Technology

The 3 Types of Quantum Computers and Their Applications

The 3 Types of Quantum Computers and Their Applications

It’s an exciting time in computing.

Just days ago, Google’s AlphaGo AI took an insurmountable lead in the 3,000 year-old game of Go against the reigning world champion, Lee Sedol. In a five-game series, the score is now 3-1 for the machine with one game left on March 15, 2016 in Seoul, South Korea.

While IBM’s Deep Blue beat reigning chess champion Garry Kasparov in 1997 by using brute force, Go is a game with more possible moves than atoms in the known universe (literally). Therefore, the technology doesn’t yet exist to make such calculations in short amounts of time.

Google had to take a different approach: to beat the grand master, it needed to enable AlphaGo to self-improve through deep learning.

AlphaGo’s historical decision is a milestone for artificial intelligence, and now the technology community is anxiously waiting to see what’s next for AI. Some say that it is beating a human world champion at a real-time strategy game such as Starcraft, while others look to quantum computing – technology that could raise the potential power of AI exponentially.

What is Quantum Computing?

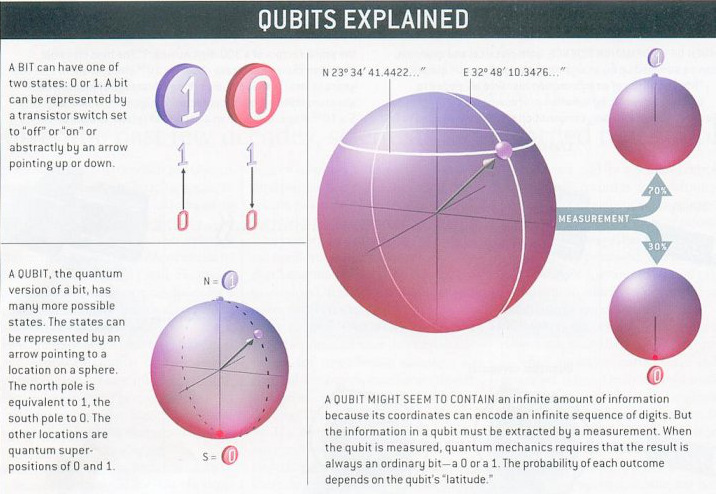

While everyday analog computing is limited to having a single value of either 0 or 1 for each bit, quantum computing uses quantum bits (qubits) that are simultaneously in both states (0 and 1) at the same time.

The consequence of this superposition, as it’s called, is that quantum computers are able to test every solution of a problem at once. Further, because of this exponential relationship, such computers should be able to double their quantum computing power with each additional qubit.

Image credit: Universe Review

Types of Quantum Computers

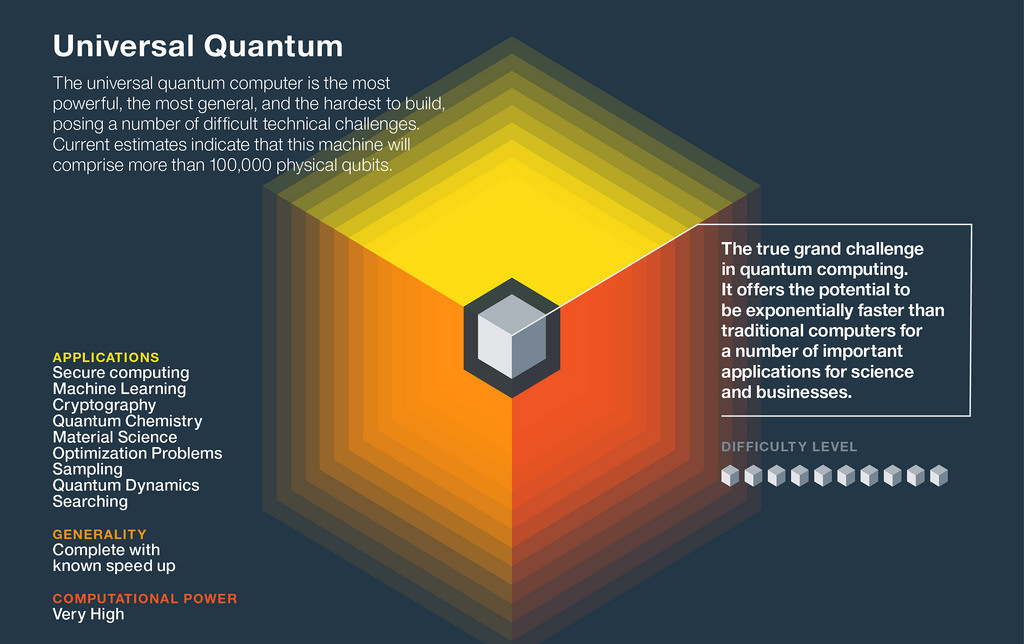

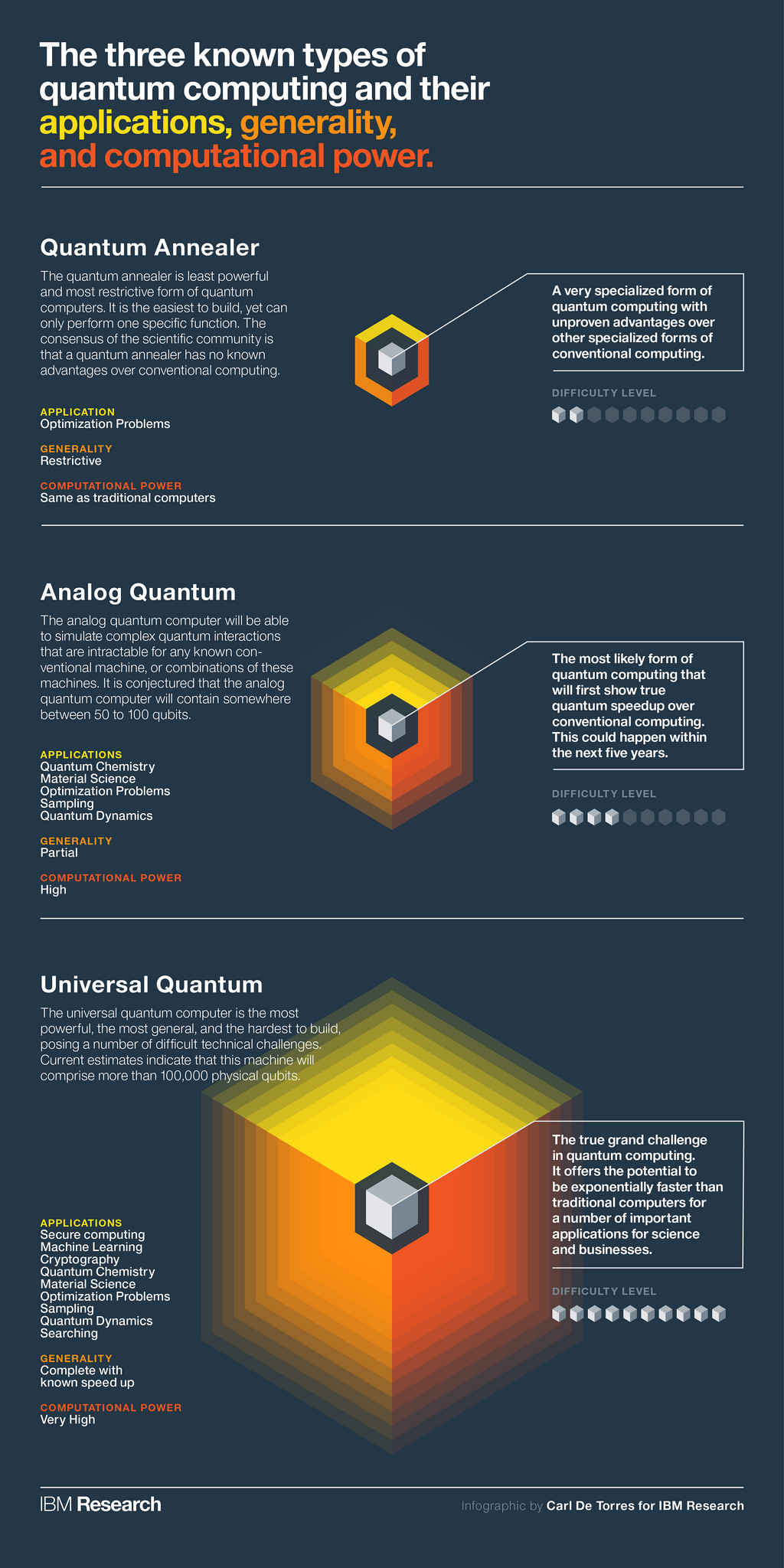

There are three types of quantum computers that are considered to be possible by IBM. Shown in the above infographic, they range from a quantum annealer to a universal quantum.

The quantum annealer has been successfully developed by Canadian company D-Wave, but it is difficult to tell whether it actually has any real “quantumness” thus far. Google added credibility to this notion in December 2015, when it revealed tests showing that its D-Wave quantum computer was 3,600 times faster than a supercomputer at solving specific, complex problems.

Expert opinion, however, is still skeptical on these claims. Such criticisms also shed light on the major limitation of quantum annealers, which is that they may only be engineered to solve very specific optimization problems, and have limited general practicality.

The holy grail of quantum computing is the universal quantum, which could allow for exponentially faster calculations with more generality.

However, building such a device ends up posing a number of important technical challenges. Quantum particles turn out to be quite fickle, and the smallest interference from light or sound can create errors in the computing process.

Doing calculations at exponential speeds is not very useful when those calculations are incorrect.

The Market and Applications

IBM highlights just some of the possibilities around universal quantum computers in a recent press release:

A universal quantum computer uses quantum mechanics to process massive amounts of data and perform computations in powerful new ways not possible with today’s conventional computers. This type of leap forward in computing could one day shorten the time to discovery for life-saving cancer drugs to a fraction of what it is today; unlock new facets of artificial intelligence by vastly accelerating machine learning; or safeguard cloud computing systems to be impregnable from cyber-attack.

This means that quantum computing could be a trillion dollar market, touching massive future markets such as artificial intelligence, robotics, defense, cryptography, and pharmaceuticals.

However, until a universal quantum can be built, the market remains fairly limited in size and focused on R&D. Quantum computing is expected to surpass a market of $5 billion market by 2020.

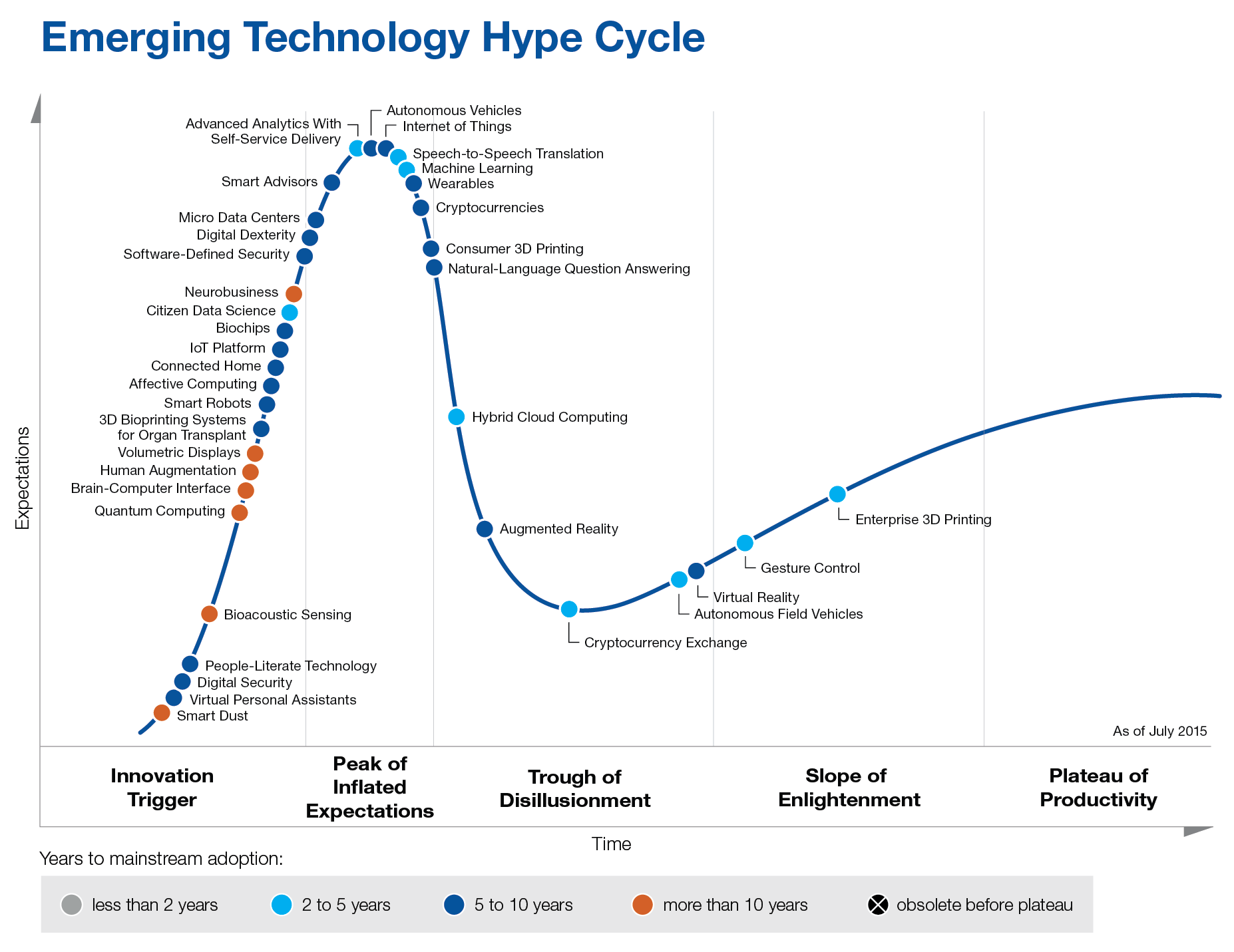

As a final note: its worth seeing where quantum computing sits on Gartner’s emerging technology hype cycle:

Gartner still describes it as being “10 years or more” away from reaching the plateau.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?