Markets

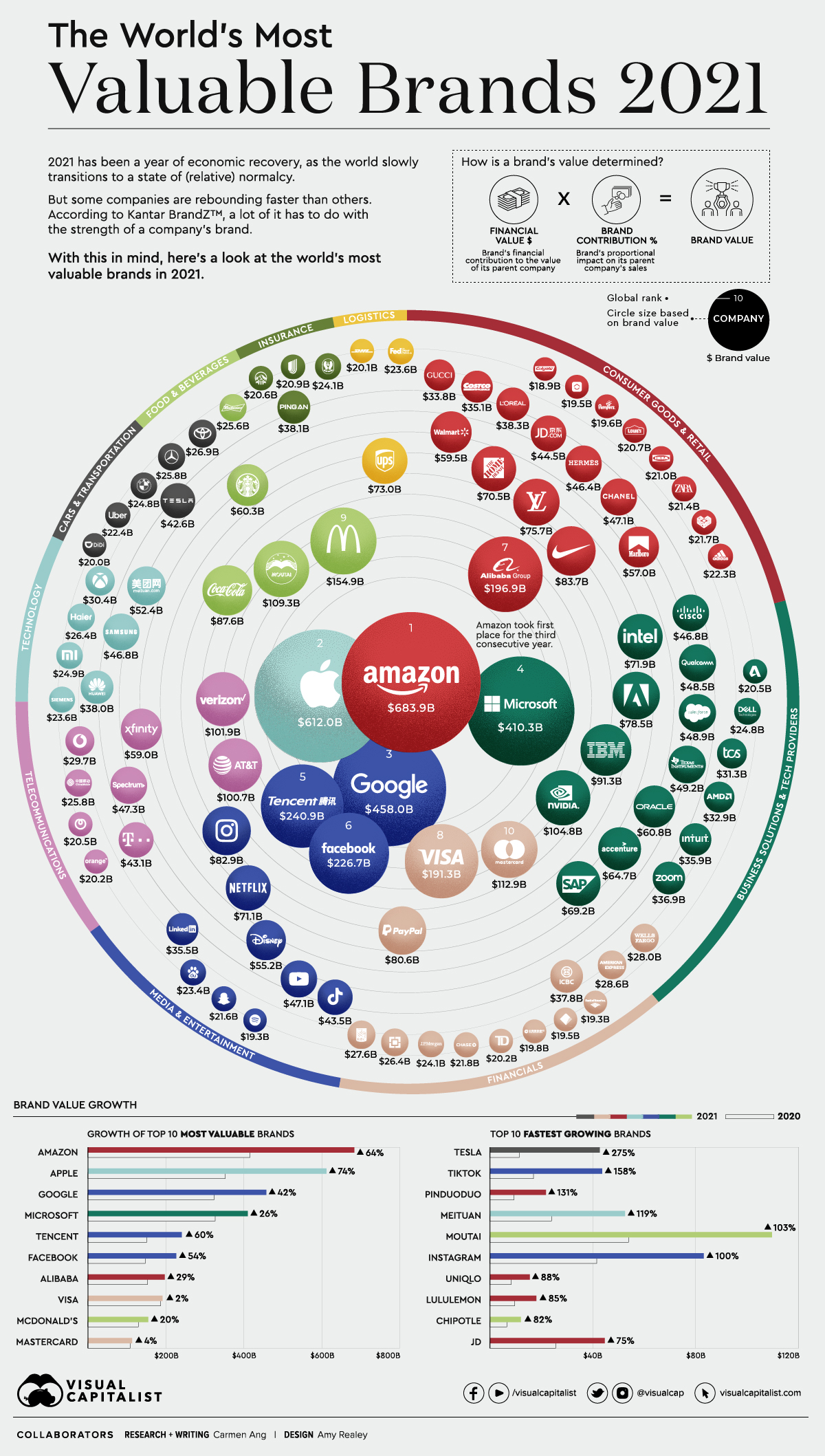

The World’s 100 Most Valuable Brands in 2021

View the full-size version of this graphic.

The World’s Top 100 Most Valuable Brands in 2021

In 2020, the global economy experienced one of the worst declines since the Great Depression.

Yet, while the ripple effects of COVID-19 have thrown many businesses into disarray, some companies have not only managed to stay afloat amidst the chaos—they’ve thrived. Using data from Kantar BrandZ, this graphic looks at the top 100 most valuable brands of 2021.

Methodology

Each year, research group Kantar BrandZ ranks companies based on their “brand value,” which is measured by:

- A brand’s total financial value, which is the financial contribution that brand brings to its parent company ($ value).

- Multiplied by its proportional value, measured by the brands proportional impact on its parent company’s sales (% value).

The financial results are then combined with quantitative survey data, sourced from over 170,000 global consumers. The end result is a holistic look at a company’s brand equity, reputation, and ability to generate value.

The Leaderboard

The total value of 2021’s Top 100 brands grew by 42%, reaching a combined $7 trillion. At the top of the list, perhaps unsurprisingly, is Amazon, with a total brand value of $683 billion.

| Rank | Brand | Brand Value ($B USD) | Category | Brand Value % change from 2020 |

|---|---|---|---|---|

| 1 | Amazon | $683.85 | Consumer Goods & Retail | 64% |

| 2 | Apple | $612.00 | Technology | 74% |

| 3 | $458.00 | Media & Entertainment | 42% | |

| 4 | Microsoft | $410.27 | Business Solutions & Tech Providers | 26% |

| 5 | Tencent | $240.93 | Media & Entertainment | 60% |

| 6 | $226.74 | Media & Entertainment | 54% | |

| 7 | Alibaba | $196.91 | Consumer Goods & Retail | 29% |

| 8 | Visa | $191.29 | Financial Services | 2% |

| 9 | McDonald's | $154.92 | Food & Beverages | 20% |

| 10 | Mastercard | $112.88 | Financial Services | 4% |

| 11 | Moutai | $109.33 | Food & Beverages | 103% |

| 12 | Nvidia | $104.76 | Business Solutions & Tech Providers | n/a |

| 13 | Verizon | $101.94 | Telecom Providers | 8% |

| 14 | AT&T | $100.65 | Telecom Providers | -5% |

| 15 | IBM | $91.34 | Business Solutions & Tech Providers | 9% |

| 16 | Coca-Cola | $87.60 | Food & Beverages | 4% |

| 17 | Nike | $83.71 | Consumer Goods & Retail | 68% |

| 18 | $82.90 | Media & Entertainment | 100% | |

| 19 | PayPal | $80.62 | Payments | 66% |

| 20 | Adobe | $78.52 | Business Solutions & Tech Providers | n/a |

| 21 | Louis Vuitton | $75.73 | Consumer Goods & Retail | 46% |

| 22 | UPS | $73.02 | Logistics | 44% |

| 23 | Intel | $71.94 | Business Solutions & Tech Providers | n/a |

| 24 | Netflix | $71.13 | Media & Entertainment | 55% |

| 25 | The Home Depot | $70.52 | Consumer Goods & Retail | 22% |

| 26 | SAP | $69.24 | Business Solutions & Tech Providers | 20% |

| 27 | Accenture | $64.73 | Business Solutions & Tech Providers | n/a |

| 28 | Oracle | $60.84 | Business Solutions & Tech Providers | n/a |

| 29 | Starbucks | $60.27 | Food & Beverages | 26% |

| 30 | Walmart | $59.52 | Consumer Goods & Retail | 30% |

| 31 | Xfinity | $59.00 | Telecom Providers | 26% |

| 32 | Marlboro | $57.01 | Consumer Goods & Retail | -2% |

| 33 | Disney | $55.22 | Media & Entertainment | 13% |

| 34 | Meituan | $52.40 | Technology | 119% |

| 35 | Texas Instruments | $49.24 | Business Solutions & Tech Providers | n/a |

| 36 | Salesforce | $48.98 | Business Solutions & Tech Providers | 61% |

| 37 | Qualcomm | $48.36 | Business Solutions & Tech Providers | n/a |

| 38 | Spectrum | $47.28 | Telecom Providers | 10% |

| 39 | YouTube | $47.10 | Media & Entertainment | 39% |

| 40 | Chanel | $47.05 | Consumer Goods & Retail | 30% |

| 41 | Cisco | $46.82 | Business Solutions & Tech Providers | n/a |

| 42 | Samsung | $46.77 | Technology | 44% |

| 43 | Hermès | $46.40 | Consumer Goods & Retail | 40% |

| 44 | JD | $44.52 | Consumer Goods & Retail | 75% |

| 45 | TikTok | $43.52 | Media & Entertainment | 158% |

| 46 | Deutsche Telekom | $43.10 | Telecom Providers | 16% |

| 47 | Tesla | $42.61 | Cars & Transportation | 275% |

| 48 | L'Oréal Paris | $38.31 | Consumer Goods & Retail | 30% |

| 49 | Ping An | $38.05 | Insurance | 13% |

| 50 | Huawei | $38.02 | Technology | 29% |

| 51 | ICBC | $37.77 | Financial Services | -1% |

| 52 | Zoom | $36.93 | Business Solutions & Tech Providers | n/a |

| 53 | Intuit | $35.87 | Business Solutions & Tech Providers | n/a |

| 54 | $35.52 | Media & Entertainment | 19% | |

| 55 | Costco | $35.14 | Consumer Goods & Retail | 23% |

| 56 | Gucci | $33.84 | Consumer Goods & Retail | 24% |

| 57 | AMD | $32.92 | Business Solutions & Tech Providers | n/a |

| 58 | Tata Consulting Services | $31.28 | Business Solutions & Tech Providers | n/a |

| 59 | Xbox | $30.40 | Technology | 55% |

| 60 | Vodafone | $29.74 | Telecom Providers | 29% |

| 61 | American Express | $28.58 | Financial Services | -3% |

| 62 | Wells Fargo | $28.00 | Financial Services | -8% |

| 63 | RBC | $27.61 | Financial Services | 33% |

| 64 | Toyota | $26.97 | Cars & Transportation | -5% |

| 65 | Haier | $26.42 | Technology | 41% |

| 66 | HDFC Bank | $26.37 | Financial Services | 27% |

| 67 | Mercedes-Benz | $25.84 | Cars & Transportation | 21% |

| 68 | China Mobile | $25.82 | Telecom Providers | -25% |

| 69 | Budweiser | $25.55 | Food & Beverages | 5% |

| 70 | Xiaomi | $24.89 | Technology | 50% |

| 71 | BMW | $24.82 | Cars & Transportation | 21% |

| 72 | Dell Technologies | $24.78 | Business Solutions & Tech Providers | 36% |

| 73 | LIC | $24.14 | Insurance | 38% |

| 74 | J.P. Morgan | $24.11 | Financial Services | 37% |

| 75 | Siemens | $23.64 | Conglomerate | 69% |

| 76 | Fedex | $23.59 | Logistics | 53% |

| 77 | Baidu | $23.36 | Media & Entertainment | 57% |

| 78 | Uber | $22.41 | Cars & Transportation | 41% |

| 79 | Adidas | $22.34 | Consumer Goods & Retail | 51% |

| 80 | Chase | $21.83 | Financial Services | 7% |

| 81 | Pinduoduo | $21.73 | Consumer Goods & Retail | 131% |

| 82 | Snapchat | $21.61 | Media & Entertainment | n/a |

| 83 | Zara | $21.38 | Consumer Goods & Retail | 0% |

| 84 | Ikea | $21.02 | Consumer Goods & Retail | 17% |

| 85 | UnitedHealthCare | $20.87 | Insurance | 32% |

| 86 | Lowe's | $20.67 | Consumer Goods & Retail | 51% |

| 87 | AIA | $20.60 | Insurance | 16% |

| 88 | NTT | $20.48 | Telecom Providers | 1% |

| 89 | Autodesk | $20.45 | Business Solutions & Tech Providers | n/a |

| 90 | TD | $20.21 | Financial Services | 17% |

| 91 | Orange | $20.20 | Telecom Providers | 4% |

| 92 | DHL | $20.14 | Logistics | 39% |

| 93 | Didi Chuxing | $20.04 | Cars & Transportation | 0% |

| 94 | China Construction Bank | $19.78 | Financial Services | -6% |

| 95 | Pampers | $19.62 | Consumer Goods & Retail | 6% |

| 96 | KE | $19.50 | Consumer Goods & Retail | n/a |

| 97 | Commonwealth Bank | $19.47 | Financial Services | 48% |

| 98 | Bank of America | $19.32 | Financial Services | 14% |

| 99 | Spotify | $19.28 | Media & Entertainment | n/a |

| 100 | Colgate | $18.89 | Consumer Goods & Retail | 8% |

It’s the third consecutive year that Amazon has placed first on the list. Since last year’s ranking, the ecommerce brand has seen its value grow by 64%. Keep in mind, this accounts for all areas of Amazon’s business, including its web and subscription services.

Second on the list is Apple with a brand value of $612 billion. Apple wasn’t completely immune to the impacts of COVID-19—in the early days of the pandemic, its stock dipped almost 19% from record highs—but the company recovered and reported record-breaking revenue, generating $64.7 billion in Q4 2020.

It’s fitting that the top brands on the list are big tech companies since the pandemic pushed consumers online for both their shopping and entertainment needs. A few social media platforms placed high on the list as well, like Facebook, which rose two ranks this year to score the sixth spot with a brand value of $227 billion.

Instagram and TikTok trailed behind Facebook when it came to total brand value, but both platforms saw exceptional growth compared to last year’s report. In fact, when looking at brand value growth from 2020, both brands scored a spot in the top 10.

Insights into Brand Value Growth

The most valuable brand report has been ranking companies for over a decade, and some overarching factors have stood out as key contributors to brand value growth:

1. The Big Get Bigger

Starting “strong” can give brands an edge. This is because growth rate is closely correlated with high brand equity. In other words, a strong brand will likely see more growth than a weaker brand, which might explain why companies like Amazon and Apple have been able to hold their place at the top for several consecutive years.

Keep in mind, this doesn’t account for industry disruptors. An innovative company could come out of the woodwork next year and give the Big Tech giants a run for their money.

2. Marketing Makes a Difference

The right strategy can make a difference, and even smaller brands can make a splash if the message is impactful. Brands with emotional associations, like pride or popularity, tend to see that translate into brand value growth.

Companies like Nike and Coca-Cola have mastered the art of emotional advertising. For instance, in May last year, Nike released a video urging consumers to stand up for equality, in a video titled, “For Once, Just Don’t Do It.”

3. Smart Investment

It’s not just about developing an effective marketing strategy, it’s about executing that strategy, and continually investing in ways that perpetuate your brand message.

For instance, innovation is the core value of Tesla’s brand, and the electric car company walks the walk—in 2020, the company spent $1.5 billion on R&D.

Markets

U.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

U.S. Debt Interest Payments Reach $1 Trillion

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The cost of paying for America’s national debt crossed the $1 trillion dollar mark in 2023, driven by high interest rates and a record $34 trillion mountain of debt.

Over the last decade, U.S. debt interest payments have more than doubled amid vast government spending during the pandemic crisis. As debt payments continue to soar, the Congressional Budget Office (CBO) reported that debt servicing costs surpassed defense spending for the first time ever this year.

This graphic shows the sharp rise in U.S. debt payments, based on data from the Federal Reserve.

A $1 Trillion Interest Bill, and Growing

Below, we show how U.S. debt interest payments have risen at a faster pace than at another time in modern history:

| Date | Interest Payments | U.S. National Debt |

|---|---|---|

| 2023 | $1.0T | $34.0T |

| 2022 | $830B | $31.4T |

| 2021 | $612B | $29.6T |

| 2020 | $518B | $27.7T |

| 2019 | $564B | $23.2T |

| 2018 | $571B | $22.0T |

| 2017 | $493B | $20.5T |

| 2016 | $460B | $20.0T |

| 2015 | $435B | $18.9T |

| 2014 | $442B | $18.1T |

| 2013 | $425B | $17.2T |

| 2012 | $417B | $16.4T |

| 2011 | $433B | $15.2T |

| 2010 | $400B | $14.0T |

| 2009 | $354B | $12.3T |

| 2008 | $380B | $10.7T |

| 2007 | $414B | $9.2T |

| 2006 | $387B | $8.7T |

| 2005 | $355B | $8.2T |

| 2004 | $318B | $7.6T |

| 2003 | $294B | $7.0T |

| 2002 | $298B | $6.4T |

| 2001 | $318B | $5.9T |

| 2000 | $353B | $5.7T |

| 1999 | $353B | $5.8T |

| 1998 | $360B | $5.6T |

| 1997 | $368B | $5.5T |

| 1996 | $362B | $5.3T |

| 1995 | $357B | $5.0T |

| 1994 | $334B | $4.8T |

| 1993 | $311B | $4.5T |

| 1992 | $306B | $4.2T |

| 1991 | $308B | $3.8T |

| 1990 | $298B | $3.4T |

| 1989 | $275B | $3.0T |

| 1988 | $254B | $2.7T |

| 1987 | $240B | $2.4T |

| 1986 | $225B | $2.2T |

| 1985 | $219B | $1.9T |

| 1984 | $205B | $1.7T |

| 1983 | $176B | $1.4T |

| 1982 | $157B | $1.2T |

| 1981 | $142B | $1.0T |

| 1980 | $113B | $930.2B |

| 1979 | $96B | $845.1B |

| 1978 | $84B | $789.2B |

| 1977 | $69B | $718.9B |

| 1976 | $61B | $653.5B |

| 1975 | $55B | $576.6B |

| 1974 | $50B | $492.7B |

| 1973 | $45B | $469.1B |

| 1972 | $39B | $448.5B |

| 1971 | $36B | $424.1B |

| 1970 | $35B | $389.2B |

| 1969 | $30B | $368.2B |

| 1968 | $25B | $358.0B |

| 1967 | $23B | $344.7B |

| 1966 | $21B | $329.3B |

Interest payments represent seasonally adjusted annual rate at the end of Q4.

At current rates, the U.S. national debt is growing by a remarkable $1 trillion about every 100 days, equal to roughly $3.6 trillion per year.

As the national debt has ballooned, debt payments even exceeded Medicaid outlays in 2023—one of the government’s largest expenditures. On average, the U.S. spent more than $2 billion per day on interest costs last year. Going further, the U.S. government is projected to spend a historic $12.4 trillion on interest payments over the next decade, averaging about $37,100 per American.

Exacerbating matters is that the U.S. is running a steep deficit, which stood at $1.1 trillion for the first six months of fiscal 2024. This has accelerated due to the 43% increase in debt servicing costs along with a $31 billion dollar increase in defense spending from a year earlier. Additionally, a $30 billion increase in funding for the Federal Deposit Insurance Corporation in light of the regional banking crisis last year was a major contributor to the deficit increase.

Overall, the CBO forecasts that roughly 75% of the federal deficit’s increase will be due to interest costs by 2034.

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Markets1 week ago

Markets1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001