An Industry Transformed: Four Emerging Trends in Film & TV

The following content is sponsored by Purely Streamonomics

Four Emerging Trends in Film & TV

In 2020, the Film & TV industry experienced unprecedented growth. Amidst the global pandemic, audience demand for streaming services surged, production spending grew, and TV series budgets reached all-time highs.

The industry’s growth isn’t likely to slow down anytime soon and with the recent slew of media mergers, even more change is on the horizon.

What key developments in the Film & TV industry are worth paying attention to? Based on research compiled by Purely Streamonomics, here’s a look at the four emerging trends that could revolutionize the industry as we know it.

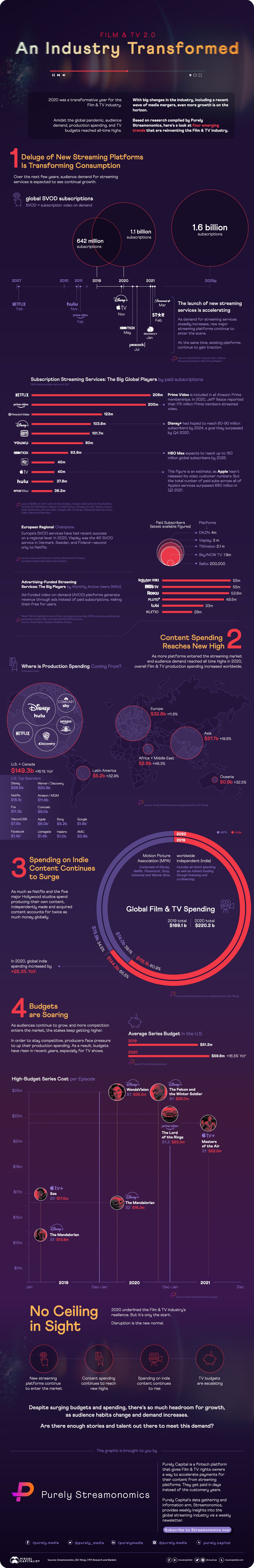

#1: Uptick in New Streaming Platforms

As worldwide lockdown measures drove people indoors, audience demand for home entertainment surged.

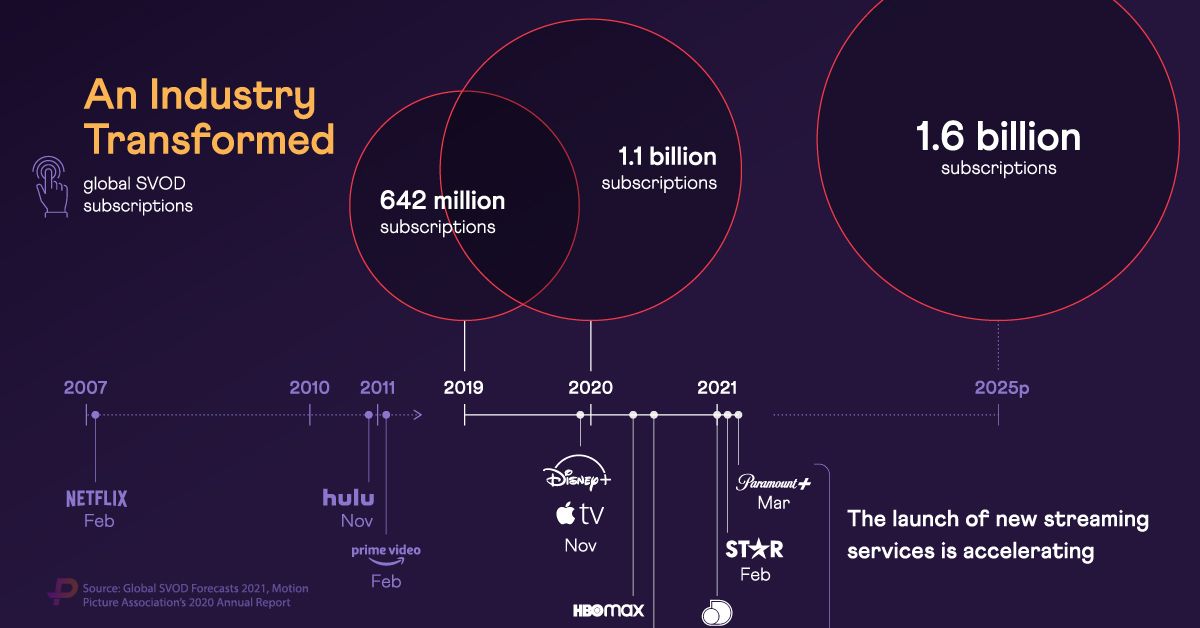

Between 2019-2020, the number of global online video subscriptions increased by 26%, reaching 1.2 billion subscriptions. This growth is expected to continue in the coming years—in fact, by 2025, subscriptions are expected to reach 1.6 billion worldwide.

In tandem with this growing audience demand, new streaming platforms are entering the market at an accelerated pace. 2020 welcomed four new subscription video on demand (SVOD) platforms: Apple TV, HBO Max, Peacock, and Disney+.

New SVOD platforms have garnered large audiences in a short amount of time. For example, Disney+ has already gained over 100 million subscribers since its launch in November 2020.

| Platform | Paid Subscribers (latest available data as of June 2021) |

|---|---|

| Netflix | 208 million |

| Prime Video | 200 million |

| Tencent Video | 123 million |

| Disney+ | 103.6 million |

| iQiyi | 101.7 million |

| Youku | 90 million |

| HBO Max | 63.9 million |

| AppleTV | 40 million |

| Hulu | 37.8 million |

| Eros Now | 36.2 million |

In addition to SVOD services, advertising video on demand (AVOD) platforms—which generate revenue through ads instead of subscribers—are also gaining popularity. Some of these ad-funded services have built up larger audiences than their SVOD counterparts. For instance, IMDb’s free platform IMDbTV has 55 million monthly active users, which is more than Hulu’s number of paid subscribers.

#2: Surge in Content Spending

As more platforms emerge and audience demand grows, spending on content production continues to ramp up as well.

In 2020, a record-breaking $220.2 billion was spent on making and acquiring new feature films and TV programming—that’s a 16.5% increase compared to production spending in 2019.

Where in the world is all this production spending coming from? Perhaps unsurprisingly, over two-thirds of global spending in 2020 came from the U.S. and Canada.

| Region | 2020 Production Spending | % Change (YoY) |

|---|---|---|

| U.S. & Canada | $149.3 billion | 16.1% |

| Latin America | $5.2 billion | 32.9% |

| Europe | $32.6 billion | 11.8% |

| Africa & Middle East | $2.8 billion | 46.3% |

| Asia | $27.7 billion | 19.8% |

| Oceania | $0.9 billion | 32.5% |

Despite Hollywood’s dominance, it’s worth noting that smaller markets in regions such as Latin America, Africa, and the Middle East experienced significant growth in 2020.

#3: Spending on Indie Content Rises

With overall content spending at an all-time high, the independent film (indie) market is experiencing growth as well. In fact, of the billions spent on content production, over half went to indie filmmakers.

Keep in mind, this estimate includes direct spending on indie content, along with indirect funding through licensing and co-financing agreements with big studios. In other words, players like Disney and Warner Bros. still technically produce the most content—however, they often outsource production work to independent filmmakers, or buy the rights to indie content, to distribute on their streaming platforms.

All in all, global spending on indie content increased by 25.3% in 2020, year-over-year. And this indie growth could continue into 2021 and beyond, as distributors and streaming giants rush to fill their content pipelines that have run dry because of production challenges and delays caused by COVID-19.

#4: TV Budgets Continue to Soar

As more competition enters the streaming market, producers are facing pressure to up their production value so they can keep their audience’s attention. In other words, because the stakes are getting higher, the cost of production is rising—especially for TV.

In 2020, the budget for an average TV series in the U.S. was $59.6 million, a 16.5% increase year-over-year. One of the most high-cost TV shows last year was WandaVision, a Marvel Cinematic Universe series that cost Disney approximately $200 million (which breaks down to around $25 million per episode).

As series budgets rise, the line between film and TV has started to blur. For instance, characters and narratives from WandaVision will have direct ties to the upcoming Doctor Strange sequel, which gives fans an extra incentive to watch the Disney+ series.

No Ceiling in Sight for the Film & TV Industry

Despite months of disruptions caused by COVID-19, the Film & TV industry showed resilience in 2020. But it’s only just the beginning—as audience demand continues to grow, and budgets keep rising, growth has become the new normal.

This graphic is brought to you by Purely Streamonomics, a monthly newsletter that provides key insights into the global Film & TV market.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.