Technology

How to Stop Your Home From Being Hacked

How to Stop Your Home From Being Hacked

Billions of new objects are being connected to the internet of things (IoT), and it’s going to change your life.

However, if you are not careful, this change may not be in the positive way that is expected.

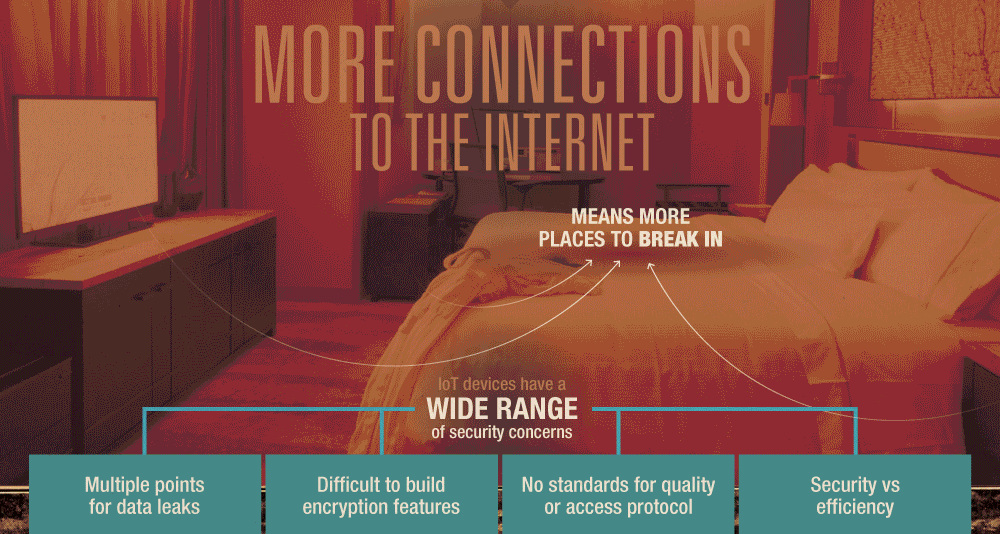

As more home devices get connected to the internet, new doors get opened for hackers to potentially access your personal information. Any hacking of this data could have dire consequences to your personal life, career, or financial security.

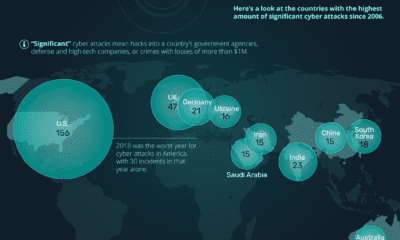

Today’s infographic from RefiGuide gives context around IoT hacking, including the range of security concerns created by new IoT devices and suggestions on how you can protect yourself.

IoT Hacking Isn’t New

Did you know that former Vice President Dick Cheney had a Wi-Fi enabled pacemaker? His cardiologist disabled this feature in 2007 to ensure that hackers couldn’t control his heartbeat. While this seems like the plot from the TV series Homeland (it was), that doesn’t make it any less possible.

Internet security experts have been warning for years about the dangers of a more connected world. To date, we’ve seen the following examples of IoT hacks:

- Jeep recalled 1.4 million vehicles after it was proven they could be hacked remotely

- Same goes for a Ford Escape, using a physical connection and laptop

- Over 100k IoT devices were used to block traffic to sites such as Twitter and Netflix in a DDoS attack

- Samsung “smart fridges” were found to leave Gmail login credentials vulnerable to hackers

Despite thousands of new IoT devices hitting the market, the fact is that many lack sufficient encryption features. This makes them particularly vulnerable.

Further, connected devices provide multiple entrances for would-be hackers: the device, connected devices, data centers, and communication channels are all possible access points.

How to Protect Yourself

Until manufacturers are able to guarantee that basic cybersecurity measures are in place for new IoT devices, there are a few ways you can protect yourself.

First, make strong passwords for your router and connected devices, and consider disabling them when you are away from home for extended periods of time. Don’t connect devices that you don’t need – consider holding off on your Wi-Fi connected “smart fridge” until it is something you truly need.

Next, create segmented networks at home for your IoT devices, PC and mobile, and guests. Give each of them different tiers of access, such that someone hacking the IoT network will not be able to tap into your personal data.

Lastly, keep your router firmware up-to-date. This is the programming it uses to function, and regularly updating firmware (either automatically or manually) means that it will be less vulnerable to hacks.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business1 week ago

Business1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?