Technology

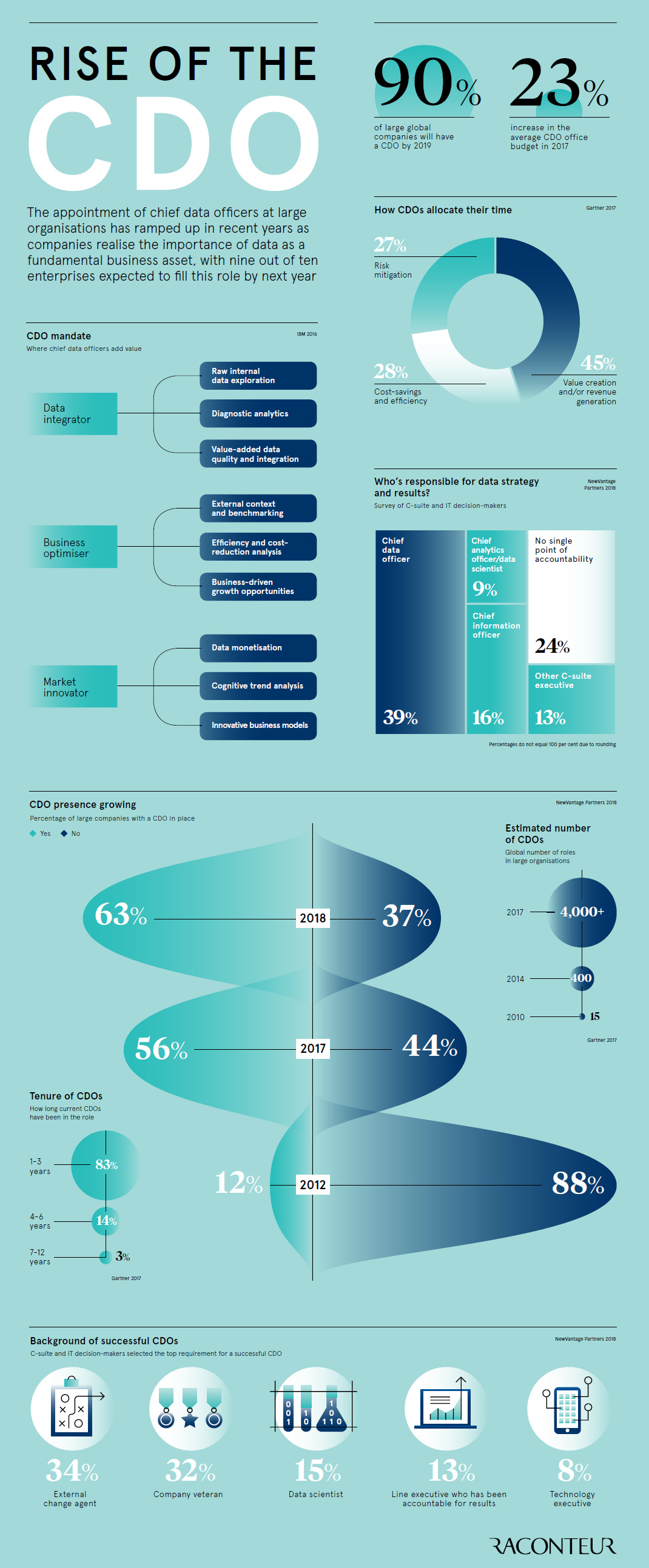

The Rise of the Chief Data Officer (CDO)

The Rise of the Chief Data Officer (CDO)

Data has taken on a central role in our daily lives, permeating nearly every activity in the business and public sectors. It’s now considered an essential piece of the puzzle for any serious organization, enabling everything from game-changing insights to the birth of entire new technologies or business models.

In fact, data is so important nowadays that some experts are saying that it’s the most valuable resource in the modern economy, even going as far as describing data as the “new oil”. While not everyone agrees with this kind of hyperbole, it’s fair to say that how organizations approach data will be a major determining factor for future growth and success – and thus, having someone to make the most of data is crucial.

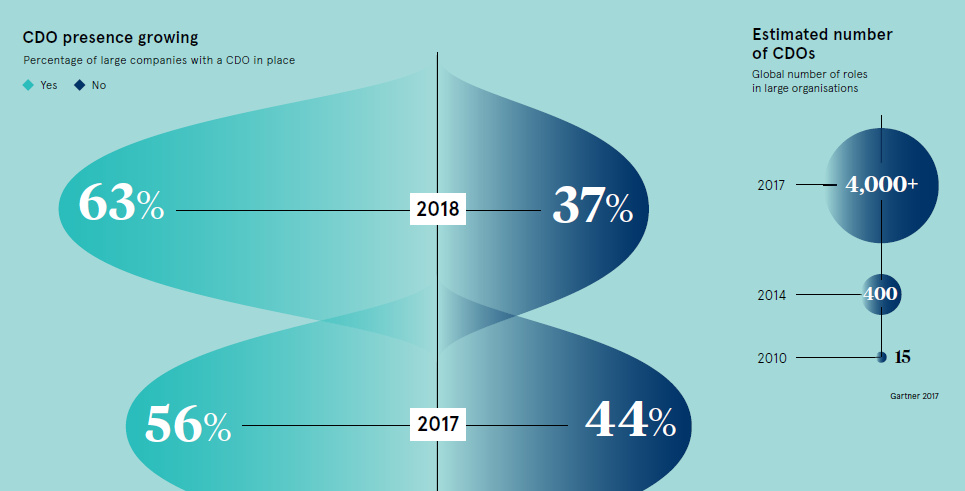

To guide these kinds of decisions, many organizations are making a structural change to their C-suite: the addition of a Chief Data Officer (CDO).

The Changing C-Suite

The set of executives that reports to the modern CEO is constantly evolving, and over the last couple of decades we’ve seen the implementation of other tech-focused positions such as the Chief Information Officer (CIO) and the Chief Technology Officer (CTO).

The CDO is the newest addition to the mix, and it’s a job that’s responsible for enterprise wide governance and utilization of information as an asset. This includes oversight over data processing, analysis, data mining, information trading, and other means.

Today’s infographic comes from Raconteur, and it breaks down organizational perspectives on the role of the CDO, along with how execs in this fast-evolving position are allocating their time to achieve their mandates.

The CDO Mandate

Approximately 90% of large global organizations will have a CDO by 2019, and the general mandate for most CDOs will be as follows:

Data Integrator:

Raw internal data exploration, diagnostic analytics, and value-added data quality and integration

Business Optimizer:

External context and benchmarking, cost-reduction analysis, and business-driven growth opportunities

Market Innovator:

Data monetization, cognitive trend analysis, and innovative business models

Meanwhile, Gartner breaks it down in a similar way, suggesting that CDOs spend 45% of their time focused on value creation or revenue generation, 27% on risk mitigation, and 28% on cost savings and efficiency.

Who Makes a Good CDO?

As with any new type of role, there are always questions about how to get someone that is the right fit.

Here is the background of successful CDOs thus far, according to NewVantage Partners:

| Background | Percentage of Successful CDOs |

|---|---|

| External change agent | 34% |

| Company veteran | 32% |

| Data scientist | 15% |

| Results-driving line executive | 13% |

| Technology executive | 8% |

Like the constantly evolving landscape of data itself, the role of CDO will keep changing in the future as more organizations search for new ways to make the most of this precious resource.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Travel1 week ago

Travel1 week agoRanked: The World’s Top Flight Routes, by Revenue

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024