Maps

Mapped: The World’s Biggest Private Tax Havens

The World’s Biggest Private Tax Havens

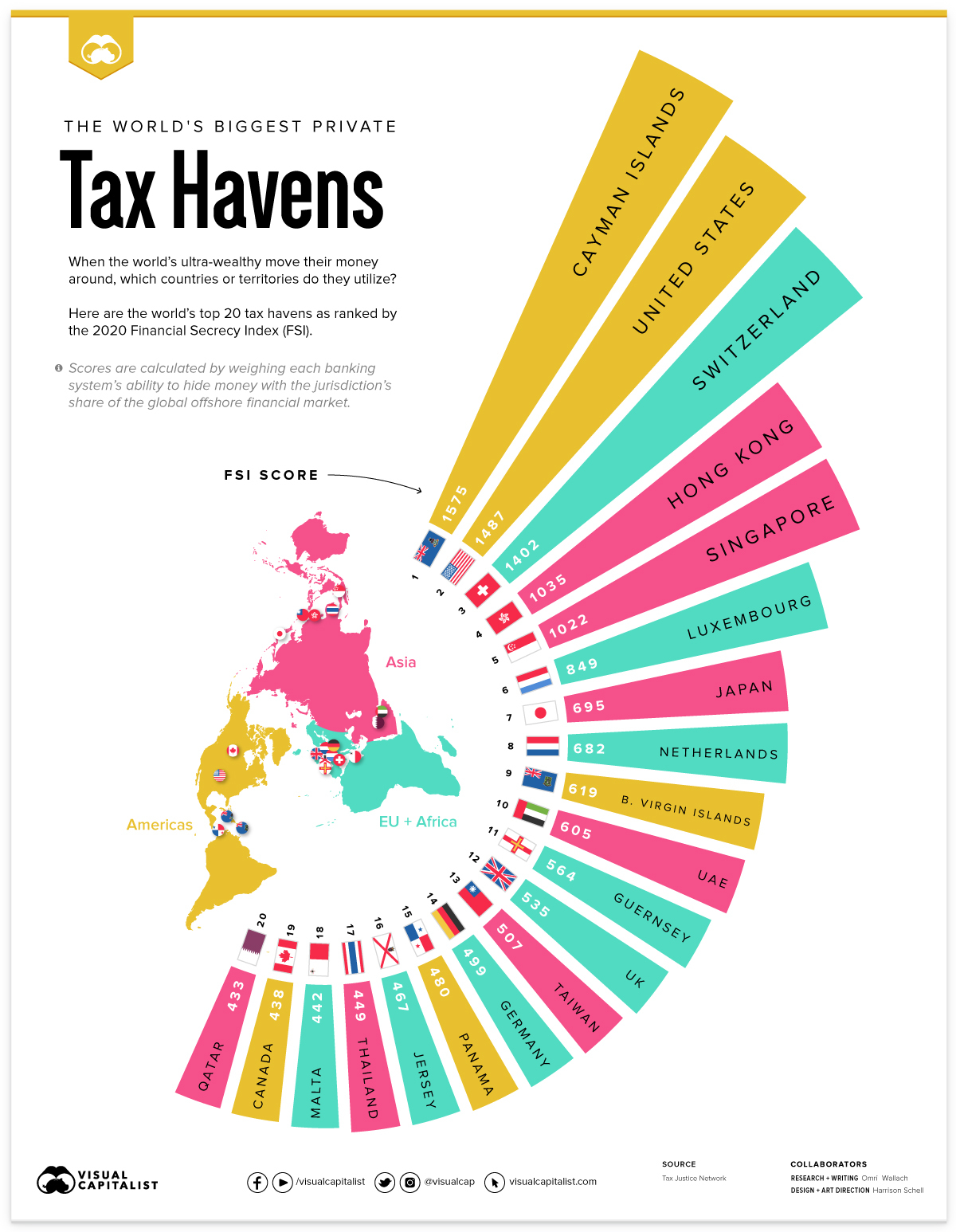

When the world’s ultra-wealthy look for tax havens to shield income and wealth from their domestic governments, where do they turn?

If you’re putting money in offshore bank accounts in order to save on taxes, there are two main criteria you’re looking for: secrecy and accessibility. Based on pop culture and media reports, you might imagine a secretive bank in Switzerland or a tiny island nation in the Caribbean.

And though there is some truth to that logic, the reality is that the world’s biggest tax havens are spread all over the world. Some of them are small nations as expected, but others are major economic powers that might be surprising.

Here are the world’s top 20 tax havens, as ranked by the 2020 Financial Secrecy Index (FSI) by the English NGO Tax Justice Network.

Which Countries are the Biggest Tax Havens?

The FSI ranks countries and territories from all over the world on two criteria: secrecy and scale.

- Secrecy Score: How well the jurisdiction’s banking system can hide money. This includes analysis of ownership registration, legal entity transparency, tax and financial regulations, and cooperation with international standards.

- Global Scale Weight: What is the jurisdiction’s share of the world’s total cross-border financial services? This metric is based primarily on the IMF’s Balance of Payments statistics.

By weighing a country’s ability to hide money by its relative share of offshore financial services, we see the tax havens with the biggest impact on the global economy.

| Rank | Jurisdiction | Region |

|---|---|---|

| 1 | 🇰🇾 Cayman Islands | Caribbean |

| 2 | 🇺🇸 United States | North America |

| 3 | 🇨🇭 Switzerland | Europe |

| 4 | 🇭🇰 Hong Kong | East Asia |

| 5 | 🇸🇬 Singapore | Southeast Asia |

| 6 | 🇱🇺 Luxembourg | Europe |

| 7 | 🇯🇵 Japan | East Asia |

| 8 | 🇳🇱 Netherlands | Europe |

| 9 | 🇻🇬 British Virgin Islands | Caribbean |

| 10 | 🇦🇪 United Arab Emirates | Middle East |

| 11 | 🇬🇬 Guernsey | Europe |

| 12 | 🇬🇧 United Kingdom | Europe |

| 13 | 🇹🇼 Taiwan | East Asia |

| 14 | 🇩🇪 Germany | Europe |

| 15 | 🇵🇦 Panama | Caribbean |

| 16 | 🇯🇪 Jersey | Europe |

| 17 | 🇹🇭 Thailand | Southeast Asia |

| 18 | 🇲🇹 Malta | Europe |

| 19 | 🇨🇦 Canada | North America |

| 20 | 🇶🇦 Qatar | Middle East |

At a glance, the top 20 tax havens are spread out across regions. Just under half of the list is located in Europe, but the rest are spread out across the Americas and Asia.

And the jurisdictions are opposites in many ways. They include financial powerhouses like the U.S., Japan, and the UK as well as smaller nations and territories like the Cayman Islands, Hong Kong, and Luxembourg.

But one surprising thing many of them have in common is a link to England. In addition to the UK, four of the top 20 tax havens—Cayman Islands, British Virgin Islands, Guernsey, and Jersey—are British Overseas Territories or Crown Dependencies.

Also worth noting is the importance of scale in the rankings. The highest ranking jurisdictions by secrecy score were actually the Maldives, Angola and Algeria, but they represent less than 0.1% of total offshore financial services.

Best Place To Hide Private Vs. Corporate Tax

Some of the listed tax havens might be confusing to nationals of those countries, but that’s where relativity is important. The U.S. and Canada might not be tax havens for American or Canadian nationals, but the ultra-wealthy from East Asia and the Middle East are reported to utilize them due to holes in foreign tax laws. Likewise, the UAE has reportedly become a tax haven for Africa’s ultra-wealthy.

In addition, many of the countries used as tax havens for individual wealth are also utilized by corporations.

The Tax Justice Network’s 2021 assessment of corporate tax havens listed the British Virgin Islands, Cayman Islands, and Bermuda as the top three tax corporate tax havens.

While individuals might create shell companies in tax havens to hide their wealth, corporations are usually directly incorporated in the tax haven in order to defer taxes.

But the tax haven landscape might soon shift. The G7 struck a deal in June 2021 to start taxing multinational corporations based on the revenue generated in each country (instead of where the company is based), as well as setting a global minimum tax of 15%. In total, a group of 130 countries have agreed to the deal, including India, China, the UK, and the Cayman Islands.

As the campaign to bring back deferred taxes ramps up, the question becomes one of response. Will the ultra-wealthy individuals and corporations start to work in tandem with the new rules, or discover new workarounds and tax havens?

Maps

The Largest Earthquakes in the New York Area (1970-2024)

The earthquake that shook buildings across New York in April 2024 was the third-largest quake in the Northeast U.S. over the past 50 years.

The Largest Earthquakes in the New York Area

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

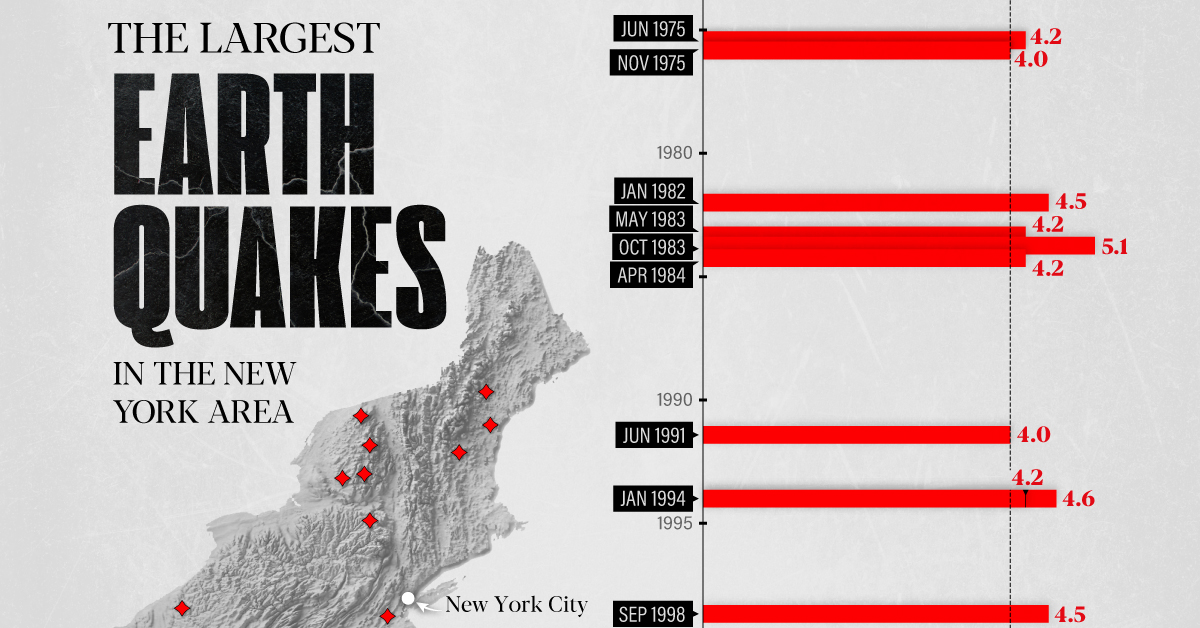

The 4.8 magnitude earthquake that shook buildings across New York on Friday, April 5th, 2024 was the third-largest quake in the U.S. Northeast area over the past 50 years.

In this map, we illustrate earthquakes with a magnitude of 4.0 or greater recorded in the Northeastern U.S. since 1970, according to the United States Geological Survey (USGS).

Shallow Quakes and Older Buildings

The earthquake that struck the U.S. Northeast in April 2024 was felt by millions of people from Washington, D.C., to north of Boston. It even caused a full ground stop at Newark Airport.

The quake, occurring just 5 km beneath the Earth’s surface, was considered shallow, which is what contributed to more intense shaking at the surface.

According to the USGS, rocks in the eastern U.S. are significantly older, denser, and harder than those on the western side, compressed by time. This makes them more efficient conduits for seismic energy. Additionally, buildings in the Northeast tend to be older and may not adhere to the latest earthquake codes.

Despite disrupting work and school life, the earthquake was considered minor, according to the Michigan Technological University magnitude scale:

| Magnitude | Earthquake Effects | Estimated Number Each Year |

|---|---|---|

| 2.5 or less | Usually not felt, but can be recorded by seismograph. | Millions |

| 2.5 to 5.4 | Often felt, but only causes minor damage. | 500,000 |

| 5.5 to 6.0 | Slight damage to buildings and other structures. | 350 |

| 6.1 to 6.9 | May cause a lot of damage in very populated areas. | 100 |

| 7.0 to 7.9 | Major earthquake. Serious damage. | 10-15 |

| 8.0 or greater | Great earthquake. Can totally destroy communities near the epicenter. | One every year or two |

The largest earthquake felt in the area over the past 50 years was a 5.3 magnitude quake that occurred in Au Sable Forks, New York, in 2002. It damaged houses and cracked roads in a remote corner of the Adirondack Mountains, but caused no injuries.

| Date | Magnitude | Location | State |

|---|---|---|---|

| April 20, 2002 | 5.3 | Au Sable Forks | New York |

| October 7, 1983 | 5.1 | Newcomb | New York |

| April 5, 2024 | 4.8 | Whitehouse Station | New Jersey |

| October 16, 2012 | 4.7 | Hollis Center | Maine |

| January 16, 1994 | 4.6 | Sinking Spring | Pennsylvania |

| January 19, 1982 | 4.5 | Sanbornton | New Hampshire |

| September 25, 1998 | 4.5 | Adamsville | Pennsylvania |

| June 9, 1975 | 4.2 | Altona | New York |

| May 29, 1983 | 4.2 | Peru | Maine |

| April 23, 1984 | 4.2 | Conestoga | Pennsylvania |

| January 16, 1994 | 4.2 | Sinking Spring | Pennsylvania |

| November 3, 1975 | 4 | Long Lake | New York |

| June 17, 1991 | 4 | Worcester | New York |

The largest earthquake in U.S. history, however, was the 1964 Good Friday quake in Alaska, measuring 9.2 magnitude and killing 131 people.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Money2 weeks ago

Money2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries