Technology

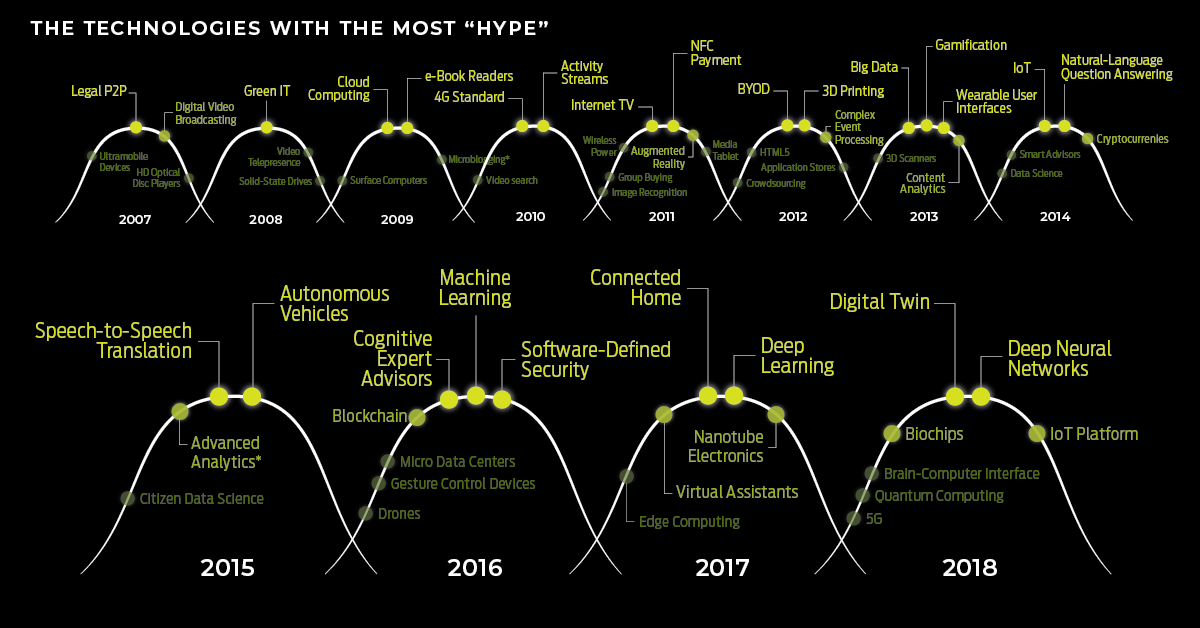

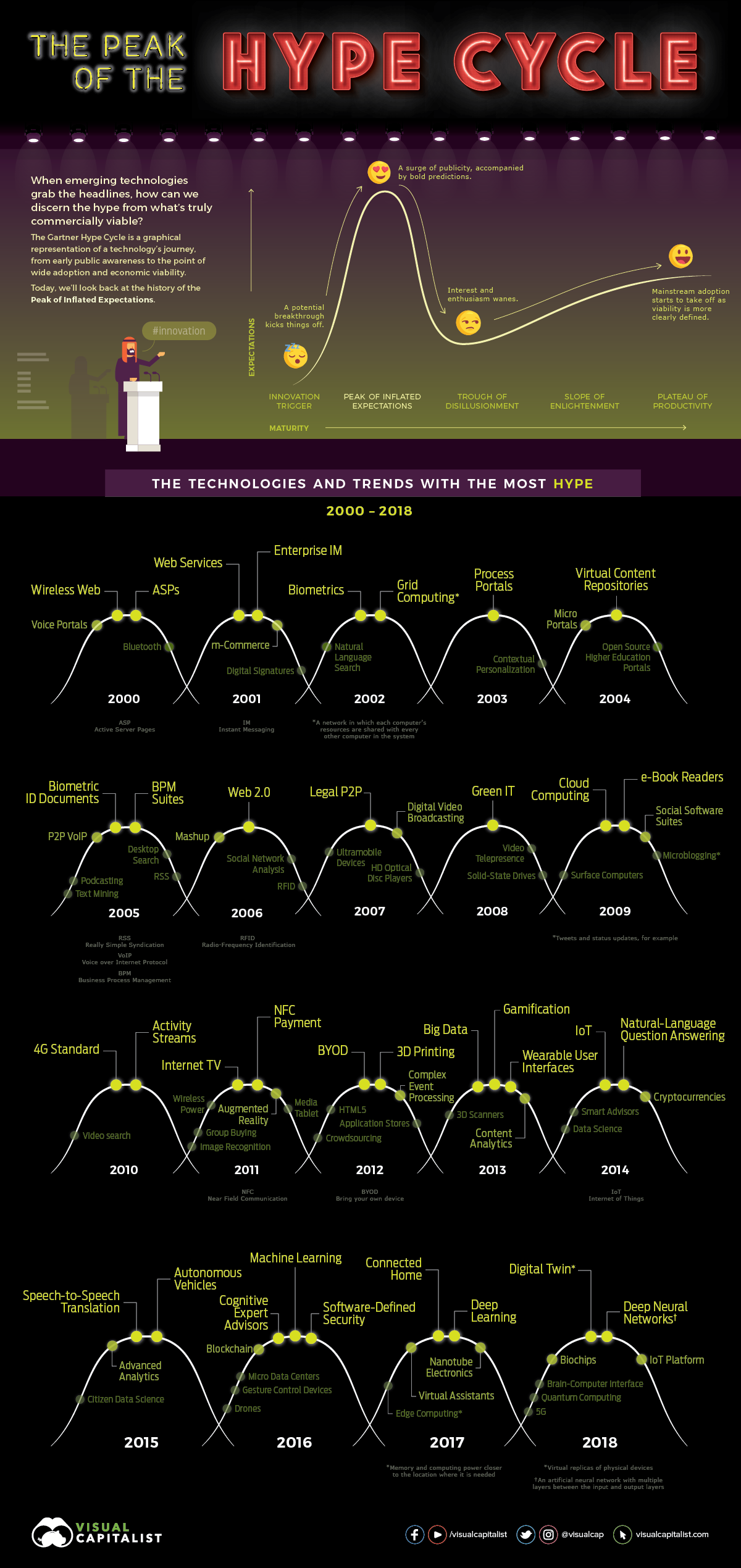

The Most Hyped Technology of Every Year From 2000-2018

Visualizing Technology Hype Cycles (2000-2018)

Nothing captures our collective imagination quite like emerging technology.

In a short amount of time, technological innovations such as wireless internet and social networking have become a ubiquitous part of our everyday lives, quietly transforming the way we live, work, and communicate. Other promising technologies have their moment in the sun, only to fade into obscurity.

Gartner’s Hype Cycle charts the roller coaster ride of emerging tech, from the first stirrings of public awareness to the point of wider adoption and economic viability. Today’s graphic is a retrospective look at which trends scaled the summit of the Hype Cycle each year since 2000.

Reaching the Peak

As the media searches for the next big thing, certain technologies tend to dominate the headlines. Meanwhile, venture capital flows into the companies racing to bring the tech to market, valuations swell, marketing departments generate excitement, and the expectations of the general public begin to grow as well.

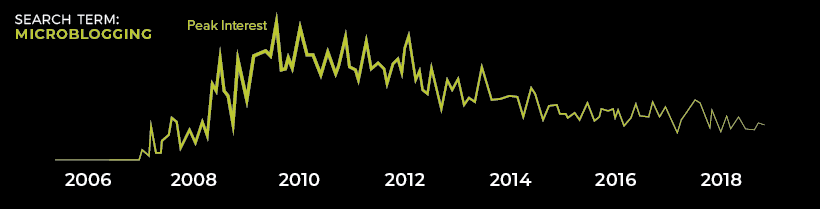

One example of this phenomenon at work is the adoption of microblogging. Today, we don’t think twice about posting a tweet or updating our status on Facebook, but a decade ago, the act of posting a short public message was major shift in the way people used technology to communicate with one another. The intense buzz that sent microblogging towards the top of the Hype Cycle is corroborated by Google Search data.

Living Up to the Hype

A few technologies transcend the hype to transform entire industries. Here are some examples that lived up to their time in the spotlight.

Cloud Computing

Right from the beginning, the analogy of data breaking the shackles of folders and clunky external drives – instead zipping efficiently into the invisible cloud – generated a lot of excitement. It felt like the future of computing, and enterprises and individuals eagerly adopted the technology.

Today, Microsoft and Amazon’s cloud computing divisions each make $6-7 billion in revenue per quarter, and that number is still growing at a brisk pace.

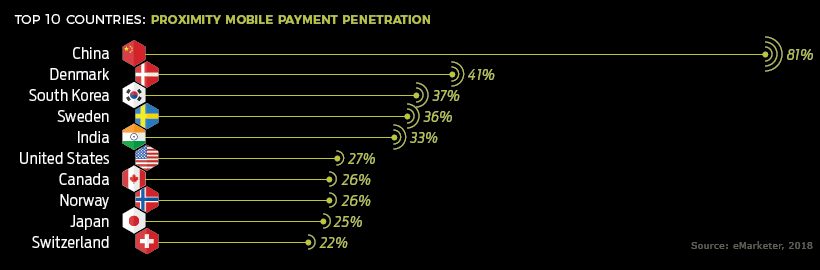

NFC Payments

Near Field Communication – the technology that enables contactless payments – is transforming the way people pay for purchases around the world.

The global contactless payments market is expected to reach $138.4 billion by 2023. Here’s a look at where NFC payments are making the greatest in-roads:

The Ones That Underwhelmed

During the Christmas season of 2009, Kindle became the most gifted item in Amazon’s history. This watershed moment looked like the end of physical books as the public embraced the e-reader as the new way of consuming text.

Fast-forward to today, and only 19% of adults in the U.S. own an e-reader.

Of course, not every technology that grabs the headlines is going to become the next iPhone. Here are some others that didn’t immediately meet expectations after topping the Hype Cycle.

m-Commerce

Some concepts fail primarily because they’re ahead of their time. Such is the case with mobile commerce.

By 2001, more than half of Americans owned mobile phones, and this represented a huge opportunity. Unfortunately, early m-commerce was restricted by the limitations of mobile phones of that time period. It wasn’t until the introduction of smartphones that the concept really took off. Today, nearly half of all online transactions are made via mobile devices.

3D Printing

Few technologies reach the fever pitch that 3D printing did in 2012. From the $1.4 billion merger of the largest players in the sector to the reports of firearm blueprints circulating the web, you could forgive people for believing that the 3D printer was destined to become the next microwave. In the end, interest in 3D printing leveled off.

While it is getting used for prototyping in many different industries, it remains to be seen whether the technology will ever achieve the wide consumer-level adoption that was promised.

What’s Next?

When 2019’s Hype Cycle is released later this year, it remains to be seen which technology will rise to the top. Based on the trajectory from last year, search volume, and current news reports, 5G is a strong competitor.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business1 week ago

Business1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc1 week ago

Misc1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes