Technology

The 50 Most Visited Websites in the World

View the full-resolution version of this infographic

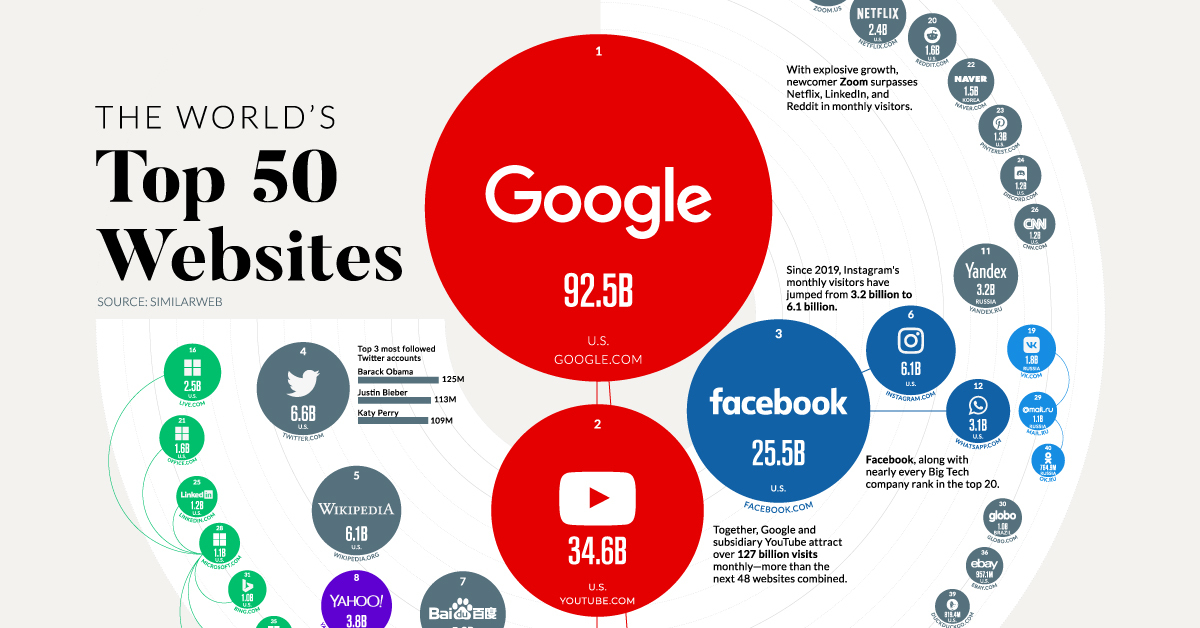

The 50 Most Visited Websites In the World

View the high-resolution of the infographic by clicking here.

If you spend any time online, it’s likely you’re familiar with some of the world’s most visited websites. On today’s internet, a handful of giants have unmatched dominance.

Top Three Websites (Monthly visits):

- Google: 92.5 billion

- YouTube: 34.6 billion

- Facebook: 25.5 billion

Together, the top three websites rake in 152 billion visits monthly, outpacing the next 47 websites combined. What’s more, as the pandemic transformed everything from the way we work, learn, communicate, and shop—a majority of these activities migrated online.

In this new visualization, we look at the most visited websites around the world, drawing data from SimilarWeb (as of November 2020).

The Top Global Websites

Servicing over two trillion search queries annually through its network, Alphabet-owned Google ranks highest with its flagship domain, Google.com. Google derives approximately 80% of its earnings from ad revenues.

| Rank | Website | Monthly Visitors | Country of Origin | Category |

|---|---|---|---|---|

| 1 | Google.com | 92.5B | U.S. | Search Engines |

| 2 | Youtube.com | 34.6B | U.S. | TV Movies and Streaming |

| 3 | Facebook.com | 25.5B | U.S. | Social Networks and Online Communities |

| 4 | Twitter.com | 6.6B | U.S. | Social Networks and Online Communities |

| 5 | Wikipedia.org | 6.1B | U.S. | Dictionaries and Encyclopedias |

| 6 | Instagram.com | 6.1B | U.S. | Social Networks and Online Communities |

| 7 | Baidu.com | 5.6B | China | Search Engines |

| 8 | Yahoo.com | 3.8B | U.S. | News and Media |

| 9 | xvideos.com | 3.4B | Czech Republic | Adult |

| 10 | pornhub.com | 3.3B | Canada | Adult |

| 11 | Yandex.ru | 3.2B | Russia | Search Engines |

| 12 | Whatsapp.com | 3.1B | U.S. | Social Networks and Online Communities |

| 13 | Amazon.com | 2.9B | U.S. | Marketplace |

| 14 | xnxx.com | 2.9B | Czech Republic | Adult |

| 15 | Zoom.us | 2.7B | U.S. | Computers Electronics and Technology |

| 16 | Live.com | 2.5B | U.S. | |

| 17 | Netflix.com | 2.4B | U.S. | TV Movies and Streaming |

| 18 | Yahoo.co.jp | 2.4B | Japan | News and Media |

| 19 | Vk.com | 1.8B | Russia | Social Networks and Online Communities |

| 20 | Reddit.com | 1.6B | U.S. | Social Networks and Online Communities |

| 21 | Office.com | 1.6B | U.S. | Programming and Developer Software |

| 22 | Naver.com | 1.5B | South Korea | News and Media |

| 23 | Pinterest.com | 1.3B | U.S. | Social Networks and Online Communities |

| 24 | Discord.com | 1.2B | U.S. | Social Networks and Online Communities |

| 25 | Linkedin.com | 1.2B | U.S. | Social Networks and Online Communities |

| 26 | Cnn.com | 1.2B | U.S. | News and Media |

| 27 | xhamster.com | 1.2B | Cyprus | Adult |

| 28 | Microsoft.com | 1.1B | U.S. | Programming and Developer Software |

| 29 | Mail.ru | 1.1B | Russia | |

| 30 | Globo.com | 1.0B | Brazil | News and Media |

| 31 | Bing.com | 1.0B | U.S. | Search Engines |

| 32 | Twitch.tv | 1.0B | U.S. | Video Games Consoles and Accessories |

| 33 | Google.com.br | 1.0B | Brazil | Search Engines |

| 34 | QQ.com | 981.3M | China | News and Media |

| 35 | Microsoftonline.com | 968.9M | Unknown | Programming and Developer Software |

| 36 | ebay.com | 957.1M | U.S. | Marketplace |

| 37 | Msn.com | 885.4M | U.S. | News and Media |

| 38 | News.yahoo.co.jp | 839.8M | Japan | News and Media |

| 39 | Duckduckgo.com | 819.4M | U.S. | Search Engines |

| 40 | Ok.ru | 764.9M | Russia | Social Networks and Online Communities |

| 41 | Walmart.com | 718.6M | U.S. | Marketplace |

| 42 | Bilibili.com | 686.0M | China | Animation and Comics |

| 43 | Tiktok.com | 663.2M | China | Social Networks and Online Communities |

| 44 | Paypal.com | 657.2M | U.S. | Financial Planning and Management |

| 45 | Google.de | 624.5M | Germany | Search Engines |

| 46 | Amazon.co.jp | 619.2M | Japan | Marketplace |

| 47 | Aliexpress.com | 611.0M | China | Marketplace |

| 48 | Amazon.de | 608.8M | Germany | Marketplace |

| 49 | Rakuten.co.jp | 593.4M | Japan | Marketplace |

| 50 | Amazon.co.uk | 579.7M | United Kingdom | Marketplace |

Coming in second, social networking platform Facebook has a user base of 2.7 billion. On average, users spend 34 minutes on the site daily, while 36% of users say it’s also where they get their news—higher than any other social network.

As the leading search engine in China, Baidu (#7) received 5.6 billion visitors in November. Baidu is also branching out its business— venturing into electric vehicles (EVs) in a partnership with China-based automaker Geely.

As video conferencing vaulted in demand during the pandemic, Zoom (#15), launched into the most visited websites with 2.7 billion visitors monthly. Similarly, TikTok (#43) became a freshly minted addition.

The Most Visited Websites, By Country of Origin

With 27 sites on the list, the U.S. remains a dominant player. While its reach is highly concentrated on a global level, just a handful of companies own a majority of these sites.

See the static version of each regional graphic here.

Microsoft (#28), for instance, owns seven of the top sites in the world including LinkedIn (#25) and Live.com (#16). Amazon (#13), on the other hand owns five including Twitch.tv (#32), along with popular Amazon-focused domains in Japan, U.K., and Germany.

China holds five top websites: Baidu (#7), QQ (#34), Bilibili (#42), TikTok (#43), and AliExpress (#47). The Tencent-owned QQ.com, ranks as the top news site in China, with over 981 million monthly visits. Like WeChat, QQ also provides a popular messaging platform.

Just four of the most visited websites globally are based in both Russia and Japan, while the rest of the world account for 10 top sites altogether.

Reaching New Heights

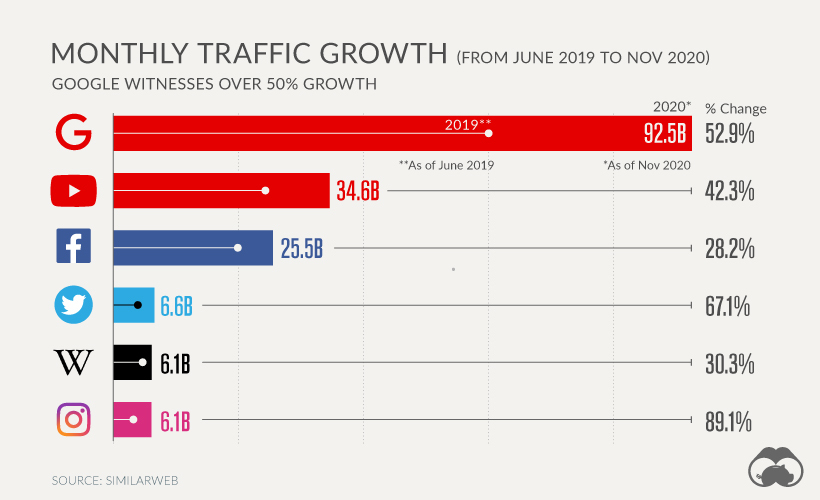

While global internet patterns are clearly dominated by a few titans, what can we make of their recent traffic growth?

Between June 2019 and November 2020, Google’s monthly visitors increased 52.9%. Among the most visited websites globally, this rate of growth falls only behind Instagram (#6) at 89.1% and Twitter (#4) at 67.1%.

Wikipedia (#5), a non-profit website that originated in 2001 by Larry Sanger and Jimmy Wales realized over 30% growth.

While large tech companies have only accelerated their market share—Google makes up roughly 90% of the search ad market—several regulatory bodies are placing greater scrutiny on them. An October 2020 antitrust report suggested that Big Tech is in fact anti-competitive, drawing comparisons with oil tycoons of the 19th and 20th centuries.

With these key forces in mind, it raises a critical question: is there a limit to their growth?

Technology

Visualizing AI Patents by Country

See which countries have been granted the most AI patents each year, from 2012 to 2022.

Visualizing AI Patents by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This infographic shows the number of AI-related patents granted each year from 2010 to 2022 (latest data available). These figures come from the Center for Security and Emerging Technology (CSET), accessed via Stanford University’s 2024 AI Index Report.

From this data, we can see that China first overtook the U.S. in 2013. Since then, the country has seen enormous growth in the number of AI patents granted each year.

| Year | China | EU and UK | U.S. | RoW | Global Total |

|---|---|---|---|---|---|

| 2010 | 307 | 137 | 984 | 571 | 1,999 |

| 2011 | 516 | 129 | 980 | 581 | 2,206 |

| 2012 | 926 | 112 | 950 | 660 | 2,648 |

| 2013 | 1,035 | 91 | 970 | 627 | 2,723 |

| 2014 | 1,278 | 97 | 1,078 | 667 | 3,120 |

| 2015 | 1,721 | 110 | 1,135 | 539 | 3,505 |

| 2016 | 1,621 | 128 | 1,298 | 714 | 3,761 |

| 2017 | 2,428 | 144 | 1,489 | 1,075 | 5,136 |

| 2018 | 4,741 | 155 | 1,674 | 1,574 | 8,144 |

| 2019 | 9,530 | 322 | 3,211 | 2,720 | 15,783 |

| 2020 | 13,071 | 406 | 5,441 | 4,455 | 23,373 |

| 2021 | 21,907 | 623 | 8,219 | 7,519 | 38,268 |

| 2022 | 35,315 | 1,173 | 12,077 | 13,699 | 62,264 |

In 2022, China was granted more patents than every other country combined.

While this suggests that the country is very active in researching the field of artificial intelligence, it doesn’t necessarily mean that China is the farthest in terms of capability.

Key Facts About AI Patents

According to CSET, AI patents relate to mathematical relationships and algorithms, which are considered abstract ideas under patent law. They can also have different meaning, depending on where they are filed.

In the U.S., AI patenting is concentrated amongst large companies including IBM, Microsoft, and Google. On the other hand, AI patenting in China is more distributed across government organizations, universities, and tech firms (e.g. Tencent).

In terms of focus area, China’s patents are typically related to computer vision, a field of AI that enables computers and systems to interpret visual data and inputs. Meanwhile America’s efforts are more evenly distributed across research fields.

Learn More About AI From Visual Capitalist

If you want to see more data visualizations on artificial intelligence, check out this graphic that shows which job departments will be impacted by AI the most.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023