Money

The Decline of Upward Mobility in One Chart

The Decline Of Upward Mobility In One Chart

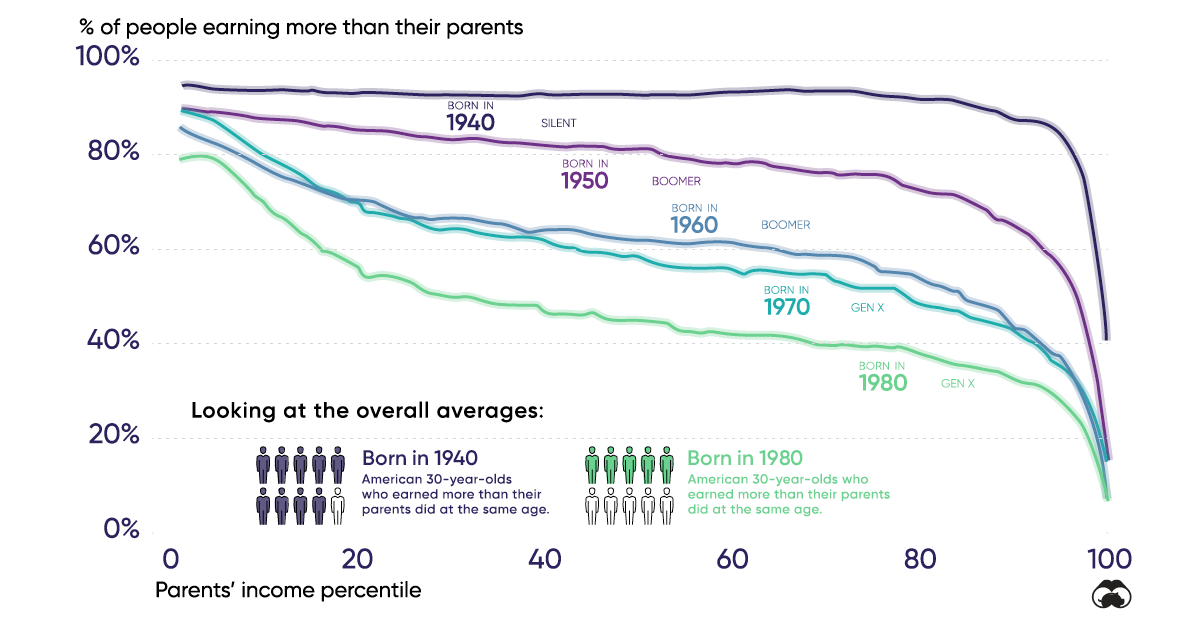

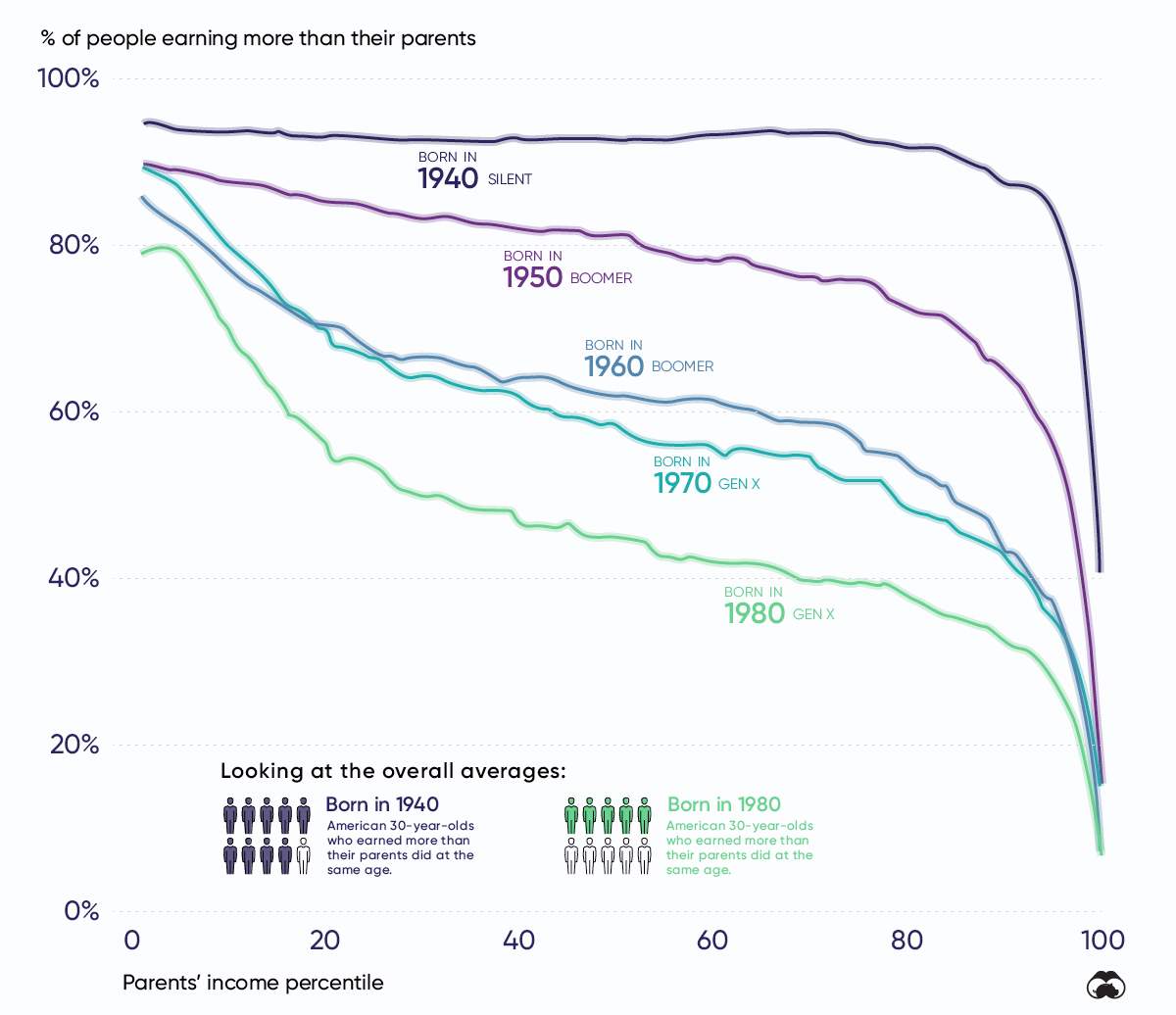

For decades, a majority of Americans have been able to climb the economic ladder by earning higher incomes than their parents. These improving conditions are known as upward mobility, and form an important part of the American Dream.

However, each consecutive generation is finding it harder to make this ascent. In this graphic, we illustrate the decline in upward mobility over five decades using data from Opportunity Insights.

Understanding The Chart

This graphic plots the probability that a 30-year-old American has to outearn their parents (vertical axis) depending on their parent’s income percentile (horizontal axis). The 1st percentile represents America’s lowest earners, while the 99th percentile the richest.

As we move from left to right on the chart, the portion of people who outearn their parents takes a steep decline. This suggests that people born into upper class families are less likely to outearn their parents, regardless of generation.

The key takeaway, though, is that the starting point of this downward trend has shifted to the left. In other words, fewer people in the lower- and middle-classes are climbing the economic ladder.

| Decade Born | Chance of Outearning Parents (Bottom Percentile) | Chance of Outearning Parents (50th Percentile) | Chance of Outearning Parents (Top Income Percentile) |

|---|---|---|---|

| 1940 | 95% | 93% | 41% |

| 1950 | 90% | 81% | 15% |

| 1960 | 86% | 62% | 7% |

| 1970 | 90% | 59% | 16% |

| 1980 | 79% | 45% | 8% |

Declines can be seen across the board, but those growing up in the middle-class (50th percentile) have taken the largest hit. Within this bracket, individuals born in 1980 have only a 45% chance of outearning their parents at age 30, compared to 93% for those born in 1940.

Stagnating Wage Growth a Culprit

One factor behind America’s deteriorating upward mobility is the sluggish pace at which wages have grown. For example, the average hourly wage in 1964, when converted to 2018 dollars, is $20.27. Compare this to $22.65, the average hourly wage in 2018. That represents a mere 11.7% increase over a span of 54 years.

However, this may not be as bad as it sounds. While the prices of some goods and services have risen over time, others have actually become more affordable. Since January 1998, for example, the prices of electronic goods such as TVs and cellphones have actually decreased. In this way, individuals today are more prosperous than previous generations.

This benefit is likely outweighed by relative increases in other services, though. Whereas inflation since January 1998 totaled 58.8%, the costs of health and education services increased by more than 160% over the same time frame.

Income Distribution

While wages have been stagnant as a whole, it doesn’t paint the full picture. Another factor to consider is America’s changing income distribution.

| Income Class | 1970 Share of U.S. Aggregate Income | 2018 Share of U.S. Aggregate Income |

|---|---|---|

| Upper | 28% | 48% |

| Middle | 62% | 43% |

| Lower | 10% | 9% |

Source: Pew Research Center

Like the data on upward mobility, the middle class takes the largest hit here, with its share of U.S. aggregate income falling by 19 percentage points. Over the same time frame, the upper class was able to increase its share of total income by 20 percentage points.

Is It All Bad News?

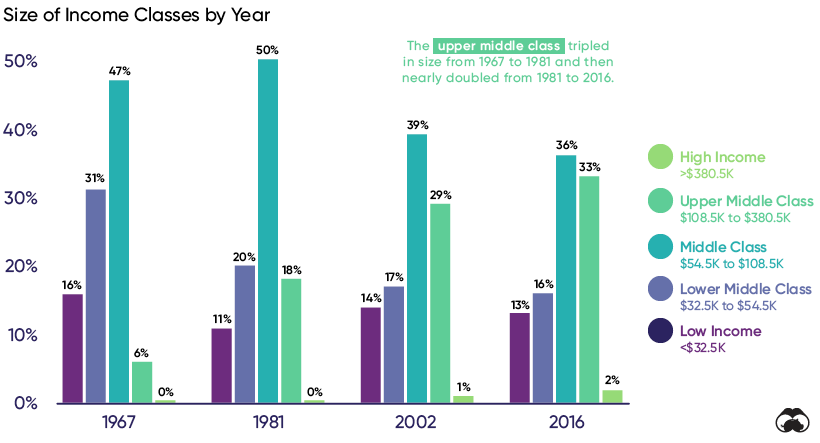

Americans are less likely to earn more than their parents, but this doesn’t mean that upward mobility has completely disappeared—it’s just becoming less accessible. Below, we illustrate the changes in size for different income classes from 1967 to 2016.

The upper middle class has grown significantly, from 6% of the population in 1967 to 33% in 2016. At the same time, the middle class shrank from 47% to 36% and the lower middle class shrank from 31% to 16%.

The data suggests that some middle class Americans are still managing to pull themselves up into the next income bracket—it’s just not an effect that was as broad-based as it’s been in the past.

Does The American Dream Still Exist?

The American Dream is the belief that upward mobility is attainable for everyone through their own actions. This implies that growth will be continuous and widespread, two factors that have seemingly deteriorated in recent decades.

Researchers believe there are numerous complex reasons behind America’s stagnating wages. A decline in union membership, for example, could be eroding employees’ collective bargaining power. Other factors such as technological change may also apply downwards pressure on the wages of less educated workers.

Income inequality, on the other hand, is clearly shown by the data. We can also refer to the Gini-coefficient, a statistical measure of economic inequality. It ranges between 0 and 1, with 0 representing perfect equality and 1 representing perfect inequality (one person holds all the income). The U.S. currently has a Gini-coefficient of 0.434, the highest of any G7 country.

Long story short, the American Dream is still alive—it’s just becoming harder to come by.

Money

Charted: Who Has Savings in This Economy?

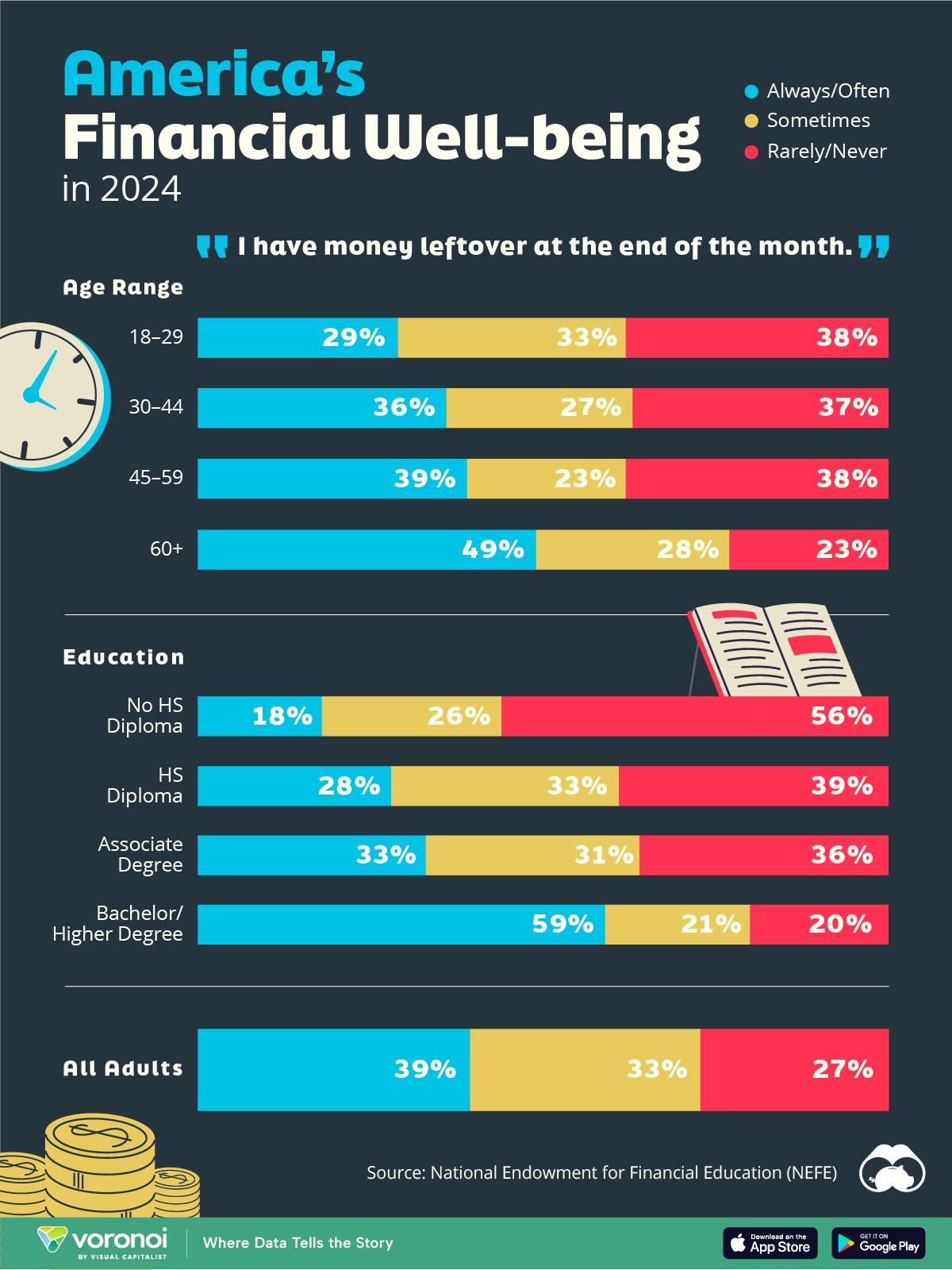

Older, better-educated adults are winning the savings game, reveals a January survey by the National Opinion Research Center at the University of Chicago.

Who Has Savings in This Economy?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Two full years of inflation have taken their toll on American households. In 2023, the country’s collective credit card debt crossed $1 trillion for the first time. So who is managing to save money in the current economic environment?

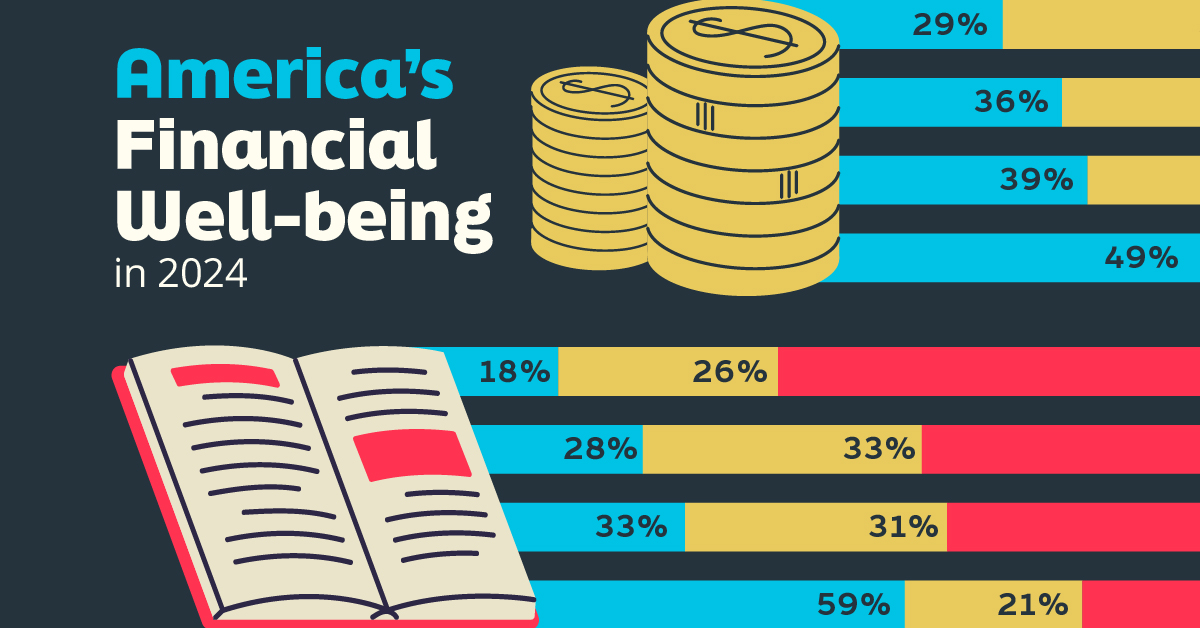

We visualize the percentage of respondents to the statement “I have money leftover at the end of the month” categorized by age and education qualifications. Data is sourced from a National Endowment for Financial Education (NEFE) report, published last month.

The survey for NEFE was conducted from January 12-14, 2024, by the National Opinion Research Center at the University of Chicago. It involved 1,222 adults aged 18+ and aimed to be representative of the U.S. population.

Older Americans Save More Than Their Younger Counterparts

General trends from this dataset indicate that as respondents get older, a higher percentage of them are able to save.

| Age | Always/Often | Sometimes | Rarely/Never |

|---|---|---|---|

| 18–29 | 29% | 33% | 38% |

| 30–44 | 36% | 27% | 37% |

| 45–59 | 39% | 23% | 38% |

| Above 60 | 49% | 28% | 23% |

| All Adults | 39% | 33% | 27% |

Note: Percentages are rounded and may not sum to 100.

Perhaps not surprisingly, those aged 60+ are the age group with the highest percentage saying they have leftover money at the end of the month. This age group spent the most time making peak earnings in their careers, are more likely to have investments, and are more likely to have paid off major expenses like a mortgage or raising a family.

The Impact of Higher Education on Earnings and Savings

Based on this survey, higher education dramatically improves one’s ability to save. Shown in the table below, those with a bachelor’s degree or higher are three times more likely to have leftover money than those without a high school diploma.

| Education | Always/Often | Sometimes | Rarely/Never |

|---|---|---|---|

| No HS Diploma | 18% | 26% | 56% |

| HS Diploma | 28% | 33% | 39% |

| Associate Degree | 33% | 31% | 36% |

| Bachelor/Higher Degree | 59% | 21% | 20% |

| All Adults | 39% | 33% | 27% |

Note: Percentages are rounded and may not sum to 100.

As the Bureau of Labor Statistics notes, earnings improve with every level of education completed.

For example, those with a high school diploma made 25% more than those without in 2022. And as the qualifications increase, the effects keep stacking.

Meanwhile, a Federal Reserve study also found that those with more education tended to make financial decisions that contributed to building wealth, of which the first step is to save.

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue