Visual Capitalist

What’s Coming Up in the Next Month on VC+?

If you’re a regular visitor to Visual Capitalist, you know that we’re your home base for data-driven, beautiful visuals that help explain a complex world.

But did you know there’s a way to get an even more out of Visual Capitalist, all while helping support the work we do?

Coming Soon on VC+

VC+ is our newly launched members program that gives you exclusive access to extra visual content and insightful special features. It also gets you access to The Trendline, our new members-only graphic newsletter.

So, what is getting sent to VC+ members in the coming days?

“The Rise and Fall of Civilizations”

SPECIAL DISPATCH: Our 9 best visualizations on topics related to world history

Over the course of human history, many civilizations have come to power.

Regardless of whether we are examining the dominance of Genghis Khan and the Mongols, or we’re looking at the more modern rise of superpowers like the United States and China, there is always a compelling visual story to tell.

This upcoming VC+ feature summarizes some of our favorite maps, visualizations, animations, and visual timelines that tell the great stories of human history.

Publishing date: Dec 20 (Get VC+ to access)

“The Most Popular Trendline Stories of 2019”

SPECIAL DISPATCH: What stories did VC+ members love the most?

Since the launch of VC+, we have published 9 editions of The Trendline, our premium graphic newsletter – highlighting 100+ visualizations and data-driven reports chosen by our editors.

If you’ve missed out on this, then this is a great opportunity.

At the end of the year, we’ll be doing a roundup of the most popular Trendline stories over recent months, giving you one-stop access to the cream of the crop.

Publishing date: Dec 27 (Get VC+ to access)

“Prediction Consensus”

SPECIAL DISPATCH: Behind the scenes with our Managing Editor

At the end of every year, we get inundated with bold predictions made by media outlets.

To start the New Year, we’ll sum up all the predictions we can find for 2020 in one data-driven graphic on Visual Capitalist. We’ll see where pundits agree, and where they don’t.

Meanwhile, VC+ members will get to see behind the scenes on our process. How did we tackle such a project, and why did we make the decisions we made?

Publishing date: Jan 2, 2020 (Get VC+ to access)

The Trendline

PREMIUM NEWSLETTER: Our weekly members-only newsletter for VC+ members

Every week, VC+ members also get our premium graphic newsletter, The Trendline.

With The Trendline, we’ll send you the best visual content, datasets, and insightful reports relating to business that our editors find each week.

Publishing Date: Every Sunday

More Visuals. More Insight. More Understanding.

Get access to these upcoming features by becoming a VC+ member.

For a limited time, get 25% off, which makes your VC+ membership the same price as a coffee each month:

PS – We look forward to sending you even more great visuals and data!

VC+

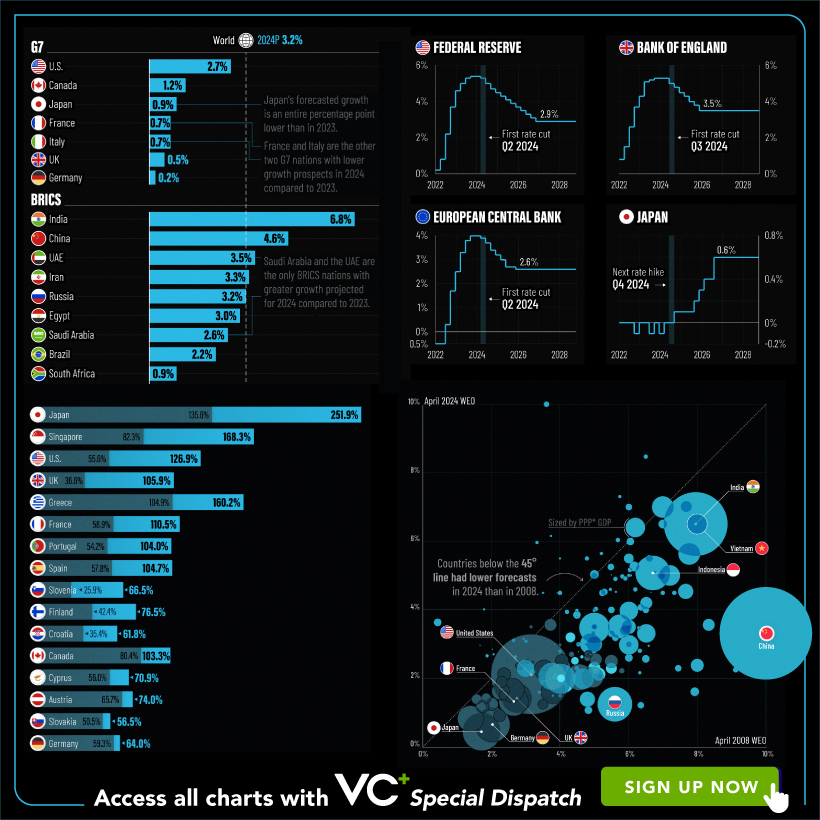

VC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

A sneak preview of the exclusive VC+ Special Dispatch—your shortcut to understanding IMF’s World Economic Outlook report.

Have you read IMF’s latest World Economic Outlook yet? At a daunting 202 pages, we don’t blame you if it’s still on your to-do list.

But don’t worry, you don’t need to read the whole April release, because we’ve already done the hard work for you.

To save you time and effort, the Visual Capitalist team has compiled a visual analysis of everything you need to know from the report—and our VC+ Special Dispatch is available exclusively to VC+ members. All you need to do is log into the VC+ Archive.

If you’re not already subscribed to VC+, make sure you sign up now to access the full analysis of the IMF report, and more (we release similar deep dives every week).

For now, here’s what VC+ members get to see.

Your Shortcut to Understanding IMF’s World Economic Outlook

With long and short-term growth prospects declining for many countries around the world, this Special Dispatch offers a visual analysis of the key figures and takeaways from the IMF’s report including:

- The global decline in economic growth forecasts

- Real GDP growth and inflation forecasts for major nations in 2024

- When interest rate cuts will happen and interest rate forecasts

- How debt-to-GDP ratios have changed since 2000

- And much more!

Get the Full Breakdown in the Next VC+ Special Dispatch

VC+ members can access the full Special Dispatch by logging into the VC+ Archive, where you can also check out previous releases.

Make sure you join VC+ now to see exclusive charts and the full analysis of key takeaways from IMF’s World Economic Outlook.

Don’t miss out. Become a VC+ member today.

What You Get When You Become a VC+ Member

VC+ is Visual Capitalist’s premium subscription. As a member, you’ll get the following:

- Special Dispatches: Deep dive visual briefings on crucial reports and global trends

- Markets This Month: A snappy summary of the state of the markets and what to look out for

- The Trendline: Weekly curation of the best visualizations from across the globe

- Global Forecast Series: Our flagship annual report that covers everything you need to know related to the economy, markets, geopolitics, and the latest tech trends

- VC+ Archive: Hundreds of previously released VC+ briefings and reports that you’ve been missing out on, all in one dedicated hub

You can get all of the above, and more, by joining VC+ today.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries