Misc

Video: A Deep Dive Into the World’s Oceans

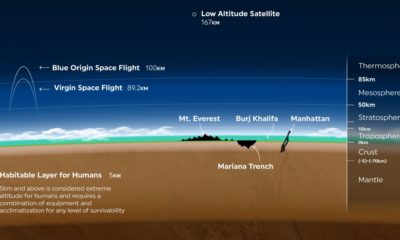

In the battle for mind-share, space vs. sea is no contest.

From the epic race to reach the surface of the moon, to the well-documented trials and tribulations of SpaceX’s rocket launches, space is widely regarded as mankind’s natural next step.

For centuries, we’ve gazed at the night sky attempting to decode the messages of the cosmos, but we’ve treated the ocean as a dumping ground or as a nemesis. In the era of big data, it’s strange to note that an estimated 95% of the world’s oceans still remain unexplored.

A Deep Dive Into the World’s Oceans

Today’s video, from Tech Insider, helps shed some light on just how deep the ocean is, and put that depth into a context us surface-dwellers can understand.

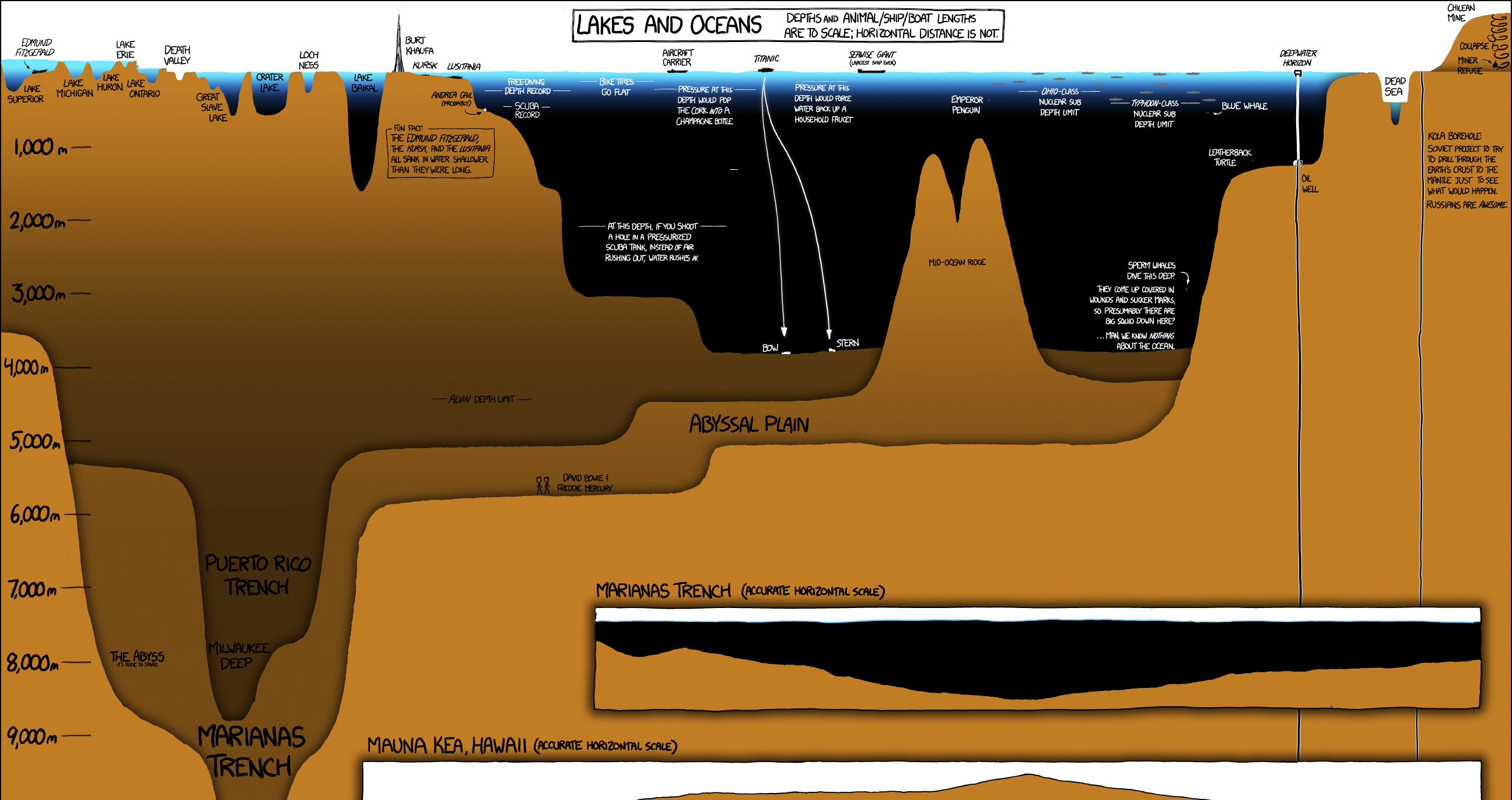

The ocean is vast, but looking at it in terms of light and food supply allows us to better understand the structure of that ecosystem.

There are five main oceanic divisions:

| Ocean Zone | Depth (m) | Depth (ft) |

|---|---|---|

| epipelagic | Surface to 200 m | Surface to 650 ft |

| mesopelagic | 200 to 1,000 m | 650 to 3,300 ft |

| bathypelagic | 1,000 to 4000 m | 3,300 to 13,000 ft |

| abyssopelagic | 4,000 to 6,000 m | 13,000 to 20,000 ft |

| hadopelagic | 6,000 to 11,000 m | 20,000 to 36,000 ft |

Let’s take a look at each layer in more detail.

Scratching the Surface

The surface layer of the ocean, or epipelagic zone, is the portion we’re most familiar with. This portion of the ocean is amply lit by the sun, and though it’s the smallest zone by volume, it contains much of the ocean’s life. In fact, the phytoplankton living at this level produce half of the world’s oxygen.

One of the chief concerns about climate change is that acidification and temperature changes may dramatically influence levels of phytoplankton in the ocean, thus putting Earth’s largest source of oxygen in jeopardy.

Due to its proximity to sunlight, this layer of the ocean is the fuel that feeds the rest of the ocean. As organisms die, they begin to sink to the lower depths in the form of “marine snow”. This is vital since plant life cannot survive beyond this thin, top layer of water. Put simply, the epipelagic zone feeds the rest of the ocean.

The Twilight Zone

The next layer, called the mesopelagic zone, begins 200m below the surface and extends down to the 1km level. At this point, sunlight illuminating the water begins to wane and water pressure already begins to push beyond what the human body can tolerate.

This dimly lit zone is where we begin to see evolutionary adaptations such as bioluminescence. Large fish and whales also enter this zone to hunt for food.

Hello Darkness, My Old Friend

At 1km below the surface – in the bathypelagic zone – sunlight has faded completely and the ocean is nearly pitch black. This region accounts for 90% of the ocean’s volume and as the video below (via TEDed) explains, this is where things start to get really weird.

The Abyss

The aptly named abyssopelagic zone, begins at 4,000 meters below the surface and extends down to 6,000 meters (or the ocean floor). At this level, the water temperature is nearly at freezing level, and because no sunlight reaches this zone, many of the animals that live here are sightless. The Abyss is the largest zone in the ocean, accounting for about 75% of the ocean floor and 54% of the ocean’s volume.

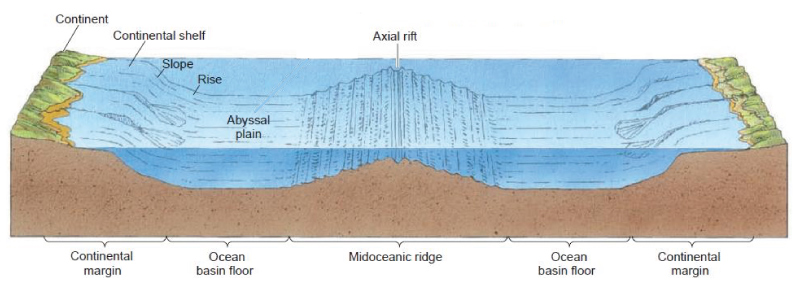

This region of the ocean is the home of the Abyssal plains. The plains are the upper surface of sediment that has accumulated in abyssal depressions, smoothing out what would otherwise by irregular topography. By this depth the consistent flow of marine snow has decreased dramatically, so organisms depend on occasional “feasts” to survive. Occasionally, events such as large algae blooms near the surface end up delivering huge amounts of food to the ocean floor once those blooms die off.

Abyssal plains could eventually become a big deal economically due to hydrocarbon exploration and mineral extraction. An example of the latter is polymetallic nodules. These potato-sized concretions are scattered around the seafloor at depths greater than 4,000 meters. If it becomes economically viable to harvest these nodules (comprised of manganese, iron, nickel, cobalt, and copper), companies could generate considerable revenue. Currently, there are eight commercial contractors licensed by the International Seabed Authority to explore the extraction of nodule resources.

Earth’s Final Frontier

The hadopelagic zone comprises less than 1% of ocean volume and 0.2% of the seafloor, but looms large as one of Earth’s least understood ecosystems. In fact, more humans have been on the moon than have visited this area of the ocean, and most of this zone only exists within deep water trenches and canyons that extend well beyond the Abyssal plains. There are 33 “hadal trenches” and five of them exceed 10,000 meters – including the world’s deepest oceanic point, the Mariana Trench.

The water pressure here can reach a mind-bending eight tons per square inch, but in spite of the extreme pressure, lack of food, and near-freezing temperatures, life can still be found. Most of the creatures that inhabit the hadal zone are literally bottom feeders; they eat the very last bits of marine snow that reach the trench floor.

While nearly all organisms on Earth derive energy either directly or indirectly from the sun, certain organisms have adapted to survive by using hydrothermal vents as an energy source. Many of the creatures living around vents contain symbiotic bacteria, which subsist off hydrogen sulphide emissions. This unique ecosystem provides clues for how life could exist on other planets with more extreme ecosystems.

Maps

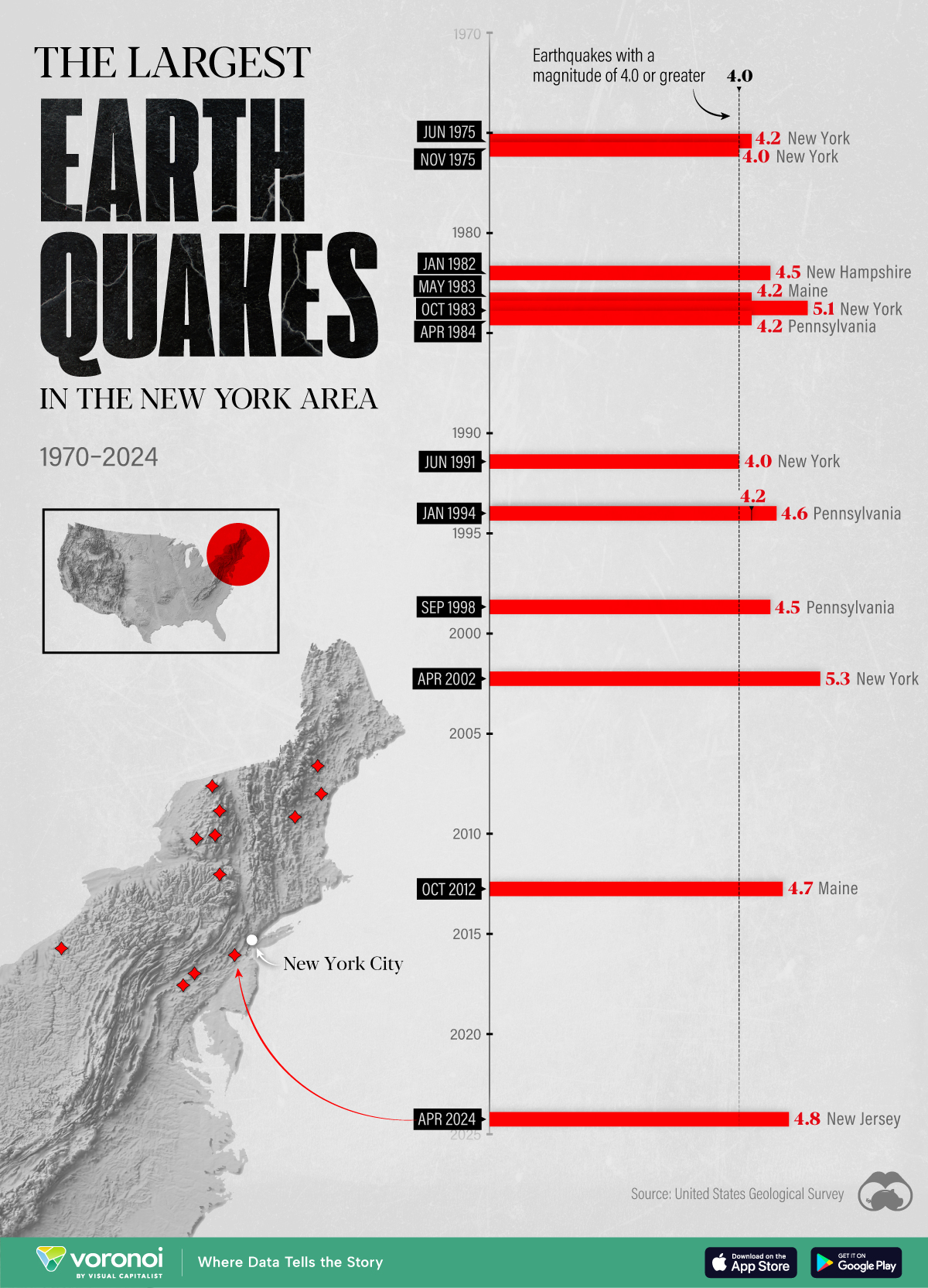

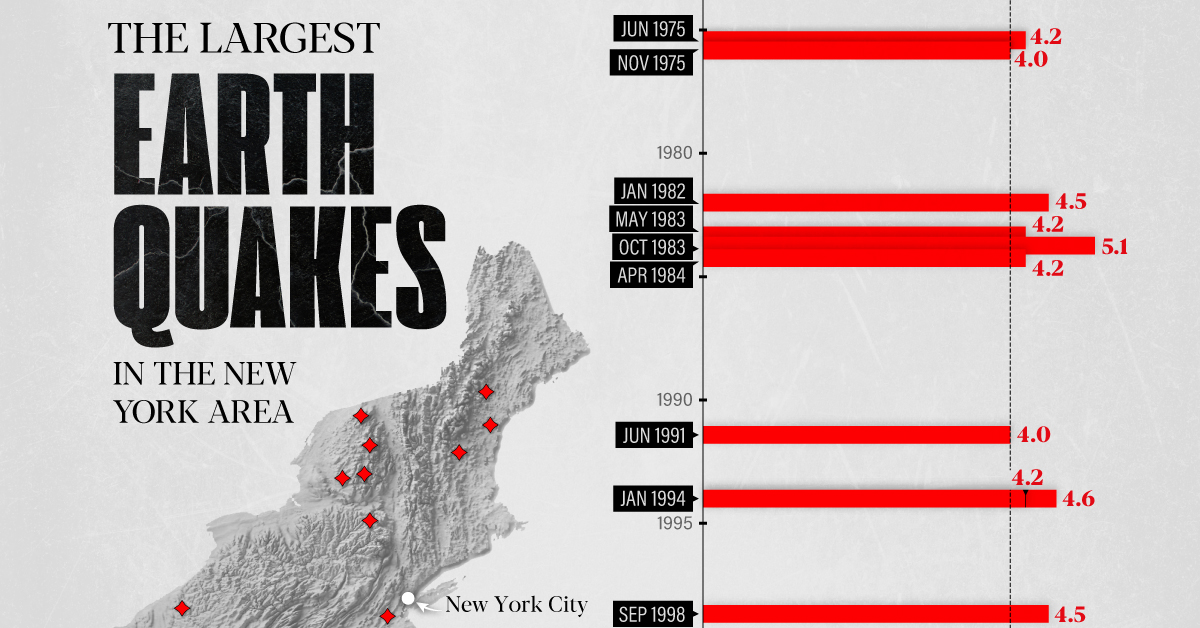

The Largest Earthquakes in the New York Area (1970-2024)

The earthquake that shook buildings across New York in April 2024 was the third-largest quake in the Northeast U.S. over the past 50 years.

The Largest Earthquakes in the New York Area

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

The 4.8 magnitude earthquake that shook buildings across New York on Friday, April 5th, 2024 was the third-largest quake in the U.S. Northeast area over the past 50 years.

In this map, we illustrate earthquakes with a magnitude of 4.0 or greater recorded in the Northeastern U.S. since 1970, according to the United States Geological Survey (USGS).

Shallow Quakes and Older Buildings

The earthquake that struck the U.S. Northeast in April 2024 was felt by millions of people from Washington, D.C., to north of Boston. It even caused a full ground stop at Newark Airport.

The quake, occurring just 5 km beneath the Earth’s surface, was considered shallow, which is what contributed to more intense shaking at the surface.

According to the USGS, rocks in the eastern U.S. are significantly older, denser, and harder than those on the western side, compressed by time. This makes them more efficient conduits for seismic energy. Additionally, buildings in the Northeast tend to be older and may not adhere to the latest earthquake codes.

Despite disrupting work and school life, the earthquake was considered minor, according to the Michigan Technological University magnitude scale:

| Magnitude | Earthquake Effects | Estimated Number Each Year |

|---|---|---|

| 2.5 or less | Usually not felt, but can be recorded by seismograph. | Millions |

| 2.5 to 5.4 | Often felt, but only causes minor damage. | 500,000 |

| 5.5 to 6.0 | Slight damage to buildings and other structures. | 350 |

| 6.1 to 6.9 | May cause a lot of damage in very populated areas. | 100 |

| 7.0 to 7.9 | Major earthquake. Serious damage. | 10-15 |

| 8.0 or greater | Great earthquake. Can totally destroy communities near the epicenter. | One every year or two |

The largest earthquake felt in the area over the past 50 years was a 5.3 magnitude quake that occurred in Au Sable Forks, New York, in 2002. It damaged houses and cracked roads in a remote corner of the Adirondack Mountains, but caused no injuries.

| Date | Magnitude | Location | State |

|---|---|---|---|

| April 20, 2002 | 5.3 | Au Sable Forks | New York |

| October 7, 1983 | 5.1 | Newcomb | New York |

| April 5, 2024 | 4.8 | Whitehouse Station | New Jersey |

| October 16, 2012 | 4.7 | Hollis Center | Maine |

| January 16, 1994 | 4.6 | Sinking Spring | Pennsylvania |

| January 19, 1982 | 4.5 | Sanbornton | New Hampshire |

| September 25, 1998 | 4.5 | Adamsville | Pennsylvania |

| June 9, 1975 | 4.2 | Altona | New York |

| May 29, 1983 | 4.2 | Peru | Maine |

| April 23, 1984 | 4.2 | Conestoga | Pennsylvania |

| January 16, 1994 | 4.2 | Sinking Spring | Pennsylvania |

| November 3, 1975 | 4 | Long Lake | New York |

| June 17, 1991 | 4 | Worcester | New York |

The largest earthquake in U.S. history, however, was the 1964 Good Friday quake in Alaska, measuring 9.2 magnitude and killing 131 people.

-

Technology2 weeks ago

Technology2 weeks agoRanked: The Most Popular Smartphone Brands in the U.S.

-

Automotive1 week ago

Automotive1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money1 week ago

Money1 week agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Demographics2 weeks ago

Demographics2 weeks agoVisualizing the Size of the Global Senior Population