Why the Demand for Carbon Credits Is Bright

The following content is sponsored by the Carbon Streaming Corporation

Why the Demand Outlook for Carbon Credits Is Bright

More than ever, carbon credits are playing a critical role in tackling climate change.

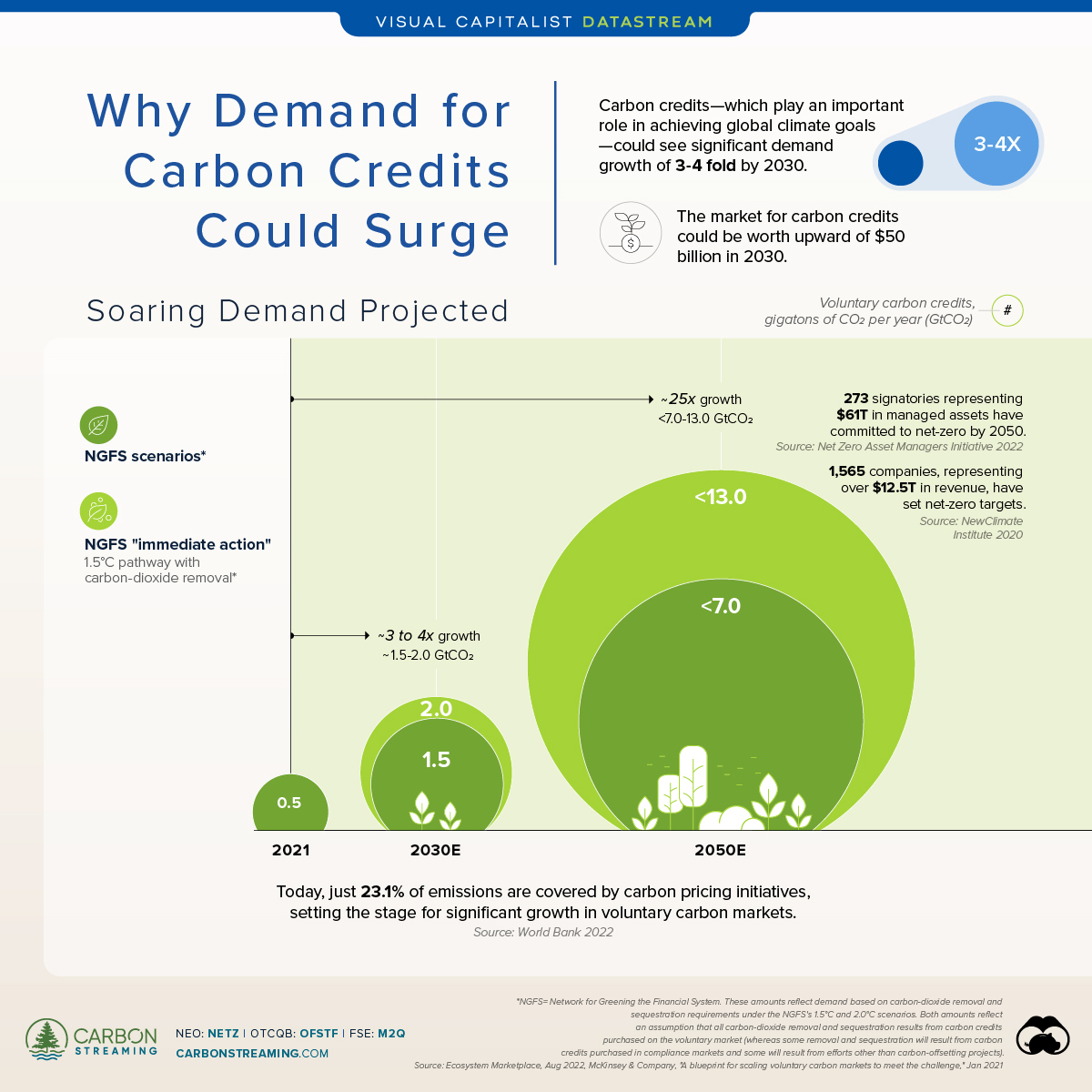

Based on demand projections for carbon credits, the voluntary carbon market could grow up to 25-fold by 2050. Voluntary carbon markets are where carbon credits can be purchased by those that voluntarily want to offset their emissions.

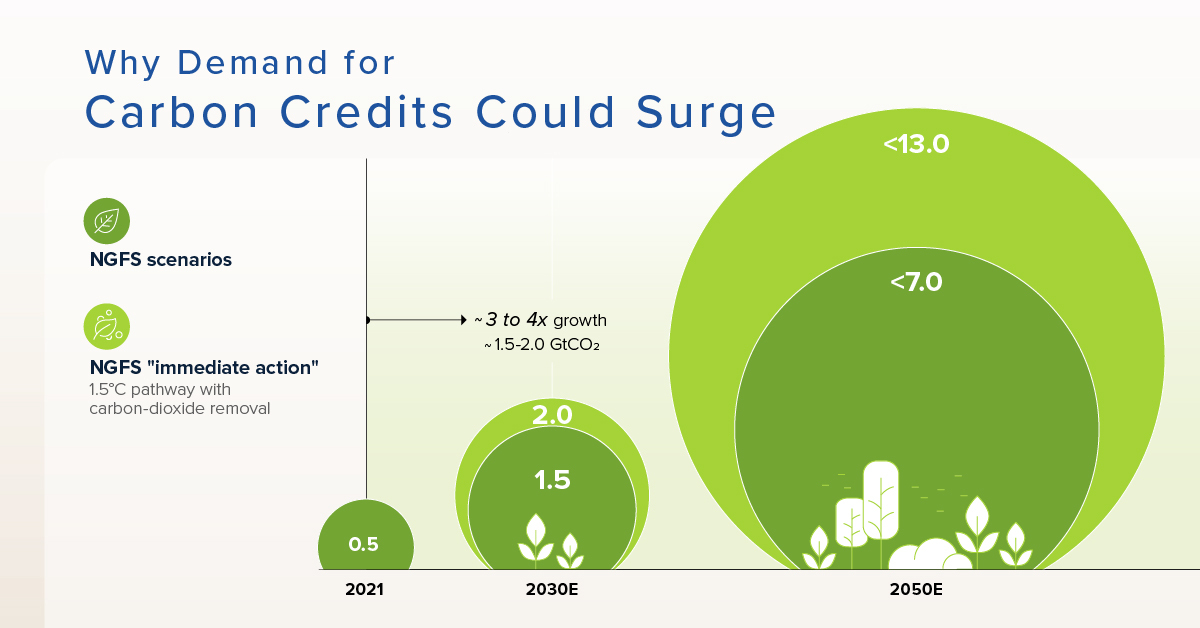

In this graphic sponsored by Carbon Streaming Corporation, we show two demand scenarios in voluntary carbon markets:

| NGFS scenarios (GtCO₂) | NGFS “immediate action” 1.5°C pathway scenario (GtCO₂)* |

|

|---|---|---|

| 2021 (actual) | 0.5 | 0.5 |

| 2030E | 1.5 | 2.0 |

| 2050E | <7 | <13 |

*With carbon dioxide removal

Source: Ecosystem Marketplace, McKinsey, NGFS = Network for Greening the Financial System

First, one gigaton is equal to one billion metric tons of CO₂— or one trillion kilograms.

According to the forecast from McKinsey, annual global demand for carbon credits could reach up to 1.5 to 2 billion metric tons of carbon dioxide by 2030 and up to 7 to 13 billion metric tons by midcentury.

This has steep implications for the voluntary carbon market: McKinsey estimates that in 2020 just a fraction of these totals were retired by buyers, at roughly 95 million metric tons.

How Do Carbon Credits Work?

A carbon credit represents one metric ton of greenhouse gas (GHG) emissions.

As companies contend with time and technological gaps in reducing their emissions, they purchase carbon credits to help offset their emissions. These purchases are facilitated by brokers who connect corporate buyers with project developers.

Project developers create carbon offset projects, such as protecting mangroves or reforestation. These projects, in turn, generate carbon credits.

Some projects also advance multiple United Nations Sustainable Development Goals by providing additional economic, social, educational, or biodiversity benefits.

Here is the transaction volume and value of the voluntary carbon markets.

| Year | Volume (MtCO₂e) | Value (USD) |

|---|---|---|

| 2021 | 493 | $1,985M |

| 2020 | 203 | $520M |

| 2019 | 104 | $320M |

Source: Ecosystem Marketplace

In 2021, the value of the voluntary markets reached almost $2 billion— a record high. Driving this demand are corporate net-zero commitments, among other factors.

For instance, 1,565 companies with $12.5 trillion in revenue have set net-zero targets. Not only that, the 273 signatories of the Net-Zero Asset Managers Initiative, that represent $61 trillion in managed assets, are committed to supporting the goal of net-zero GHG emissions by 2050 or sooner.

As bold action is being increasingly expected from shareholders, carbon credits will likely play a greater role in corporate climate strategy.

Where does this data come from?

Source: Ecosystem Marketplace (August 2022), McKinsey, ‘A blueprint for scaling voluntary carbon markets to meet the challenge,’ (January 2021).

-

Datastream10 months ago

Datastream10 months agoCan You Calculate Your Daily Carbon Footprint?

Discover how the average person’s carbon footprint impacts the environment and learn how carbon credits can offset your carbon footprint.

-

Datastream11 months ago

Datastream11 months agoThe 10 Longest Range EVs for 2023

This infographic lists 10 of the longest range EVs currently for sale in the U.S. in 2023. The Lucid Air takes first place at 516 miles.

-

Economy11 months ago

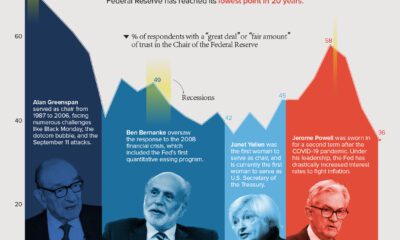

Economy11 months agoCharted: Public Trust in the Federal Reserve

Public trust in the Federal Reserve chair has hit its lowest point in 20 years. Get the details in this infographic.

-

Datastream12 months ago

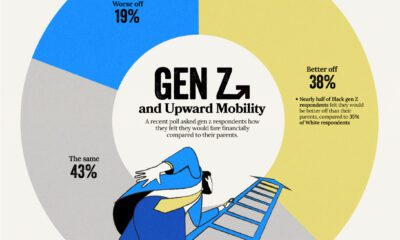

Datastream12 months agoHow Gen Z Feels About Its Financial Future

Despite the looming uncertainty, members of Gen Z maintains an optimistic outlook about their financial future

-

Datastream1 year ago

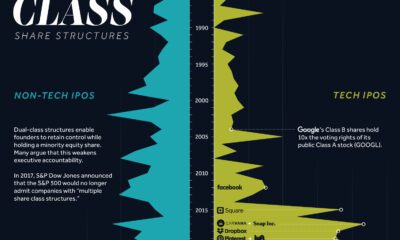

Datastream1 year agoMore U.S. Tech Companies are Adopting Unequal Dual-Class Voting Structures

Dual-class share structures are rising in popularity, and they give executives much more voting power within a public company.

-

Datastream1 year ago

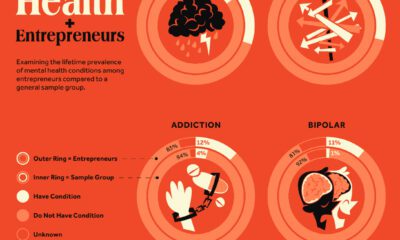

Datastream1 year agoThe Link Between Entrepreneurship and Mental Health Conditions

Research explores the link between entrepreneurship and mental health conditions such as ADHD and bipolar disorder