Economy

The Top 10 Biggest Companies in India

The Top 10 Biggest Companies in India

When India hosted the 13th BRICS summit in September 2021, it was the sixth-largest economy in the world with a GDP of $3.05 trillion.

That’s more than double the GDP it had when the country first joined the group of emerging economies in 2009 (alongside Brazil, Russia, China and later South Africa), at $1.3 trillion.

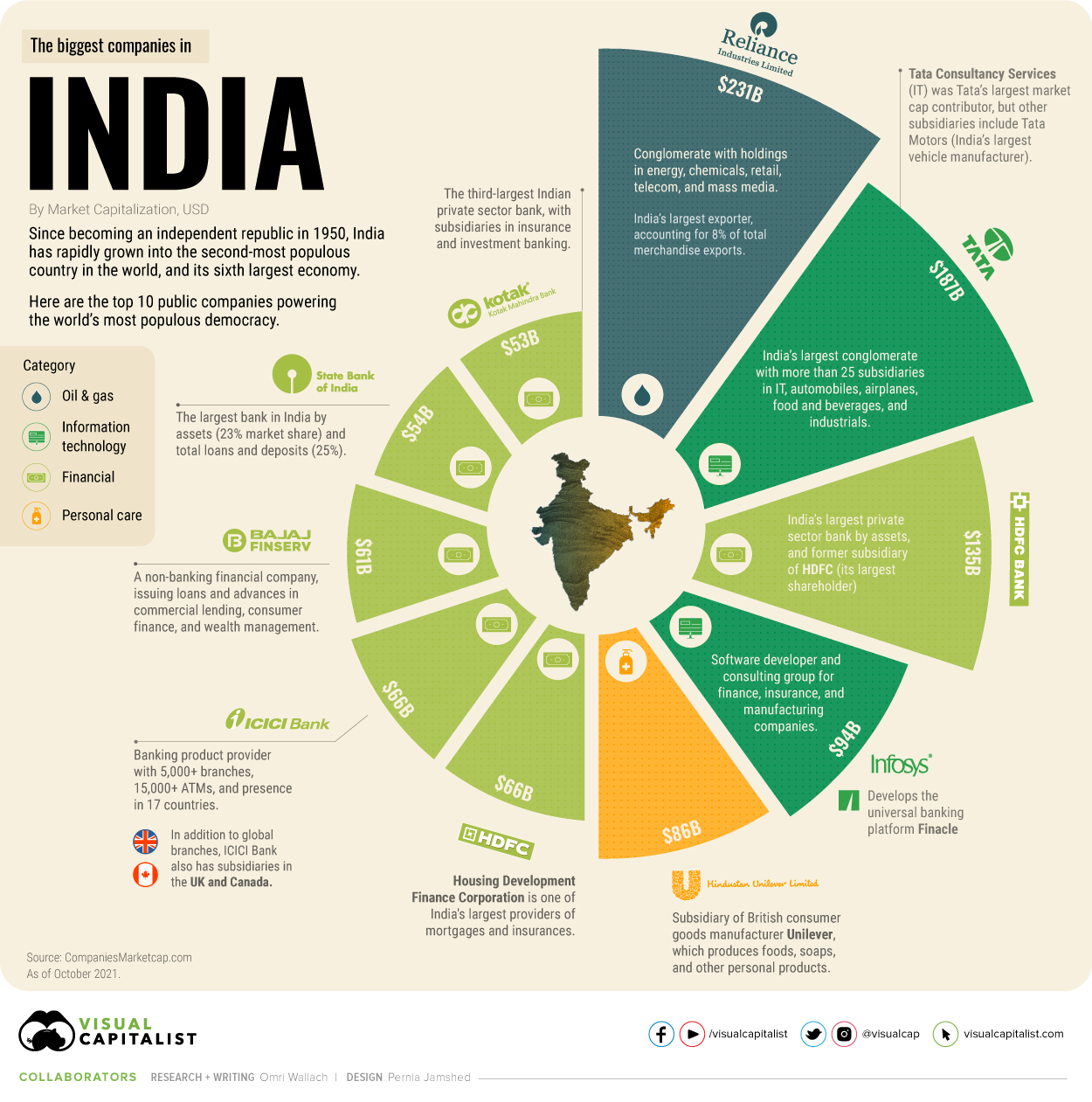

What are the major industries and companies driving this growth in GDP, and rising alongside it? This time we’re highlighting the top 10 biggest companies in India, the world’s most populous democracy.

What Are the Biggest Public Companies in India?

India’s growth to one of the world’s most powerful economies came extremely quickly, considering it only became a federal republic in 1950.

In 1951, the country was considered relatively impoverished compared to the Western world, with 361 million people, a per-capita income of just $64, and a literacy rate of 17%. By 2021, the population had surged to 1.2 billion, income rose to $1,498, and literacy climbed to 74%.

And most of that growth was fueled internally, as the Indian government was largely protectionist until the 1990s. Today, its free market policies and wide cultural reach help bolster the country’s massive industrial, agricultural, and telecommunications industries.

Here are India’s biggest public companies by market capitalization in October 2021:

| Top 10 Indian Companies | Category | Market Cap (USD) |

|---|---|---|

| Reliance Industries | Oil and Gas | $230.7B |

| Tata Group | Information Technology | $186.7B |

| HDFC Bank | Financial | $135.1B |

| Infosys | Information Technology | $94.4B |

| Hindustan Unilever | Personal Care | $85.6B |

| Housing Development Finance Corporation (HDFC) | Financial | $66.0B |

| ICICI Bank | Financial | $65.7B |

| Bajaj Finance | Financial | $61.7B |

| State Bank of India | Financial | $54.3B |

| Kotak Mahindra Bank | Financial | $53.3B |

Topping the charts are two massive conglomerates, Reliance Industries with a market cap of $231 billion and Tata Group with a market cap of $187 billion.

Reliance started in textile production before a string of oil discoveries and purchases saw it overtake state-owned oil enterprises in revenue. Now the conglomerate also has holdings in petrochemicals, retail, telecom, and mass media, making chairman and largest shareholder Mukesh Ambani the richest person in Asia with a net worth of $100 billion.

But India’s largest conglomerate is Tata Group, with more than 25 subsidiaries in IT (its largest income source), airplanes, food and beverages, and industrials. Tata Motors is India’s largest vehicle manufacturer, and the owner of South Korea’s Daewoo and the UK’s Jaguar Land Rover.

India’s Top 10 Biggest Companies Mainly in Financials

Outside of major conglomerates and a well-known subsidiary, India’s top 10 biggest companies are concentrated in the financial sector.

One of those is HDFC Bank with a market cap of $135.1 billion. An offshoot of the #6 ranked company Housing Development Finance Corporation, HDFC Bank is India’s largest private sector bank by assets.

In total, financials make up six of India’s 10 biggest companies. In addition to HDFC, they include banking provider ICICI Bank (which also has subsidiaries in the UK and Canada), commercial lending company Bajaj Finance, and banks Kotak Mahindra Bank and State Bank of India (the country’s first national bank and its largest).

But there were two non-financial companies bigger than most of India’s banks; Financial software developer and consultant Infosys and personal products company Hindustan Unilever, a subsidiary of British consumer goods giant Unilever.

India is also an agricultural powerhouse—the world’s largest producer of milk and second largest of tea—but most of it is consumed internally by its sizable population. Agriculture accounts for 18.1% of the country’s GDP, behind services at 55.6% and the industrial sector at 26.3%.

With more rapid economic growth on the horizon, India’s biggest companies list might shift over time. What other companies or industries do you associate with India?

Markets

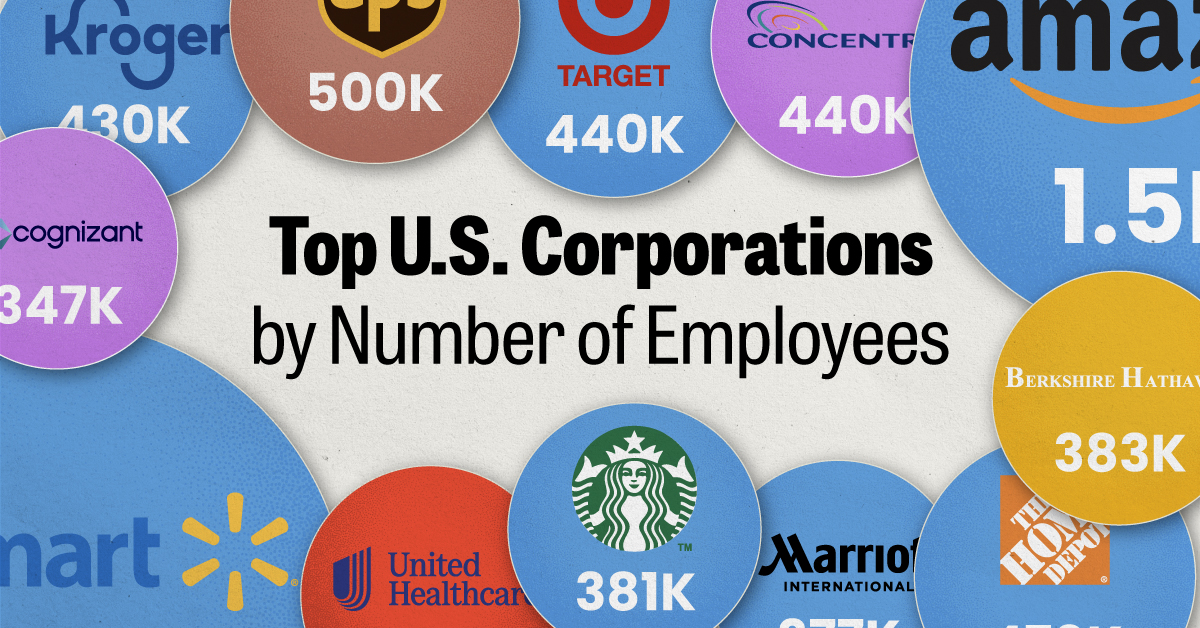

Ranked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

The Largest U.S. Corporations by Number of Employees

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Revenue and profit are common measures for measuring the size of a business, but what about employee headcount?

To see how big companies have become from a human perspective, we’ve visualized the top U.S. companies by employees. These figures come from companiesmarketcap.com, and were accessed in March 2024. Note that this ranking includes publicly-traded companies only.

Data and Highlights

The data we used to create this list of largest U.S. corporations by number of employees can be found in the table below.

| Company | Sector | Number of Employees |

|---|---|---|

| Walmart | Consumer Staples | 2,100,000 |

| Amazon | Consumer Discretionary | 1,500,000 |

| UPS | Industrials | 500,000 |

| Home Depot | Consumer Discretionary | 470,000 |

| Concentrix | Information Technology | 440,000 |

| Target | Consumer Staples | 440,000 |

| Kroger | Consumer Staples | 430,000 |

| UnitedHealth | Health Care | 400,000 |

| Berkshire Hathaway | Financials | 383,000 |

| Starbucks | Consumer Discretionary | 381,000 |

| Marriott International | Consumer Discretionary | 377,000 |

| Cognizant | Information Technology | 346,600 |

Retail and Logistics Top the List

Companies like Walmart, Target, and Kroger have a massive headcount due to having many locations spread across the country, which require everything from cashiers to IT professionals.

Moving goods around the world is also highly labor intensive, explaining why UPS has half a million employees globally.

Below the Radar?

Two companies that rank among the largest U.S. corporations by employees which may be less familiar to the public include Concentrix and Cognizant. Both of these companies are B2B brands, meaning they primarily work with other companies rather than consumers. This contrasts with brands like Amazon or Home Depot, which are much more visible among average consumers.

A Note on Berkshire Hathaway

Warren Buffett’s company doesn’t directly employ 383,000 people. This headcount actually includes the employees of the firm’s many subsidiaries, such as GEICO (insurance), Dairy Queen (retail), and Duracell (batteries).

If you’re curious to see how Buffett’s empire has grown over the years, check out this animated graphic that visualizes the growth of Berkshire Hathaway’s portfolio from 1994 to 2022.

-

Technology2 weeks ago

Technology2 weeks agoRanked: The Most Popular Smartphone Brands in the U.S.

-

Automotive1 week ago

Automotive1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money1 week ago

Money1 week agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Demographics2 weeks ago

Demographics2 weeks agoVisualizing the Size of the Global Senior Population