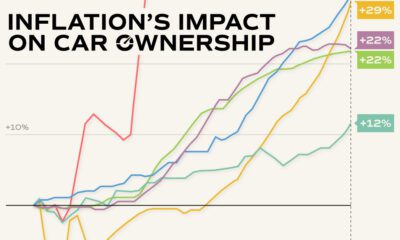

Inflation has impacted various car ownership costs in America, including prices for new and used cars, parts, and insurance.

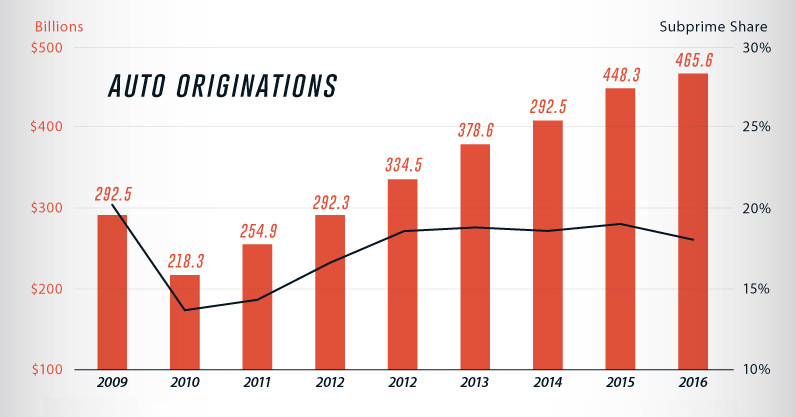

After a borrowing spree during COVID-19, younger Americans are struggling to keep up with their auto loan payments.

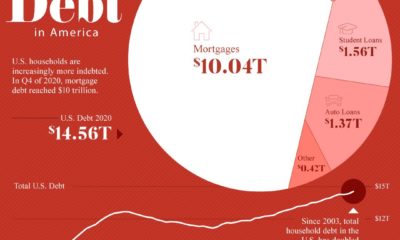

Robust growth in mortgages has pushed U.S. consumer debt to nearly $16 trillion. Click to gain further insight into the situation.

Since 2003, U.S. household debt has doubled to over $14.5 trillion. We break down the components of this colossal figure.

Auto loans have shot up past the $1 trillion mark in the U.S., and delinquencies in subprime auto loans are ticking upwards.

Everything you ever wanted to know about consumer debt in one infographic. We show the historical context, as well as the latest numbers for each category.