Technology

Which Companies Belong to the Elite Trillion-Dollar Club?

Which Companies Belong to the Elite Trillion-Dollar Club?

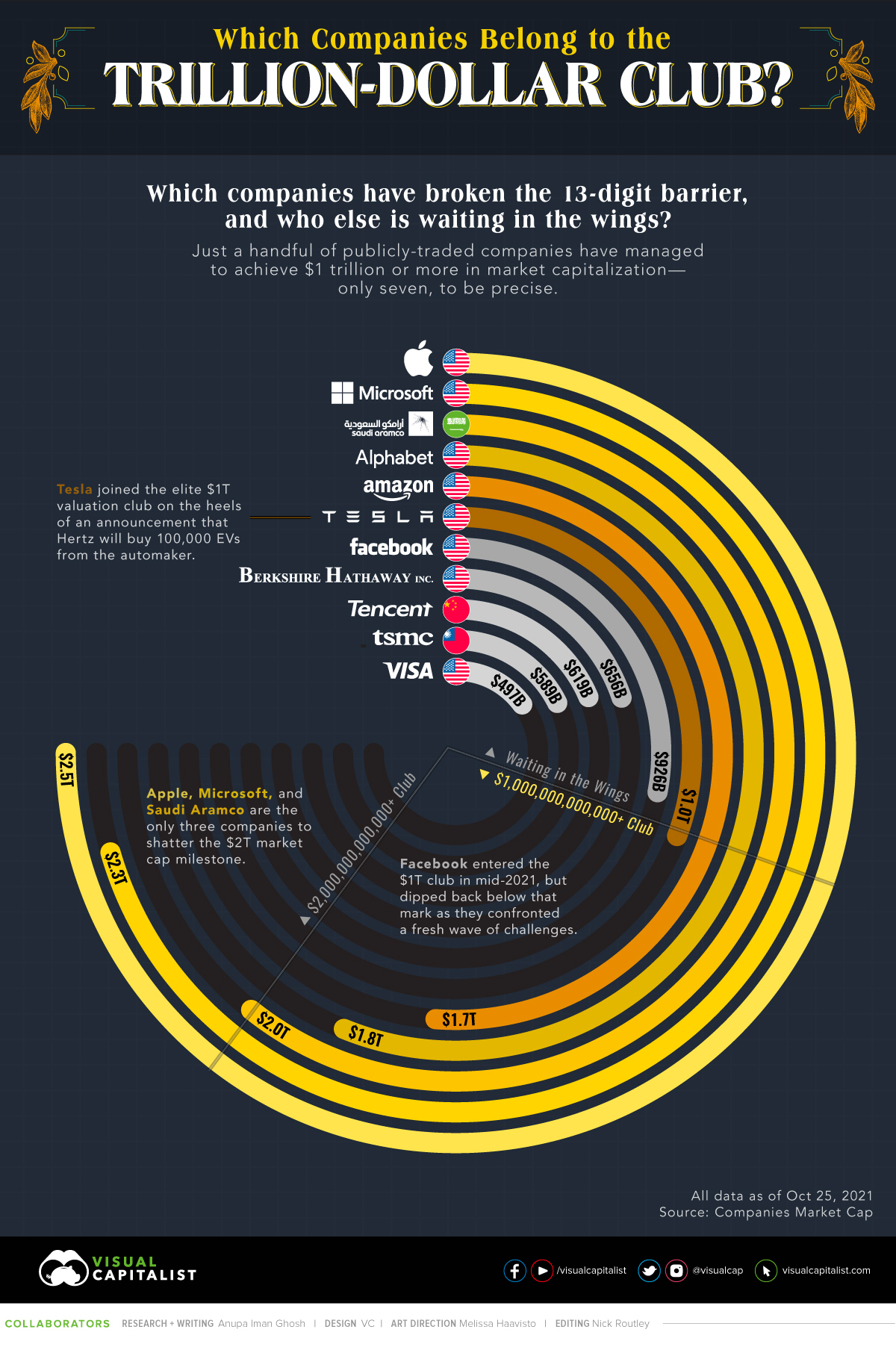

Just a handful of publicly-traded companies have managed to achieve $1 trillion or more in market capitalization—only seven, to be precise.

We pull data from Companies Market Cap to find out which familiar names are breaking the 13-digit barrier—and who else is waiting in the wings.

The Major Players in the Game

Apple, Microsoft, and Saudi Aramco are the three companies to have shattered the $2T market cap milestone to date, leaving others in the dust. Apple was also the first among its Big Tech peers to ascend to the $1 trillion landmark back in 2018.

| Company | Valuation | Country | Age of company |

|---|---|---|---|

| Apple | $2.46T | 🇺🇸 U.S. | 45 years (Founded 1976) |

| Microsoft | $2.31T | 🇺🇸 U.S. | 46 years (Founded 1975) |

| Saudi Aramco | $2.00T | 🇸🇦 Saudi Arabia | 88 years (Founded 1933) |

| Alphabet (Google) | $1.84T | 🇺🇸 U.S. | 23 years (Founded 1998) |

| Amazon | $1.68T | 🇺🇸 U.S. | 27 years (Founded 1994) |

| Tesla | $1.01T | 🇺🇸 U.S. | 18 years (Founded 2003) |

Footnote: Data is current as of October 25, 2021. Facebook is the 7th company historically to reach $1 trillion, but dipped out recently.

The largest oil and gas giant—Saudi Aramco is the only non-American company to make the trillion-dollar club. This makes it a notable outlier, as American companies typically dominate the leaderboard of the biggest corporations around the world.

Tesla Reaches $1 Trillion

Tesla reached the $1 trillion market cap for the first time due to a strong trading day on Monday October 25th. Their shares popped some 10%, off the announcement of some positive news from Hertz and Morgan Stanley.

First, Hertz, a car rental company, revealed an order for 100,000 Tesla vehicles — the largest order in the automaker’s history. Second, an auto analyst at Morgan Stanley made revisions and raised his price target on Tesla to $1,200.

Whether Tesla can stay a trillion dollar company will likely be a much discussed topic after today, as their valuation has always been a controversial one. Bearish investors frequently point to Tesla’s lack of fundamentals relative to traditional car companies. For instance, their market cap relative to cars sold:

| Company | Market Cap ($B) | Cars Sold (2020) | Value Per Car Sold | If Valued Like Tesla |

|---|---|---|---|---|

| Tesla | $1,000 | 500,000 | $2 million | $1.0 Trillion |

| Volkswagen | $148 | 9.3 million | $15,000 | $18.6 trillion |

| Toyota | $242 | 9.5 million | $25,000 | $19.0 trillion |

| Ford | $62 | 4.2 million | $14,000 | $8.4 trillion |

Based on the 500,000 cars Tesla sold in 2020, their $1 trillion market cap values them at $2 million per car sold. As an extreme example, if Volkswagen and Toyota were to be valued in a similar fashion, their market caps would be close to $19 trillion each. Larger than all of the elite trillion-dollar club combined.

Who Else Might Join the Trillion-Dollar Club?

Companies with a market capitalization above $500 billion are also few and far between. After Facebook, which until recently was part of the elite trillion-dollar club, Warren Buffet’s Berkshire Hathaway is the closest to joining the Four Comma Club. Though there’s still some ways to go, their market cap of $656 billion means shares would need to appreciate some 52%.

| Company | Valuation | Country | Age of company |

|---|---|---|---|

| $926B | 🇺🇸 U.S. | 17 years (Founded 2004) | |

| Berkshire Hathaway | $656B | 🇺🇸 U.S. | 182 years (Founded 1839) |

| TSMC | $619B | 🇹🇼 Taiwan | 34 years (Founded 1987) |

| Tencent | $589B | 🇨🇳 China | 23 years (Founded 1998) |

| Visa | $497B | 🇺🇸 U.S. | 63 years (Founded 1958) |

Visa, one of the pioneers of consumer credit in the United States, continues to innovate even 63 years after its founding. In attempts to expand the reach of its already massive payments ecosystem, Visa is experimenting with acquisitions, and even dipping its toes into cryptocurrency with some success.

Whether the next company to join the trillion-dollar club comes from the U.S., from the tech industry, or out of left field, it’s clear that it has some pretty big shoes to fill.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Travel1 week ago

Travel1 week agoRanked: The World’s Top Flight Routes, by Revenue

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024