Spotlight on Colorado’s Cannabis Market

Spotlight on Colorado’s Cannabis Market

In 2014, Colorado made history by being the first state to have the sale of legal recreational cannabis take place. Once considered unchartered territory, the state has since established itself as a mature and prospering legal market.

And as various governments explore the possibilities around cannabis legalization, policymakers likely consider Colorado’s journey as one to potentially emulate in order to reach some of the same longer-term outcomes that have materialized.

The following sponsored graphic from Tenacious Labs provides a spotlight analysis of the Colorado cannabis market, and looks at defining trends and key developments that have occurred during the last eight years.

Zooming in on Sales and Tax Revenue

From a fiscal perspective, cannabis legalization has been a hit for the state of Colorado. Since it started in 2014, Colorado has generated over $2 billion in tax and fee revenue from the legal cannabis space.

Here’s a look at the growing tax revenues, which started from a modest $46 million and have surged nearly 10x.

| Year | Tax Revenue Generated ($M) |

|---|---|

| 2014 | $46.1 |

| 2015 | $104.7 |

| 2016 | $164.1 |

| 2017 | $220.6 |

| 2018 | $243.4 |

| 2019 | $279.1 |

| 2020 | $362.0 |

| 2021 | $396.1 |

Moreover, cannabis sales are still increasing. The year 2021 was a record year which generated $2.2 billion in revenue.

Given the rise in debts most governments have incurred in response to the COVID-19 pandemic, new sources of revenue and taxation, and rising ones at that, are attractive and may act as a key driver for legalization initiatives in other regions.

Cannabis Employment is Lighting Up

There are multiple converging factors that suggest cannabis legalization may result in a long list of benefits. Like sales and taxes, the employment sector has seen robust growth and shows more and more signs of picking up speed.

In Colorado, the industry boasts over 40,000 jobs that contribute to the local economy, including ones like “budtender”, which were almost nonexistent a number of years ago.

Likewise, the number of cannabis jobs across the country has grown from 122,000 in 2017 to 428,000 in 2022. In fact, in the U.S. there are now more jobs in cannabis than there are bank tellers, insurance agents, and hairstylists.

But the growth isn’t expected to stop quite yet. By 2025, some estimates say there will be 1.5 million jobs in cannabis, as legalization momentum continues to surge. In other words, the cannabis industry can represent 1% of the roughly 150 million people employed in America.

New Product Innovation

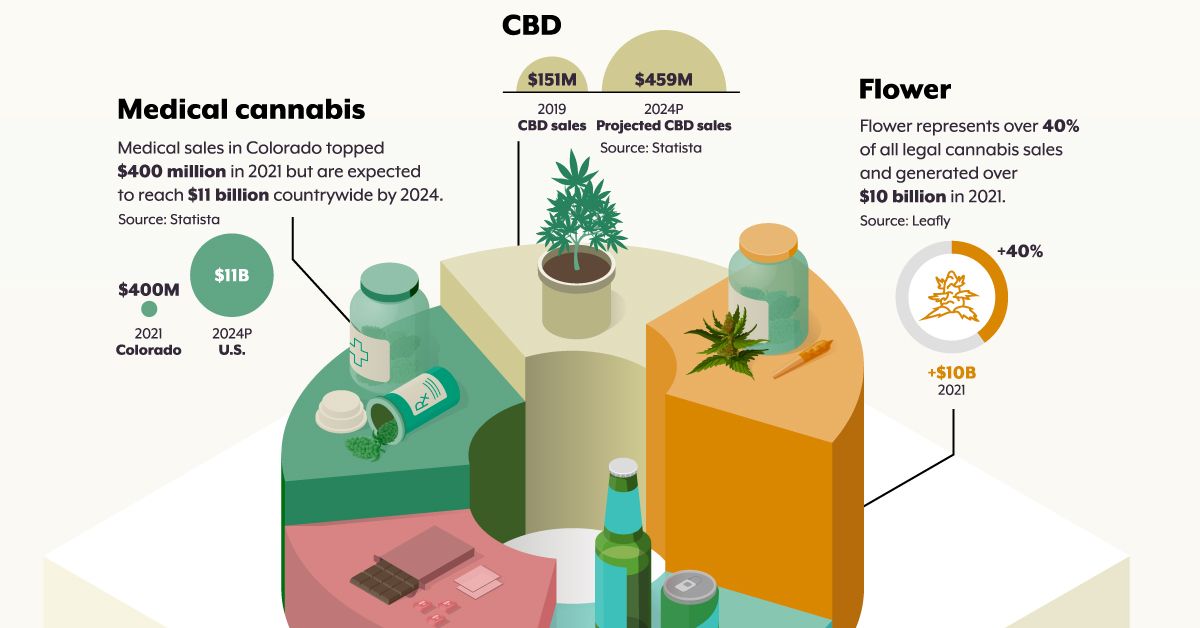

Fueling the growing figures around the cannabis industry is the high level of innovation in this space. Given the versatility of the cannabis plant, the modern industry now offers greater diversity and variety in products. And this can come in the form of consumption methods ranging from inhalation like vaping and smoking, to edible beverages and baked goods.

Here’s how market share for these products fared in 2020:

| Product | Market Share (%) | Market Value ($B) |

|---|---|---|

| Flower | 43.4% | $10.9B |

| Cartridges | 20.3% | $5.1B |

| Edibles | 9.2% | $2.3B |

| Concentrates | 8.8% | $2.2B |

| Pre-rolls | 8.8% | $2.2B |

| Topicals | 0.8% | $0.2B |

| Accessories | 8.8% | $2.2B |

However, innovation in products is not stopping.

In 2020, an additional 7,000 new products hit dispensary shelves compared to the year prior. With new products emerging every day, it’s highly possible the future of cannabis can expand its total addressable market by attracting new consumers who may not resonate with the offerings of today.

Project Funding and Community Impact

Where do the millions in annual cannabis tax revenue go? Since legalization, Colorado has produced a track record of positive and impactful initiatives they’ve funded through cannabis dollars.

In addition, the state breaks down these revenues and shows how funds are allocated.

| Distribution of Annual Tax Revenues | Percentage of Revenues |

|---|---|

| Marijuana Tax Cash Fund | 42% |

| Public School Capital Construction Assistance Fund | 24% |

| Public School Fund | 17% |

| Local Government Distribution | 9% |

| General Fund | 8% |

By far the largest portion of these funds go to the Marijuana Tax Cash Fund. Which supports an assortment of construction projects and law enforcement programs throughout the state.

Next, is the Public School Capital Construction Assistance Fund, which receives almost a quarter of the total tax dollars. This fund helps provide much needed capital to schools when upgrading their facilities.

Altogether, taxation from cannabis is making positive impacts across numerous avenues. For instance, in recent years, $3 million went towards opioid intervention, $16 million for affordable housing, and $20 million for early literacy programs. As cannabis sales grow, funds from taxes should follow suit, which only fuel greater and more frequent community programs and state initiatives.

Paving the Way Forward

In just under a decade, Colorado has demonstrated the ability to implement cannabis regulations that benefit stakeholders and society more broadly.

As tax revenues, employment, innovation in products, and communities all continue to flourish, many states and countries alike might seek to emulate these results and will look at the Colorado story for guidance.

In the next part of The Legal Landscape Series, we’ll dive into a legal vs illegal overview of cannabis markets.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology…

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.