The History of Cannabis Prohibition in the U.S.

The History of Cannabis Prohibition in the U.S.

The legal status of cannabis in the U.S. isn’t always clear. At the federal level, it is an illegal Schedule I drug. However, individual states have the ability to determine their own laws around cannabis sales and usage.

But cannabis was not always illegal at the top level. It was only in the last 100 years that cannabis faced a prohibition similar to the alcohol prohibition of the early 1920s.

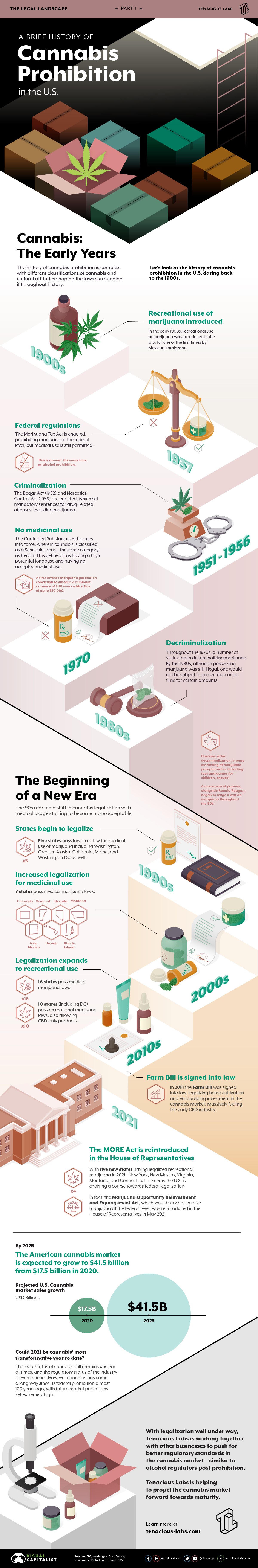

In this infographic from Tenacious Labs, we explore the fascinating history of cannabis prohibition in the U.S. dating all the way back to the 1900s.

The Early History of Cannabis Legality

The earliest laws surrounding the cannabis plant in the U.S. were drafted before the country was even founded. In 1619, a law was passed in the colony of Virginia which required every single farm to grow cannabis and produce hemp, an important commodity at the time.

Over time, marijuana from the cannabis plant started to be used for medicinal purposes. Early recreational use was first introduced by Mexican immigrants in the early 1900s.

Flash forward to the 1930s, when the country was struggling financially during the Great Depression. To encourage economic growth, alcohol prohibition was lifted, and those who had supported teetotalling began to target marijuana instead. At the time, cannabis was consumed largely in black and Mexican communities, and racist attitudes began to shape an association between crime, lewd behavior, immorality, and marijuana.

Legal Changes

The 1930s marked the beginning of America’s war against marijuana. Here’s a glance at some of the most famous laws around cannabis prohibition:

- The Marihuana Tax Act (1937)

- The Boggs Act (1952)

- The Narcotics Control Act (1956)

- The Controlled Substances Act (1971)

In 1937, the Marihuana Tax Act was enforced, prohibiting marijuana federally but still allowing medical use. Prior to that, 29 states had already outlawed marijuana on their own.

But by the 1950s, a counterculture movement had begun, with young people using marijuana recreationally much more than previous generations.

Eventually, the Boggs Act (1952) and Narcotics Control Act (1956) were put in place to combat the counterculture. These laws set mandatory sentences for drug-related offenses, including marijuana. A first-offense marijuana possession conviction could result in a minimum sentence of 2-10 years with a fine of up to $20,000.

In 1970, cannabis was classified as a Schedule I drug—the same category as heroin—under the Controlled Substances Act. However, the 70s also saw an opposing shift, with a number of states beginning to decriminalize marijuana. ℹ️ Decriminalization means that although possessing marijuana remains illegal, one is not subject to prosecution or jail time for possessing certain amounts.

After decriminalization, commercial businesses began to capitalize and started to market marijuana-related products. Some products were marketed towards children, which, in tandem with the intensive hippie culture from the 70s, sparked a war against marijuana led by parents and supported by president Ronald Reagan.

The Modern Era

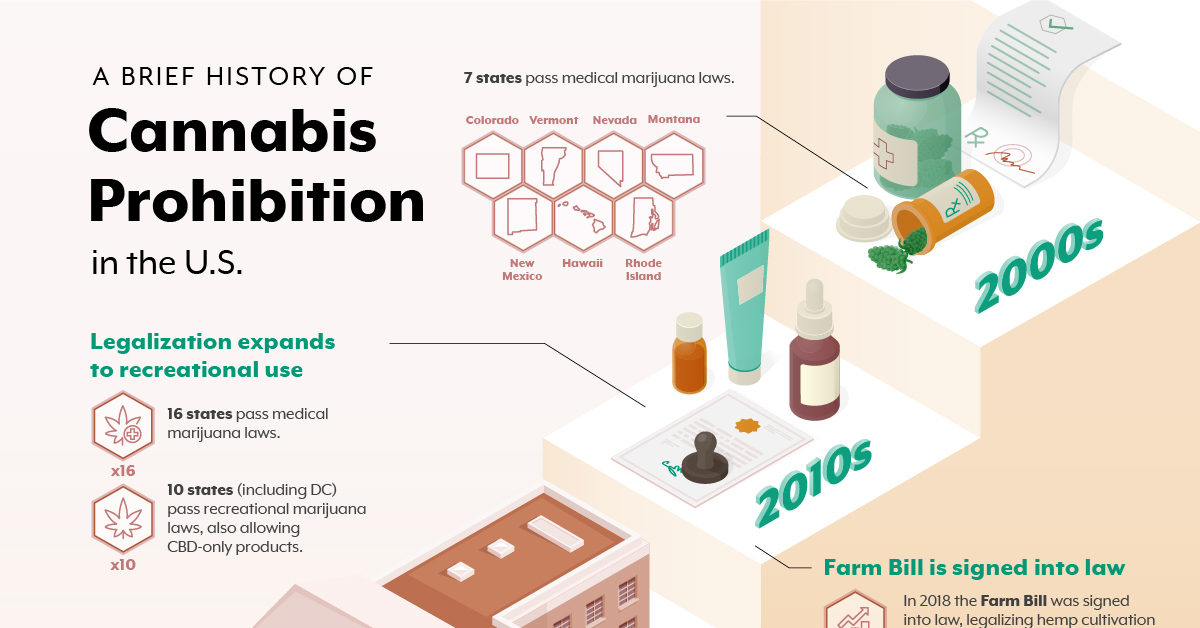

During the 1990s, five states passed laws to allow the medical usage of marijuana—between 2010 and 2020, 16 states passed medical marijuana laws.

| State | Status |

|---|---|

| Alabama | Legal for medical use |

| Alaska | Legal |

| Arizona | Legal |

| Arkansas | Legal for medical use |

| California | Legal |

| Colorado | Legal |

| Connecticut | Legal |

| Delaware | Legal for medical use |

| Florida | Legal for medical use |

| Georgia | Legal for medical use |

| Hawaii | Legal for medical use |

| Idaho | Illegal |

| Illinois | Legal |

| Indiana | Legal for medical use |

| Iowa | Legal for medical use |

| Kansas | Illegal |

| Kentucky | Illegal |

| Louisiana | Legal for medical use |

| Maine | Legal |

| Maryland | Legal for medical use |

| Massachusetts | Legal |

| Michigan | Legal |

| Minnesota | Legal for medical use |

| Mississippi | Legal for medical use |

| Missouri | Legal for medical use |

| Montana | Legal |

| Nebraska | Illegal, decriminalized |

| Nevada | Legal |

| New Hampshire | Legal for medical use |

| New Jersey | Legal |

| New Mexico | Legal |

| New York | Legal |

| North Carolina | Legal for medical use |

| North Dakota | Legal for medical use |

| Ohio | Legal for medical use |

| Oklahoma | Legal for medical use |

| Oregon | Legal |

| Pennsylvania | Legal for medical use |

| Rhode Island | Legal for medical use |

| South Carolina | Legal for medical use |

| South Dakota | Legal for medical use |

| Tennessee | Legal for medical use (Limited) |

| Texas | Legal for medical use (Limited) |

| Utah | Legal for medical use |

| Vermont | Legal |

| Virginia | Legal |

| Washington | Legal |

| Washington, DC | Legal |

| West Virginia | Legal for medical use |

| Wisconsin | Illegal |

| Wyoming | Illegal |

In 2021, a total of 18 states have fully legalized cannabis, while another 26 have allowed marijuana usage for medicinal purposes in some capacity. Furthermore, the MORE Act—a bill to legalize marijuana federally—was reintroduced in the House of Representatives in May 2021.

If passed, the MORE Act (the Marijuana Opportunity Reinvestment and Expungement Act) would essentially remove cannabis from its classification as a Schedule I drug under the Controlled Substances Act. It would also work towards the expungement of criminals who were charged with crimes related to marijuana.

While the U.S. government has gone back and forth with cannabis legalization over the years, it appears that in the 21st century, the path only leads one way: towards federal legalization.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology…

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.