Technology

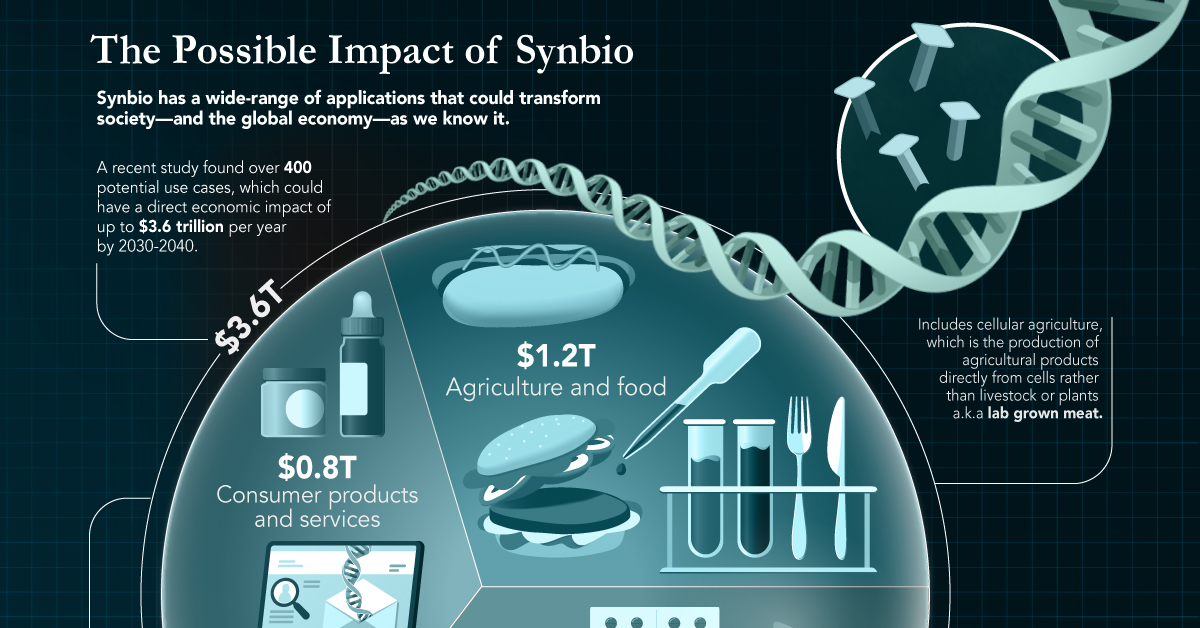

Synthetic Biology: The $3.6 Trillion Science Changing Life as We Know It

How Synthetic Biology Could Change Life as we Know it

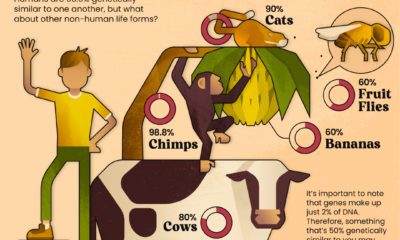

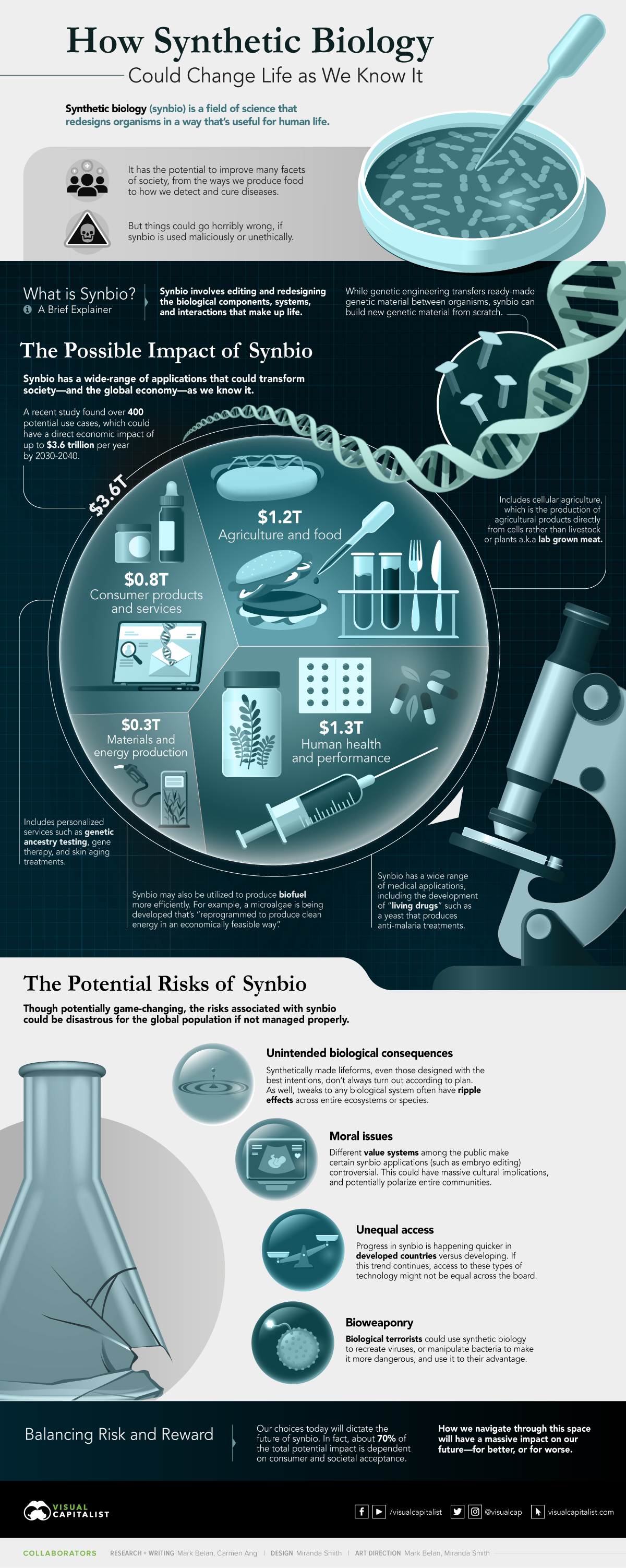

Synthetic biology (synbio) is a field of science that redesigns organisms in an effort to enhance and support human life. According to one projection, this rapidly growing field of science is expected to reach $28.8 billion in global revenue by 2026.

Although it has the potential to transform many aspects of society, things could go horribly wrong if synbio is used for malicious or unethical reasons. This infographic explores the opportunities and potential risks that this budding field of science has to offer.

What is Synthetic Biology?

We’ve covered the basics of synbio in previous work, but as a refresher, here’s a quick explanation of what synbio is and how it works.

Synbio is an area of scientific research that involves editing and redesigning different biological components and systems in various organisms.

It’s like genetic engineering but done at a more granular level—while genetic engineering transfers ready-made genetic material between organisms, synbio can build new genetic material from scratch.

The Opportunities of Synbio

This field of science has a plethora of real-world applications that could transform our everyday lives. A study by McKinsey found over 400 potential uses for synbio, which were broken down into four main categories:

- Human health and performance

- Agriculture and food

- Consumer products and services

- Materials and energy production

If those potential uses become reality in the coming years, they could have a direct economic impact of up to $3.6 trillion per year by 2030-2040.

1. Human Health and Performance

The medical and health sector is predicted to be significantly influenced by synbio, with an economic impact of up to $1.3 trillion each year by 2030-2040.

Synbio has a wide range of medical applications. For instance, it can be used to manipulate biological pathways in yeast to produce an anti-malaria treatment.

It could also enhance gene therapy. Using synbio techniques, the British biotech company Touchlight Genetics is working on a way to build synthetic DNA without the use of bacteria, which would be a game-changer for the field of gene therapy.

2. Agriculture and Food

Synbio has the potential to make a big splash in the agricultural sector as well—up to $1.2 trillion per year by as early as 2030.

One example of this is synbio’s role in cellular agriculture, which is when meat is created from cells directly. The cost of creating lab-grown meat has decreased significantly in recent years, and because of this, various startups around the world are beginning to develop a variety of cell-based meat products.

3. Consumer Products and Services

Using synthetic biology, products could be tailored to suit an individual’s unique needs. This would be useful in fields such as genetic ancestry testing, gene therapy, and age-related skin procedures.

By 2030-2040, synthetic biology could have an economic impact on consumer products and services to the tune of up to $800 billion per year.

4. Materials and Energy Production

Synbio could also be used to boost efficiency in clean energy and biofuel production. For instance, microalgae are currently being “reprogrammed” to produce clean energy in an economically feasible way.

This, along with other material and energy improvements through synbio methods, could have a direct economic impact of up to $300 billion each year.

The Potential Risks of Synbio

While the potential economic and societal benefits of synthetic biology are vast, there are a number of risks to be aware of as well:

- Unintended biological consequences: Making tweaks to any biological system can have ripple effects across entire ecosystems or species. When any sort of lifeform is manipulated, things don’t always go according to plan.

- Moral issues: How far we’re comfortable going with synbio depends on our values. Certain synbio applications, such as embryo editing, are controversial. If these types of applications become mainstream, they could have massive societal implications, with the potential to increase polarization within communities.

- Unequal access: Innovation and progress in synbio is happening faster in wealthier countries than it is in developing ones. If this trend continues, access to these types of technology may not be equal worldwide. We’ve already witnessed this type of access gap during the rollout of COVID-19 vaccines, where a majority of vaccines have been administered in rich countries.

- Bioweaponry: Synbio could be used to recreate viruses, or manipulate bacteria to make it more dangerous, if used with ill intent.

According to a group of scientists at the University of Edinburgh, communication between the public, synthetic biologists, and political decision-makers is crucial so that these societal and environmental risks can be mitigated.

Balancing Risk and Reward

Despite the risks involved, innovation in synbio is happening at a rapid pace.

By 2030, most people will have likely eaten, worn, or been treated by a product created by synthetic biology, according to synthetic biologist Christopher A. Voigt.

Our choices today will dictate the future of synbio, and how we navigate through this space will have a massive impact on our future—for better, or for worse.

Brands

How Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

How Tech Logos Have Evolved Over Time

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

One would be hard-pressed to find a company that has never changed its logo. Granted, some brands—like Rolex, IBM, and Coca-Cola—tend to just have more minimalistic updates. But other companies undergo an entire identity change, thus necessitating a full overhaul.

In this graphic, we visualized the evolution of prominent tech companies’ logos over time. All of these brands ranked highly in a Q1 2024 YouGov study of America’s most famous tech brands. The logo changes are sourced from 1000logos.net.

How Many Times Has Google Changed Its Logo?

Google and Facebook share a 98% fame rating according to YouGov. But while Facebook’s rise was captured in The Social Network (2010), Google’s history tends to be a little less lionized in popular culture.

For example, Google was initially called “Backrub” because it analyzed “back links” to understand how important a website was. Since its founding, Google has undergone eight logo changes, finally settling on its current one in 2015.

| Company | Number of Logo Changes |

|---|---|

| 8 | |

| HP | 8 |

| Amazon | 6 |

| Microsoft | 6 |

| Samsung | 6 |

| Apple | 5* |

Note: *Includes color changes. Source: 1000Logos.net

Another fun origin story is Microsoft, which started off as Traf-O-Data, a traffic counter reading company that generated reports for traffic engineers. By 1975, the company was renamed. But it wasn’t until 2012 that Microsoft put the iconic Windows logo—still the most popular desktop operating system—alongside its name.

And then there’s Samsung, which started as a grocery trading store in 1938. Its pivot to electronics started in the 1970s with black and white television sets. For 55 years, the company kept some form of stars from its first logo, until 1993, when the iconic encircled blue Samsung logo debuted.

Finally, Apple’s first logo in 1976 featured Isaac Newton reading under a tree—moments before an apple fell on his head. Two years later, the iconic bitten apple logo would be designed at Steve Jobs’ behest, and it would take another two decades for it to go monochrome.

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue