Markets

The Top 10 U.S. Cities For Women-Owned Businesses

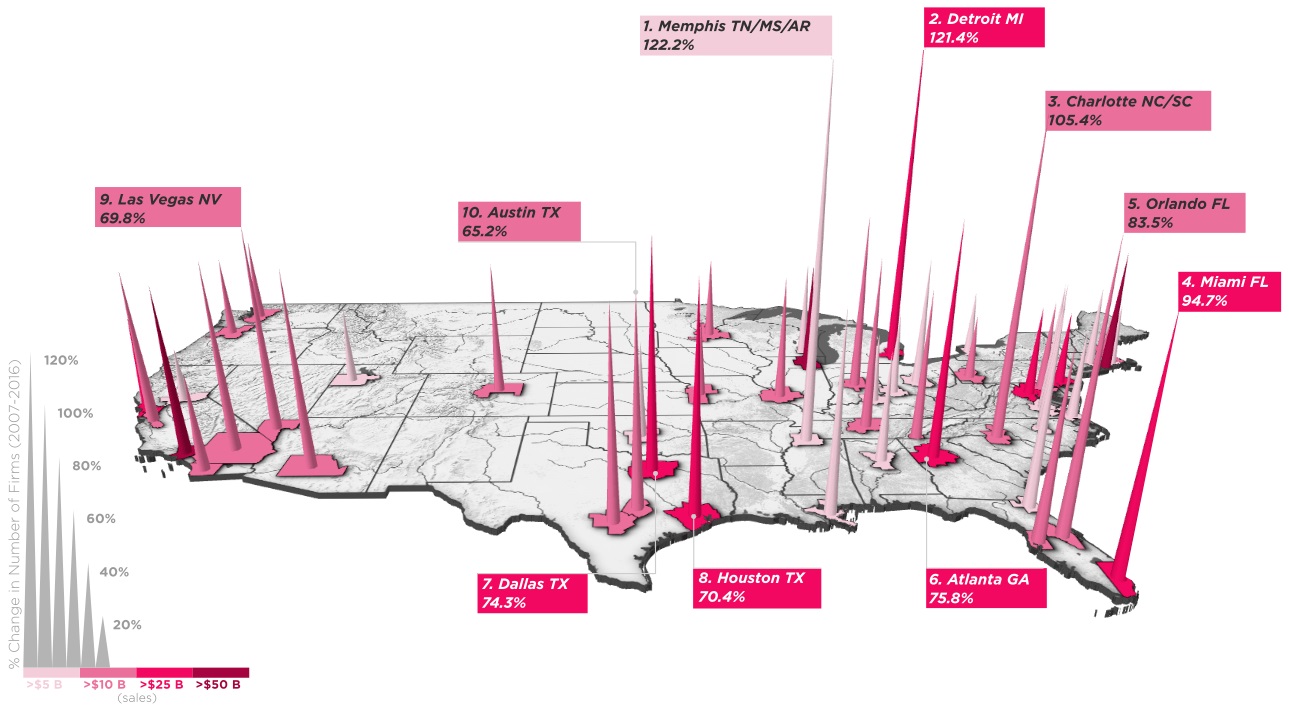

The Top 10 Cities For Women-Owned Businesses

Women are conquering the business world at a rapid pace, especially in areas such as small business and entrepreneurship.

The proof? In the last decade, the number of women-owned firms nationwide has grown by over 3.5 million, now representing 38% of all businesses in the United States.

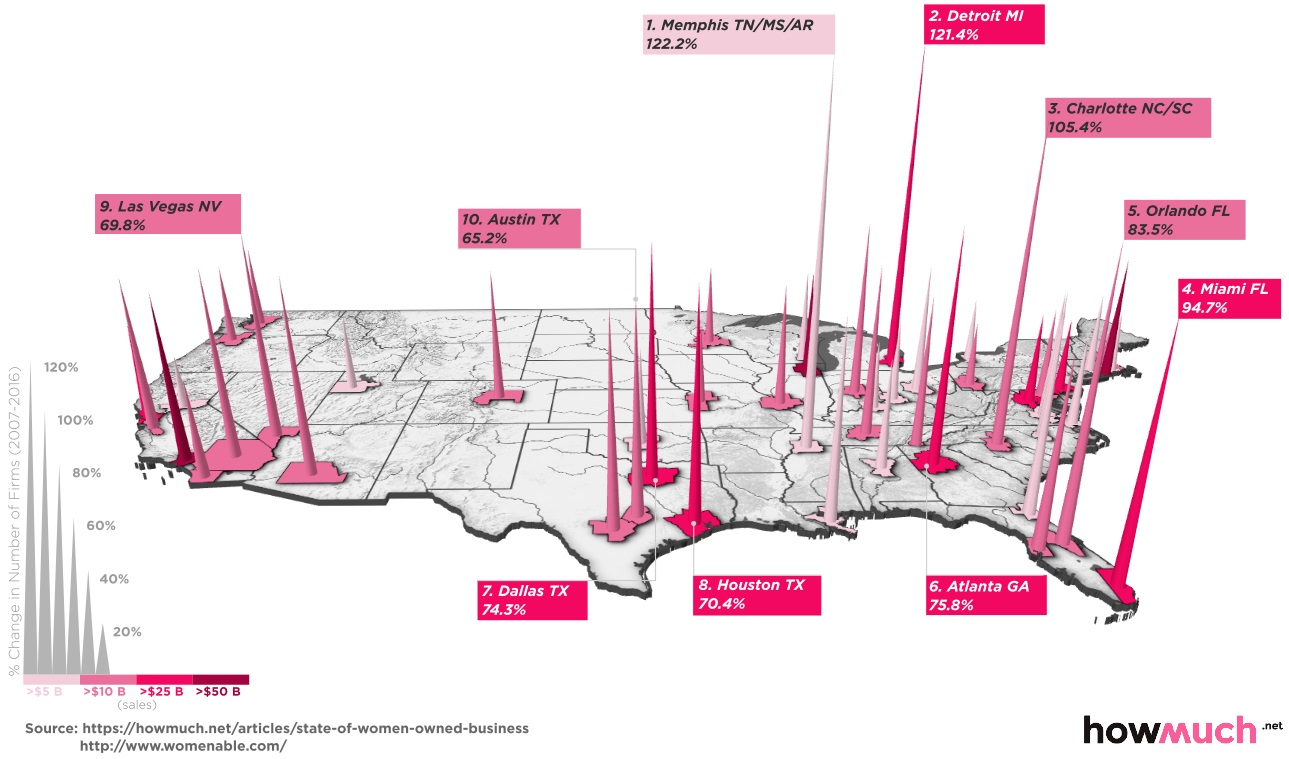

Today’s map from HowMuch.net shows the top American cities where business is booming for women entrepreneurs.

Where are Women-Owned Businesses Growing Fastest?

Looking at the percentage growth in women-owned businesses tells us a lot about the way local economies have developed in the past decade.

Though women-owned firms in larger cities may have more absolute growth and revenue, a high growth rate shows the rapid emergence of a business community where there may have not been one before.

| Rank | City | Growth as Percentage | Absolute Growth | Revenue ($ Billion) |

|---|---|---|---|---|

| 1 | Memphis | 122% | 47,798 | 6.1 |

| 2 | Detroit | 121.4% | 140,000 | 25.1 |

| 3 | Charlotte | 105.4% | 61,568 | 13.3 |

| 4 | Miami | 94.7% | 220,000 | 41.4 |

| 5 | Orlando | 83.5% | 72,930 | 12.3 |

| 6 | Atlanta | 75.8% | 133,000 | 36.9 |

| 7 | Dallas | 74.3% | 100,000 | 47.0 |

| 8 | Houston | 70.4% | 107,000 | 36.1 |

| 9 | Las Vegas | 69.8% | 44,341 | 10.4 |

| 10 | Austin | 65.2% | 41,413 | 10.3 |

Memphis’ women are leading the charge in the development of their city’s relatively small economy. Though the city is ranked only 45th in terms of revenue generation by women-owned firms, it’s adding new women-owned businesses at a very rapid pace.

The growth rate in Memphis of 122.2% between 2007-2016 leads the nation, making it one of only three cities (along with Charlotte and Detroit) where women-led business growth has more than doubled since 2007.

Absolute Growth Numbers

More metropolitan cities like New York or Los Angeles already have a bigger base of women entrepreneurs to start with, so their percentage growth is not high enough to show up on the aforementioned map.

However, it is worth looking at where the most women-owned businesses are being added (in absolute terms) as well:

| Rank | City | Absolute Growth | Growth as Percentage | Revenue ($ Billion) |

|---|---|---|---|---|

| 1 | New York City | 271,000 | 44.9% | 140.0 |

| 2 | Los Angeles | 225,000 | 55.0% | 95 |

| 3 | Miami | 220,000 | 94.7% | 41.4 |

| 4 | Detroit | 140,000 | 121.4% | 25.1 |

| 5 | Atlanta | 133,000 | 75.8% | 36.9 |

| 6 | Houston | 107,000 | 70.4% | 36.1 |

| 7 | Chicago | 105,500 | 39.0% | 50.0 |

| 8 | Dallas | 100,000 | 74.3% | 47.0 |

| 9 | Riverside | 60,000 | 62.8% | 19.9 |

| 10 | Washington, D.C. | 57,000 | 32.6% | 37.1 |

Interestingly enough, certain cities appear on both lists, showing impressive growth both in relative and absolute terms.

Detroit and Miami are fairly unique in that they make the top five on both lists. Detroit grew its women-owned businesses by 121.4%, or 140,000 in absolute terms. Meanwhile, Miami grew at 94.7% to add 220,000 businesses since 2007.

Houston and Atlanta are two other cities that fare very well on both lists.

Sponsored Infographics

The Money Project

Markets

U.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

U.S. Debt Interest Payments Reach $1 Trillion

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The cost of paying for America’s national debt crossed the $1 trillion dollar mark in 2023, driven by high interest rates and a record $34 trillion mountain of debt.

Over the last decade, U.S. debt interest payments have more than doubled amid vast government spending during the pandemic crisis. As debt payments continue to soar, the Congressional Budget Office (CBO) reported that debt servicing costs surpassed defense spending for the first time ever this year.

This graphic shows the sharp rise in U.S. debt payments, based on data from the Federal Reserve.

A $1 Trillion Interest Bill, and Growing

Below, we show how U.S. debt interest payments have risen at a faster pace than at another time in modern history:

| Date | Interest Payments | U.S. National Debt |

|---|---|---|

| 2023 | $1.0T | $34.0T |

| 2022 | $830B | $31.4T |

| 2021 | $612B | $29.6T |

| 2020 | $518B | $27.7T |

| 2019 | $564B | $23.2T |

| 2018 | $571B | $22.0T |

| 2017 | $493B | $20.5T |

| 2016 | $460B | $20.0T |

| 2015 | $435B | $18.9T |

| 2014 | $442B | $18.1T |

| 2013 | $425B | $17.2T |

| 2012 | $417B | $16.4T |

| 2011 | $433B | $15.2T |

| 2010 | $400B | $14.0T |

| 2009 | $354B | $12.3T |

| 2008 | $380B | $10.7T |

| 2007 | $414B | $9.2T |

| 2006 | $387B | $8.7T |

| 2005 | $355B | $8.2T |

| 2004 | $318B | $7.6T |

| 2003 | $294B | $7.0T |

| 2002 | $298B | $6.4T |

| 2001 | $318B | $5.9T |

| 2000 | $353B | $5.7T |

| 1999 | $353B | $5.8T |

| 1998 | $360B | $5.6T |

| 1997 | $368B | $5.5T |

| 1996 | $362B | $5.3T |

| 1995 | $357B | $5.0T |

| 1994 | $334B | $4.8T |

| 1993 | $311B | $4.5T |

| 1992 | $306B | $4.2T |

| 1991 | $308B | $3.8T |

| 1990 | $298B | $3.4T |

| 1989 | $275B | $3.0T |

| 1988 | $254B | $2.7T |

| 1987 | $240B | $2.4T |

| 1986 | $225B | $2.2T |

| 1985 | $219B | $1.9T |

| 1984 | $205B | $1.7T |

| 1983 | $176B | $1.4T |

| 1982 | $157B | $1.2T |

| 1981 | $142B | $1.0T |

| 1980 | $113B | $930.2B |

| 1979 | $96B | $845.1B |

| 1978 | $84B | $789.2B |

| 1977 | $69B | $718.9B |

| 1976 | $61B | $653.5B |

| 1975 | $55B | $576.6B |

| 1974 | $50B | $492.7B |

| 1973 | $45B | $469.1B |

| 1972 | $39B | $448.5B |

| 1971 | $36B | $424.1B |

| 1970 | $35B | $389.2B |

| 1969 | $30B | $368.2B |

| 1968 | $25B | $358.0B |

| 1967 | $23B | $344.7B |

| 1966 | $21B | $329.3B |

Interest payments represent seasonally adjusted annual rate at the end of Q4.

At current rates, the U.S. national debt is growing by a remarkable $1 trillion about every 100 days, equal to roughly $3.6 trillion per year.

As the national debt has ballooned, debt payments even exceeded Medicaid outlays in 2023—one of the government’s largest expenditures. On average, the U.S. spent more than $2 billion per day on interest costs last year. Going further, the U.S. government is projected to spend a historic $12.4 trillion on interest payments over the next decade, averaging about $37,100 per American.

Exacerbating matters is that the U.S. is running a steep deficit, which stood at $1.1 trillion for the first six months of fiscal 2024. This has accelerated due to the 43% increase in debt servicing costs along with a $31 billion dollar increase in defense spending from a year earlier. Additionally, a $30 billion increase in funding for the Federal Deposit Insurance Corporation in light of the regional banking crisis last year was a major contributor to the deficit increase.

Overall, the CBO forecasts that roughly 75% of the federal deficit’s increase will be due to interest costs by 2034.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?