Visualizing the Rise of mCommerce

The following content is sponsored by Logiq

Visualizing the Rise of mCommerce

Cellphones are becoming increasingly more prevalent across the globe. In fact, as of 2021, there are more mobile connections than people on the planet.

Because of this, the mobile commerce (mCommerce) market is expanding fast. By 2025, mCommerce is expected to double its share of U.S. retail sales.

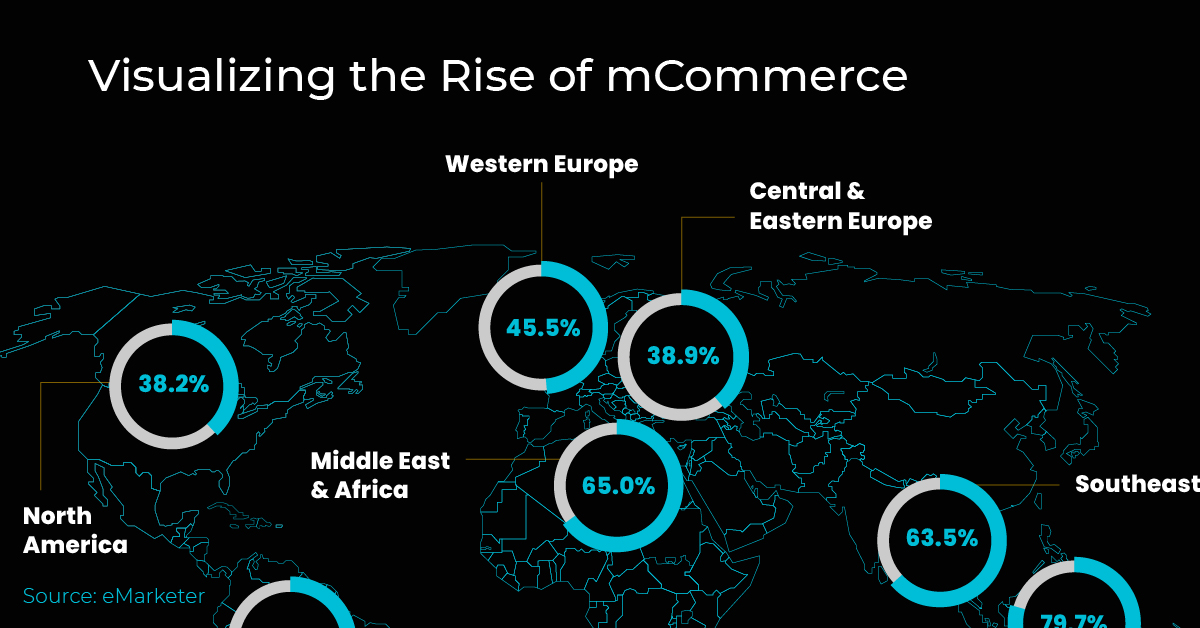

This graphic from Logiq provides a snapshot of the mCommerce landscape, and how companies can capitalize on this rapidly changing retail environment.

The Three Types of mCommerce

First things first—what exactly is mCommerce? It’s essentially any financial transaction done on a mobile device. There are three main types:

- Mobile Shopping: eCommerce that’s optimized for mobile. This includes dedicated shopping apps, websites designed for mobile use, and even social media platforms that have built-in shopping features.

- Mobile Banking: Like online banking, but usually in the form of a dedicated mobile banking app that allows for on-the-go access to your accounts.

- Mobile Payments: This includes mobile wallets, contactless payments, money transfers and mobile point-of-sale.

In other words, mCommerce is a branch of eCommerce that allows people to buy and sell goods from almost anywhere with a mobile connection.

Mapping Out the Market

mCommerce has captured a significant portion of global eCommerce sales. As of May 2021, it makes up 65% of total retail eCommerce sales worldwide.

But some regions are adopting it faster than others. In Asia-Pacific, 79.7% of the region’s total eCommerce sales are done via mobile.

| Region | % of total retail eCommerce sales |

|---|---|

| Asia-Pacific | 79.7% |

| Middle East & Africa | 65.0% |

| Southeast Asia | 63.5% |

| Latin America | 48.8% |

| Western Europe | 45.5% |

| Central & Eastern Europe | 38.9% |

| North America | 38.2% |

Why is mCommerce so widespread in Asia-Pacific? One reason could be the region’s relatively young (and tech-savvy) population—people aged 15 to 24 make up 19% of its overall population.

This, along with Asia-Pacific’s high levels of wealth and its general digital competitiveness—especially in China—could help explain why mCommerce has taken off so quickly in the region.

While each region’s mCommerce market looks slightly different, growth is expected across the globe. In the next five years, the global mCommerce market is expected to grow to $2.7 trillion, at a CAGR of roughly 34%.

The Pros and Cons

There are a number of positive impacts, along with some challenges, that arise as a result of mCommerce’s increasing prevalence.

A big positive impact is its convenience. Mobile shopping gives consumers access to on-demand shopping that they can tap into anywhere, so long as there’s a mobile connection.

It also helps create a frictionless shopping experience. For example, thanks to mobile wallets, customers don’t even have to type out their credit card details to purchase something—it’s just a click away.

That being said, its rapid growth also means that businesses need to consider ways to optimize for mobile. Like eCommerce, innovation in the mCommerce landscape is fast and ever-evolving, which means that companies need to remain agile so they don’t get left behind.

How Businesses Can Adapt

Despite these challenges, mCommerce is expected to keep growing, and businesses will need to cater to this market if they want to remain competitive.

Logiq can help companies navigate through this ever-changing landscape. It allows businesses to plan and execute multi-channel strategies, and provides data analytics to help track progress.

To learn more about Logiq’s offerings, click here.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.