Technology

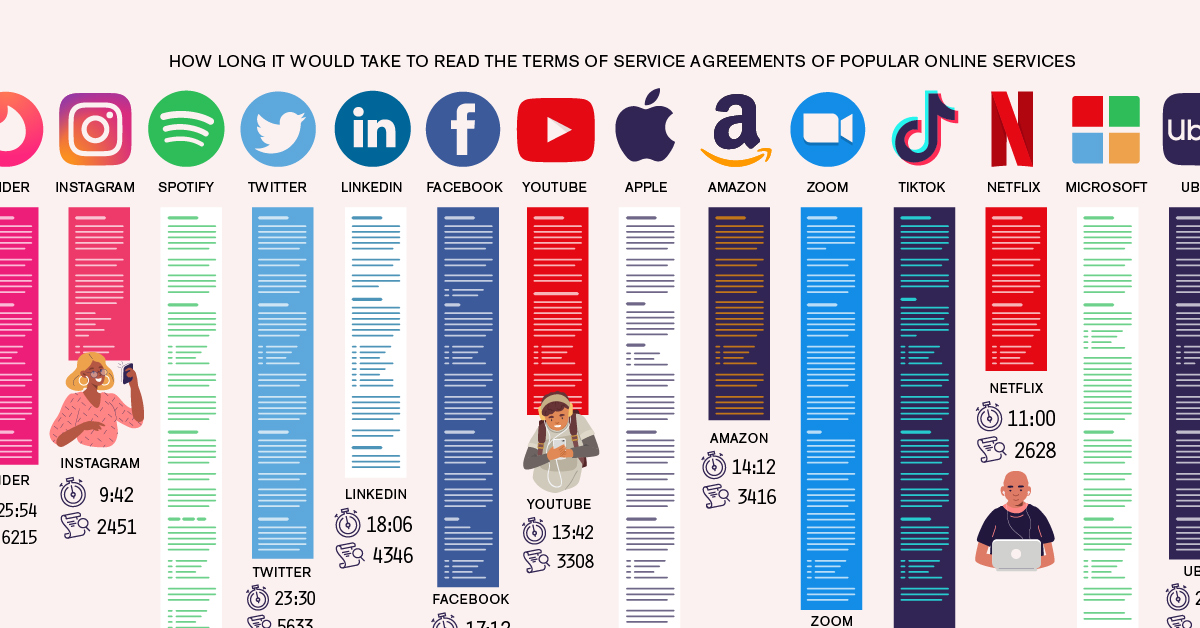

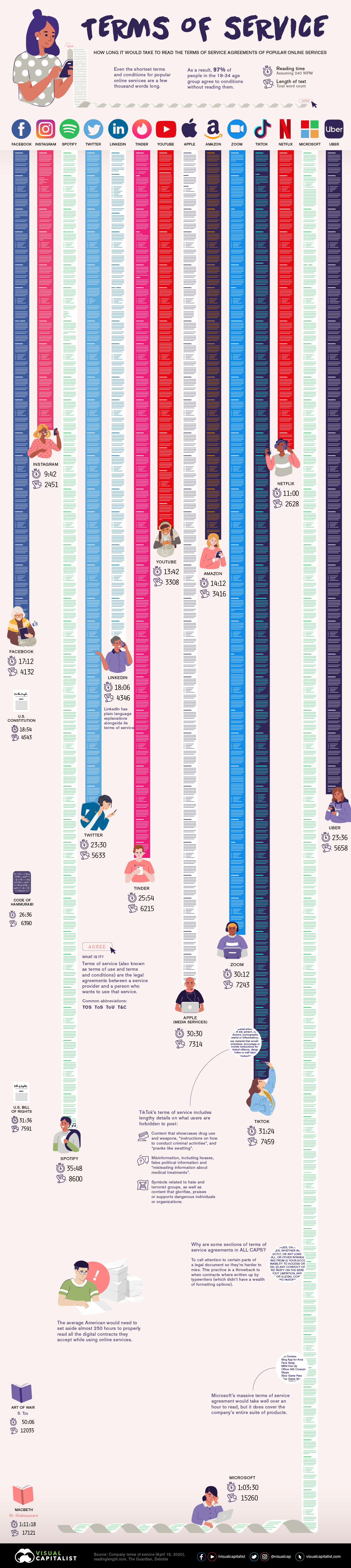

Visualizing the Length of the Fine Print, for 14 Popular Apps

Terms of Service: The Length of Common Digital Contracts

Do you take the time to read the terms of service before you agree to when downloading the latest app or software?

Of course you do…

The world is awash with apps and internet services that ask potential users to agree to a service agreement. Most people click on ‘agree’ and move on, knowing that reading the service agreements could put them to sleep and defer their favorite internet fix.

Taking inspiration from designer Dima Yarovinsky’s project titled I Agree, today’s post visualizes the length of service agreements, by counting the words and calculating how long it would take users to read each one.

Ain’t Nobody Got Time for That

The average reading speed of most adults is 200 to 250 words per minute (wpm). College students, probably because they are very studious and not skimming, move that pace up to around 300 words per minute. For the sake of this analysis, we calculated reading times based on 240 wpm.

| App/Service | Word Count | How many minutes to read? (240 wpm) |

|---|---|---|

| Microsoft | 15,260 | 63.5 |

| Spotify | 8,600 | 35.8 |

| Niantic (Pokemon Go) | 8,466 | 35.2 |

| TikTok | 7,459 | 31.4 |

| Apple (Media Services) | 7,314 | 30.5 |

| Zoom | 6,891 | 28.7 |

| Tinder | 6,215 | 25.9 |

| Slack | 5,782 | 24.1 |

| Uber | 5,658 | 23.6 |

| 5,633 | 23.5 | |

| Bumble | 5,442 | 22.7 |

| Snapchat | 4,935 | 20.6 |

| 4,346 | 18.1 | |

| 4,132 | 17.2 | |

| 3,459 | 14.4 | |

| Amazon | 3,416 | 14.2 |

| YouTube | 3,308 | 13.7 |

| 3,267 | 13.6 | |

| Dropbox | 2,704 | 11.3 |

| Netflix | 2,628 | 11.0 |

| 2,451 | 9.7 |

The service agreement for Microsoft stands out at the top of the list with an agreement that would take over an hour to read — a bit less time than it would take to read Shakespeare’s Macbeth. To be fair, this service agreement does seem to cover the company’s entire suite of products.

These agreements are an insight into the legal mumbo jumbo that exists when it comes to regulating the use of these apps. There are a multitude of agreements that go even further into depth about what rules govern developers, online cash transactions and much more. The average American would need to set aside almost 250 hours to properly read all the digital contracts they accept while using online services.

Regardless, users may feel like they are wasting time reviewing a contract that can neither change or refuse—or more vitally, even comprehend.

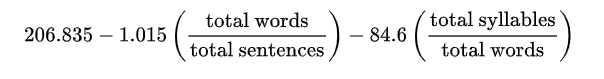

Not All Text is Equal: The Flesch Reading-Ease Test

Apparently dealing with some of his own textual frustration, a Dr. Rudolf Flesch observed that some text, in particular legal language, appeared to be written to make reading as difficult as humanly possible.

Long sentences filled with arcane words can drag out simple sentences and discourage comprehension. Flesch wanted to measure the variability in reading comprehension — and by studying different kinds of writing, he developed a formula to determine readability and forever scorn lawyers.

In the Flesch Reading-Ease test, higher scores indicate material that is easier to read. Lower numbers mark passages that are more difficult to read. The formula for the Flesch Reading-Ease Score (FRES) test is:

The readability score uses two metrics:

- The numbers of words per sentence

- The number of syllables per word

Based on this score, a text would correspond to a particular education level.

| Score | Grade | Avg. Words per sentence | Syllables per 100 words |

|---|---|---|---|

| 100-90 | 5th grade | 8 | 123 |

| 90.0-80.0 | 6th grade | 11 | 131 |

| 90.0-70.0 | 7th grade | 14 | 139 |

| 70.0-60.0 | 8th and 9th grade | 17 | 147 |

| 60.0-50.0 | 10 to 12th grade | 21 | 155 |

| 50.0-30.0 | College | 25 | 167 |

| 30.0-0.0 | College graduate | 29 | 192 |

So how do the service agreements in our sample rank in terms of the Flesch Reading-Ease test?

| App/Service | Flesch Reading Ease Score | Equivalent Grade Level |

|---|---|---|

| 56 | 10 to 12th grade | |

| 56 | 10 to 12th grade | |

| 54 | 10 to 12th grade | |

| 54 | 10 to 12th grade | |

| Microsoft | 54 | 10 to 12th grade |

| Snapchat | 54 | 10 to 12th grade |

| Dropbox | 51 | 10 to 12th grade |

| Bumble | 50 | College level |

| YouTube | 50 | College level |

| 48 | College level | |

| Apple Media Services | 47 | College level |

| Tinder | 46 | College level |

| Amazon | 45 | College level |

| Netflix | 45 | College level |

| TikTok | 44 | College level |

| Spotify | 44 | College level |

| Zoom | 42 | College level |

| Uber | 40 | College level |

| 39 | College level | |

| Niantic (Pokemon Go) | 39 | College level |

| Slack | 36 | College level |

While not the most difficult to read, they definitely include a fair amount of legalese that helps discourage reading. The length and the difficulty of reading these agreements makes them practically useless to the average person.

This is a problem because it undermines basic concepts of contracts and informed consent. Users are giving up their rights without their knowledge.

Terms of Service: You Are the Product

These apps and software are the forefront of the data collection for a multi-billion dollar industry.

Individual user activity and information get easily collected and stored, creating databases of user patterns. This type of behavioral information makes marketers salivate, allowing them target their products to their ideal audience at lower costs than traditional advertising.

Do you know what you have agreed to?

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Markets1 week ago

Markets1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001