The History of the Abitibi Gold Belt

The following content is sponsored by the Clarity Gold

The Abitibi: Canada’s Golden Powerhouse

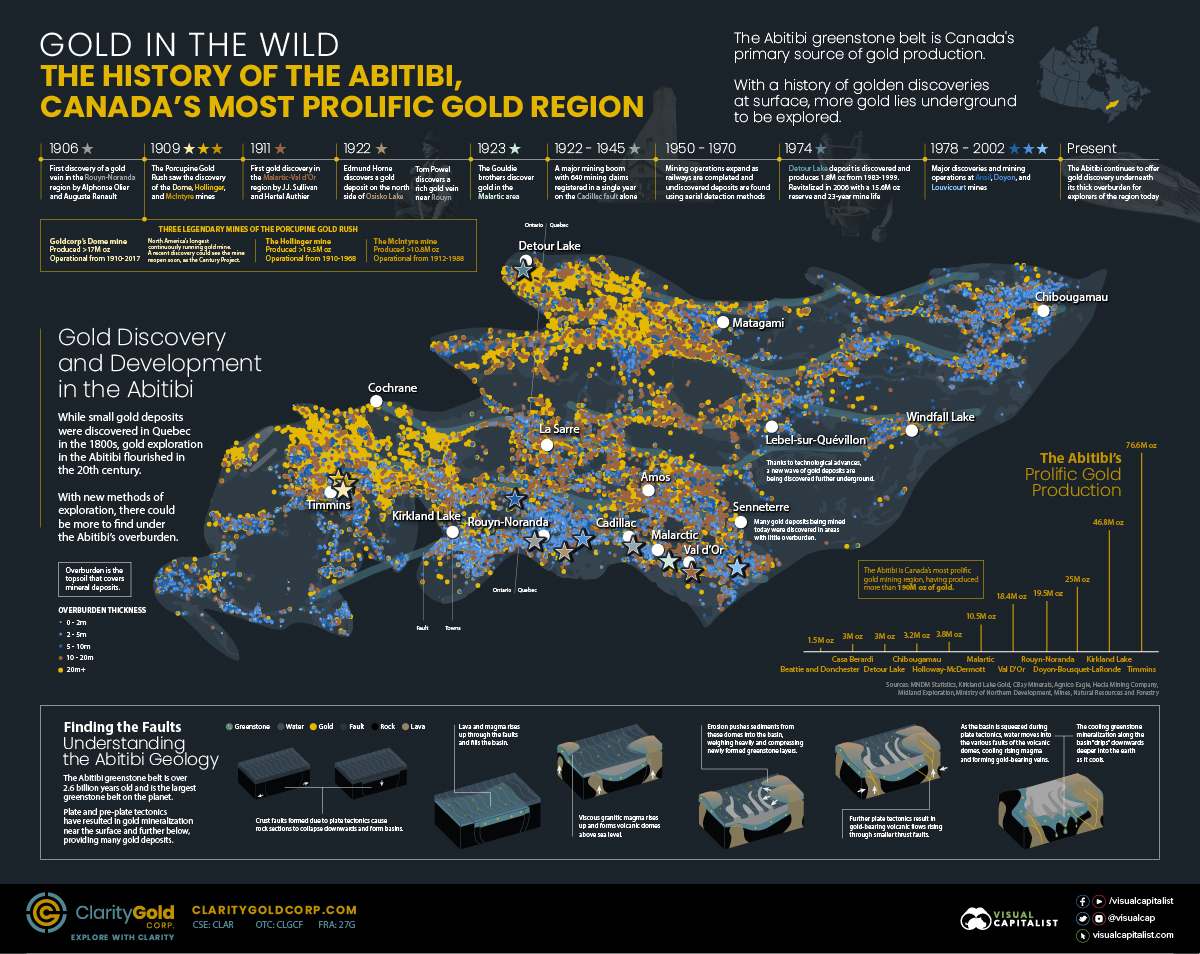

At the heart of Canada lies a greenstone belt that has provided the nation with more than 90% of its gold production. With more than 100 years of gold discovery in the Abitibi region located between Québec and Ontario, this area was the kiln that helped forge the Canadian mining industry.

Ever since the discovery of gold at Lac Fortune in 1906, the Abitibi has grown to become one of the world’s most prolific gold mining regions, and has produced over 190 million ounces of gold.

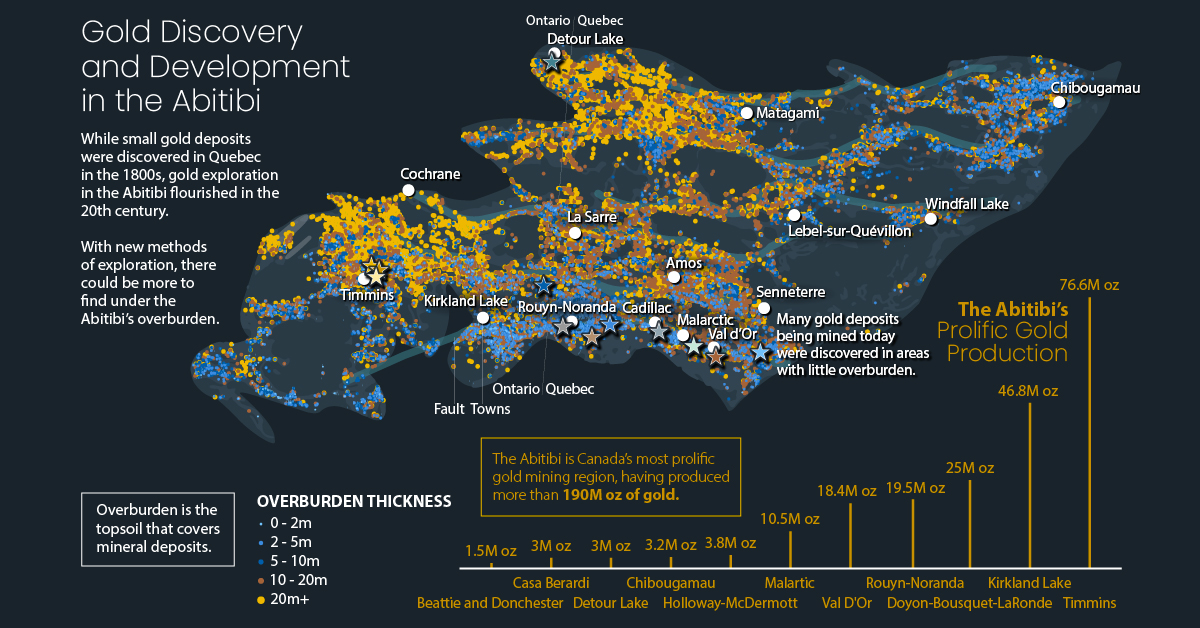

This graphic sponsored by Clarity Gold maps the history of gold discovery in the Abitibi and showcases the region’s overburden thickness. With a history of prolific discovery and production, there’s still plenty to explore under the Abitibi’s areas of thick overburden.

A Timeline of Gold Discovery in the Abitibi

Canada, known more for beaver pelts and timber, did not reveal its riches immediately. There were only a handful of gold discoveries in its early history. Gold was first discovered in 1823, on the shores of Rivière Chaudière in Québec, further east of the region known as the Abitibi today.

But as settlers spread west, gold surfaced in British Columbia and the Yukon in the late 1800s, kicking off the Cariboo and Klondike gold rushes. It wasn’t until the 1900s that gold was found in the Abitibi greenstone belt, marking the beginning of the modern era for the Canadian mining industry.

First Discovery and the Porcupine Gold Rush

Gold within the Abitibi was first discovered on the shores of Lac Fortune in 1906, by Alphonse Olier and Auguste Renault. This first discovery was notable, but didn’t result in an immediate gold rush and mine development in the region.

Instead, it was a gold discovery in 1909 further west that kicked off what would be known as the Porcupine Gold Rush in Northern Ontario. The dome-shaped rock where the gold vein was discovered was developed into the Dome mine, which grew to become one of the three historic mines in the Timmins area.

Along with the establishment of the Dome mine, this gold rush also saw the development of the Hollinger and McIntyre mines which were both producing gold by 1912. These three mines have served as powerhouses of Canadian gold production for decades, delivering more than 45 million ounces of gold collectively.

| Mine | Gold Produced |

|---|---|

| Dome Mine | 17M oz |

| Hollinger Mine | 19.5M oz |

| McIntyre Mine | 10.8M oz |

Source: Ministry of Northern Development, Mines, Natural Resources and Forestry

This first gold rush was just the beginning of the Abitibi region’s mining boom, with other discoveries on the Quebec side of the region also being developed around the same time.

The Mining Boom on the Cadillac Fault

As the Dome, Hollinger, and McIntyre mines were being developed and started producing gold, another key gold discovery occurred in the Malartic-Val d’Or region. This discovery by J.J. Sullivan and Hertel Authier wasn’t quite enough for mine development to begin right away, but further discoveries in the surrounding areas were highlighting the golden exploration potential of the Abitibi region.

In 1922, Edmund Horne discovered a gold deposit near Osisko Lake, not far from the first gold discovery by Lac Fortune with Tom Powel discovering a rich gold vein nearby the same year. A third gold discovery in 1923 in the Malartic area by the Gouldie brothers marked the beginning of a mining development boom all along the Cadillac fault where these discoveries were occurring.

Over the next two decades, the fault saw hundreds of mining claims every year, with the towns of Rouyn, Noranda, Cadillac, and Malartic all growing alongside mine development and production. By 1931, Rouyn and Noranda had become the second and third most cosmopolitan cities in Quebec after Montreal, with gold mines bringing waves of workers and explorers.

Leaps in Gold Exploration Technology

Over the following decades, technological advances in transportation and deposit detection have allowed gold discovery and development to flourish in the Abitibi region. Aerial detection methods helped identify new deposits, and the development of Canada’s sprawling railway systems allowed for easier access and transportation of materials and people.

These advances resulted in the discovery of the Detour Lake deposit along with discoveries that would go on to become the Ansil, Doyon, and Louvicourt mines. Today, historic mines born from decade-old discoveries like Detour Lake and the Malartic mine are still producing gold.

Across the many different mining camps, the Abitibi region has produced more than 190 million ounces of gold and counting today.

| Mining Camp | Gold Produced |

|---|---|

| Timmins | 76.6M oz |

| Kirkland Lake | 46.8M oz |

| Doyon-Bousquet-LaRonde | 25M oz |

| Rouyn-Noranda | 19.5M oz |

| Val D'Or | 18.4M oz |

| Malartic | 10.5M oz |

| Holloway-McDermott | 3.8M oz |

| Chibougamau | 3.2M oz |

| Detour Lake | 3M oz |

| Casa Berardi | 3M oz |

| Beattie and Donchester | 1.5M oz |

Sources: MNDM Statistics, Kirkland Lake Gold, CBay Minerals, Agnico Eagle, Hecla Mining Company, Midland Exploration

The Abitibi’s Golden Geology and Undiscovered Future

The Abitibi’s storied history of gold discovery and production stems from its 2.6 billion year old greenstone belt, the defining geological factor of the region. Greenstone belts are ancient terrain formed by volcanic flows alongside sedimentary rocks that often contain orebodies of gold, copper, silver, lead, and zinc.

Formed over millions of years, greenstone belts begin with the rising of lava and magma through crustal faults that fill a variety of basins across the region. Over extended time, erosion and plate tectonics resulted in high amounts of pressure and heat compressing layers of greenstone rock and gold-bearing volcanic flows to form orebodies of gold and other minerals.

Covering the greenstone belt and its golden deposits is a layer of overburden, topsoil that can range from 1-20 meters of depth. Many of the early discoveries were located near to the surface, leaving further gold potential at depth to future generations.

While many of the areas with thin overburden have been heavily explored and developed, explorers in the region like Clarity Gold are working to discover the gold deposits that lie further underneath thick layers of overburden.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.