Technology

Time Machine: Apple vs. Microsoft vs. IBM over the Last 20 Years

A decade ago, if you asked someone how they would get rich off of a time travel machine, a fairly common answer would be to go back in time and buy shares of Microsoft after its 1986 IPO.

While this is still a great answer today, the value of the software giant actually peaked back in 1999 with a market capitalization of $613 billion. Microsoft today is worth far less at only $443 billion – and after adjusting for inflation, that makes it worth around half of its peak value in 1999.

That raises the question – if we were to go back 20 years in time today, which company would be the best buy?

Stockchoker, a website that shows you the hypothetical value of stocks that you could have bought, covers this exact premise in an interactive visualization. Starting with $1,000 on January 1, 1996, the visualization shows the value of this money invested in each of Microsoft, IBM, and Apple.

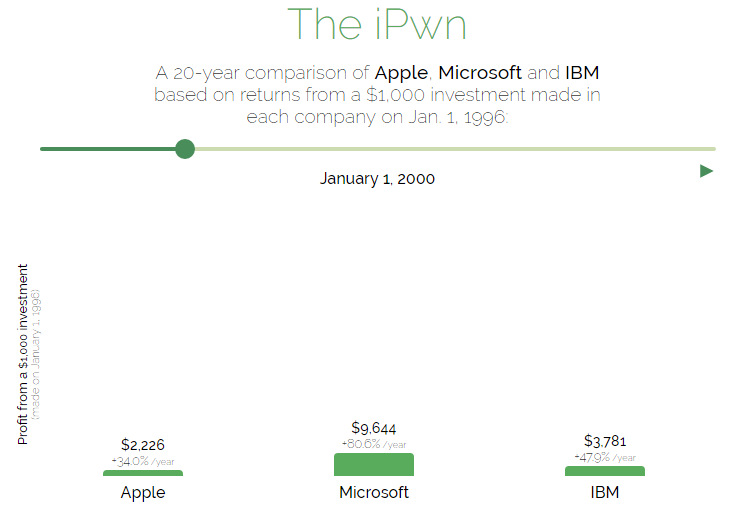

Let’s start by looking at Jan 1, 2000 on the timeline, near Microsoft’s peak market cap:

Four years after the initial investment, Microsoft has returned an impressive 80% per year. Meanwhile, IBM is also growing fast at a clip of about 48% per annum, and Apple is working to reinvent itself as a company. Keep in mind the release of the iPod has not happened yet – that would occur to much fanfare in 2001.

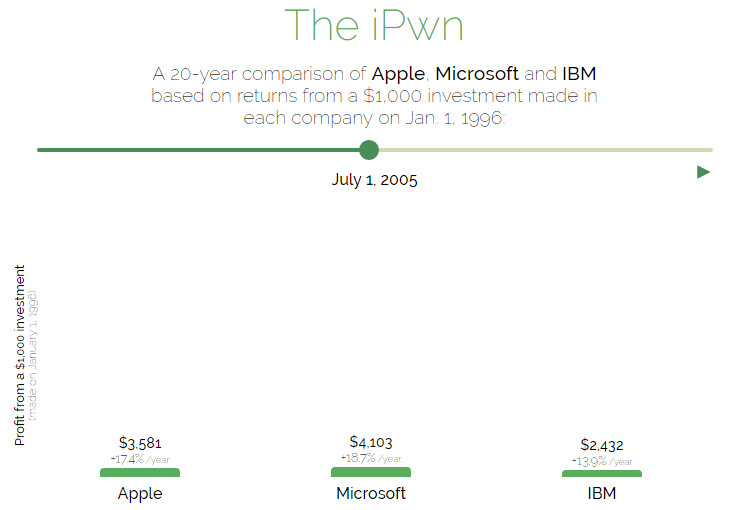

Close to ten years later, the reinvented Apple is a success story. The iPod is flying off the shelves, and computer sales have increased dramatically. Although Microsoft still has the lead in terms of market valuation, the launch of the iPhone in 2006 would change everything.

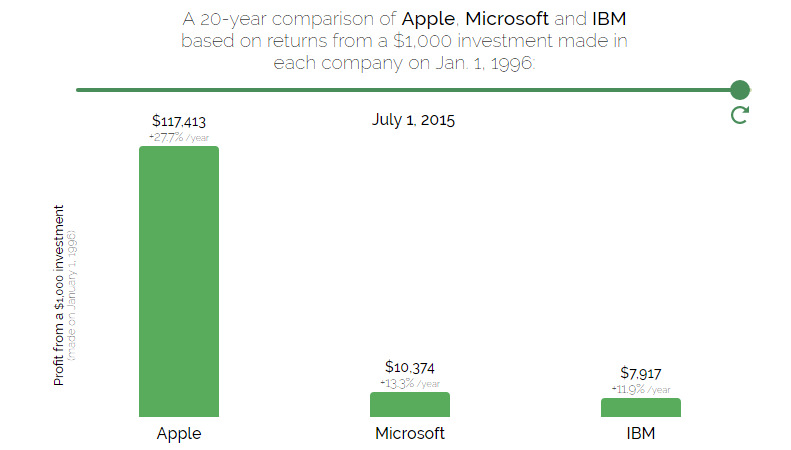

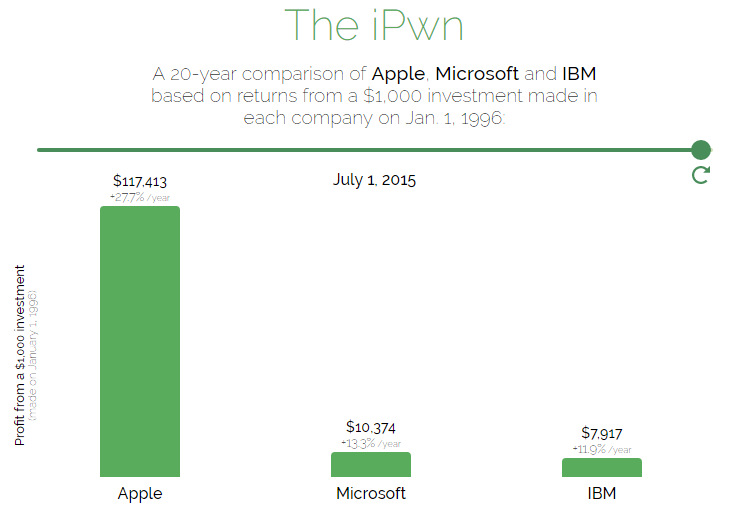

Finally, we’ve reached mid-2015. Apple is now primarily in competition with Google (which IPO’d in 2004) for the most valuable company in the world. The $1,000 invested in Apple in 1996 is now worth a hefty $117,413 for a return of over 100x.

Want to travel back in time and watch this for yourself? Visit the interactive visualization by clicking here.

Brands

How Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

How Tech Logos Have Evolved Over Time

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

One would be hard-pressed to find a company that has never changed its logo. Granted, some brands—like Rolex, IBM, and Coca-Cola—tend to just have more minimalistic updates. But other companies undergo an entire identity change, thus necessitating a full overhaul.

In this graphic, we visualized the evolution of prominent tech companies’ logos over time. All of these brands ranked highly in a Q1 2024 YouGov study of America’s most famous tech brands. The logo changes are sourced from 1000logos.net.

How Many Times Has Google Changed Its Logo?

Google and Facebook share a 98% fame rating according to YouGov. But while Facebook’s rise was captured in The Social Network (2010), Google’s history tends to be a little less lionized in popular culture.

For example, Google was initially called “Backrub” because it analyzed “back links” to understand how important a website was. Since its founding, Google has undergone eight logo changes, finally settling on its current one in 2015.

| Company | Number of Logo Changes |

|---|---|

| 8 | |

| HP | 8 |

| Amazon | 6 |

| Microsoft | 6 |

| Samsung | 6 |

| Apple | 5* |

Note: *Includes color changes. Source: 1000Logos.net

Another fun origin story is Microsoft, which started off as Traf-O-Data, a traffic counter reading company that generated reports for traffic engineers. By 1975, the company was renamed. But it wasn’t until 2012 that Microsoft put the iconic Windows logo—still the most popular desktop operating system—alongside its name.

And then there’s Samsung, which started as a grocery trading store in 1938. Its pivot to electronics started in the 1970s with black and white television sets. For 55 years, the company kept some form of stars from its first logo, until 1993, when the iconic encircled blue Samsung logo debuted.

Finally, Apple’s first logo in 1976 featured Isaac Newton reading under a tree—moments before an apple fell on his head. Two years later, the iconic bitten apple logo would be designed at Steve Jobs’ behest, and it would take another two decades for it to go monochrome.

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue