Mining

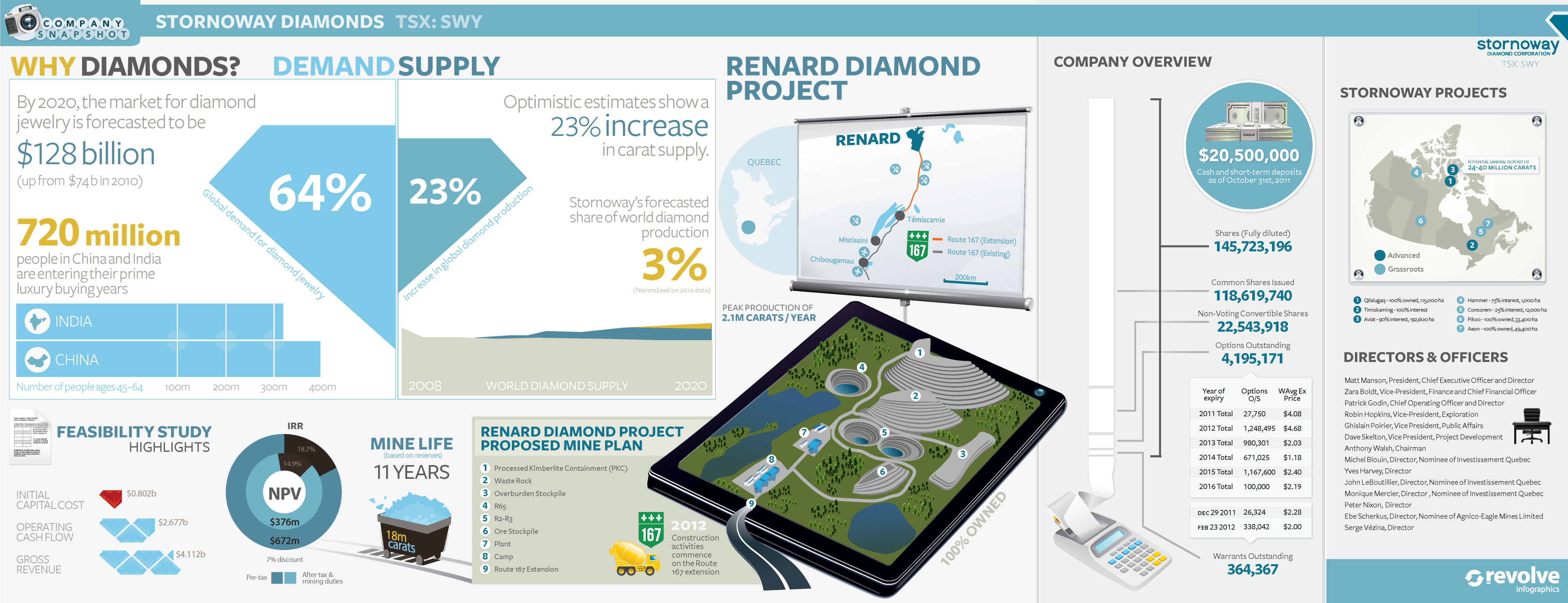

Stornoway Diamonds (TSX:SWY)

Stornoway is building Quebec’s first diamond mine at it s 100% Renard Project

Forward looking information

This infographic contains “forward-looking information” within the meaning of Canadian securities legislation and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995. This information and these statements, referred to herein as “forward-looking statements”, are made as of the date of this presentation and the Company does not intend, and does not assume any

obligation, to update these forward-looking statements, except as required by law.

Forward-looking statements relate to future events or future performance and reflect current expectations or beliefs regarding future events and

include, but are not limited to, statements with respect to: (i) the amount of mineral resources and exploration targets; (ii) the amount of future

production over any period; (iii) net present value and internal rates of return of the mining operation; (iv) capital costs and operating costs; (v) mine expansion potential and expected mine life; (vi) expected time frames for completion of permitting and regulatory approvals and making a production decision; (vii) future exploration plans; (viii) future market prices for rough diamonds; and (ix) sources of and anticipated financing requirements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives,

assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “anticipates”, “plans”, “projects”,

“estimates”, “assumes”, “intends”, “strategy”, “goals”, “objectives” or variations thereof or stating that certain actions, events or results “may”,

“could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements

of historical fact and may be forward-looking statements.

Forward-looking statements are made based upon certain assumptions and other important factors that, if untrue, could cause the actual results,

performances or achievements of Stornoway to be materially different from future results, performances or achievements expressed or implied by

such statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the

environment in which Stornoway will operate in the future, including the price of diamonds, anticipated costs and ability to achieve goals. Certain

important factors that could cause actual results, performances or achievements to differ materially from those in the forward-looking statements

include, but are not limited to: (i) estimated completion date for the Environmental and Social Impact Assessment; (ii) required capital investment

and estimated workforce requirements; (iii) estimates of net present value and internal rates of return; (iv) receipt of regulatory approvals on

acceptable terms within commonly experienced time frames; (v) the assumption that a production decision will be made, and that decision will be

positive; (vi) anticipated timelines for the commencement of mine production; (vii) anticipated timelines related to the Route 167 extension and the

impact on the development schedule at Renard; (viii) anticipated timelines for community consultations and the conclusion of an Impact and

Benefits Agreement; (ix) market prices for rough diamonds and the potential impact on the Renard Project’s value; and (x) future exploration plans

and objectives. Additional risks are described in Stornoway’s most recently filed Annual Information Form, annual and interim MD&A, and other

disclosure documents available under the Company’s profile at: www.sedar.com.

When relying on our forward-looking statements to make decisions with respect to Stornoway, investors and others should carefully consider the

foregoing factors and other uncertainties and potential events. Stornoway does not undertake to update any forward-looking statement, whether

written or oral, that may be made from time to time by Stornoway or on our behalf, except as required by law.

Lithium

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and various Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) | Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳 China | 242,700 | 34% |

| BYD | 🇨🇳 China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷 Korea | 108,487 | 15% |

| Panasonic | 🇯🇵 Japan | 56,560 | 8% |

| SK On | 🇰🇷 Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷 Korea | 35,703 | 5% |

| CALB | 🇨🇳 China | 23,493 | 3% |

| Farasis Energy | 🇨🇳 China | 16,527 | 2% |

| Envision AESC | 🇨🇳 China | 8,342 | 1% |

| Sunwoda | 🇨🇳 China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries