Misc

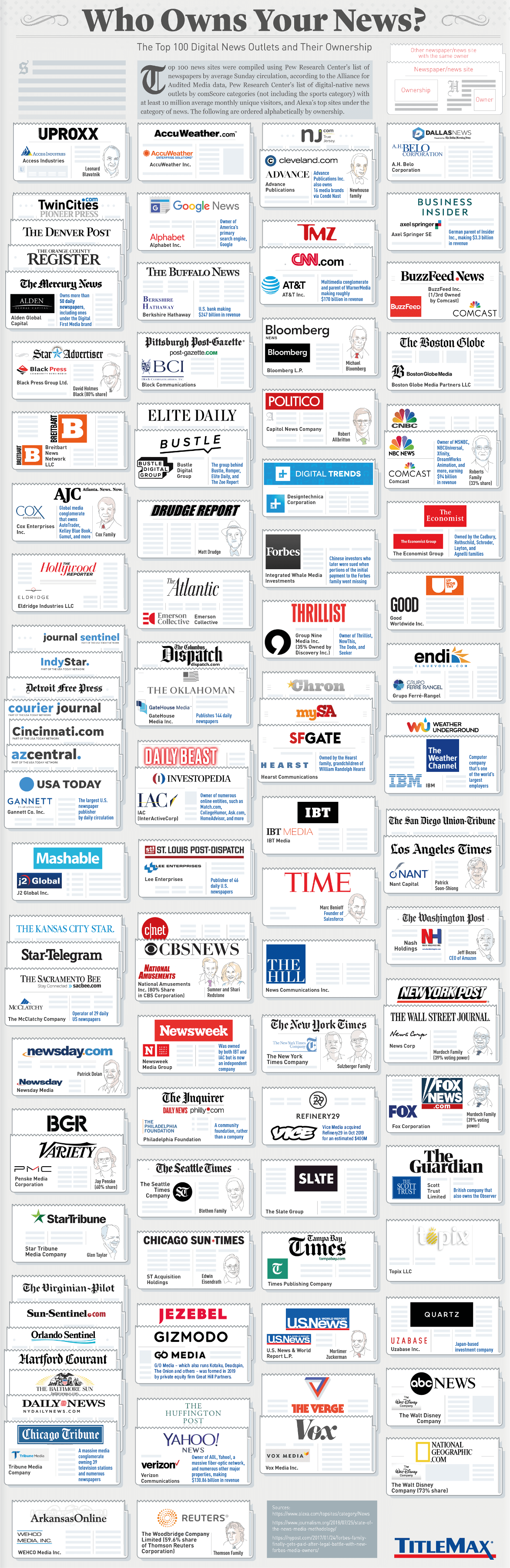

Who Owns Your Favorite News Media Outlet?

Who Owns Your Favorite News Media Outlet?

It’s no secret that news media is a tough industry.

For various reasons — from tech disruption to changing media consumption habits — the U.S. has seen a net loss of 1,800 local newspapers over the past 15 years. As regional newspapers are bundled together, and venture-backed digital media brands expand their portfolios, the end result is a trend towards increased consolidation.

Today’s graphic, created by TitleMax, is a broad look at who owns U.S. news media outlets.

Escaping the News Desert

As outlets battle the duopoly of Google and Facebook for advertising revenue, the local news game has become increasingly difficult.

As a result, news deserts have been springing up all over America:

What happens when times get tough?

One option is to simply go out of business, while another traditional solution is to combine forces through consolidation. While not ideal, the latter option at least provides a potential route to revenue and cost synergies that make it easier to compete in a challenging environment.

Nation of Consolidation

Though the numbers have decreased in recent years, regional news media still reaches millions of people each day.

Below is a look at the top 20 owners of America’s newspapers:

| Parent Companies | Total Papers | Example brands |

|---|---|---|

| New Media Investment Group | 451 | Patriot Ledger, The Columbus Dispatch, The Providence Journal |

| Gannett | 216 | USA Today, Detroit Free Press, Arizona Republic |

| Digital First Media | 158 | Oakland Tribune, San Jose Mercury News, Denver Post |

| Adams Publishing Group | 144 | The Charlotte Sun, Wyoming Tribune-Eagle |

| CNHI | 114 | Niagara Gazette, The Huntsville Item, The Lebanon Reporter |

| Lee Enterprises | 100 | Arizona Daily Sun, St. Louis Post Dispatch |

| Ogden Newspapers | 81 | The Maui News, The Toledo Chronicle, Salem News |

| Tribune Publishing | 77 | Chicago Tribune, Los Angeles Times, The Baltimore Sun |

| Berkshire Hathaway Media | 75 | Buffalo News, Winston-Salem Journal, Omaha World-Herald |

| Shaw Media | 71 | Suburban Life Magazine, Putnam County Record |

| Boone Newspapers | 66 | The Austin Daily Herald, The Charlotte Gazette |

| Hearst Corp. | 66 | San Francisco Chronicle, Seattlepi.com, Houston Chronicle |

| Paxton Media Group | 58 | Daily Corinthian, Connersville News-Examiner |

| Landmark Media Enterprises | 55 | Citrus County Chronicle, The News-Enterprise |

| Community Media Group | 51 | Lafayette Leader, The Wellsboro Gazette |

| AIM Media | 50 | Odessa American, El Nuevo Heraldo |

| McClatchy | 49 | Idaho Statesman, Miami Herald, The Sacramento Bee |

| Advance Publications | 46 | The New Yorker, Vanity Fair, Wired, The Oregonian, NJ.com |

| Rust Communications | 44 | Cherokee Chronicle Times, Southeast Missourian |

| News Media Corp. | 43 | Cheyenne Minuteman, Brookings Register, Newport News Times |

Turnover in this segment of the market has been brisk. In fact, more than half of existing newspapers have changed ownership in the past 15 years, some multiple times. For example, the LA Times is now in the hands of its third owner since 2000, after being purchased by billionaire biotech investor Patrick Soon-Shiong.

The industry may be facing another dramatic drop off in ownership diversity as the two largest players, New Media Investment Group and Gannett, are on the path to merging. If shareholders give the thumbs-up during the vote this November, Gannett will have amassed the largest online audience of any American news provider.

The Flying Vs: Vox and Vice

It isn’t just regional papers being swept up in the latest round of mergers and acquisitions — new media is getting into the mix as well.

Vox Media recently inked a deal to acquire New York Media, the firm behind New York Magazine, Vulture, and The Cut.

I think you’re going to see that trend [of consolidation] across the industry. I just hope it’s done for the right reasons. You see too many of these things done for financial engineering.

– Jim Bankoff, CEO of Vox Media

Meanwhile, Vice recently acquired Refinery29 for $400 million, giving it access to a new audience skewed towards millennial women. This match-up seems awkward on the surface, but it allows advertisers to reach a broader cross-section of people within each ad ecosystem.

Both companies announced layoffs in the past year, and this restructuring may help both companies win as they consolidate resources.

The Bottom Line

While news media isn’t quite as consolidated as the broader media ecosystem, it’s certainly trending in that direction. Thousands of American communities that had local newspapers in 2004 now have no news coverage at all, while remaining papers are increasingly becoming units within an umbrella company, with no direct stake in community reporting.

That said, until the issue of monetization is definitively sorted out, consolidation may be the only way to keep the presses from stopping.

About the Graphic

This list of top 100 news sites was compiled using the following criteria:

– The top “digital-native” news outlets by monthly unique visitors (Pew Research and ComScore, excluding sports)

– The top newspapers by average Sunday circulation (Pew Research and Alliance for Audited Media)

– Alexa’s top sites under the category of news (U.S. only, excluding user-generated)

Note: The graphic has been updated to reflect changes in ownership for Refinery29, Gizmodo, and Jezebel.

VC+

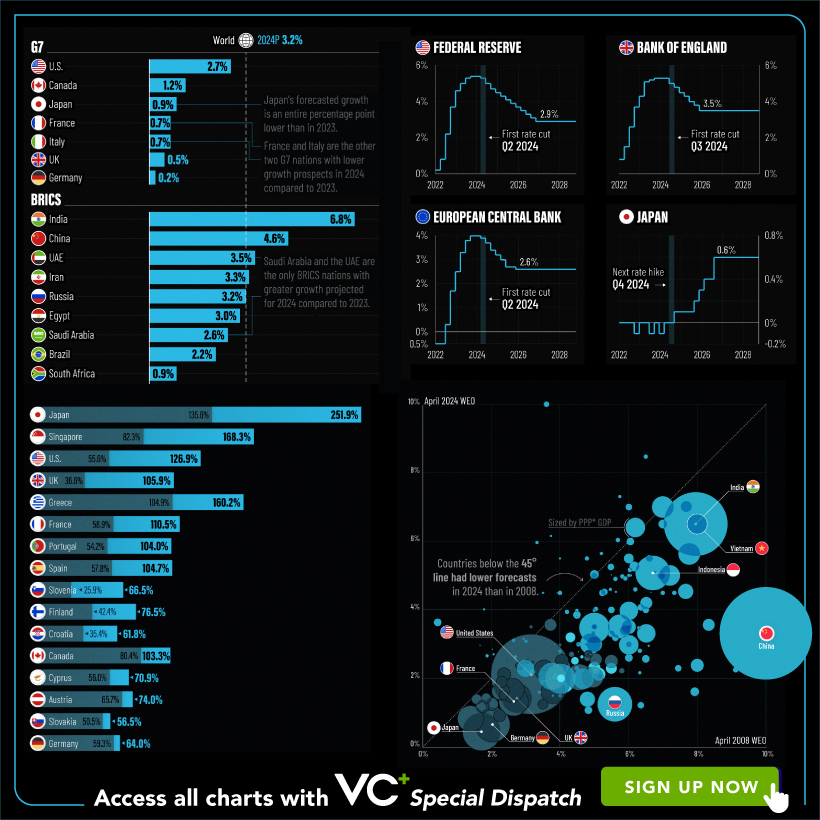

VC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

A sneak preview of the exclusive VC+ Special Dispatch—your shortcut to understanding IMF’s World Economic Outlook report.

Have you read IMF’s latest World Economic Outlook yet? At a daunting 202 pages, we don’t blame you if it’s still on your to-do list.

But don’t worry, you don’t need to read the whole April release, because we’ve already done the hard work for you.

To save you time and effort, the Visual Capitalist team has compiled a visual analysis of everything you need to know from the report—and our upcoming VC+ Special Dispatch will be available exclusively to VC+ members on Thursday, April 25th.

If you’re not already subscribed to VC+, make sure you sign up now to receive the full analysis of the IMF report, and more (we release similar deep dives every week).

For now, here’s what VC+ members can expect to receive.

Your Shortcut to Understanding IMF’s World Economic Outlook

With long and short-term growth prospects declining for many countries around the world, this Special Dispatch offers a visual analysis of the key figures and takeaways from the IMF’s report including:

- The global decline in economic growth forecasts

- Real GDP growth and inflation forecasts for major nations in 2024

- When interest rate cuts will happen and interest rate forecasts

- How debt-to-GDP ratios have changed since 2000

- And much more!

Get the Full Breakdown in the Next VC+ Special Dispatch

VC+ members will receive the full Special Dispatch on Thursday, April 25th.

Make sure you join VC+ now to receive exclusive charts and the full analysis of key takeaways from IMF’s World Economic Outlook.

Don’t miss out. Become a VC+ member today.

What You Get When You Become a VC+ Member

VC+ is Visual Capitalist’s premium subscription. As a member, you’ll get the following:

- Special Dispatches: Deep dive visual briefings on crucial reports and global trends

- Markets This Month: A snappy summary of the state of the markets and what to look out for

- The Trendline: Weekly curation of the best visualizations from across the globe

- Global Forecast Series: Our flagship annual report that covers everything you need to know related to the economy, markets, geopolitics, and the latest tech trends

- VC+ Archive: Hundreds of previously released VC+ briefings and reports that you’ve been missing out on, all in one dedicated hub

You can get all of the above, and more, by joining VC+ today.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Money2 weeks ago

Money2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries