Technology

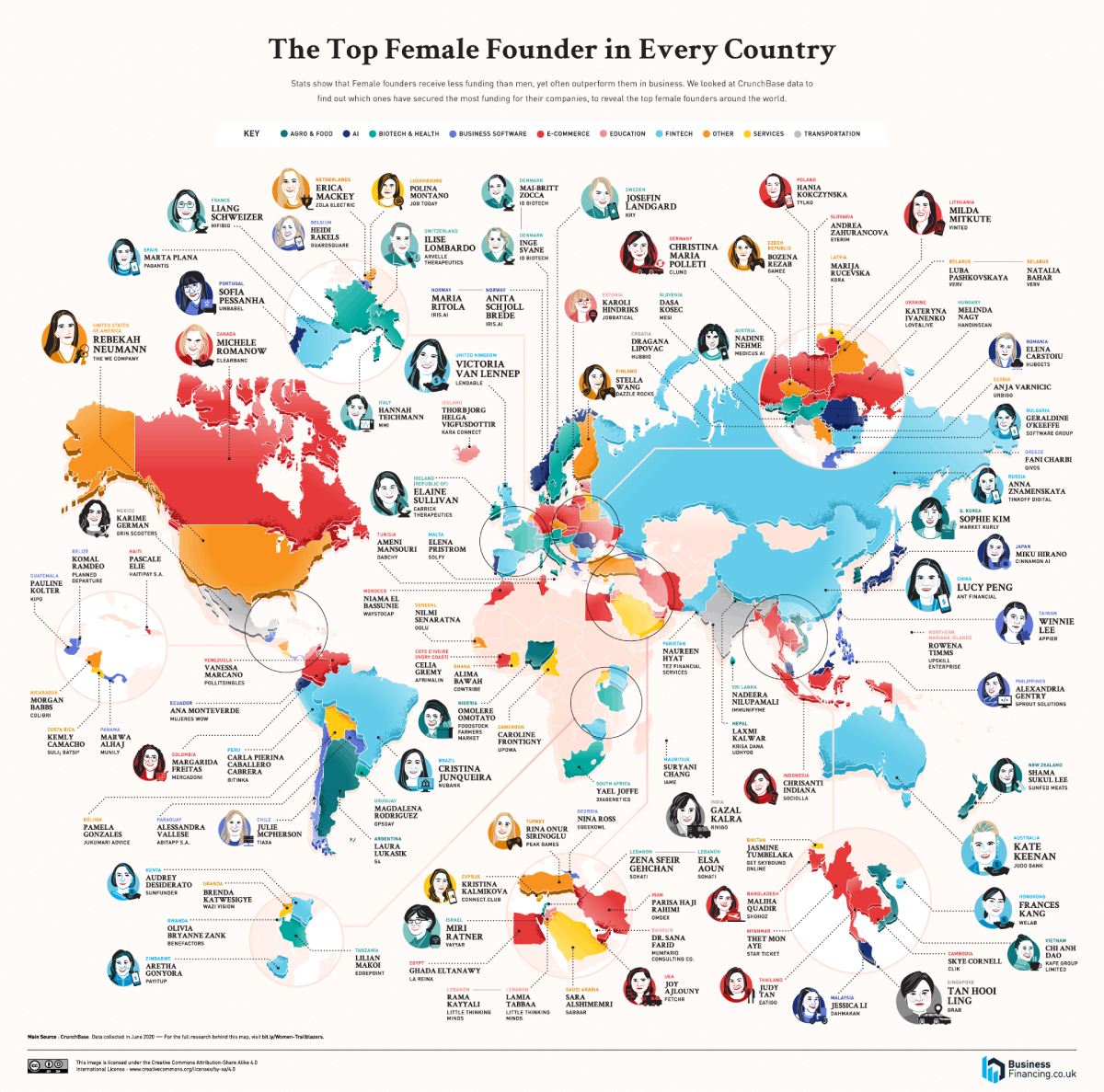

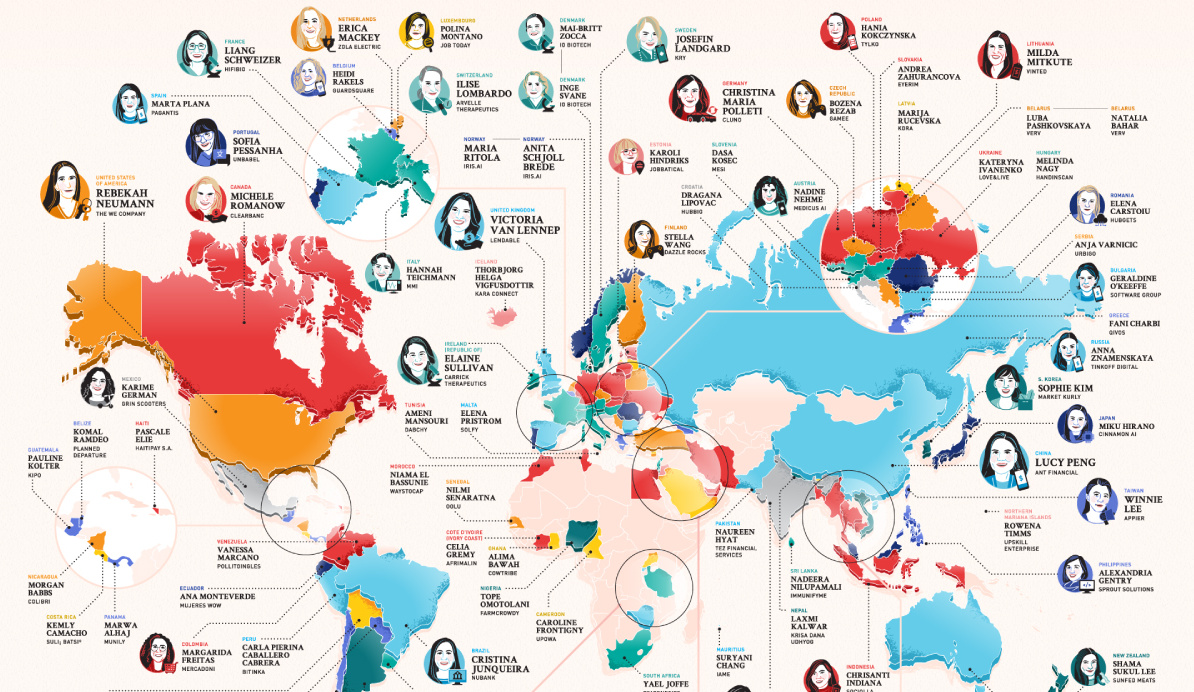

Mapped: The Top Female Founder in Each Country

View the full-size version of this infographic.

Mapped: The Top Female Founder in Each Country

View the high resolution of this infographic by clicking here.

Companies with at least one female founder generate 78 cents of revenue for every dollar of venture funding, while male-led startups generate roughly 31 cents.

Yet, startups with only female founders receive just 3% of total invested dollars globally.

The above infographic from Business Financing explores the global landscape of female-led startups. It shows the top female founders according to the highest amount of capital raised, in each country profiled.

Global Rankings: The Top 10 Female Founders

Which female founders have received the most funding worldwide?

Based on data from Crunchbase, individuals were selected across 102 countries if they were a founder or co-founder of an active company as of May 21, 2020. Companies were selected depending on their status in seed, early stage venture, or late stage venture funding.

With $22 billion in funding, Lucy Peng, co-founder of Ant Group and Alibaba tops the list. Peng taught economics for five years before co-founding Alibaba with 18 others in 1999. Today, she is worth over $1 billion.

Peng’s 2.1% stake in Ant Group is estimated to be worth roughly $4.8 billion. Ant Group filed for an IPO worth an estimated $225 billion valuation in August 2020.

| Female Founder | Funding | Company | Industry | Country |

|---|---|---|---|---|

| Lucy Peng | $22B | Ant | Financial | China |

| Rebekah Neumann | $19.5B | The We Company | Real Estate | U.S. |

| Tan Hooi Ling | $9.9B | Grab | Transportation | Singapore |

| Kate Keenan | $1.4B | Judo Bank | FinTech | Australia |

| Victoria van Lennep | $1.2B | Lendable | FinTech | United Kingdom |

| Cristina Junqueira | $1.1B | Nubank | FinTech | Brazil |

| Frances Kang | $581M | WeLab | FinTech | Hong Kong |

| Sophie Kim | $282M | Market Kurly | Agro & Food | South Korea |

| Ilise Lombardo | $278M | Arvelle Therapeutics | Biotech & Health | Switzerland |

| Milda Mitkute | $260M | Vinted | Ecommerce | Lithuania |

Following Peng is Rebekah Neumann, who has raised $19.5 billion with The We Company. Neumann studied business with a minor in Buddhism at Cornell, and later co-founded the gig-focused firm in 2010 with her husband Adam Neumann and Miguel McKelvey. Following the notoriously disastrous IPO of WeWork, she and her husband have since left the company.

Coming in third is Tan Hooi Ling who founded Grab in Singapore. The ride-hailing app is a major competitor of Uber in Asian markets.

Cristina Junqueira, who co-founded digital banking firm NuBank, also makes it into the top 10 list. Currently, NuBank operates as the largest fintech firm in South America, with over 20 million users. Meanwhile, Lithuania’s first tech unicorn, Vinted was co-founded by Milda Mitkute and serves as the largest secondhand clothing platform worldwide.

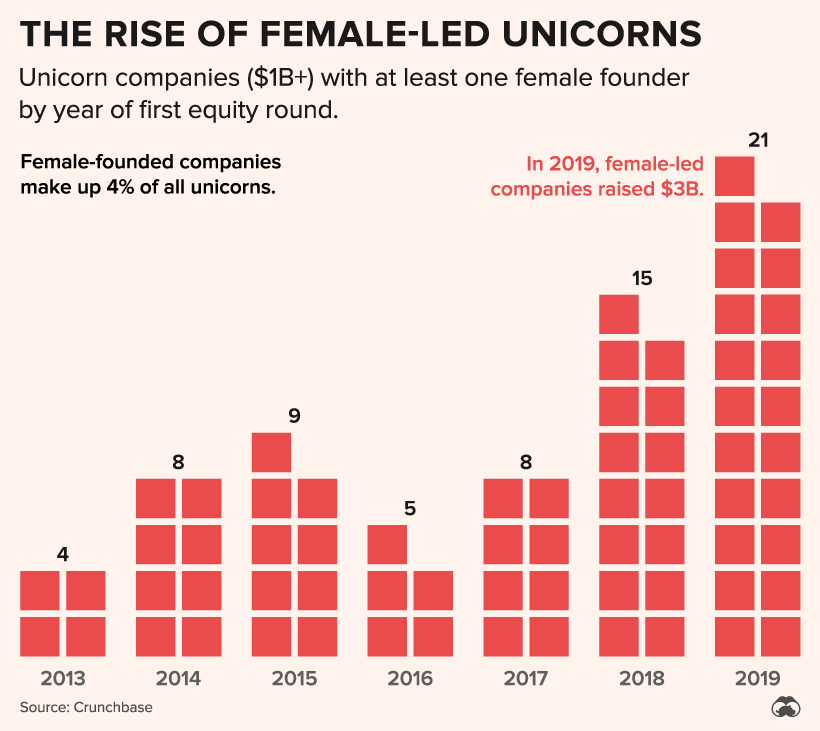

Unicorns Bucking the Trend

While funding for female-led startups has been disproportionately low over the years, the number of unicorns—private companies valued in excess of $1 billion—headed by women has grown over fivefold.

Since 2013, women-led unicorns have jumped from just four to 21 in 2019. While these numbers are still objectively quite small, they continue to climb.

Among the newly minted unicorns in 2019 was Airwallex, a company that allows businesses to track cross-border revenues. In April, the startup raised $160 million, valuing it at $1.8 billion.

Along with Airwallex, Scale, Glossier and The RealReal are also found on the list.

New Waves of Venture Capital

In 2019, 2,300 venture deal rounds included startups with at least one female founder. Of these, a number of startups raised over $100 million in funding in 2019 on a worldwide level.

| Startup | Funding Amount | Country |

|---|---|---|

| Guild Education | $157 million | U.S. |

| Luckin Coffee | $150 million | China |

| Northern Arc | $130 million | India |

| Kuaikan Manhua | $125 million | China |

| SpringWorks Therapeutics | $125 million | U.S. |

| Rent the Runway | $125 million | U.S. |

| Genera Energy | $118 million | U.S. |

| Tala | $110 million | U.S. |

| Kronos Bio | $105 million | U.S. |

| Insitro | $100 million | U.S. |

| Talaris | $100 million | U.S. |

| Away | $100 million | U.S. |

| Glossier | $100 million | U.S. |

Interestingly, funding data shows that women VCs are three times more likely than men to invest in women. This, coupled with the growing number of female partners at venture capital firms, is bringing a new perspective to tech financing.

At the same time, it’s opening up new markets. For instance, the $57 billion child care industry is largely overlooked by the VC world. San Francisco-based Winnie raised $9 million in funding in 2019, capitalizing on a marketplace specifically for parents.

Consumer products and markets focusing on solutions for women present areas of significant growth, particularly on a global level.

What’s Next For Female Founders?

While just a fraction of all venture funding is allocated to women-led companies, trends illustrate clear resilience.

Female-founded firms continually outperform—and shareholder returns are only getting better every year. As both startup and venture capital ecosystems continue to evolve, the future of women-led entrepreneurship is as bright as ever.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business1 week ago

Business1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc1 week ago

Misc1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes