Technology

The Big Five: Largest Acquisitions by Tech Company

The Big Five: Largest Acquisitions by Tech Company

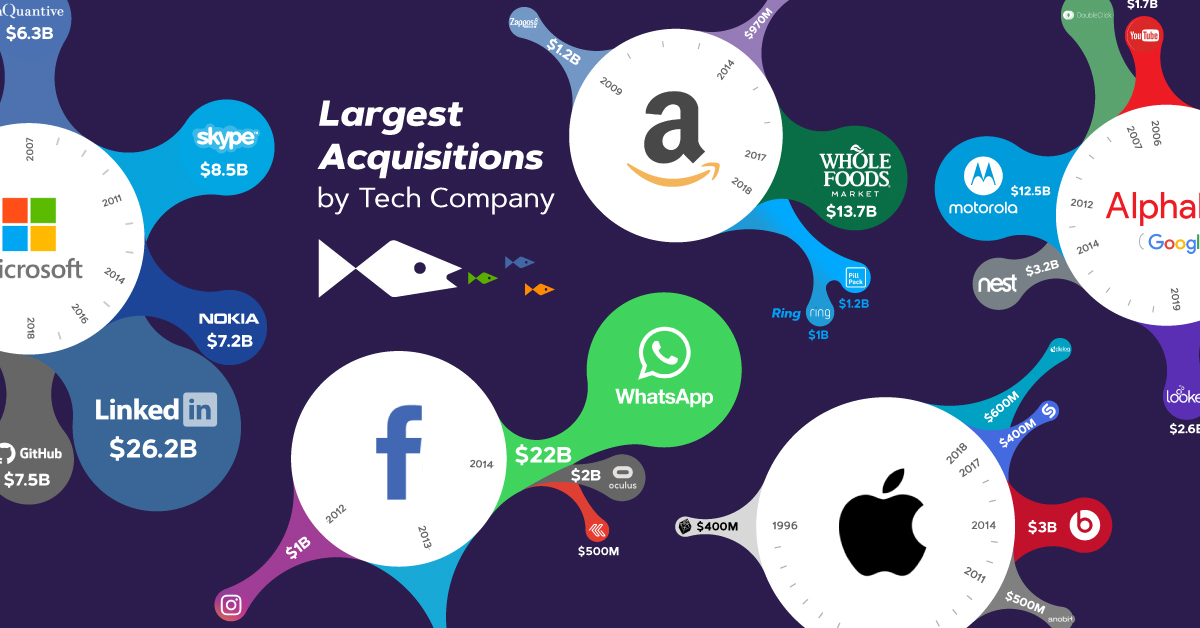

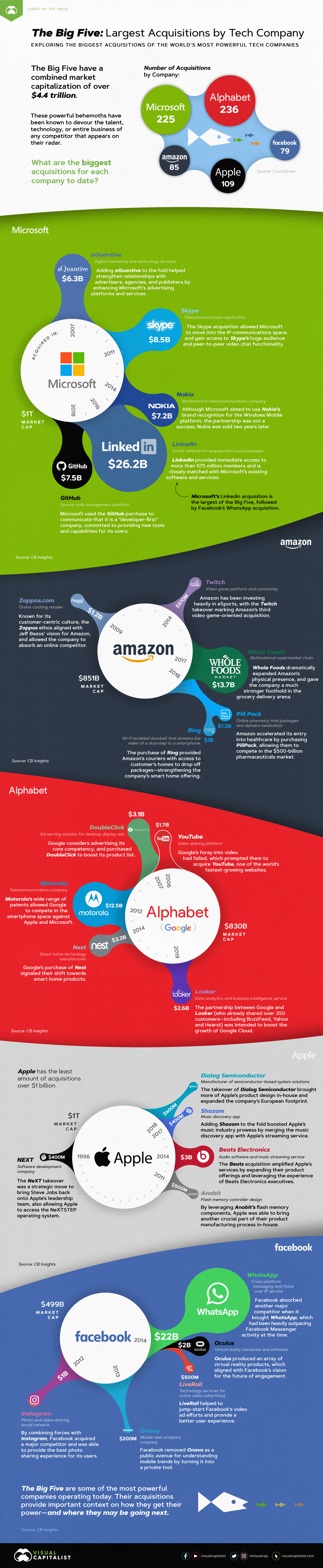

The Big Five tech giants, or “FAAMG”—Facebook, Amazon, Apple, Microsoft, and Google (Alphabet)—have a combined market capitalization of over $4 trillion.

These powerful tech behemoths often devour the talent, technology, or entire businesses of aspiring competitors. Given their financial weight, mergers and acquisitions have become a key tactic in maintaining their strong grip on tech supremacy.

Today’s Chart of the Week explores the world’s most powerful tech companies and their biggest acquisitions to date.

Which Acquisitions Were a Success?

While these tech giants may have had big aspirations for these exceedingly large deals, they have mixed success rates.

Microsoft

Microsoft made its big move 2016 to buy LinkedIn for $26.2 billion, and it’s the most sizable acquisition by any of the Big Five tech companies.

Microsoft’s 5 Biggest Acquisitions:

| Acquisition (Year) | Amount | Category |

|---|---|---|

| LinkedIn (2016) | $26.2 billion | Social Media |

| Skype (2011) | $8.5 billion | Telecommunications |

| GitHub (2018) | $7.5 billion | Software |

| Nokia (2014) | $7.2 billion | Telecommunications |

| aQuantive (2007) | $6.3 billion | Marketing |

The LinkedIn deal was made due to the synergy between the two companies’ offerings, and Microsoft’s desire to gain access to LinkedIn’s 575 million members.

However, not all of Microsoft’s acquisitions have been as successful, such as its 2014 purchase of Nokia’s Devices & Services business for $7.2 billion. This seemed like a smart move at the time, considering the Finnish company held 41% of the global handset market.

Yet, Microsoft sold the asset for a mere $350 million just two years later. Microsoft shifted its strategy and exited the feature phone market, choosing to focus on a narrow, niche market for their hardware.

Amazon

Amazon has closed more than $20 billion in acquisitions and investments since 2017. This includes the purchase of Whole Foods, which Amazon bought for $13.7 billion, and is the company’s largest acquisition to date.

Amazon’s 5 Biggest Acquisitions:

| Acquisition (Year) | Amount | Category |

|---|---|---|

| Whole Foods (2017) | $13.7 billion | Retail |

| Zappos (2009) | $1.2 billion | Retail |

| Ring (2018) | $1.2 billion | Technology |

| PillPack (2018) | $1 billion | Pharmaceuticals |

| Twitch (2014) | $970 million | Social Media |

From purchases to bolster the AI of smart assistant Alexa, to Wi-Fi enabled doorbell Ring, recent additions clearly show the company intends to cement its presence in people’s homes.

After acquiring Whole Foods, Amazon began offering store discounts to Prime customers, in an attempt to bundle its home offerings and provide a more holistic customer experience.

Alphabet

Alphabet has made several daring moves into the hardware and data science sectors. The company’s biggest acquisition was Motorola, which it bought in 2012 for $12.5 billion.

Alphabet’s 5 Biggest Acquisitions:

| Acquisition (Year) | Amount | Category |

|---|---|---|

| Motorola (2012) | $12.5 billion | Telecommunications |

| Nest (2014) | $3.2 billion | Technology |

| DoubleClick (2007) | $3.1 billion | Marketing |

| Looker (2019) | $2.6 billion | Software |

| YouTube (2006) | $1.7 billion | Social Media |

However, the purchase of Motorola was a bet that didn’t pay off. Alphabet sold off much of Motorola’s assets for less than $3 billion in 2014, a little less than two years after it had originally acquired it.

Alphabet continues to consolidate its acquisitions in order to simplify its organizational structure. DoubleClick, acquired in 2007, merged with Google Analytics 360 Suite under the Google Marketing Platform—making it easier for marketers to access their metrics using one platform.

Apple

Out of the Big Five companies, Apple has the fewest acquisitions over $1 billion. Its largest purchase was for Beats Electronics, which it acquired for $3 billion in 2014.

Apple’s 5 Biggest Acquisitions

| Acquisition (Year) | Amount | Category |

|---|---|---|

| Beats (2014) | $3 billion | Music |

| Dialog Semiconductor (2018) | $600 million | Manufacturing |

| Anobit (2011) | $500 million | Manufacturing |

| Shazam (2017) | $400 million | Music |

| NeXT Computer (1996) | $400 million | Technology |

Apple’s increasing music streaming efforts have been evident, with the acquisition of Shazam three years after it purchased Beats Electronics.

In an intriguing recent turn of events, Apple recently announced it will acquire the majority of Intel’s smartphone modem business. This $1 billion deal will allow Apple to build all of its devices in-house, and better prepare the iPhone for the upcoming 5G push.

Facebook’s largest acquisition has been WhatsApp Messenger, which it purchased for $22 billion in 2014. The WhatsApp acquisition is the second largest of the Big Five, following Microsoft’s LinkedIn purchase.

Facebook’s 5 Biggest Acquisitions:

| Acquisition (Year) | Amount | Category |

|---|---|---|

| WhatsApp (2014) | $22 billion | Social Media |

| Oculus (2014) | $2 billion | Technology |

| Instagram (2012) | $1 billion | Social Media |

| LiveRail (2014) | $500 million | Marketing |

| Onavo (2013) | $200 million | Analytics |

Aside from absorbing any competitors who encroach on Facebook’s turf—such as WhatsApp and Instagram—Facebook’s takeovers have been aimed at venturing into uncharted territory. The acquisition of virtual reality manufacturer, Oculus, is evidence of Facebook’s bet on virtual reality as the future of engagement.

“After games, we’re going to make Oculus a platform for many other experiences. Imagine enjoying a court side seat at a game, or studying in a classroom of students and teachers all over the world —just by putting on goggles in your home.”

—Mark Zuckerberg

Predicting the Next Shift

The Big Five are some of the most influential companies in the world today.

Beyond rapidly reshaping the global tech landscape, these acquisitions provide important context on how tech companies consolidate power—and, more importantly, what will fuel their next phase of growth.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?