Misc

Why the Cayman Islands Are Better For Business

Why the Cayman Islands Are Better For Business

Presented by Cayman Enterprise City

On February 8, 1794, the people of the Cayman Islands rescued the crews of a group of ten merchant ships. The ships had struck a reef and run aground during rough seas.

Legend has it that King George III of the United Kingdom rewarded the Caymanians with a promise never to introduce taxes as compensation for their generosity, as one of the ships carried a member of the King’s own family.

Whether this legend is true or not, the Cayman Islands have a rich history of relying on indirect taxes, making it one of the best places to do business in the world.

5 Reasons It’s Worth Relocating a Company to the Caymans

1. Life is Grand

The Cayman Islands are an English-speaking Overseas British Territory with year-round warmth and state-of-the-art infrastructure and attractions.

Grand Cayman, the largest of the three islands, has an area of about 200 km².

Its most striking features include: the shallow, reef-protected lagoon called the North Sound, as well as the famous Seven Mile Beach along the west of the island.

- GDP per capita: 14th in the world – The highest standard of living in the Caribbean.

- Ranked ‘The friendliest place on earth to live and work’ in a recent HSBC expat global survey.

- Ranked: “The Caribbean’s Best Beach” – Seven Mile Beach by Caribbean Travel & Life

2. The Ideal Business Jurisdiction

Located in the Eastern Standard Timezone and 3.5 hrs from Toronto and 3 hrs from New York City, Cayman is the ideal business jurisdiction. The island also has direct flights to London, the gateway to Europe.

The Cayman Islands have the some of the highest anti-money laundering compliance requirements and offers a pro-business regulatory environment.

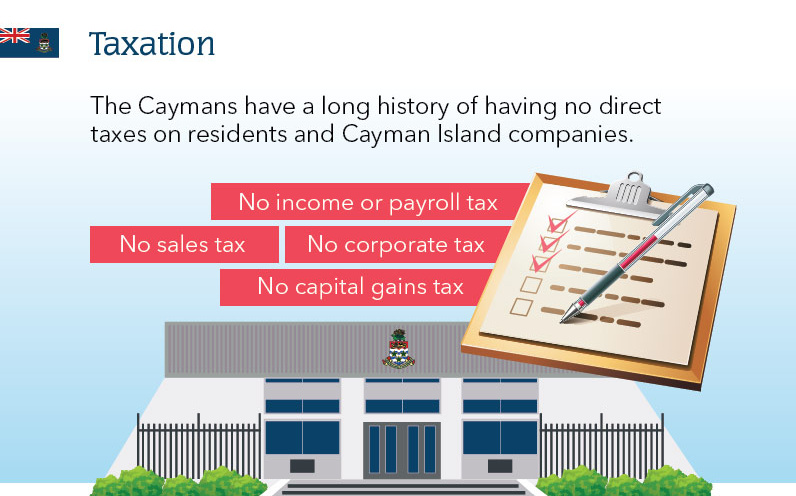

3. Taxation

The Caymans have a long history of having no direct taxes on residents and Cayman Island companies.

- No corporate tax

- No capital gains tax

- No sales tax

- No income or payroll tax

This has partly allowed the Caymans to become the sixth largest global financial centre and the #1 home to hedge funds in the world.

4. A Gateway to World-Class Companies and Services

The Cayman Islands is home to many global institutions including banking, accounting, and law firms.

Companies in the Cayman:

- 40 of 50 of the world’s top banks have branches

- The Big 4 accounting institutions

- Global law offices such as Maples & Calder

It has a world-class infrastructure, excellent schools, colleges and medical facilities, plus every conceivable form of entertainment, sporting, dining and leisure facility.

5. Special Economic Zones

The Cayman Islands have recently introduced “Special Economic Zones” that specifically cater to exempted companies, creating an alternative licensing regime, as well as a number of additional incentives for entities wishing to establish a physical presence in the Islands.

- 100% exempt from corporate, capital gains, sales, income tax and import duties

- 100% foreign ownership permitted

- Five year renewable work/residence visas granted within 5 days

- 3-4 week fast-track set-up of operations

- Intellectual Property owned offshore

- No government reporting requirements

- Strategic base with easy access to lucrative North and Latin American markets

One More Reason: Cayman Enterprise City

Cayman Enterprise City (“CEC”) is an award-winning Special Economic Zone located in the tax-neutral Cayman Islands, created for knowledge-based industries and has developed into an innovative, entrepreneurial technology hub benefiting from a tax-exempt environment.

CEC has stripped away the red-tape and financial constraints normally associated with setting up an offshore Cayman company with a physical presence. CEC enables international companies to easily and cost-effectively set up offices with staff on the ground and have a genuine offshore physical presence and generate active business income in the Cayman Islands.

Misc

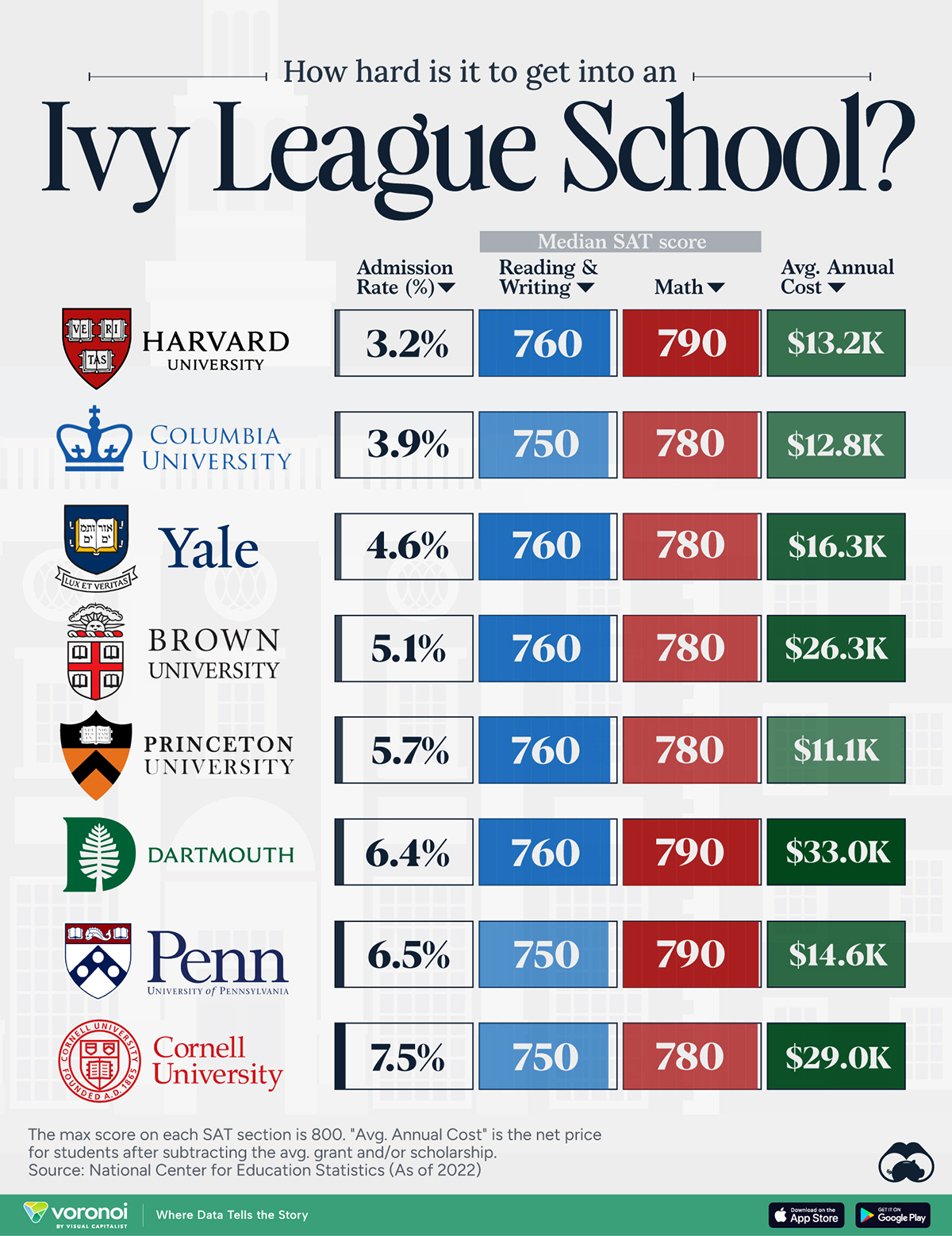

How Hard Is It to Get Into an Ivy League School?

We detail the admission rates and average annual cost for Ivy League schools, as well as the median SAT scores required to be accepted.

How Hard Is It to Get Into an Ivy League School?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Ivy League institutions are renowned worldwide for their academic excellence and long-standing traditions. But how hard is it to get into one of the top universities in the U.S.?

In this graphic, we detail the admission rates and average annual cost for Ivy League schools, as well as the median SAT scores required to be accepted. The data comes from the National Center for Education Statistics and was compiled by 24/7 Wall St.

Note that “average annual cost” represents the net price a student pays after subtracting the average value of grants and/or scholarships received.

Harvard is the Most Selective

The SAT is a standardized test commonly used for college admissions in the United States. It’s taken by high school juniors and seniors to assess their readiness for college-level academic work.

When comparing SAT scores, Harvard and Dartmouth are among the most challenging universities to gain admission to. The median SAT scores for their students are 760 for reading and writing and 790 for math. Still, Harvard has half the admission rate (3.2%) compared to Dartmouth (6.4%).

| School | Admission rate (%) | SAT Score: Reading & Writing | SAT Score: Math | Avg Annual Cost* |

|---|---|---|---|---|

| Harvard University | 3.2 | 760 | 790 | $13,259 |

| Columbia University | 3.9 | 750 | 780 | $12,836 |

| Yale University | 4.6 | 760 | 780 | $16,341 |

| Brown University | 5.1 | 760 | 780 | $26,308 |

| Princeton University | 5.7 | 760 | 780 | $11,080 |

| Dartmouth College | 6.4 | 760 | 790 | $33,023 |

| University of Pennsylvania | 6.5 | 750 | 790 | $14,851 |

| Cornell University | 7.5 | 750 | 780 | $29,011 |

*Costs after receiving federal financial aid.

Additionally, Dartmouth has the highest average annual cost at $33,000. Princeton has the lowest at $11,100.

While student debt has surged in the United States in recent years, hitting $1.73 trillion in 2023, the worth of obtaining a degree from any of the schools listed surpasses mere academics. This is evidenced by the substantial incomes earned by former students.

Harvard grads, for example, have the highest average starting salary in the country, at $91,700.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business1 week ago

Business1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?