Chart of the Week

The Most Miserable Countries in the World

The Most Miserable Countries in the World

Some people believe that happiness comes from within. In the world of economics, however, happiness may be more linked to quantitative factors such as inflation, lending rates, employment levels, and growth in gross domestic product (GDP).

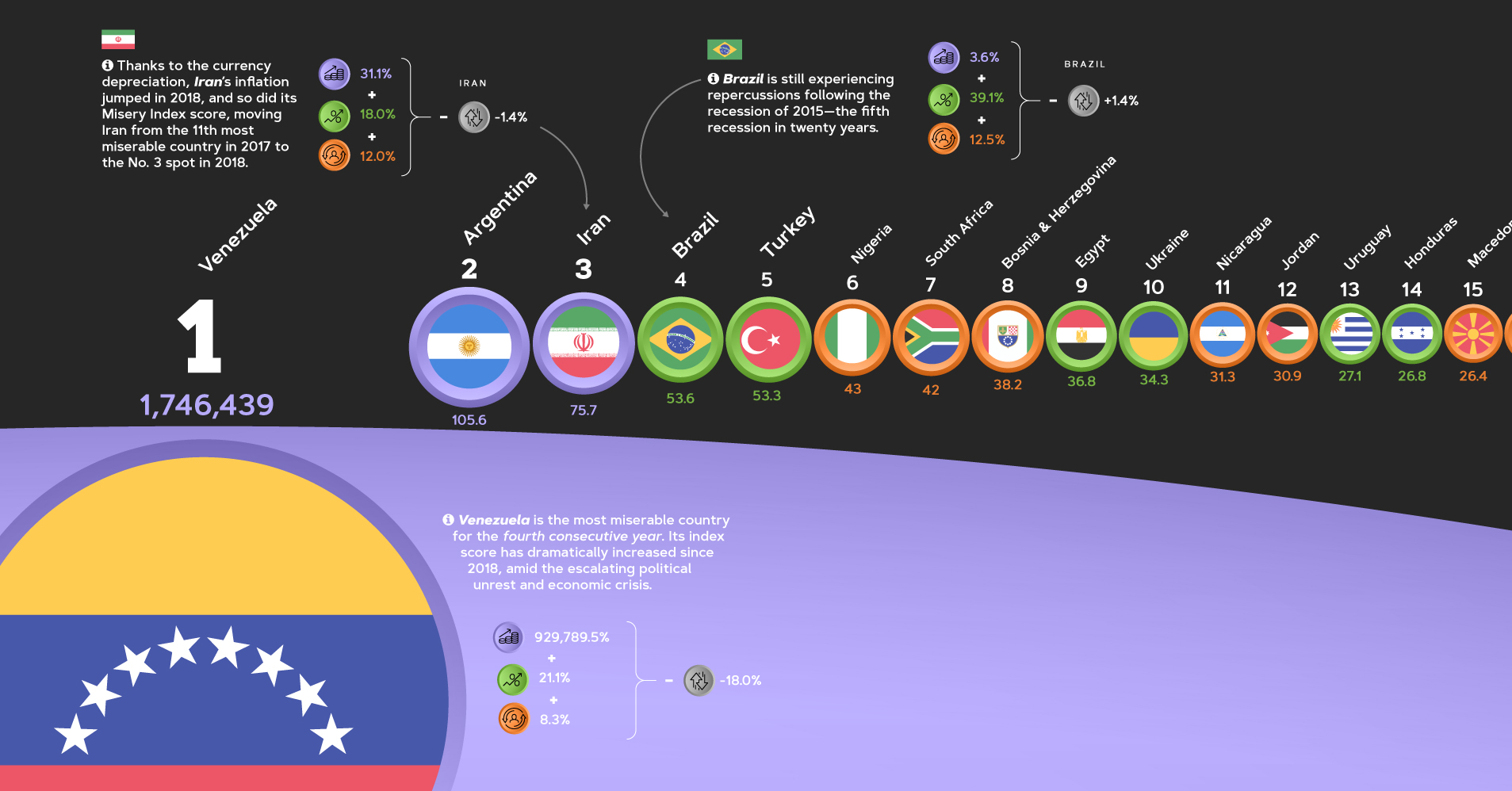

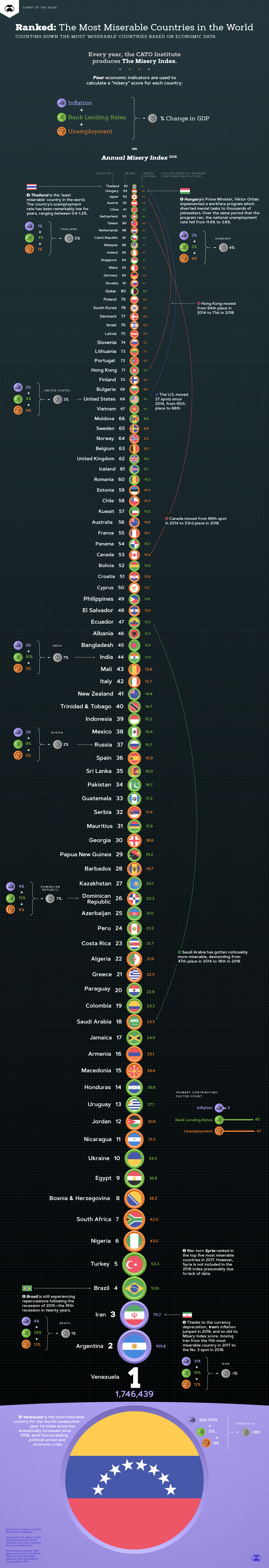

This week’s chart uses data from Steve Hanke of the Cato Institute, and it visualizes the 2019 Misery Index rankings, across 95 countries that report this data on a consistent basis.

The index uses four key economic variables to rank and score countries:

- Inflation

- Lending rate

- Unemployment rate

- GDP per capita growth

Here are the Misery Index scores for all 95 countries:

| Rank | Country | Contributing Factor | Misery Index Score |

|---|---|---|---|

| #1 | 🇻🇪 Venezuela | Inflation | 1,746,439.1 |

| #2 | 🇦🇷 Argentina | Inflation | 105.6 |

| #3 | 🇮🇷 Iran | Inflation | 75.7 |

| #4 | 🇧🇷 Brazil | Lending Rates | 53.6 |

| #5 | 🇹🇷 Turkey | Unemployment | 53.3 |

| #6 | 🇳🇬 Nigeria | Unemployment | 43.0 |

| #7 | 🇿🇦 South Africa | Unemployment | 42.0 |

| #8 | 🇧🇦 Bosnia and Herzegovina | Unemployment | 38.2 |

| #9 | 🇪🇬 Egypt | Lending Rates | 36.8 |

| #10 | 🇺🇦 Ukraine | Lending Rates | 34.3 |

| #11 | Nicaragua | Unemployment | 31.3 |

| #12 | Jordan | Unemployment | 30.9 |

| #13 | Uruguay | Lending Rates | 27.1 |

| #14 | Honduras | Unemployment | 26.8 |

| #15 | Macedonia | Unemployment | 26.4 |

| #16 | Armenia | Unemployment | 25.1 |

| #17 | Jamaica | Lending Rates | 24.9 |

| #18 | Saudi Arabia | Unemployment | 23.5 |

| #19 | Colombia | Lending Rates | 23.2 |

| #20 | Paraguay | Lending Rates | 22.9 |

| #21 | Greece | Unemployment | 22.5 |

| #22 | Algeria | Unemployment | 21.9 |

| #23 | Costa Rica | Lending Rates | 21.7 |

| #24 | Peru | Lending Rates | 21.2 |

| #25 | Azerbaijan | Lending Rates | 21.0 |

| #26 | Dominican Republic | Lending Rates & Unemployment | 20.3 |

| #27 | Kazakhstan | Lending Rates | 20.1 |

| #28 | Barbados | Unemployment | 19.7 |

| #29 | Papua New Guinea | Lending Rates | 19.2 |

| #30 | Georgia | Unemployment | 18.8 |

| #31 | Mauritius | Lending Rates | 17.9 |

| #32 | Serbia | Unemployment | 17.4 |

| #33 | Guatemala | Lending Rates | 17.2 |

| #34 | Pakistan | Lending Rates | 16.7 |

| #35 | Sri Lanka | Lending Rates | 16.0 |

| #36 | Spain | Unemployment | 15.9 |

| #37 | Russia | Lending Rates | 15.7 |

| #38 | Mexico | Lending Rates | 15.4 |

| #39 | Indonesia | Lending Rates | 15.2 |

| #40 | Trinidad & Tobago | Lending Rates | 14.7 |

| #41 | New Zealand | Lending Rates | 14.4 |

| #42 | Italy | Unemployment | 13.7 |

| #43 | Mali | Unemployment | 13.6 |

| #44 | India | Lending Rates | 13.2 |

| #45 | Bangladesh | Lending Rates | 12.6 |

| #46 | Albania | Lending Rates | 12.2 |

| #47 | Ecuador | Unemployment | 12.2 |

| #48 | El Salvador | Unemployment | 12.0 |

| #49 | Philipines | Lending Rates | 11.8 |

| #50 | Cyprus | Unemployment | 11.7 |

| #51 | Croatia | Unemployment | 10.9 |

| #52 | Bolivia | Lending Rates | 10.8 |

| #53 | Canada | Unemployment | 10.8 |

| #54 | Panama | Lending Rates | 10.7 |

| #55 | France | Unemployment | 10.7 |

| #56 | Australia | Unemployment | 10.6 |

| #57 | Kuwait | Lending Rates | 10.5 |

| #58 | Chile | Unemployment | 10.3 |

| #59 | Estonia | Unemployment | 10.3 |

| #60 | Romania | Lending Rates | 10.3 |

| #61 | Iceland | Lending Rates | 9.7 |

| #62 | United Kingdom | Lending Rates | 9.6 |

| #63 | Belgium | Unemployment | 9.3 |

| #64 | Norway | Unemployment | 9.3 |

| #65 | Sweden | Unemployment | 8.8 |

| #66 | Moldova | Lending Rates | 8.8 |

| #67 | Vietnam | Lending Rates | 8.7 |

| #68 | United States | Lending Rates | 8.7 |

| #69 | Bulgaria | Unemployment | 8.6 |

| #70 | Finland | Unemployment | 8.3 |

| #71 | Hong Kong | Lending Rates | 8.3 |

| #72 | Portugal | Unemployment | 8.2 |

| #73 | Lithuania | Unemployment | 7.3 |

| #74 | Slovenia | Unemployment | 7.2 |

| #75 | Latvia | Unemployment | 7.0 |

| #76 | Israel | Unemployment | 6.8 |

| #77 | Denmark | Unemployment | 6.8 |

| #78 | South Korea | Unemployment | 6.5 |

| #79 | Poland | Unemployment | 6.5 |

| #80 | Qatar | Lending Rates | 5.8 |

| #81 | Slovakia | Unemployment | 5.7 |

| #82 | Germany | Unemployment | 5.6 |

| #83 | Malta | Unemployment | 5.3 |

| #84 | Singapore | Lending Rates | 5.2 |

| #85 | Ireland | Unemployment | 5.1 |

| #86 | Malaysia | Lending Rates | 5.1 |

| #87 | Czech Republic | Lending Rates | 5.0 |

| #88 | Netherlands | Unemployment | 4.7 |

| #89 | Taiwan | Unemployment | 4.4 |

| #90 | Switzerland | Lending Rates | 4.2 |

| #91 | China | Lending Rates | 4.2 |

| #92 | Austria | Unemployment | 3.9 |

| #93 | Japan | Unemployment | 3.3 |

| #94 | Hungary | Unemployment | 2.6 |

| #95 | Thailand | Lending Rates | 1.7 |

To calculate each Misery Index score, a simple formula is used: GDP per capita growth is subtracted from the sum of unemployment, inflation, and bank lending rates.

Which of these factors are driving scores in some of the more “miserable” countries? Which countries rank low on the list, and why?

The Highest Misery Index Scores

Two Latin American countries, Venezuela and Argentina, rank near the top of Hanke’s index.

1. Vexation in Venezuela

Venezuela holds the title of the most “miserable” country in the world for the fourth consecutive year in a row. According to the United Nations, four million Venezuelans have left the country since its economic crisis began in 2014.

Turmoil in Venezuela has been further fueled by skyrocketing hyperinflation. Citizens struggle to afford basic items such as food, toiletries, and medicine. The Cafe Con Leche Index was created specifically to monitor the rapidly changing inflation rates in Venezuela.

Not only does Venezuela have the highest score in the Misery Index, but its score has also seen a dramatic increase over the past year as the crisis has accelerated.

2. Argentina’s History of Volatility

Argentina is the second most “miserable” country, which comes as no surprise given the country’s history of economic crises.

The 2018 Argentine monetary crisis caused a severe devaluation of the peso. The downfall forced the President, Mauricio Macri, to request a loan from the International Monetary Fund (IMF).

To put things in perspective, this is the 22nd lending arrangement between Argentina and the IMF. Only six countries have had more commitments to the international organization, including Haiti (27) and Colombia (25).

The Lowest Misery Index Scores

The two countries with the lowest scores in the index have one thing in common: extremely low rates of unemployment.

1. Why Thailand is the Land of Smiles

Thailand takes the prize as the least “miserable” country in the world on the index. The country’s unemployment rate has been remarkably low for years, ranging between 0.4% and 1.2% since 2011. This is the result of the country’s unique structural factors. The “informal” sectors—such as street vendors or taxi drivers—absorb people who become unemployed in the “formal” sector.

Public infrastructure investments by the Thai government continue to attract both private domestic and foreign investments, bolstering the country’s GDP alongside tourism and exports.

2. Hungary’s Prime Minister Sets the Score

Hungary is the second least “miserable” country in the world according to the index.

In 2010, Prime Minister Viktor Orbán implemented a workfare program which diverted menial tasks to thousands of job seekers. Over the same period that the program ran, the national unemployment rate fell from 11.4% to 3.8%.

Orbán won a controversial fourth term in 2018, possibly in part due to promises to protect the country’s sovereignty against the European Union. Despite accusations of populism and even authoritarian tendencies, the Prime Minister still commands a strong following in Hungary.

Chart of the Week

The Road to Recovery: Which Economies are Reopening?

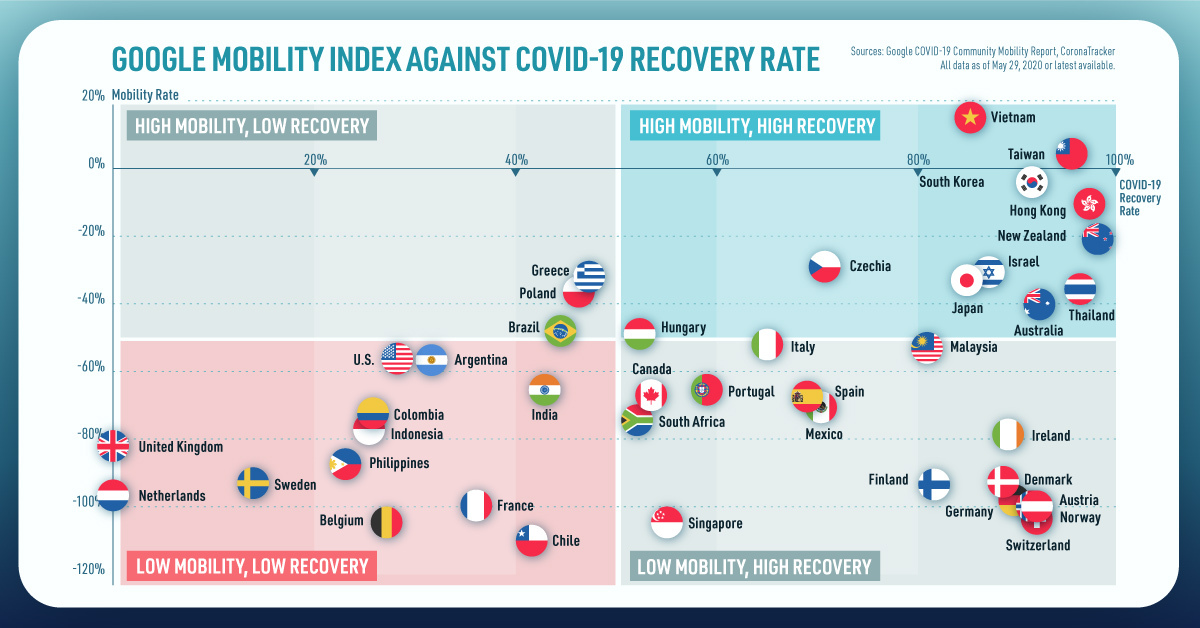

We look at mobility rates as well as COVID-19 recovery rates for 41 economies, to see which countries are reopening for business.

The Road to Recovery: Which Economies are Reopening?

COVID-19 has brought the world to a halt—but after months of uncertainty, it seems that the situation is slowly taking a turn for the better.

Today’s chart measures the extent to which 41 major economies are reopening, by plotting two metrics for each country: the mobility rate and the COVID-19 recovery rate:

- Mobility Index

This refers to the change in activity around workplaces, subtracting activity around residences, measured as a percentage deviation from the baseline. - COVID-19 Recovery Rate

The number of recovered cases in a country is measured as the percentage of total cases.

Data for the first measure comes from Google’s COVID-19 Community Mobility Reports, which relies on aggregated, anonymous location history data from individuals. Note that China does not show up in the graphic as the government bans Google services.

COVID-19 recovery rates rely on values from CoronaTracker, using aggregated information from multiple global and governmental databases such as WHO and CDC.

Reopening Economies, One Step at a Time

In general, the higher the mobility rate, the more economic activity this signifies. In most cases, mobility rate also correlates with a higher rate of recovered people in the population.

Here’s how these countries fare based on the above metrics.

| Country | Mobility Rate | Recovery Rate | Total Cases | Total Recovered |

|---|---|---|---|---|

| Argentina | -56% | 31.40% | 14,702 | 4,617 |

| Australia | -41% | 92.03% | 7,150 | 6,580 |

| Austria | -100% | 91.93% | 16,628 | 15,286 |

| Belgium | -105% | 26.92% | 57,849 | 15,572 |

| Brazil | -48% | 44.02% | 438,812 | 193,181 |

| Canada | -67% | 52.91% | 88,512 | 46,831 |

| Chile | -110% | 41.58% | 86,943 | 36,150 |

| Colombia | -73% | 26.28% | 25,366 | 6,665 |

| Czechia | -29% | 70.68% | 9,140 | 6,460 |

| Denmark | -93% | 88.43% | 11,512 | 10,180 |

| Finland | -93% | 81.57% | 6,743 | 5,500 |

| France | -100% | 36.08% | 186,238 | 67,191 |

| Germany | -99% | 89.45% | 182,452 | 163,200 |

| Greece | -32% | 47.28% | 2,906 | 1,374 |

| Hong Kong | -10% | 97.00% | 1,067 | 1,035 |

| Hungary | -49% | 52.31% | 3,816 | 1,996 |

| India | -65% | 42.88% | 165,386 | 70,920 |

| Indonesia | -77% | 25.43% | 24,538 | 6,240 |

| Ireland | -79% | 88.92% | 24,841 | 22,089 |

| Israel | -31% | 87.00% | 16,872 | 14,679 |

| Italy | -52% | 64.99% | 231,732 | 150,604 |

| Japan | -33% | 84.80% | 16,683 | 14,147 |

| Malaysia | -53% | 80.86% | 7,629 | 6,169 |

| Mexico | -69% | 69.70% | 78,023 | 54,383 |

| Netherlands | -97% | 0.01% | 45,950 | 3 |

| New Zealand | -21% | 98.01% | 1,504 | 1,474 |

| Norway | -100% | 91.87% | 8,411 | 7,727 |

| Philippines | -87% | 23.08% | 15,588 | 3,598 |

| Poland | -36% | 46.27% | 22,825 | 10,560 |

| Portugal | -65% | 58.99% | 31,596 | 18,637 |

| Singapore | -105% | 55.02% | 33,249 | 18,294 |

| South Africa | -74% | 52.44% | 27,403 | 14,370 |

| South Korea | -4% | 91.15% | 11,344 | 10,340 |

| Spain | -67% | 69.11% | 284,986 | 196,958 |

| Sweden | -93% | 13.91% | 35,727 | 4,971 |

| Switzerland | -101% | 91.90% | 30,796 | 28,300 |

| Taiwan | 4% | 95.24% | 441 | 420 |

| Thailand | -36% | 96.08% | 3,065 | 2,945 |

| U.S. | -56% | 28.20% | 1,768,346 | 498,720 |

| United Kingdom | -82% | 0.05% | 269,127 | 135 |

| Vietnam | 15% | 85.02% | 327 | 278 |

Mobility data as of May 21, 2020 (Latest available). COVID-19 case data as of May 29, 2020.

In the main scatterplot visualization, we’ve taken things a step further, assigning these countries into four distinct quadrants:

1. High Mobility, High Recovery

High recovery rates are resulting in lifted restrictions for countries in this quadrant, and people are steadily returning to work.

New Zealand has earned praise for its early and effective pandemic response, allowing it to curtail the total number of cases. This has resulted in a 98% recovery rate, the highest of all countries. After almost 50 days of lockdown, the government is recommending a flexible four-day work week to boost the economy back up.

2. High Mobility, Low Recovery

Despite low COVID-19 related recoveries, mobility rates of countries in this quadrant remain higher than average. Some countries have loosened lockdown measures, while others did not have strict measures in place to begin with.

Brazil is an interesting case study to consider here. After deferring lockdown decisions to state and local levels, the country is now averaging the highest number of daily cases out of any country. On May 28th, for example, the country had 24,151 new cases and 1,067 new deaths.

3. Low Mobility, High Recovery

Countries in this quadrant are playing it safe, and holding off on reopening their economies until the population has fully recovered.

Italy, the once-epicenter for the crisis in Europe is understandably wary of cases rising back up to critical levels. As a result, it has opted to keep its activity to a minimum to try and boost the 65% recovery rate, even as it slowly emerges from over 10 weeks of lockdown.

4. Low Mobility, Low Recovery

Last but not least, people in these countries are cautiously remaining indoors as their governments continue to work on crisis response.

With a low 0.05% recovery rate, the United Kingdom has no immediate plans to reopen. A two-week lag time in reporting discharged patients from NHS services may also be contributing to this low number. Although new cases are leveling off, the country has the highest coronavirus-caused death toll across Europe.

The U.S. also sits in this quadrant with over 1.7 million cases and counting. Recently, some states have opted to ease restrictions on social and business activity, which could potentially result in case numbers climbing back up.

Over in Sweden, a controversial herd immunity strategy meant that the country continued business as usual amid the rest of Europe’s heightened regulations. Sweden’s COVID-19 recovery rate sits at only 13.9%, and the country’s -93% mobility rate implies that people have been taking their own precautions.

COVID-19’s Impact on the Future

It’s important to note that a “second wave” of new cases could upend plans to reopen economies. As countries reckon with these competing risks of health and economic activity, there is no clear answer around the right path to take.

COVID-19 is a catalyst for an entirely different future, but interestingly, it’s one that has been in the works for a while.

Without being melodramatic, COVID-19 is like the last nail in the coffin of globalization…The 2008-2009 crisis gave globalization a big hit, as did Brexit, as did the U.S.-China trade war, but COVID is taking it to a new level.

—Carmen Reinhart, incoming Chief Economist for the World Bank

Will there be any chance of returning to “normal” as we know it?

-

Markets1 week ago

Markets1 week agoRanked: The Largest U.S. Corporations by Number of Employees

-

Green3 weeks ago

Green3 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?