Technology

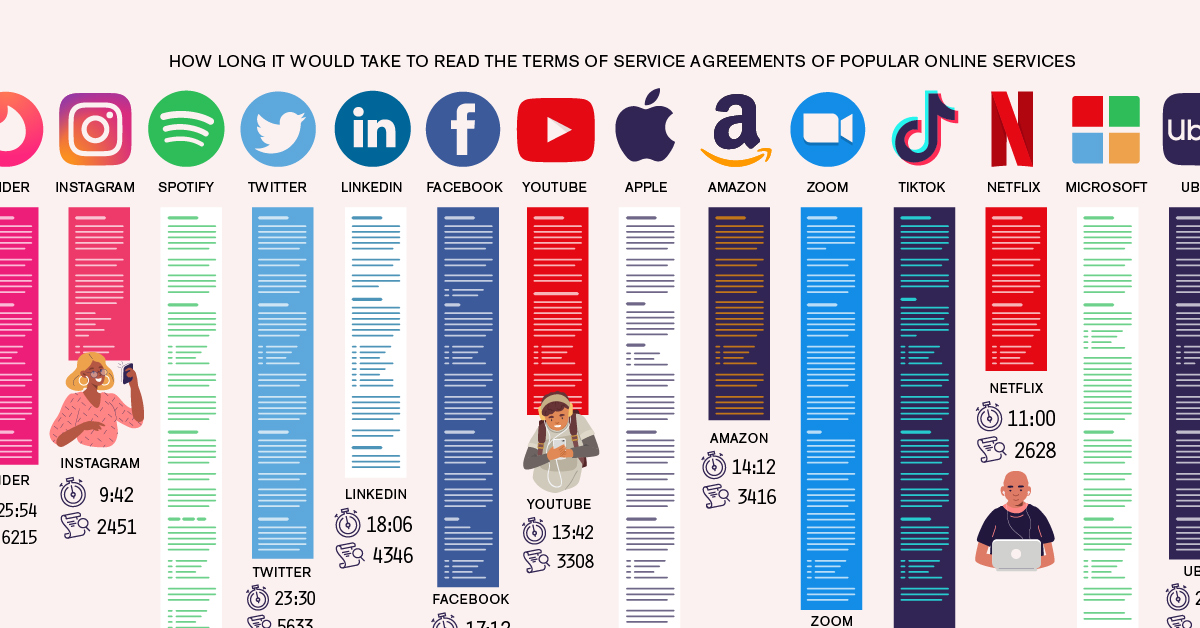

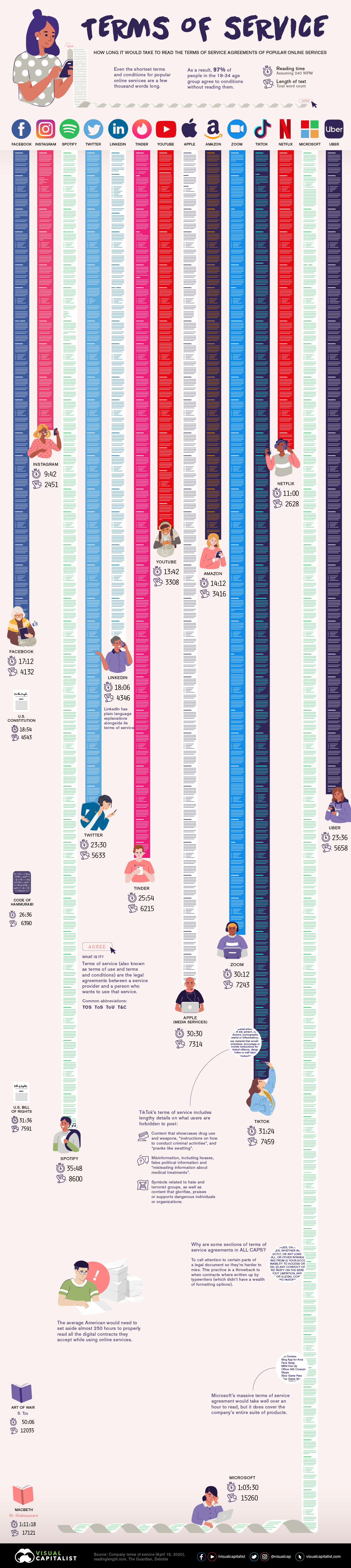

Visualizing the Length of the Fine Print, for 14 Popular Apps

Terms of Service: The Length of Common Digital Contracts

Do you take the time to read the terms of service before you agree to when downloading the latest app or software?

Of course you do…

The world is awash with apps and internet services that ask potential users to agree to a service agreement. Most people click on ‘agree’ and move on, knowing that reading the service agreements could put them to sleep and defer their favorite internet fix.

Taking inspiration from designer Dima Yarovinsky’s project titled I Agree, today’s post visualizes the length of service agreements, by counting the words and calculating how long it would take users to read each one.

Ain’t Nobody Got Time for That

The average reading speed of most adults is 200 to 250 words per minute (wpm). College students, probably because they are very studious and not skimming, move that pace up to around 300 words per minute. For the sake of this analysis, we calculated reading times based on 240 wpm.

| App/Service | Word Count | How many minutes to read? (240 wpm) |

|---|---|---|

| Microsoft | 15,260 | 63.5 |

| Spotify | 8,600 | 35.8 |

| Niantic (Pokemon Go) | 8,466 | 35.2 |

| TikTok | 7,459 | 31.4 |

| Apple (Media Services) | 7,314 | 30.5 |

| Zoom | 6,891 | 28.7 |

| Tinder | 6,215 | 25.9 |

| Slack | 5,782 | 24.1 |

| Uber | 5,658 | 23.6 |

| 5,633 | 23.5 | |

| Bumble | 5,442 | 22.7 |

| Snapchat | 4,935 | 20.6 |

| 4,346 | 18.1 | |

| 4,132 | 17.2 | |

| 3,459 | 14.4 | |

| Amazon | 3,416 | 14.2 |

| YouTube | 3,308 | 13.7 |

| 3,267 | 13.6 | |

| Dropbox | 2,704 | 11.3 |

| Netflix | 2,628 | 11.0 |

| 2,451 | 9.7 |

The service agreement for Microsoft stands out at the top of the list with an agreement that would take over an hour to read — a bit less time than it would take to read Shakespeare’s Macbeth. To be fair, this service agreement does seem to cover the company’s entire suite of products.

These agreements are an insight into the legal mumbo jumbo that exists when it comes to regulating the use of these apps. There are a multitude of agreements that go even further into depth about what rules govern developers, online cash transactions and much more. The average American would need to set aside almost 250 hours to properly read all the digital contracts they accept while using online services.

Regardless, users may feel like they are wasting time reviewing a contract that can neither change or refuse—or more vitally, even comprehend.

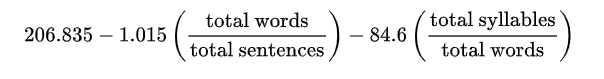

Not All Text is Equal: The Flesch Reading-Ease Test

Apparently dealing with some of his own textual frustration, a Dr. Rudolf Flesch observed that some text, in particular legal language, appeared to be written to make reading as difficult as humanly possible.

Long sentences filled with arcane words can drag out simple sentences and discourage comprehension. Flesch wanted to measure the variability in reading comprehension — and by studying different kinds of writing, he developed a formula to determine readability and forever scorn lawyers.

In the Flesch Reading-Ease test, higher scores indicate material that is easier to read. Lower numbers mark passages that are more difficult to read. The formula for the Flesch Reading-Ease Score (FRES) test is:

The readability score uses two metrics:

- The numbers of words per sentence

- The number of syllables per word

Based on this score, a text would correspond to a particular education level.

| Score | Grade | Avg. Words per sentence | Syllables per 100 words |

|---|---|---|---|

| 100-90 | 5th grade | 8 | 123 |

| 90.0-80.0 | 6th grade | 11 | 131 |

| 90.0-70.0 | 7th grade | 14 | 139 |

| 70.0-60.0 | 8th and 9th grade | 17 | 147 |

| 60.0-50.0 | 10 to 12th grade | 21 | 155 |

| 50.0-30.0 | College | 25 | 167 |

| 30.0-0.0 | College graduate | 29 | 192 |

So how do the service agreements in our sample rank in terms of the Flesch Reading-Ease test?

| App/Service | Flesch Reading Ease Score | Equivalent Grade Level |

|---|---|---|

| 56 | 10 to 12th grade | |

| 56 | 10 to 12th grade | |

| 54 | 10 to 12th grade | |

| 54 | 10 to 12th grade | |

| Microsoft | 54 | 10 to 12th grade |

| Snapchat | 54 | 10 to 12th grade |

| Dropbox | 51 | 10 to 12th grade |

| Bumble | 50 | College level |

| YouTube | 50 | College level |

| 48 | College level | |

| Apple Media Services | 47 | College level |

| Tinder | 46 | College level |

| Amazon | 45 | College level |

| Netflix | 45 | College level |

| TikTok | 44 | College level |

| Spotify | 44 | College level |

| Zoom | 42 | College level |

| Uber | 40 | College level |

| 39 | College level | |

| Niantic (Pokemon Go) | 39 | College level |

| Slack | 36 | College level |

While not the most difficult to read, they definitely include a fair amount of legalese that helps discourage reading. The length and the difficulty of reading these agreements makes them practically useless to the average person.

This is a problem because it undermines basic concepts of contracts and informed consent. Users are giving up their rights without their knowledge.

Terms of Service: You Are the Product

These apps and software are the forefront of the data collection for a multi-billion dollar industry.

Individual user activity and information get easily collected and stored, creating databases of user patterns. This type of behavioral information makes marketers salivate, allowing them target their products to their ideal audience at lower costs than traditional advertising.

Do you know what you have agreed to?

Technology

Visualizing AI Patents by Country

See which countries have been granted the most AI patents each year, from 2012 to 2022.

Visualizing AI Patents by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This infographic shows the number of AI-related patents granted each year from 2010 to 2022 (latest data available). These figures come from the Center for Security and Emerging Technology (CSET), accessed via Stanford University’s 2024 AI Index Report.

From this data, we can see that China first overtook the U.S. in 2013. Since then, the country has seen enormous growth in the number of AI patents granted each year.

| Year | China | EU and UK | U.S. | RoW | Global Total |

|---|---|---|---|---|---|

| 2010 | 307 | 137 | 984 | 571 | 1,999 |

| 2011 | 516 | 129 | 980 | 581 | 2,206 |

| 2012 | 926 | 112 | 950 | 660 | 2,648 |

| 2013 | 1,035 | 91 | 970 | 627 | 2,723 |

| 2014 | 1,278 | 97 | 1,078 | 667 | 3,120 |

| 2015 | 1,721 | 110 | 1,135 | 539 | 3,505 |

| 2016 | 1,621 | 128 | 1,298 | 714 | 3,761 |

| 2017 | 2,428 | 144 | 1,489 | 1,075 | 5,136 |

| 2018 | 4,741 | 155 | 1,674 | 1,574 | 8,144 |

| 2019 | 9,530 | 322 | 3,211 | 2,720 | 15,783 |

| 2020 | 13,071 | 406 | 5,441 | 4,455 | 23,373 |

| 2021 | 21,907 | 623 | 8,219 | 7,519 | 38,268 |

| 2022 | 35,315 | 1,173 | 12,077 | 13,699 | 62,264 |

In 2022, China was granted more patents than every other country combined.

While this suggests that the country is very active in researching the field of artificial intelligence, it doesn’t necessarily mean that China is the farthest in terms of capability.

Key Facts About AI Patents

According to CSET, AI patents relate to mathematical relationships and algorithms, which are considered abstract ideas under patent law. They can also have different meaning, depending on where they are filed.

In the U.S., AI patenting is concentrated amongst large companies including IBM, Microsoft, and Google. On the other hand, AI patenting in China is more distributed across government organizations, universities, and tech firms (e.g. Tencent).

In terms of focus area, China’s patents are typically related to computer vision, a field of AI that enables computers and systems to interpret visual data and inputs. Meanwhile America’s efforts are more evenly distributed across research fields.

Learn More About AI From Visual Capitalist

If you want to see more data visualizations on artificial intelligence, check out this graphic that shows which job departments will be impacted by AI the most.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023