Markets

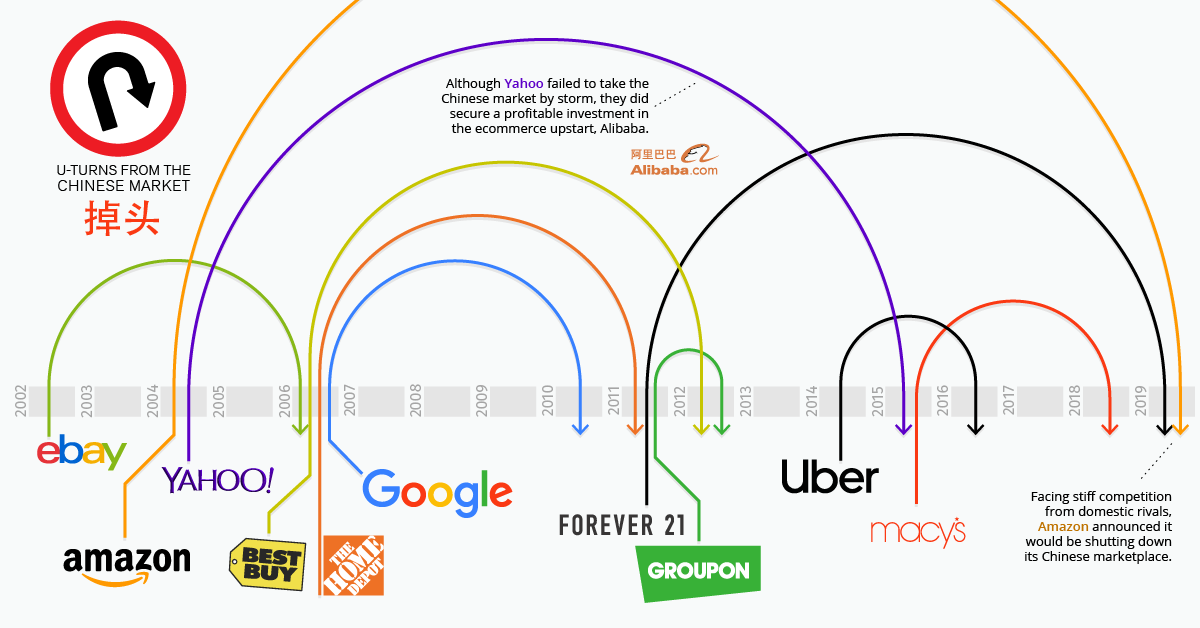

A Timeline of U-Turns from the Chinese Market

China’s economic surge is one of the biggest stories of the 21st century.

Hundreds of millions of people have been lifted out of poverty, and China’s swelling middle class has attracted the interest of Western companies.

As many American companies have discovered, doing business in China is far from straightforward. Recent history is littered with examples of companies that entered the Chinese market to great fanfare, only to retreat a few years later.

Calling Off The Offensive

Today’s infographic highlights 11 companies that ended up tapping the brakes on their ambitious forays on the other side of the Pacific.

Then, we take a look at the factors that influenced these strategic withdrawals.

Here are some high profile examples of corporate u-turns by American companies operating in the Chinese market:

When Google China’s search engine was launched in 2006, the company had made the controversial decision to censor search results within the country. Google publicly displayed a disclaimer indicating that some results were removed, which created tensions with the Chinese government.

For a while, things seemed to be going well. Even though a domestic company, Baidu, had captured the majority of the Chinese search market, Google did have a respectable market share of about 30%.

Google China’s fortune took a turn for the worse in 2010 after a major hack – Operation Aurora – exposed user data as well as intellectual property. The hack, which originated from within China, was the last straw for Google’s executive team. After one last ditch effort to provide unfiltered search results within China, the company retreated beyond the firewall.

Amazon

Amazon was an early entrant into the Chinese market. In 2004, the company acquired Joyo – an online shopping site – which was eventually rebranded to Amazon China in 2011.

Amazon China achieved some early success hitting a market share of around 15%, but today, that market share has eroded to less than 1%. Facing nearly insurmountable competition from domestic e-commerce platforms like JD and Taobao, the company recently announced it would be exiting the Chinese market.

Uber

After arriving fashionably late for the ride-hailing party in 2014, it quickly became clear that Uber was facing an uphill battle against well-funded domestic rivals. After only two years, Uber elected to u-turn out of the Chinese market.

Though Uber’s tactical exit from China is often viewed as a failure, the company has earned upwards of $8B through its sale to competitor Didi Chuxing.

A Two-Way Street

Now that red-hot growth at home is beginning to taper off, a number of Chinese companies have begun their push into other markets around the world. Much like their American counterparts, brands pushing beyond China’s borders are seeing varied success in their expansion efforts.

One high-profile example is Huawei. The telecommunications giant has been making inroads in countries around the world – particularly in emerging markets – but has seen pushback and scrutiny in a number of developed economies. Huawei has become a lightning rod for growing concerns over government surveillance and China’s growing influence over the global communications network.

Already, Australia has blocked the company from participating in its 5G network, and in the United States, government agencies are banned from buying Huawei gear.

If negative sentiment continues to build, it remains to be seen whether Huawei and other Chinese companies will follow the playbook of American brands in China, and turn the car around.

Economy

Economic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

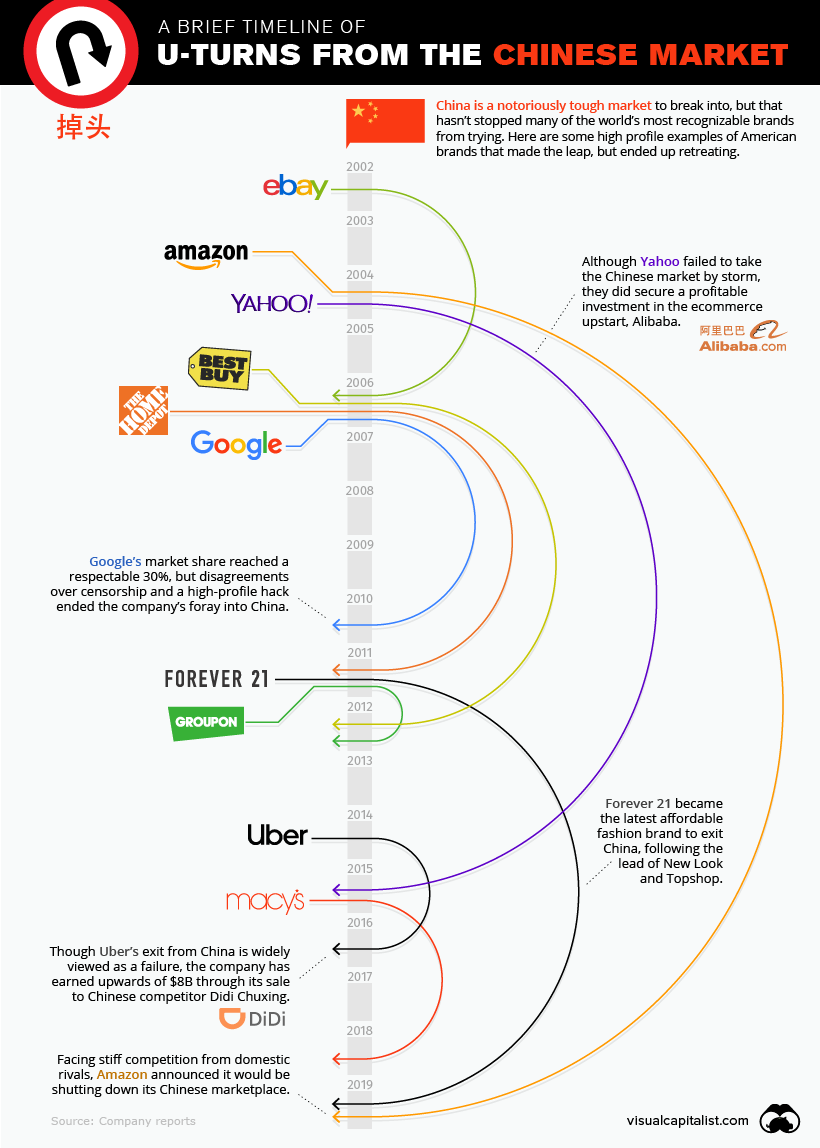

G7 & BRICS Real GDP Growth Forecasts for 2024

The International Monetary Fund’s (IMF) has released its real gross domestic product (GDP) growth forecasts for 2024, and while global growth is projected to stay steady at 3.2%, various major nations are seeing declining forecasts.

This chart visualizes the 2024 real GDP growth forecasts using data from the IMF’s 2024 World Economic Outlook for G7 and BRICS member nations along with Saudi Arabia, which is still considering an invitation to join the bloc.

Get the Key Insights of the IMF’s World Economic Outlook

Want a visual breakdown of the insights from the IMF’s 2024 World Economic Outlook report?

This visual is part of a special dispatch of the key takeaways exclusively for VC+ members.

Get the full dispatch of charts by signing up to VC+.

Mixed Economic Growth Prospects for Major Nations in 2024

Economic growth projections by the IMF for major nations are mixed, with the majority of G7 and BRICS countries forecasted to have slower growth in 2024 compared to 2023.

Only three BRICS-invited or member countries, Saudi Arabia, the UAE, and South Africa, have higher projected real GDP growth rates in 2024 than last year.

| Group | Country | Real GDP Growth (2023) | Real GDP Growth (2024P) |

|---|---|---|---|

| G7 | 🇺🇸 U.S. | 2.5% | 2.7% |

| G7 | 🇨🇦 Canada | 1.1% | 1.2% |

| G7 | 🇯🇵 Japan | 1.9% | 0.9% |

| G7 | 🇫🇷 France | 0.9% | 0.7% |

| G7 | 🇮🇹 Italy | 0.9% | 0.7% |

| G7 | 🇬🇧 UK | 0.1% | 0.5% |

| G7 | 🇩🇪 Germany | -0.3% | 0.2% |

| BRICS | 🇮🇳 India | 7.8% | 6.8% |

| BRICS | 🇨🇳 China | 5.2% | 4.6% |

| BRICS | 🇦🇪 UAE | 3.4% | 3.5% |

| BRICS | 🇮🇷 Iran | 4.7% | 3.3% |

| BRICS | 🇷🇺 Russia | 3.6% | 3.2% |

| BRICS | 🇪🇬 Egypt | 3.8% | 3.0% |

| BRICS-invited | 🇸🇦 Saudi Arabia | -0.8% | 2.6% |

| BRICS | 🇧🇷 Brazil | 2.9% | 2.2% |

| BRICS | 🇿🇦 South Africa | 0.6% | 0.9% |

| BRICS | 🇪🇹 Ethiopia | 7.2% | 6.2% |

| 🌍 World | 3.2% | 3.2% |

China and India are forecasted to maintain relatively high growth rates in 2024 at 4.6% and 6.8% respectively, but compared to the previous year, China is growing 0.6 percentage points slower while India is an entire percentage point slower.

On the other hand, four G7 nations are set to grow faster than last year, which includes Germany making its comeback from its negative real GDP growth of -0.3% in 2023.

Faster Growth for BRICS than G7 Nations

Despite mostly lower growth forecasts in 2024 compared to 2023, BRICS nations still have a significantly higher average growth forecast at 3.6% compared to the G7 average of 1%.

While the G7 countries’ combined GDP is around $15 trillion greater than the BRICS nations, with continued higher growth rates and the potential to add more members, BRICS looks likely to overtake the G7 in economic size within two decades.

BRICS Expansion Stutters Before October 2024 Summit

BRICS’ recent expansion has stuttered slightly, as Argentina’s newly-elected president Javier Milei declined its invitation and Saudi Arabia clarified that the country is still considering its invitation and has not joined BRICS yet.

Even with these initial growing pains, South Africa’s Foreign Minister Naledi Pandor told reporters in February that 34 different countries have submitted applications to join the growing BRICS bloc.

Any changes to the group are likely to be announced leading up to or at the 2024 BRICS summit which takes place October 22-24 in Kazan, Russia.

Get the Full Analysis of the IMF’s Outlook on VC+

This visual is part of an exclusive special dispatch for VC+ members which breaks down the key takeaways from the IMF’s 2024 World Economic Outlook.

For the full set of charts and analysis, sign up for VC+.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023