Technology

The Unparalleled Explosion in Cryptocurrencies

The Unparalleled Explosion in Cryptocurrencies

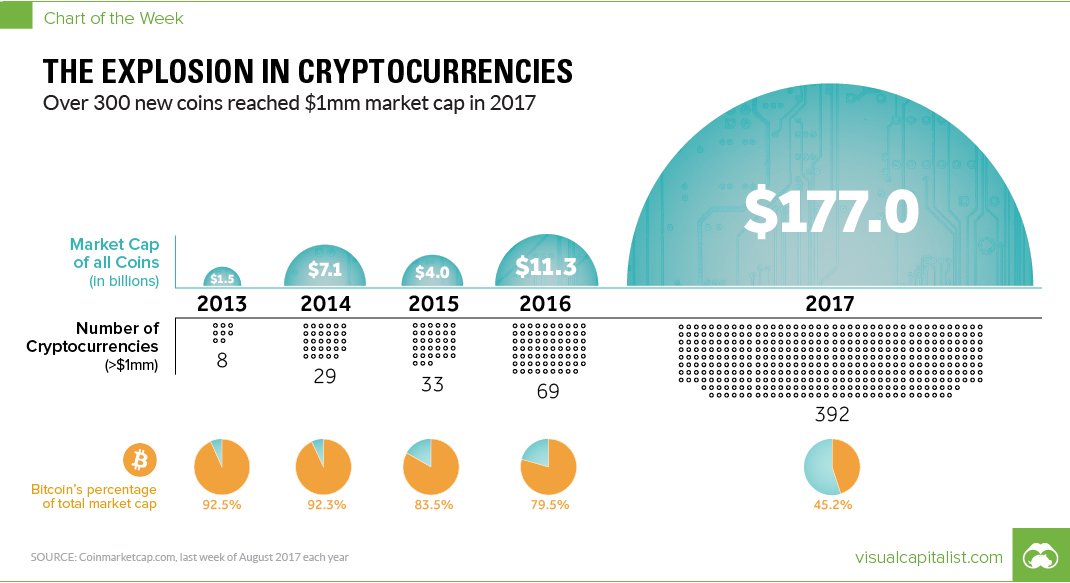

Over 300 new coins reached $1mm market cap in 2017

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

After the massive Bitcoin price surge in November 2013, the popularity of launching new cryptocurrencies took off along with it.

In fact, if you go back at historical snapshots around that time, you’ll see that there were literally hundreds of new coins available to mine and buy. Here’s one from November 2014 – a time when there were only 32 coins that were worth more than $1 million in market cap, and 354 coins that were worth less than $50,000, usually trading for tiny fractions of a cent.

It seems like everyone and their dog were launching cryptocurrencies back then, even if they were a longshot to materialize into anything.

Then vs. Now

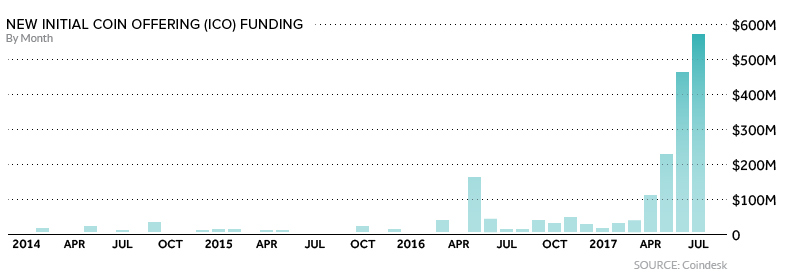

Fast forward to today, and things haven’t changed much – many people and companies are still launching new cryptocurrencies through a mechanism known as an ICO (Initial Coin Offering).

The only difference?

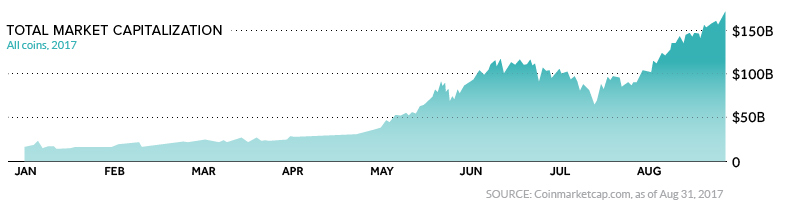

Today, there is real money at play, and in 12 months the number of cryptocurrencies worth >$1 million has soared by 468%. Meanwhile, the total value of all currencies together has skyrocketed by 1,466%.

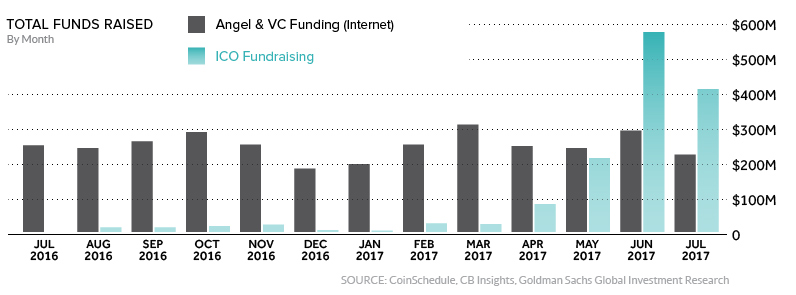

Cryptocurrency is so hot, in fact, that raising money through ICOs has become more effective than traditional early-stage angel and VC funding.

For the long-time advocates of Bitcoin and other cryptocurrencies, it is now their moment in the sun.

And with this ICO activity and a wealth of opportunities emerging, a new breed of Bitcoin millionaire has been born. Like the wealthy tech founders that exit and give back to their local startup ecosystems, these new digital tycoons are using their newfound wealth to invest in upstart crypto projects that show potential – ultimately, further enhancing the ecosystem.

Out of the Woodwork

Of course, whenever there is a massive surge in prices and speculation, there are two other players that tend to come out of the woodwork.

One is of the scammer and shyster variety, and certainly crypto-fueled scams are a concern for everyone else in the broader ecosystem.

Perhaps even a bigger threat, however, are the regulators – and in recent weeks the SEC has voiced concerns about ICO “pump and dump” schemes, while Canadian authorities have clearly stated that “most ICOs need oversight”.

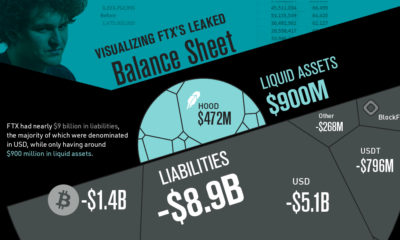

With the market exploding with hundreds of new cryptocurrencies and the total value reaching $177 billion, a new series of questions has emerged: what risk do ICO scams ultimately have on market? And, could misguided regulation disrupt the momentum of the crypto boom?

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024