecasts (2024-2026)

Global inflation rates are gradually descending, but progress has been slow.

Today, the big question is if inflation will decline far enough to trigger easing monetary policy. So far, the Federal Reserve has held rates for nine months amid stronger than expected core inflation, which excludes volatile energy and food prices.

Yet looking further ahead, inflation forecasts from the International Monetary Fund (IMF) suggest that inflation will decline as price pressures ease, but the path of disinflation is not without its unknown risks.

This graphic shows global inflation forecasts, based on data from the April 2024 IMF World Economic Outlook.

Get the Key Insights of the IMF’s World Economic Outlook

Want a visual breakdown of the insights from the IMF’s 2024 World Economic Outlook report?

This visual is part of a special dispatch of the key takeaways exclusively for VC+ members.

Get the full dispatch of charts by signing up to VC+.

The IMF’s Inflation Outlook

Below, we show the IMF’s latest projections for global inflation rates through to 2026:

| Year | Global Inflation Rate (%) | Advanced Economies Inflation Rate (%) | Emerging Market and Developing Economies Inflation Rate (%) |

|---|---|---|---|

| 2019 | 3.5 | 1.4 | 5.1 |

| 2020 | 3.2 | 0.7 | 5.2 |

| 2021 | 4.7 | 3.1 | 5.9 |

| 2022 | 8.7 | 7.3 | 9.8 |

| 2023 | 6.8 | 4.6 | 8.3 |

| 2024 | 5.9 | 2.6 | 8.3 |

| 2025 | 4.5 | 2.0 | 6.2 |

| 2026 | 3.7 | 2.0 | 4.9 |

After hitting a peak of 8.7% in 2022, global inflation is projected to fall to 5.9% in 2024, reflecting promising inflation trends amid resilient global growth.

While inflation has largely declined due to falling energy and goods prices, persistently high services inflation poses challenges to mitigating price pressures. In addition, the IMF highlights the potential risk of an escalating conflict in the Middle East, which could lead to energy price shocks and higher shipping costs.

These developments could negatively affect inflation scenarios and prompt central banks to adopt tighter monetary policies. Overall, by 2026, global inflation is anticipated to decline to 3.7%—still notably above the 2% target set by several major economies.

Adding to this, we can see divergences in the path of inflation between advanced and emerging economies. While affluent nations are forecast to see inflation edge closer to the 2% target by 2026, emerging economies are projected to have inflation rates reach 4.9%—falling closer to their pre-pandemic averages.

Get the Full Analysis of the IMF’s Outlook on VC+

This visual is part of an exclusive special dispatch for VC+ members which breaks down the key takeaways from the IMF’s 2024 World Economic Outlook.

For the full set of charts and analysis, sign up for VC+.

-

Culture6 days ago

Culture6 days agoThe World’s Top Media Franchises by All-Time Revenue

-

Science2 weeks ago

Science2 weeks agoVisualizing the Average Lifespans of Mammals

-

Technology2 weeks ago

Technology2 weeks agoHow Tech Logos Have Evolved Over Time

-

Energy2 weeks ago

Energy2 weeks agoRanked: The Top 10 EV Battery Manufacturers in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoCountries With the Largest Happiness Gains Since 2010

-

VC+2 weeks ago

VC+2 weeks agoVC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

-

Demographics2 weeks ago

Demographics2 weeks agoThe Countries That Have Become Sadder Since 2010

-

Money1 week ago

Money1 week agoCharted: Who Has Savings in This Economy?