Mining

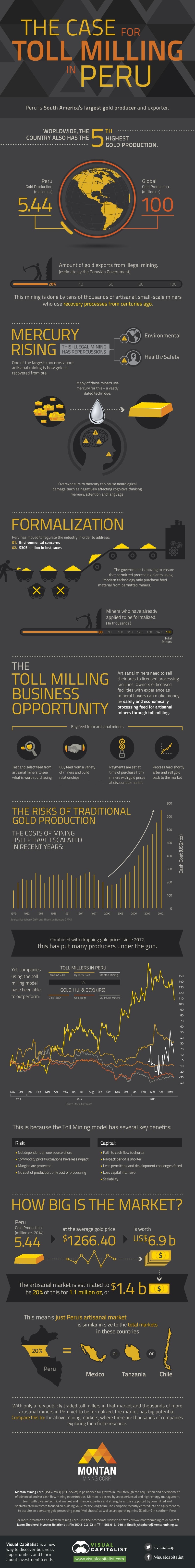

The Case for Toll Milling in Peru

The Case for Toll Milling in Peru

Gold toll milling infographic presented by: Montan Mining

Peru is South America’s largest gold producer and exporter. Worldwide, the country also has the fifth highest gold production.

2014 production: 5.44 million oz (5.4% of global production)

2014 Global production: ~100 million oz

However, the Peruvian government estimates that illegal mining accounts for about 20% of gold exports. This mining is done by tens of thousands of artisanal, small-scale miners who use metallurgical processes from centuries ago.

Mercury Rising

Illegal mining has environmental and safety repercussions. One of the largest concerns about artisanal mining is how gold is processed from ore. Many of these miners use mercury for this – a vastly dated technique.

Overexposure to mercury can cause neurological damage, such as negatively affecting cognitive thinking, memory, attention and language.

Formalization

To tackle the growing environmental concerns and also capture $305 million in lost taxes, Peru has moved to regulate the industry.

The government wants to ensure that permitted mineral processing facilities using modern technology only purchase feed material from permitted miners.

So far 80,000 of 150,000 miners have applied to be formalized.

The Toll Milling Business Opportunity

Artisanal miners need to sell their ore to licensed processing facilities. Owners of licensed facilities with experience as mineral buyers can make money by safely and economically processing feed for artisanal miners through toll milling.

How the model works:

- Test and select ores from artisanal miners to see what is worth purchasing

- Buy ores from a variety of miners and build relationships.

- Prices are set at time of purchase and are at discount to market.

- Process ore shortly after and sell gold back to the market.

The Risks of Traditional Gold Production

The costs of mining itself have escalated, with cash costs soaring in recent years. Combined with dropping gold prices since 2012, this has put many producers under the gun.

However, companies using the toll milling model have been able to outperform. This is because toll milling has several benefits:

Advantages in Risk:

- Not dependent on one source of ore.

- Commodity price fluctuations have less impact.

- Margins are protected.

- No cost of production, only cost of processing.

Advantages in Capital:

- Path to cash flow is shorter.

- Payback period is shorter.

- Less permitting and development challenges faced.

- Less capital intensive.

- Scalability.

How Big is the Market?

Peru’s gold production of 5.44 million oz (2014) at the average gold price ($1266.40) is worth US$6.9 billion.

The artisanal market is estimated to be 20% of this for 1.1 million oz, or $1.4 billion.

This mean’s just Peru’s artisanal market is similar in size to the total markets in Mexico, Tanzania, or Chile.

With only a few publicly traded toll millers in that market and thousands of more artisanal miners in Peru yet to be formalized, the market has big potential. Compare this to the above markets, where thousands of companies are vying for the same finite resources.

Mining

Gold vs. S&P 500: Which Has Grown More Over Five Years?

The price of gold has set record highs in 2024, but how has this precious metal performed relative to the S&P 500?

Gold vs. S&P 500: Which Has Grown More Over Five Years?

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Gold is considered a unique asset due to its enduring value, historical significance, and application in various technologies like computers, spacecraft, and communications equipment.

Commonly regarded as a “safe haven asset”, gold is something investors typically buy to protect themselves during periods of global uncertainty and economic decline.

It is for this reason that gold has performed rather strongly in recent years, and especially in 2024. Persistent inflation combined with multiple wars has driven up demand for gold, helping it set a new all-time high of over $2,400 per ounce.

To put this into perspective, we visualized the performance of gold alongside the S&P 500. See the table below for performance figures as of April 12, 2024.

| Asset/Index | 1 Yr (%) | 5 Yr (%) |

|---|---|---|

| 🏆 Gold | +16.35 | +81.65 |

| 💼 S&P 500 | +25.21 | +76.22 |

Over the five-year period, gold has climbed an impressive 81.65%, outpacing even the S&P 500.

Get Your Gold at Costco

Perhaps a sign of how high the demand for gold is becoming, wholesale giant Costco is reportedly selling up to $200 million worth of gold bars every month in the United States. The year prior, sales only amounted to $100 million per quarter.

Consumers aren’t the only ones buying gold, either. Central banks around the world have been accumulating gold in very large quantities, likely as a hedge against inflation.

According to the World Gold Council, these institutions bought 1,136 metric tons in 2022, marking the highest level since 1950. Figures for 2023 came in at 1,037 metric tons.

See More Graphics on Gold

If you’re fascinated by gold, be sure to check out more Visual Capitalist content including 200 Years of Global Gold Production, by Country or Ranked: The Largest Gold Reserves by Country.

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business1 week ago

Business1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc1 week ago

Misc1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes