Technology

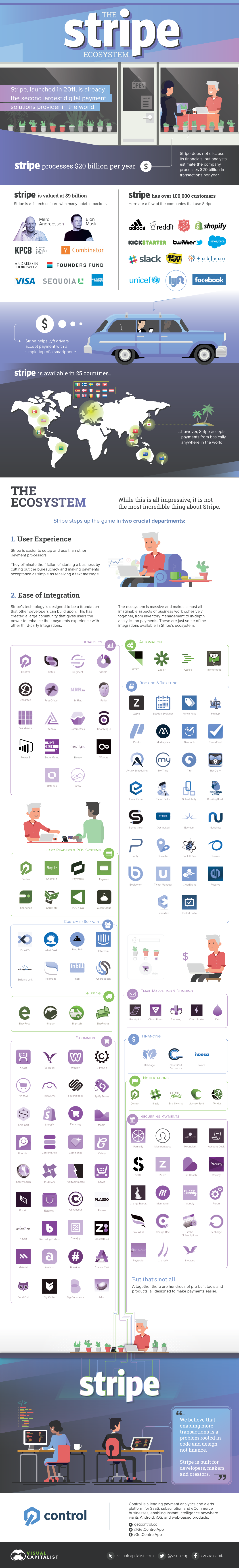

The Stripe Ecosystem in One Giant Visualization

The Stripe Ecosystem in One Giant Visualization

It seems Stripe is living up to the hype.

The fintech unicorn was just revalued at $9 billion after its latest round of funding led by General Catalyst Partners and CapitalG, the investment arm of Google’s parent company Alphabet Inc. The new financing, which almost doubled Stripe’s valuation, occurred despite a general slow-down in venture capital funding over recent months.

Why are investors doubling down on Stripe? It’s because the company seems poised to continue revolutionizing online payments, and it’s creating a ripple effect that is spreading throughout the entire e-commerce landscape.

The above infographic, courtesy of payment analytics software Control, gives insight into the rapidly evolving Stripe ecosystem – a key differentiating factor that investors are banking on with this five-year-old startup.

Breaking the mold

As is often the case with game-changing companies, Stripe was born out of frustration. Co-founders John Collison and Patrick Collison created the payment-processing platform after seeing an opportunity to improve the cumbersome online payment experience not just for entrepreneurs, but also for web developers and customers.

Stripe lets business owners set up an online payment system and start accepting payments in as little as 10 minutes, with a process that’s as simple as embedding a line of code.

Cutting Red Tape

To fully understand how freeing this is for business owners and web developers, consider how limited online payment processing used to be.

Traditionally e-commerce companies accepted payments online by connecting with third-party software such as PayPal, or by spending time and money setting up a merchant account and building a network for securely storing sensitive credit card information. While larger companies with teams of developers could do this, smaller companies were limited in their options.

Furthermore, setting up a merchant account required an arduous waiting period – sometimes even months – before approval could be granted and payments could be accepted. Once payments were processed, they were subject to days-long holding periods while they were put through various levels of regulatory bureaucracy.

How Stripe Works

Stripe is a PSP (Payment Service Provider) that lets business owners collect payments, including recurring payments, and transfer them directly to their own account instantly.

It does this by eliminating the need to store credit card information, which is what limited business owners before. Previously, when setting up an internal online payment system, web developers had to adhere to strict regulations surrounding the storing of credit card information, as per the Payment Card Industry’s Data Security Standard (PCI DSS). This is a complicated process that often requires a lot of paperwork and costly third-party consultation.

While any business or individual merchant collecting or handling credit card information is still required to maintain PCI-compliance, Stripe takes care of a lot of the legwork. Customers can enter their credit card information, which goes directly to Stripe’s secure servers, so site owners don’t have to store sensitive user data. Stripe processes the payment, checks for fraud, and takes a fee of 2.9% plus 30 cents. Business owners see the money in their bank account instantly, rather than having to wait days for clearance.

To customers, the payment experience is much the same, but faster and without the need to leave a current web page to visit a third-party page – as is the case with PayPal.

The Stripe Ecosystem

Perhaps one of the most unique aspects of Stripe is the ease with which web developers can build their own integrations that can merge with Stripe’s technology to fulfill other business requirements.

In many ways Stripe is like a giant lock into which web developers can insert their own custom-built “key”, unlocking a payment process that’s tailored to e-commerce. This has created a third-party integration ecosystem that spans nearly every aspect of running a business, from analytics to accounting, email, expenses, and shipping processes.

The best part? The massive Stripe ecosystem is accessible to anyone who uses the platform to run their online payment processing, and it truly allows developers and entrepreneurs to better serve their customers.

Big Players are Switching to Stripe

While Stripe was created with small business owners and startups in mind, recently some very big fish have joined forces with the payment processing platform, including Facebook, Lyft, Slack, Macy’s, and Target. With users in 110 countries and a recent foray into Asia, Stripe is now considered PayPal’s main competitor.

It’s no surprise then, that PayPal alumni saw Stripe’s potential early on. That’s why PayPal co-founders Elon Musk, Peter Thiel, and Max Levchin have all invested in the now $9 billion payment startup.

Brands

How Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

How Tech Logos Have Evolved Over Time

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

One would be hard-pressed to find a company that has never changed its logo. Granted, some brands—like Rolex, IBM, and Coca-Cola—tend to just have more minimalistic updates. But other companies undergo an entire identity change, thus necessitating a full overhaul.

In this graphic, we visualized the evolution of prominent tech companies’ logos over time. All of these brands ranked highly in a Q1 2024 YouGov study of America’s most famous tech brands. The logo changes are sourced from 1000logos.net.

How Many Times Has Google Changed Its Logo?

Google and Facebook share a 98% fame rating according to YouGov. But while Facebook’s rise was captured in The Social Network (2010), Google’s history tends to be a little less lionized in popular culture.

For example, Google was initially called “Backrub” because it analyzed “back links” to understand how important a website was. Since its founding, Google has undergone eight logo changes, finally settling on its current one in 2015.

| Company | Number of Logo Changes |

|---|---|

| 8 | |

| HP | 8 |

| Amazon | 6 |

| Microsoft | 6 |

| Samsung | 6 |

| Apple | 5* |

Note: *Includes color changes. Source: 1000Logos.net

Another fun origin story is Microsoft, which started off as Traf-O-Data, a traffic counter reading company that generated reports for traffic engineers. By 1975, the company was renamed. But it wasn’t until 2012 that Microsoft put the iconic Windows logo—still the most popular desktop operating system—alongside its name.

And then there’s Samsung, which started as a grocery trading store in 1938. Its pivot to electronics started in the 1970s with black and white television sets. For 55 years, the company kept some form of stars from its first logo, until 1993, when the iconic encircled blue Samsung logo debuted.

Finally, Apple’s first logo in 1976 featured Isaac Newton reading under a tree—moments before an apple fell on his head. Two years later, the iconic bitten apple logo would be designed at Steve Jobs’ behest, and it would take another two decades for it to go monochrome.

-

Markets1 week ago

Markets1 week agoRanked: The Largest U.S. Corporations by Number of Employees

-

Green3 weeks ago

Green3 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?