Cannabis

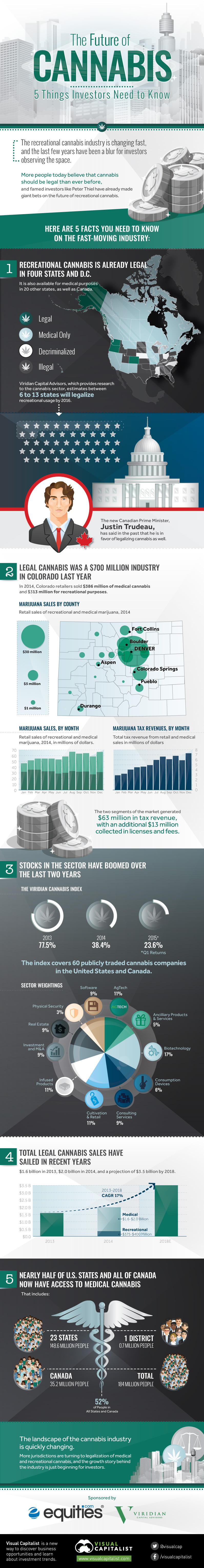

The Future of Cannabis: Five Things Investors Need To Know

The Future of Cannabis: Five Things Investors Need To Know

Presented by: Equities.com and Viridian Capital Advisors

The recreational cannabis industry is changing fast, and the last few years have been a blur for investors observing the space.

More people today believe that cannabis should be legal than ever before, and famed investors like Peter Thiel have already made giant bets on the future of recreational cannabis.

Here’s five facts you need to know on the fast-moving industry:

- Recreational cannabis is already legal in four states and D.C. It is also available for medical purposes in 20 other states, as well as Canada. Viridian Capital Advisors, which provides research to the cannabis sector, estimates between 6 to 13 states will legalize recreational usage by end of 2016.

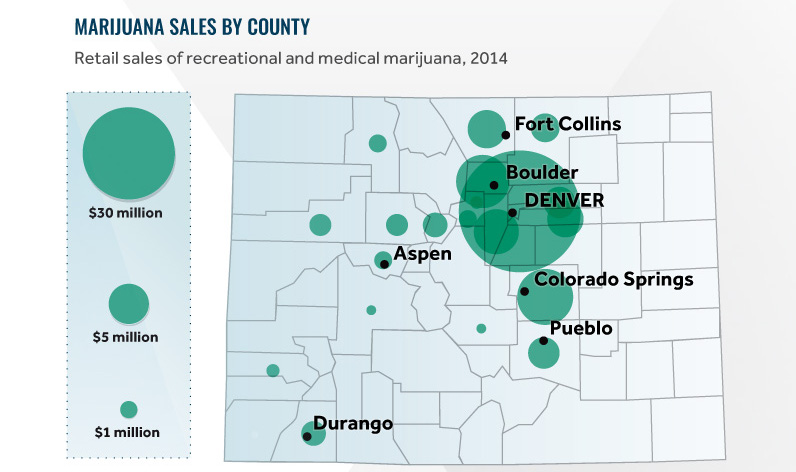

- Legal cannabis was a $700 million industry in Colorado last year. In 2014, Colorado retailers sold $386 million of medical cannabis and $313 million for recreational purposes. The two segments of the market generated $63 million in tax revenue, with an additional $13 million collected in licenses and fees.

- Stocks in the sector have boomed over the last two years. The Viridian Cannabis Index, which covers 60 publicly traded cannabis companies in the United States and Canada, was up 77.5% in 2013, 38.4% in 2014, and 23.6% in 2015 Q1.

- Total legal cannabis sales have sailed in recent years With $1.6 billion in sales in 2013, it is expected to increase to $3.5 billion in 2018, which is good for an expected 17% compound annual growth rate.

- Nearly half of U.S. states and all of Canada now have access to medical cannabis. That includes 23 states (148.6 million people), 1 district (0.7 million people) and Canada (35.2 million people). That’s 52% of the entire population of the United States and Canada.

The landscape of the cannabis industry is quickly changing. More jurisdictions are turning to legalization of medical and recreational cannabis, and the growth story behind the industry is just beginning for investors.

Politics

Timeline: Cannabis Legislation in the U.S.

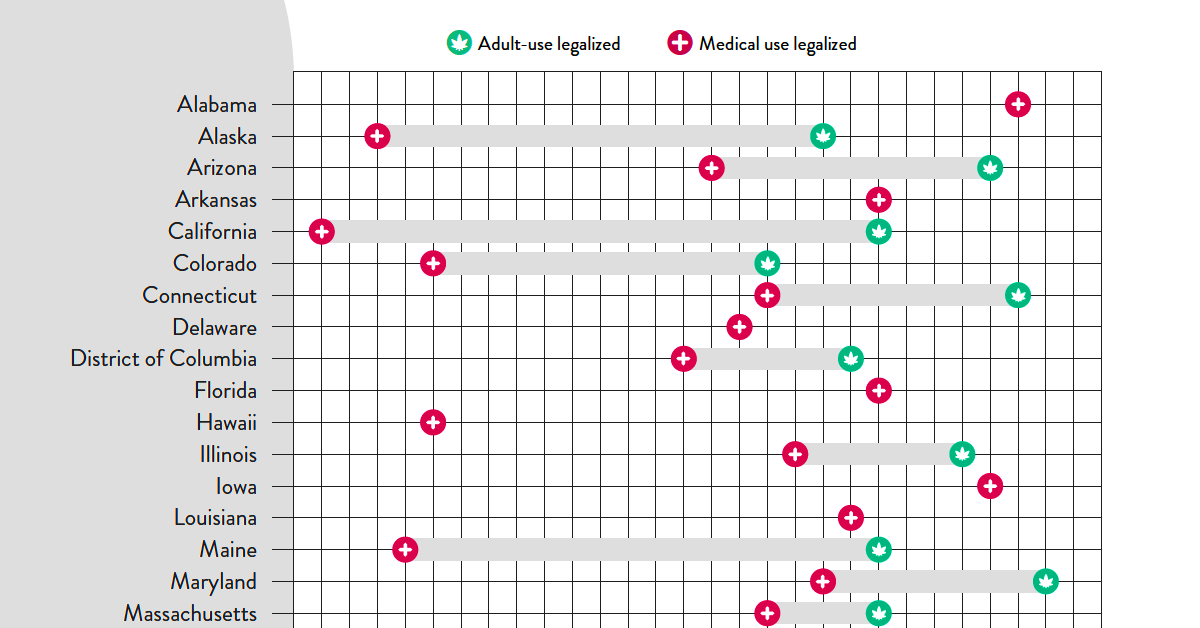

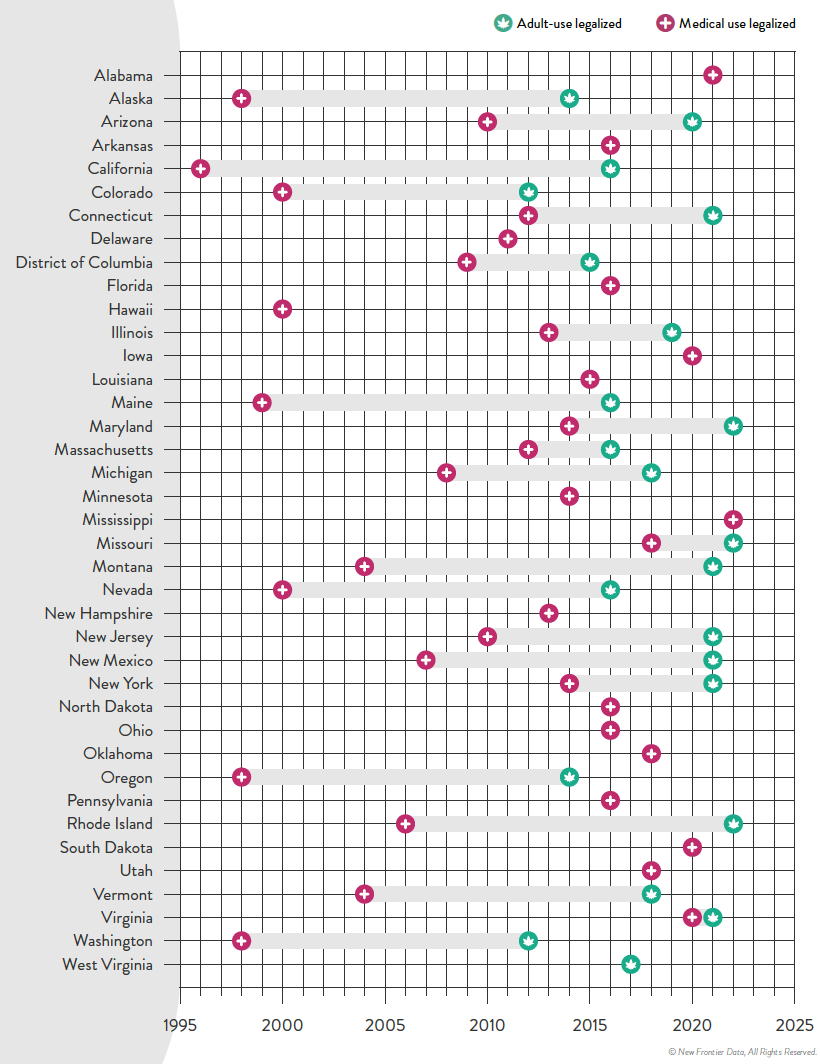

At the federal level, cannabis is illegal, but state laws differ. This graphic looks at the timelines of cannabis legislation in the U.S.

Timeline: Cannabis Legislation in the U.S.

At the federal level, cannabis is still considered an illegal substance. That said, individual states do have the right to determine their own laws around cannabis sales and usage.

This visual from New Frontier Data looks at the status of cannabis in every state and the timeline of when medical and/or recreational use became legal.

Cannabis Through the Years

In the U.S., the oldest legalese concerning cannabis dates back to the 1600s—the colony of Virginia required every farm to grow and produce hemp. Since then, cannabis use was fairly wide open until the 1930s when the Marihuana Tax Act was enforced, prohibiting marijuana federally but still technically allowing medical use.

Jumping ahead, the Controlled Substances Act was passed in 1970, classifying cannabis as Schedule I drug—the same category as heroin. This prohibited any use of the substance.

However, the 1970s also saw a counter movement, wherein many states made the move towards decriminalization. Decriminalization means that although possessing cannabis remained illegal, a person would not be subject to jail time or prosecution for possessing certain amounts.

By the 1990s, some of the first states passed laws to allow the medical usage of cannabis, and by 2012 two states in the U.S.—Washington and Colorado—legalized the recreational use of cannabis.

Cannabis Legislation Today and Beyond

The MORE Act (the Marijuana Opportunity Reinvestment and Expungement Act) was passed in the House early 2022, and if made law, it would decriminalize marijuana federally.

“This bill decriminalizes marijuana. Specifically, it removes marijuana from the list of scheduled substances under the Controlled Substances Act and eliminates criminal penalties for an individual who manufactures, distributes, or possesses marijuana.”– U.S. Congress

Cannabis still remains illegal at the federal level, but at the state levels, cannabis is now fully legal (both for medicinal and recreational purposes) in a total of 22 states.

Over 246 million Americans have legal access to some form of marijuana products with high THC levels. Looking to the future, many new cannabis markets are expected to open up in the next few years:

The earliest states expected to open up next for recreational cannabis sales are Minnesota and Oklahoma. There is always a lag between legalization and actual sales, wherein local regulatory bodies and governments set standards. States like Kentucky, on the other hand, aren’t likely to even legalize medicinal cannabis until 2028.

It’s estimated that by 2030, there will be 69 million cannabis consumers in the country, up 33% from 2022.

Overall, the U.S. cannabis market is likely an important one to watch as legal sales hit $30 billion in 2022. By the end of the decade, that number is expected to be anywhere from $58 billion to as much as $72 billion.

-

Automotive2 weeks ago

Automotive2 weeks agoTesla Is Once Again the World’s Best-Selling EV Company

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc1 week ago

Misc1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Markets2 weeks ago

Markets2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners