Technology

Visualized: Where 5G Will Change The World

View the full-size version of this infographic.

Where 5G Will Change The World

View the high resolution version of this infographic.

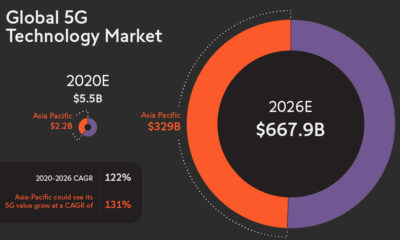

We’re on the cusp of a 5G revolution.

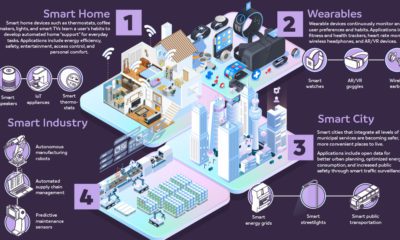

Whereas 4G brought us the network speeds necessary for online apps and mobile-streaming, 5G represents a monumental leap forward. Beyond the improvements to our existing ecosystem of devices—more speed and better stability—researchers believe that 5G can serve as the underpinning for fully-connected industries and cities.

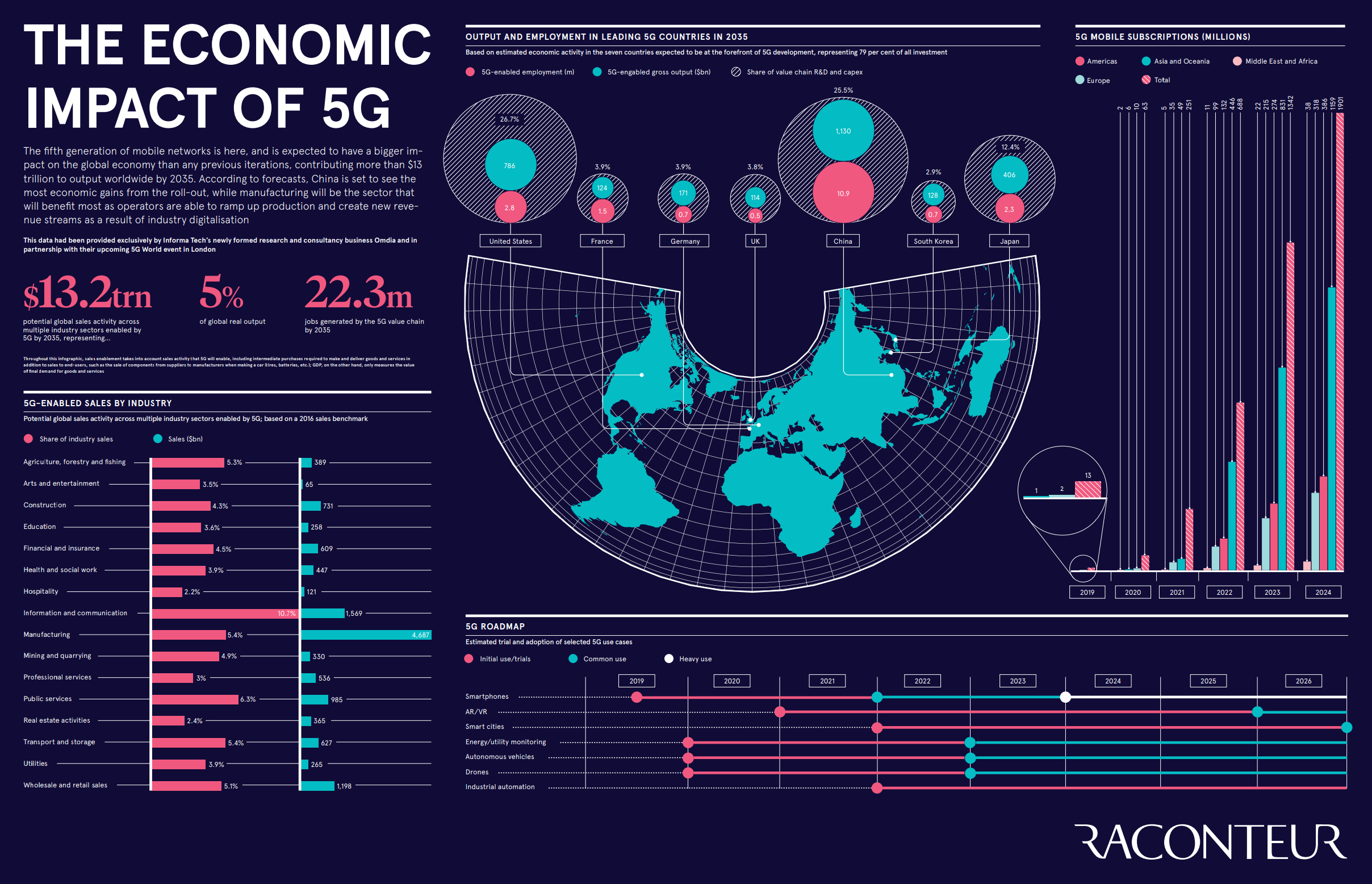

Change doesn’t happen overnight, and for us to experience 5G’s true potential, we’ll need to be patient. In light of this, today’s infographic from Raconteur visualizes the forecasted impact of 5G to help us identify the countries and industries that will most effectively leverage its power.

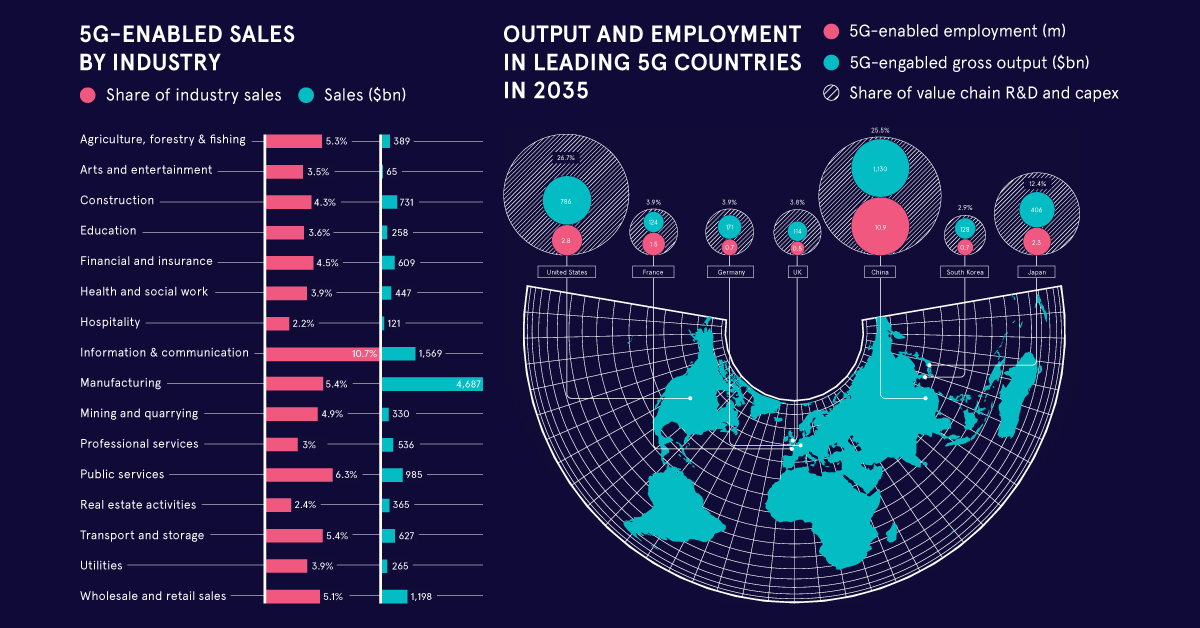

5G-Empowered Industries

5G networks are expected to generate $13.2 trillion in global sales activity by 2035. To make this easier to digest, here are the five industries which stand to benefit the most.

| Rank | Industry | Sales ($B) | Share of Industry Sales (%) |

|---|---|---|---|

| #1 | Manufacturing | $4,687 | 5.4% |

| #2 | Information and Communication | $1,569 | 10.7% |

| #3 | Wholesale and Retail Sales | $1,198 | 5.1% |

| #4 | Public Services | $985 | 6.3% |

| #5 | Construction | $731 | 4.3% |

Let’s focus on manufacturing, an industry which is expected to see a massive $4.6 trillion in 5G-enabled sales.

Efficiency is the name of the game here, and researchers predict that this technology will allow for the world’s first “smart factories”. Such factories would leverage the faster speed and reliability of 5G networks to eliminate cabled connections, improve automated processes, and most importantly, gather more data.

Combined with machine learning algorithms, this data can help companies predict when expensive equipment is about to fail, reducing the likelihood of expensive downtime.

– AT&T Business Editorial

Robots won’t be the only ones to benefit, however. While today’s factories may be lined with machines, humans are still required to be onsite for troubleshooting when issues arise. Some processes may also be too intricate to be effectively automated, thus requiring a human’s touch.

With the lower latencies (shorter delay) boasted by 5G networks, virtual and augmented reality devices can become reliable enough for use in high precision work. This exciting development has the potential to greatly increase a human worker’s productivity, as well as allow them to work in closer harmony with robots.

In fact, such technologies are already being used on factory floors.

Leading The Way

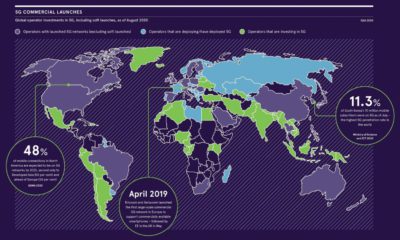

Developing 5G networks and implementing them into the many industries of the global economy is a massive undertaking, and just seven countries are expected to account for 79% of all 5G-related investment.

By 2035, here’s how these countries are expected to rank.

| Country | Share of Value Chain R&D and Capital Expenditure | 5G-enabled Output ($B) | 5G-enabled Employment (million people) |

|---|---|---|---|

| 🇺🇸 United States | 26.7% | $786 | 2.8 |

| 🇨🇳 China | 25.5% | $1,130 | 10.9 |

| 🇯🇵 Japan | 12.4% | $406 | 2.3 |

| 🇩🇪 Germany | 3.9% | $171 | 0.7 |

| 🇫🇷 France | 3.9% | $124 | 1.5 |

| 🇬🇧 United Kingdom | 3.8% | $114 | 0.5 |

| 🇰🇷 South Korea | 2.9% | $128 | 0.7 |

Incidentally, these seven nations are also some of the world’s most innovative economies.

Let’s take a closer look at the two biggest players in 5G development.

United States

It’s not a surprise to see the U.S. on top in terms of 5G investment, though it seems the country is in a peculiar position. China is right on their heels in terms of investment, and is even forecasted to surpass them in 5G-enabled output and employment.

Chinese tech giant Huawei is likely a factor behind these numbers. The company—which America has no direct rival to—is currently the world’s largest manufacturer of telecommunications equipment.

Developments such as these have formed the general consensus that China is winning the “5G race”, but putting America down for a second place finish may be a mistake. With renowned tech hubs like Silicon Valley, the U.S. still leads the rest of the world in terms of patent activity and high-tech company density.

There will be a tendency to cast these developments as another sign that the United States is losing the race … [but] U.S. companies can dominate the applications and services that run over 5G.

– Adam Segal, Director, Council on Foreign Relations

Part of what makes 5G so special is its potential to be used across a wider variety of applications including autonomous vehicles and manufacturing. Perhaps it’s here where American tech firms can use their innovative capacity and software expertise to carve out an advantage.

China

Being the world’s largest manufacturer means China is well-positioned to leverage the power of 5G networks. With nearly 11 million 5G-enabled jobs and over $1.3 trillion in output by 2035, China’s estimates are magnitudes larger than the other countries on this list.

A reason why China is such a cost-efficient place to make things is its well-established network of suppliers, manufacturers, and distributors. All three of these sectors are likely to implement 5G networks for improved speed and efficiency.

China is no slouch when it comes to innovation, either. In terms of patent activity, it ranks second in the world. Shenzhen, once a small fishing village, has become China’s answer to Silicon Valley, and is home to domestic telecom giants like Huawei and ZTE Corporation.

Yet, China faces serious obstacles as it seeks to supply the rest of the world with 5G equipment. Huawei is the subject of U.S. sanctions over allegations of its dealings with Iran. Further skepticism arises from the company’s dubious ownership structure, reliance on state subsidies, and claims of espionage.

Huawei’s quest for dominance in the global telecommunications industry has involved tactics and practices that are antithetical to fair, healthy competition.

– Foreign Policy (magazine)

Regardless of the damage these controversies may cause, China shows no signs of slowing down. The country already holds bragging rights for the world’s largest 5G consumer network, and even claims to have begun research on 6G, an eventual successor to 5G.

The Waiting Game

It’s important to remember that the vast majority of 5G benefits are still years away.

Thus, this next generation of mobile networks can be thought of as an enabling technology—new innovations and complementary technologies will be needed to realize its full potential.

While today’s infographic paints an intuitive visualization of the 5G roadmap, only time will tell which industries and countries actually see the most benefits.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?