Automotive

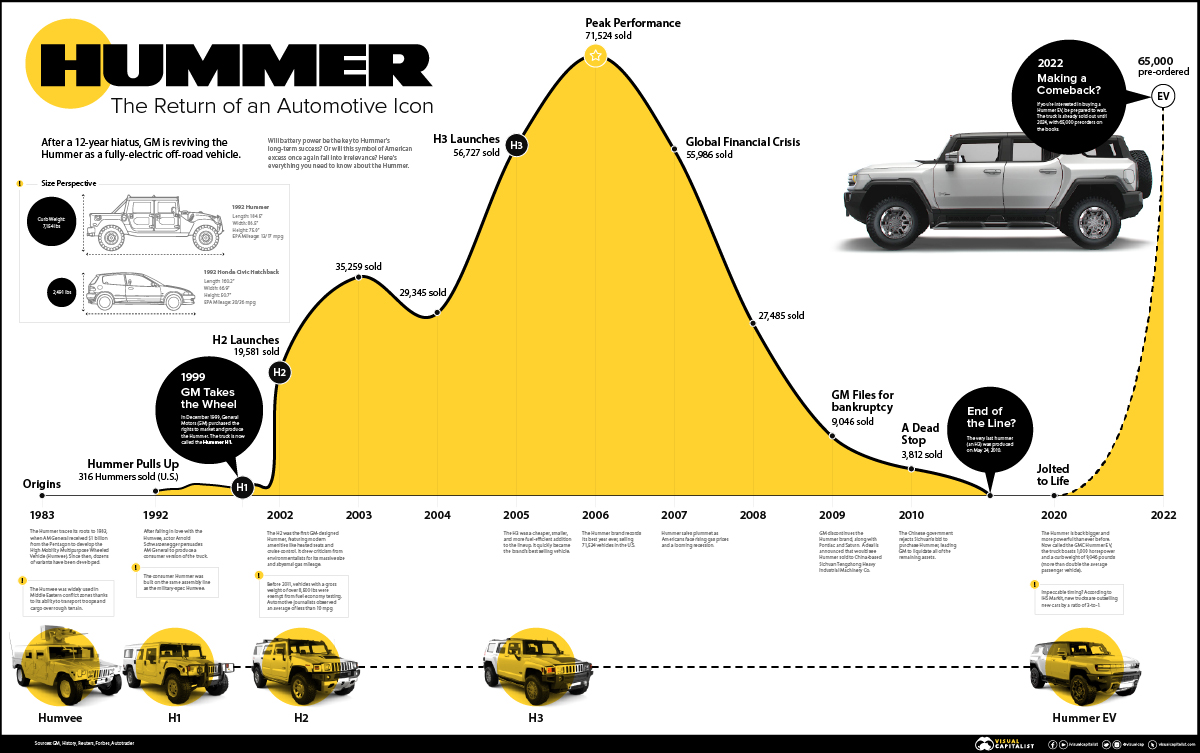

Timeline: The Rise, Fall, and Return of the Hummer

View the full-resolution version of this infographic

Timeline: The Rise, Fall, and Return of the Hummer

The Hummer brand has a relatively short history, but its trucks are some of America’s biggest automotive icons (both figuratively and literally). Originally designed for the military, Hummers are famous for their size, off-road capability, and of course, fuel consumption.

The latter proved to be the Hummer’s Achilles’ heel. By 2007, a recession was coming, and the appetite for oversized gas guzzlers had shrunk. The Hummer brand was discontinued, and its last truck rolled off the production line in 2010.

Over a decade later, GM is reviving the Hummer as a fully-electric off-road vehicle. Preorders have surpassed 65,000 units, but how does this compare to the brand’s heyday in the 2000s?

The Origins

The Hummer traces its roots to 1983, when AM General, a heavy vehicle manufacturer, received $1 billion from the Pentagon to build the High Mobility Multipurpose Wheeled Vehicle (Humvee).

The Humvee became a staple of the U.S. military, and by 1991, 72,000 had been produced. The truck was especially useful in Middle Eastern conflict zones due to its ability to transport troops and cargo over rough terrain.

If you’re wondering how this military vehicle ended up on public roads, you can thank none other than Arnold Schwarzenegger.

While filming the 1990 action-comedy, Kindergarten Cop, Arnold reportedly fell in love with a Humvee used on set. He later persuaded AM General to produce a consumer version of the truck, which arrived in 1992 under the name “Hummer”.

Apart from adding creature comforts like air conditioning, AM General made very few changes to the consumer-spec Hummer. It was notoriously crude and unsuited for city driving, but its military roots gave it plenty of character. GM saw an opportunity in expanding the brand, so in 1999, it purchased the rights to produce and market the Hummer.

Rise and Fall

GM moved rather quickly after purchasing Hummer. It renamed the truck to “H1”, and released an “H2” just a few years later.

Sales in the U.S. jumped, hitting over 35,000 in 2003 before tapering off slightly. To keep momentum going, GM rolled out the smaller and cheaper “H3” in 2005. Sales once again spiked, and the brand recorded over 71,000 sales in 2006.

Unfortunately, what goes up eventually comes down. In 2009, during GM’s bankruptcy proceedings, the Hummer brand was discontinued along with Pontiac and Saturn.

| Year | Annual U.S. Hummer Sales |

|---|---|

| 1992 | 316 |

| 1993 | 612 |

| 1994 | 718 |

| 1995 | 1,432 |

| 1996 | 1,374 |

| 1997 | 1,209 |

| 1998 | 945 |

| 1999 | 831 |

| 2000 | 1,333 |

| 2001 | 869 |

| 2002 | 19,581 |

| 2003 | 35,259 |

| 2004 | 29,345 |

| 2005 | 56,727 |

| 2006 | 71,524 |

| 2007 | 55,986 |

| 2008 | 27,485 |

| 2009 | 9,046 |

| 2010 | 3,812 |

| 2011 | 0 |

So what went wrong? For starters, the H2 was a victim of the times. It was large, expensive, and extremely thirsty for gas—attributes that don’t fare well during an economic recession.

In fact, the H2 never received an official fuel economy rating from the Environmental Protection Agency (EPA) because it was too heavy. Regulations at the time excluded vehicles over 8,500 lbs from testing, though journalists observed an average of less than 10 mpg.

The H3 mitigated some of these issues by downsizing, and it quickly become the brand’s best selling vehicle. This success was short-lived, as the H3 alone could not sustain the brand.

Jolted to Life

In 2020, GM announced the all-electric Hummer EV. It bears a strong resemblance to the H2, carrying over iconic design elements such as the front grill with vertical slats.

Compared to the H2, this electric model is longer, wider, and heavier. Estimates suggest that it will weigh over 9,000 lbs, which according to EPA estimates, is more than double the weight of the average car. This is primarily attributed to the truck’s vast quantity of battery packs.

Power is also increased thanks to the electric drivetrain, with the “Edition 1” model boasting 1,000 horsepower from its three electric motors (a similar configuration to Tesla’s Plaid platform). Lesser models, which only have two motors, are expected to generate north of 600 horsepower.

A Promising Restart

Will battery power be the key to the Hummer’s long-term success?

So far, GM appears to have played its cards right. New trucks are outselling new cars by a ratio of 3-to-1 in the U.S., and the release of the Hummer EV is well-timed to capitalize on this trend.

The Hummer EV also sheds one of its predecessors’ biggest weaknesses—fuel consumption. With gas prices at all-time highs, can we dare to call the new Hummer “economical”?

Either way, GM is certainly enjoying the economic benefits of its decision. Over 65,000 pre-orders have been received, and production of the Hummer EV is completely sold out until 2024. The truck is being built at Factory Zero in Michigan, which is GM’s first EV-dedicated production facility.

Lithium

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and various Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) | Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳 China | 242,700 | 34% |

| BYD | 🇨🇳 China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷 Korea | 108,487 | 15% |

| Panasonic | 🇯🇵 Japan | 56,560 | 8% |

| SK On | 🇰🇷 Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷 Korea | 35,703 | 5% |

| CALB | 🇨🇳 China | 23,493 | 3% |

| Farasis Energy | 🇨🇳 China | 16,527 | 2% |

| Envision AESC | 🇨🇳 China | 8,342 | 1% |

| Sunwoda | 🇨🇳 China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Money2 weeks ago

Money2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries