Technology

The World’s 25 Most Successful Media Franchises, and How They Stay Relevant

The World’s 25 Most Successful Media Franchises, and How They Stay Relevant

Great stories come and go, but there are a certain few that can truly stand the test of time.

Tugging on the heartstrings with nostalgic stories can be a powerful tool. Yet, even the most world-renowned storytellers like Disney face pressure to constantly innovate.

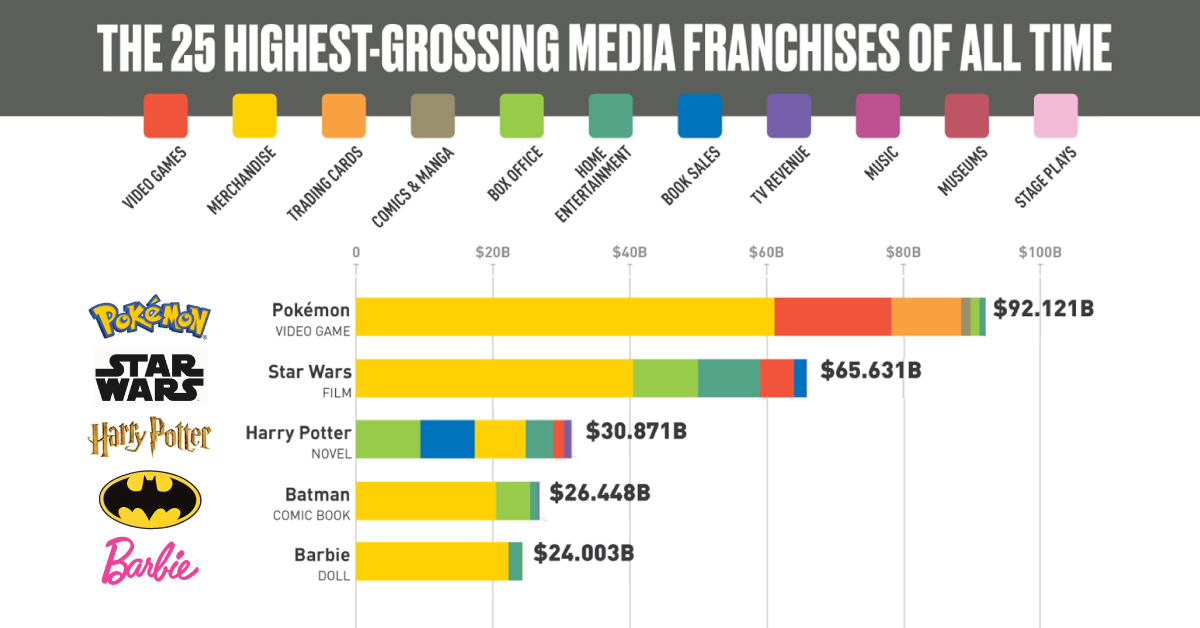

Today’s infographic from TitleMax illustrates the highest-grossing media franchises, and dives into how they generate their revenue and adapt to new mediums in changing times.

The Supreme Storytellers

According to the infographic, the majority of franchise revenue comes from merchandising. Video games, comic books, and Japanese manga are also significant drivers of income.

| Rank | Franchise | Year Created | Revenue (USD) | Main Revenue Source |

|---|---|---|---|---|

| #1 | Pokémon | 1996 | $92B | Merchandise |

| #2 | Hello Kitty | 1974 | $80B | Merchandise |

| #3 | Winnie the Pooh | 1924 | $75B | Merchandise |

| #4 | Mickey Mouse | 1928 | $70B | Merchandise |

| #5 | Star Wars | 1977 | $66B | Merchandise |

| #6 | Anpanman | 1973 | $60B | Merchandise |

| #7 | Disney Princesses | 2000 | $45B | Merchandise |

| #8 | Mario | 1981 | $36B | Video Games |

| #9 | Jump Comics | 1968 | $34B | Comics and Manga |

| #10 | Harry Potter | 1997 | $31B | Box Office |

| #11 | Marvel Cinematic Universe | 2008 | $29B | Box Office |

| #12 | Spiderman | 1962 | $27B | Merchandise |

| #13 | Gudam | 1979 | $26B | Merchandise |

| #14 | Batman | 1939 | $26B | Merchandise |

| #15 | Dragonball | 1984 | $24B | Comic and Manga |

| #16 | Barbie | 1959 | $24B | Merchandise |

| #17 | Fist of The North Star | 1983 | $22B | Video Games |

| #18 | Cars | 2006 | $22B | Merchandise |

| #19 | Toy Story | 1995 | $20B | Merchandise |

| #20 | One Piece | 1997 | $20B | Comics and Manga |

| #21 | Lord of The Rings | 1937 | $20B | Book Sales |

| #22 | James Bond | 1953 | $20B | Box Office |

| #23 | Yu-Gi-Oh | 1996 | $20B | Trading Cards |

| #24 | Peanuts | 1950 | $17B | Merchandise |

| #25 | Transformers | 1984 | $17B | Merchandise |

Perhaps surprisingly, Marvel is not included in the top 10. Despite nearly $30 billion revenue and a long history rooted in comic books, the entertainment behemoth still has much ground to cover as the newest franchise in the ranking.

Reinventing a Classic

While the list proves that success builds over time, these classics need to constantly reinvent themselves as their audiences become reliant on new technologies and demand more immersive experiences.

Pokémon

As the highest grossing media franchise earning roughly $4 billion a year, Pokémon’s strength lies in it ability to adapt to new technology.

The Japanese phenomenon has continued to reposition itself since it first introduced Pokémon cards in 1996. These days, the franchise is perhaps best known for bringing augmented reality to the masses with Pokémon Go—an app that attracted 50 million users in just 19 days.

Hello Kitty

Yet another Japanese brand tops the list of media franchises. With 50,000 product lines available in over 130 countries and cumulative revenue of $80 billion, Hello Kitty is famous for harnessing the power of cute.

The fictional character has evolved into a globally recognized symbol as a result of big name partnerships and licensing deals with the likes of Puma, Asos and Herschel—and is etched onto almost every type of accessory thinkable.

More recently, the brand announced its foray into video games, and will collaborate with the global esports organization FNATIC on content and merchandise.

Winnie the Pooh

The chronicles of Winnie the Pooh have transcended time by providing a connection to the innate wonder of childhood.

Originally created following World War I, the newest movie rendition “Christopher Robin” became the highest-grossing film in the franchise, grossing $197 million worldwide.

Mickey Mouse

With 97% brand name recognition, Mickey Mouse is officially more recognizable than Santa Claus. Similarly to Winnie the Pooh, Disney introduced Mickey Mouse as a symbol of hope following the World War.

Over 90 years later, global brands such as L’oreal, Beats, Uniqlo and more recently, Gucci are paying homage. In 2019, the luxury fashion brand licensed the Mickey Mouse image for a 3D printed bag worth $4,500, making it even more of a ubiquitous symbol of pop culture.

Star Wars

Another Disney favorite, Star Wars holds the title of most successful movie franchise, with cumulative revenues of $65 billion.

The franchise successfully appeals to a multi-generational audience by mixing old characters with new storylines, such as ‘The Mandalorian’, broadcasting on the new streaming service Disney+—hailed as one of the more exciting moves to come from the saga.

Making Magic

Disney owns three out of the top five highest grossing franchises, so it comes as no surprise that the media conglomerate is investing heavily in digital innovation to provide a more immersive customer experience.

In fact, every franchise in the ranking relies on multiple touchpoints and revenue streams to create a more interactive and emotional experience for their audience.

By harnessing a compelling combination of both imagination and technology, Disney and other top global franchises can continue to lead in the business of making magic.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?