Politics

The Obamacare Dilemma in One Infographic

The future of Obamacare is uncertain, to say the least.

President-elect Donald Trump has consistently called to repeal or replace the Affordable Care Act throughout his campaign, but many pundits see this as being a catch-22 for the incoming administration.

America’s healthcare system is already a global outlier (in a bad way), with disproportionate amounts of money being spent for very little return on life expectancy. For that reason, many people see the additional coverage of 20 million new people through Obamacare as a crucial step forward.

However, this new coverage hasn’t come without major challenges. Obamacare is plagued by soaring premiums, insurers leaving the program, and coverage monopolies in certain states. This puts America’s healthcare at an inflection point, and no one really seems to know how to solve it.

The Obamacare Dilemma

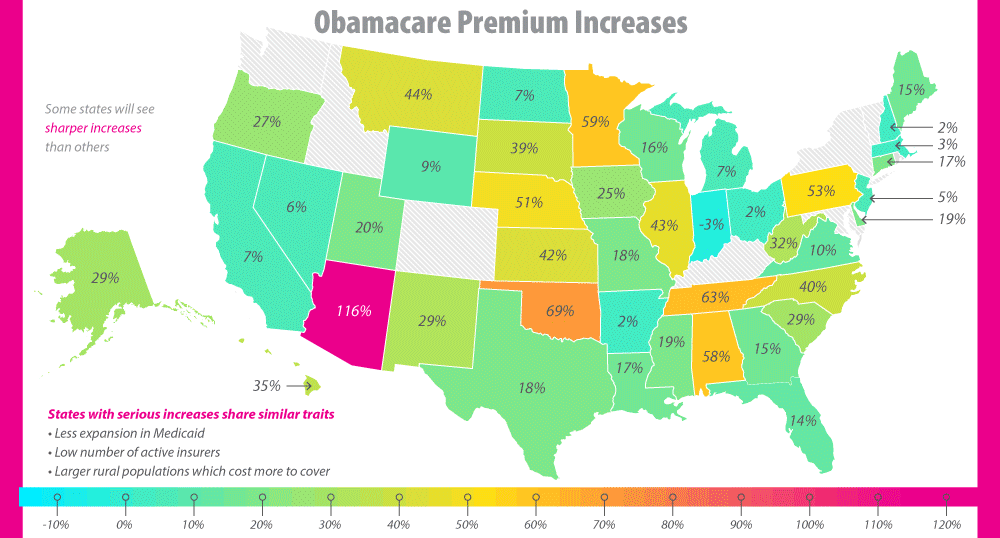

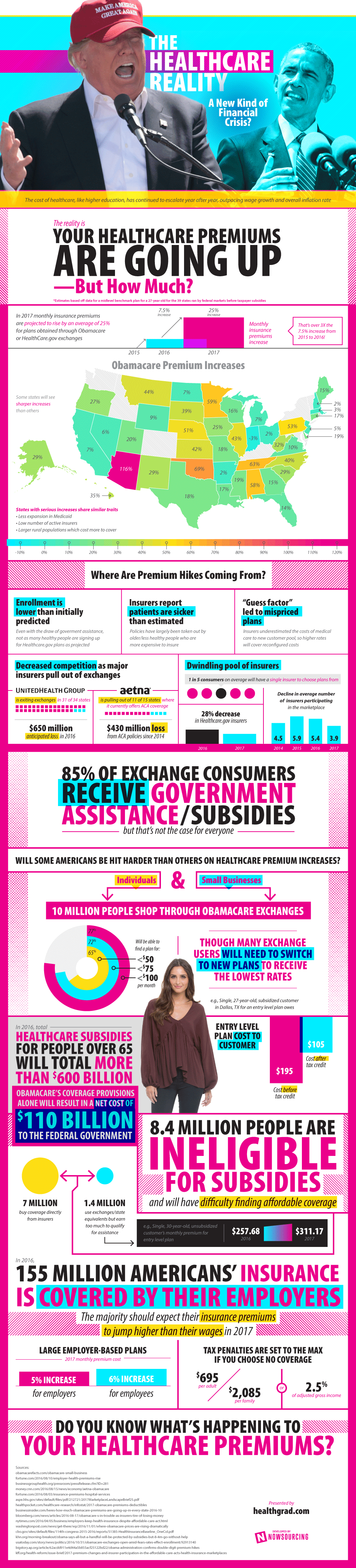

The following infographic from Healthgrad sums up the most recent metrics on Obamacare, as well as showing the double and triple digit rises in premiums that some states are facing.

As the infographic notes, the cost of healthcare has continued to escalate year after year, outpacing both inflation and wage growth. Obamacare has not been immune from this trend, and premiums are now being hiked because of low enrollment, mispriced plans, a dwindling pool of insurers, decreased competition in exchanges, and sicker patients than expected.

Despite only 25% of Americans supporting the outright repeal of Obamacare, it’s looking more and more likely that the healthcare system of tomorrow won’t look quite like it does today.

The Post-Obamacare Era

Right now, nobody knows quite what the future holds for U.S. healthcare.

Repealing or replacing Obamacare is fraught with at least six major issues, but perhaps the most significant one is a lack of decisiveness within the Republican party itself. What would Obamacare be replaced with, and how would that change be implemented?

Interestingly, there are at least seven Republican plans that have been tabled to replace Obamacare. Within that group, two of the more prominent ones come from Georgia Rep. Tom Price and House Speaker Paul Ryan.

Tom Price, who is Trump’s pick as the incoming secretary for the Department of Health and Human Services (HHS), has already published his consumer-driven healthcare model, and it already exists in legal language. In additional, Paul Ryan released his own proposal in the form of the A Better Way plan earlier this year, which also touches on other issues such as poverty, national security, and the economy.

Despite the number of options, the problem is that no one can agree on a particular solution. The party is heavily divided, and Trump is already receiving heavy blowback from the Tea Party faction for telegraphing potential delays in repealing or replacing the act.

Yes, the future of U.S. healthcare is murky – even to Trump and the GOP. However, what is clear is that with most chips stacked in the Republicans favor over the coming years, it is unlikely that they will miss the opportunity to initiate the post-Obamacare era in some shape or form.

Economy

The Bloc Effect: International Trade with Geopolitical Allies on the Rise

Rising geopolitical tensions are shaping the future of international trade, but what is the effect on trading among G7 and BRICS countries?

The Bloc Effect: International Trade with Allies on the Rise

International trade has become increasingly fragmented over the last five years as countries have shifted to trading more with their geopolitical allies.

This graphic from The Hinrich Foundation, the first in a three-part series covering the future of trade, provides visual context to the growing divide in trade in G7 and pre-expansion BRICS countries, which are used as proxies for geopolitical blocs.

Trade Shifts in G7 and BRICS Countries

This analysis uses IMF data to examine differences in shares of exports within and between trading blocs from 2018 to 2023. For example, we looked at the percentage of China’s exports with other BRICS members as well as with G7 members to see how these proportions shifted in percentage points (pp) over time.

Countries traded nearly $270 billion more with allies in 2023 compared to 2018. This shift came at the expense of trade with rival blocs, which saw a decline of $314 billion.

Country Change in Exports Within Bloc (pp) Change in Exports With Other Bloc (pp)

🇮🇳 India 0.0 3.9

🇷🇺 Russia 0.7 -3.8

🇮🇹 Italy 0.8 -0.7

🇨🇦 Canada 0.9 -0.7

🇫🇷 France 1.0 -1.1

🇪🇺 EU 1.1 -1.5

🇩🇪 Germany 1.4 -2.1

🇿🇦 South Africa 1.5 1.5

🇺🇸 U.S. 1.6 -0.4

🇯🇵 Japan 2.0 -1.7

🇨🇳 China 2.1 -5.2

🇧🇷 Brazil 3.7 -3.3

🇬🇧 UK 10.2 0.5

All shifts reported are in percentage points. For example, the EU saw its share of exports to G7 countries rise from 74.3% in 2018 to 75.4% in 2023, which equates to a 1.1 percentage point increase.

The UK saw the largest uptick in trading with other countries within the G7 (+10.2 percentage points), namely the EU, as the post-Brexit trade slump to the region recovered.

Meanwhile, the U.S.-China trade dispute caused China’s share of exports to the G7 to fall by 5.2 percentage points from 2018 to 2023, the largest decline in our sample set. In fact, partly as a result of the conflict, the U.S. has by far the highest number of harmful tariffs in place.

The Russia-Ukraine War and ensuing sanctions by the West contributed to Russia’s share of exports to the G7 falling by 3.8 percentage points over the same timeframe.

India, South Africa, and the UK bucked the trend and continued to witness advances in exports with the opposing bloc.

Average Trade Shifts of G7 and BRICS Blocs

Though results varied significantly on a country-by-country basis, the broader trend towards favoring geopolitical allies in international trade is clear.

Bloc Change in Exports Within Bloc (pp) Change in Exports With Other Bloc (pp)

Average 2.1 -1.1

BRICS 1.6 -1.4

G7 incl. EU 2.4 -1.0

Overall, BRICS countries saw a larger shift away from exports with the other bloc, while for G7 countries the shift within their own bloc was more pronounced. This implies that though BRICS countries are trading less with the G7, they are relying more on trade partners outside their bloc to make up for the lost G7 share.

A Global Shift in International Trade and Geopolitical Proximity

The movement towards strengthening trade relations based on geopolitical proximity is a global trend.

The United Nations categorizes countries along a scale of geopolitical proximity based on UN voting records.

According to the organization’s analysis, international trade between geopolitically close countries rose from the first quarter of 2022 (when Russia first invaded Ukraine) to the third quarter of 2023 by over 6%. Conversely, trade with geopolitically distant countries declined.

The second piece in this series will explore China’s gradual move away from using the U.S. dollar in trade settlements.

Visit the Hinrich Foundation to learn more about the future of geopolitical trade

-

Economy21 hours ago

Economy21 hours agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

-

United States1 week ago

United States1 week agoRanked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

We visualized product categories that saw the highest % increase in price due to U.S. inflation as of March 2024.

-

Economy4 weeks ago

Economy4 weeks agoG20 Inflation Rates: Feb 2024 vs COVID Peak

We visualize inflation rates across G20 countries as of Feb 2024, in the context of their COVID-19 pandemic peak.

-

Economy1 month ago

Economy1 month agoMapped: Unemployment Claims by State

This visual heatmap of unemployment claims by state highlights New York, California, and Alaska leading the country by a wide margin.

-

Economy2 months ago

Economy2 months agoConfidence in the Global Economy, by Country

Will the global economy be stronger in 2024 than in 2023?

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Money2 weeks ago

Money2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries